- Home

- »

- Next Generation Technologies

- »

-

Contact Center Transformation Market Size Report, 2030GVR Report cover

![Contact Center Transformation Market Size, Share & Trends Report]()

Contact Center Transformation Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Omnichannel Routing, Real Time Reporting & Analytics), By Service, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-491-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

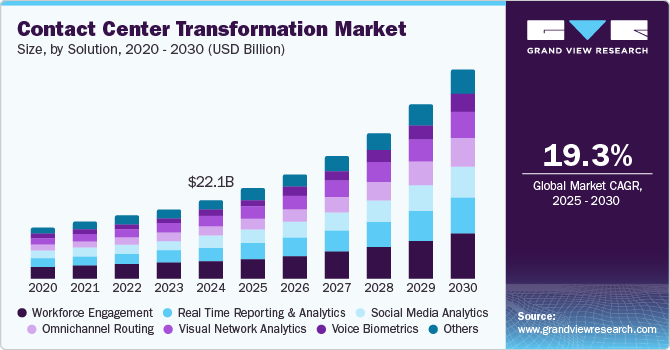

The global contact center transformation market size was valued at USD 22.08 billion in 2024 and is projected to grow at a CAGR of 19.3% from 2025 to 2030. Increasing demand for the automation and modernization of existing contact center operations across major verticals such as retail, healthcare, BFSI, and hospitality has driven the development of innovative solutions by service providers. The integration of artificial intelligence (AI) in various processes has helped transform the way that contact centers operate, ensuring optimum efficiency and higher customer satisfaction. The use of AI-driven tools has led contact centers to handle larger volumes of queries and interactions with improved accuracy while also reducing wait times by providing personalized and instant responses.

Businesses are adopting solutions such as Interactive Voice Response (IVR) modules that allow agents to handle a high volume of calls efficiently. Furthermore, the IVR module helps agents with Automatic Speech Recognition (ASR) integration, Text-to-Speech (TTS) integration, and database integration, enabling the provision of an optimal quality of customer service. Research conducted by Aberdeen Group has stated that the IVR technology can lower customer service costs by up to 30% by avoiding the requirement for human agents to handle repetitive and routine queries, enabling them to focus on more complex requests. Additionally, according to an article by TENEO.AI, a study has found that around 66% of customers prefer natural language IVR solutions, preventing the need to navigate through menus. These trends highlight the need for contact center solution providers to launch innovative products for their businesses constantly.

Enterprises' increasing usage of social media platforms to drive customer engagement and increase sales is expected to aid industry expansion during the forecast period. These channels enable contact center agents to understand customer behavior through comprehensive insights and proactively address their grievances and demands. Agents have a single console that they use to monitor every social media channel and can switch easily between them. The move towards cloud deployment is also expected to shape market growth positively, as cloud-based solutions offer scalability, cost-efficiency, and the ability to allow secure communications between employees. According to an article by Acefone, a cloud communications platform, cloud contact centers are 27% cheaper than their on-premise counterparts and lower downtime by 35%. As businesses increasingly look to save costs across their processes while also improving customer service, cloud migration is expected to become a major trend in this industry.

Solution Insights

The workforce engagement segment accounted for a leading revenue share of 21.5% in 2024 and is expected to maintain its position in the coming years. The rapid proliferation and adoption of AI tools have enabled the development and enhancing the abilities of contact center employees, which ensures better customer experiences. The use of voice bots and chatbots has meant that decision-makers can assign repetitive and simple tasks to them, enabling human agents to offer personalized experiences to customers. Contact centers are rapidly integrating these solutions to minimize their operational costs and optimize agent scheduling to boost sales and drive efficiency in the organization. Large and small enterprises are implementing workforce engagement solutions to efficiently handle staffing, forecasting, and staff monitoring requirements.

The voice biometrics segment is anticipated to witness the fastest growth during the forecast period. Growing incidences of identity theft and fraud and the need to constantly improve the customer experience have compelled contact centers to adopt voice biometrics solutions. This innovative technology enhances security and efficiency by using a person's unique voiceprint for authentication. Voice biometrics can streamline the authentication process, reducing the time that agents spend in verifying customer identities and leading to quicker resolutions and improved customer satisfaction. Enterprises are educating their customers about the benefits of voice biometrics, which is expected to increase their acceptance and trust in this solution, driving segment growth.

Service Insights

The integration & deployment segment accounted for the largest revenue share in the market in 2024. Continued efforts by contact centers to modernize their processes and infrastructure, along with the growing shift towards the cloud, have created a substantial demand for the seamless integration and deployment of advanced contact center solutions. Furthermore, service providers are offering customized solutions that can connect systems such as telephony, CRM, and chat to ensure seamless communication and significantly improve performance and process efficiency. Integration services streamline the launch of new tools and updates, keeping the contact center technologically updated and enabling them to maintain service consistency.

On the other hand, the managed services segment is anticipated to expand at the fastest growth rate from 2025 to 2030. Managed service providers aid business establishments in managing their operational costs and obtaining better performance from their client’s inbound contact center. They further help businesses in managing their infrastructure, services, and applications. Additionally, these providers offer benefits such as automatic technology upgrades to networks and secure connectivity, helping enterprises to strengthen their operations. MSPs provide continuous monitoring of contact center systems to ensure uptime and performance, with proactive maintenance and support, while also putting strategies in place to ensure business continuity during system failure or emergencies.

Deployment Insights

The on-premise segment accounted for a larger revenue share in the global market in 2024. On-premise deployment of contact center solutions is widely adopted by large enterprises that can afford more comprehensive and precise control over the functionalities and features of these systems. Furthermore, this deployment allows businesses to have direct access to their data and ensures the privacy and security of sensitive data, since it remains within the organization’s infrastructure. Additionally, the need to comply with regulations such as HIPAA or GDPR has compelled enterprises to maintain complete control over data storage and processing.

The hosted segment is anticipated to advance over the coming years. Enterprises are adopting cloud-based solutions and services that provide access to various features. Additionally, they allow businesses to engage with their clients across different channels that are cost-efficient, effective, and quick. The high scalability cloud deployment offers means that organizations can easily add or remove agents and features as per demand, without making significant investments. With an increasing number of on-premise systems utilizing outdated technologies that cannot effectively handle evolving customer demands, the shift towards hosted platforms has been accelerated in recent years.

Enterprise Size Insights

The large enterprise segment accounted for a leading revenue share in the contact center transformation market in 2024. These businesses have extensively adopted innovative contact center solutions for feedback, service, support, and marketing functions. The proliferation of AI tools such as predictive analytics and chatbots to handle routine inquiries and offer personalized services, along with the rapid adoption of cloud-based solutions, has further driven segment growth. There has been substantial growth in the number of providers focusing on designing cluster-based and highly scalable customer engagement offerings for larger organizations. These solutions can conveniently scale more than 1,000 agents with the multi-channel facility of SMS, chat, voice, social media, and email, resulting in an improved customer engagement experience.

The small and medium enterprises segment is expected to witness the fastest CAGR from 2025 to 2030. The emergence of SMEs across major industry verticals and the need to minimize manual and repetitive activities to boost efficiency and productivity has driven the adoption of contact center transformation solutions in this segment. Additionally, these enterprises are familiar with the features and advantages of AI in enabling them to analyze calls in real-time and empowering agents to respond proactively. Transformation solutions further allow the monitoring of key performance indicators (KPIs) using analytics, thus helping identify areas for improvement and ensuring strategic decision-making.

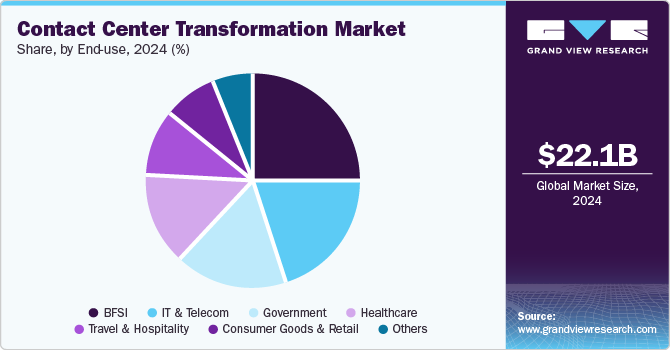

End-use Insights

The BFSI segment accounted for the largest revenue share in the market in 2024 and is expected to maintain its position during the forecast period. An increasing demand for personalized services from customers and the need to maintain the privacy and security of sensitive information has encouraged companies to offer cutting-edge services to banking and financial institutes. According to Capgemini's World Retail Banking Report 2024, banks are expected to continue investing significantly in digital transformation, with a strong focus on AI and generative AI. The latter technology is expected to enhance workforce efficiency by collaborating seamlessly with human operators and providing recommendations and insights. The use of tools such as robotic process automation (RPA) and interactive voice response (IVR) are expected to help financial institutions reduce their average handling time and offer quicker resolution to customer queries.

The consumer goods & retail segment is expected to witness the fastest CAGR during the forecast period. Retailers strongly depend on customer retention and loyalty to drive sales and improve their competitive positioning, leading to increased demand for advanced contact center solutions that can aid them in proactively connecting with customers. Moreover, tracking the purchasing behavior of consumers is another vital aspect that has driven the use of CRM and analytics solutions to capture customer data and make future recommendations to accelerate the buying process.

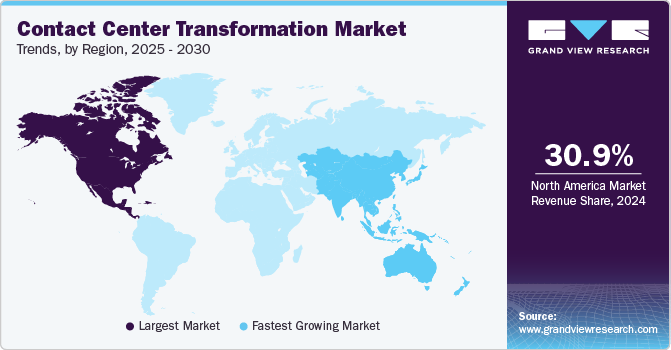

Regional Insights

The North America contact center transformation market held the largest revenue share of 30.9% in 2024. The widespread acceptance and adoption of emerging technologies in the region and the extensive use of big data and cloud platforms have driven sustained market growth. In April 2024, Bell Canada announced the launch of Google Cloud Contact Center AI for Canadian enterprises to improve employee and customer experiences. This solution offers features such as Virtual Agent to reduce call volumes and expedite resolution time, along with Agent Assist, which leverages natural language processing (NLP) in real time to determine customer requirements.

U.S. Contact Center Transformation Market Trends

The contact center transformation market in U.S. accounted for a dominant revenue share of the regional market in 2024 due to extensive digitalization across various critical sectors and the need to provide superior quality customer services due to increased competition. Additionally, the increasing establishment of call centers and the upgradation of existing ones has presented growth opportunities for service providers to offer advanced solutions. Verticals such as healthcare have also become widely aware of the benefits of elevating their contact center offerings, driving collaborations with market players.

Europe Contact Center Transformation Market Trends

Europe accounted for a notable revenue share of the global market in 2024. The regional market is expanding substantially, aided by the increasing demand for improved customer service and the adoption of digital channels. Furthermore, the need for compliance with regulations such as GDPR has a significant impact on the way that contact centers handle customer data and interactions, necessitating robust data protection measures. Organizations in Europe prioritize customer experience (CX) as a major differentiator, leading to investments in personalization and customer engagement strategies that have led to innovative contact center offerings.

Asia Pacific Contact Center Transformation Market Trends

The contact center transformation market in Asia Pacific is anticipated to emerge as the fastest-growing market during the forecast period. The demand for such solutions has increased substantially, owing to technological advancements, changing consumer behavior, and increasing competition across various industries. The region’s diverse population leads to varying consumer preferences and expectations, necessitating customized approaches to customer engagement.

The Indian contact center transformation market has witnessed strong growth in recent years, aided by the increasing focus of enterprises on ensuring better customer engagement and the positioning of the country as a leading contact center market globally. The emergence of several small and medium-sized organizations in the country, coupled with their shift towards cloud-based services, is expected to encourage major multinational service providers to launch their solutions in the economy. For instance, in October 2024, RingCentral announced that it received a PAN-India license from the Department of Telecommunications to operate across all 22 telecom circles in the country. This enables the company to offer its Global RingEX Select and RingCX contact center solutions and offer a premium experience for customers.

Key Contact Center Transformation Company Insights

Some key companies involved in the contact center transformation market include Five9, Genesys, and Talkdesk, among others.

-

Genesys is an American software company that offers employee engagement, customer engagement, and business optimization solutions and services. The company’s major offerings include platforms such as Genesys Multicloud CX, Genesys Cloud CX, and Pointillist.

Key Contact Center Transformation Companies:

The following are the leading companies in the contact center transformation market. These companies collectively hold the largest market share and dictate industry trends.

- Aculab plc

- AT&T Intellectual Property

- Cisco Systems, Inc.

- Five9, Inc.

- Genesys

- Metaswitch (Microsoft)

- Mitel Networks Corp.

- RingCentral, Inc.

- SAP SE

- Talkdesk

Recent Developments

-

In September 2024, Verint announced an extension of its partnership with Five9, by launching a cloud-to-cloud platform integration that would offer AI-driven customer experiences. The development aims to enable customers to seamlessly access industry-leading technologies from both Five9 and Verint that are in the cloud, thus providing them with superior choice and control regarding the selection and deployment of customer experience automation solutions.

-

In September 2024, Talkdesk announced the launch of its Talkdesk AI Translator and Talkdesk AI Rewriter solutions developed to aid enterprises in offering personalized and modern customer experiences.

Contact Center Transformation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.46 billion

Revenue Forecast in 2030

USD 61.48 billion

Growth rate

CAGR of 19.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Solution, service, deployment, enterprise size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Aculab plc; AT&T Intellectual Property; Cisco Systems, Inc.; Five9, Inc.; Genesys; Metaswitch (Microsoft); Mitel Networks Corp.; RingCentral, Inc.; SAP SE; Talkdesk

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contact Center Transformation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contact center transformation market report based on solution, service, deployment, enterprise size, end-use, and region.

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Omnichannel Routing

-

Real Time Reporting & Analytics

-

Social Media Analytics

-

Visual Network Analytics

-

Voice Biometrics

-

Workforce Engagement

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Consumer Goods & Retail

-

Government

-

Healthcare

-

IT & Telecom

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.