- Home

- »

- Electronic Devices

- »

-

Consumer Network Attached Storage Market, Industry Report, 2030GVR Report cover

![Consumer Network Attached Storage Market Size, Share & Trends Report]()

Consumer Network Attached Storage Market (2025 - 2030) Size, Share & Trends Analysis Report By Design, By Mount Type, By Storage Type, By Storage Capacity, By Deployment, By End User, By Regional, And Segment Forecasts

- Report ID: GVR-1-68038-481-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2017 -2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Consumer Network Attached Storage Market Summary

The global consumer network attached storage market size was estimated at USD 6,096.8 million in 2024 and is projected to reach USD 12,035.1 million by 2030, growing at a CAGR of 12.1% from 2025 to 2030. Rapid digital transformation among Small and Medium-sized Enterprises (SMEs) and the growth of unstructured data are among the primary factors boosting the adoption of consumer NAS devices.

Key Market Trends & Insights

- North America consumer network attached storage market dominated in 2024, with a share of over 34.2%.

- In terms of mount type, the standalone dominated the market, with a market share of more than 67% in 2024.

- In terms of storage type, the Hard Disk Drive (HDD) segment dominated the market, with a share of more than 65% in 2024.

- In terms of storage capacity, the 1 TB to 20 TB segment dominated the market, with a market share of more than 63% in 2024.

- In terms of deployment, the on-premise segment dominated the consumer NAS market, with a market share of over 50% in 2024.

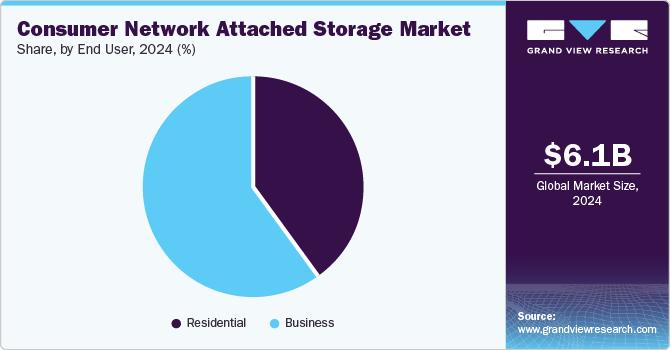

- In terms of end user, the business segment dominated with a market share of more than 59% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,096.8 Million

- 2030 Projected Market Size: USD 12,035.1 Million

- CAGR (2025-2030): 12.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

A NAS device is a centralized storage device that enables multiple users to share and store files over a Transmission Control Protocol/Internet Protocol (TCP/IP) network through an Ethernet cable or Wi-Fi. A consumer NAS is designed for at-home users and small and medium-sized businesses needing centralized file storage.

Several incumbents of consumer electronics, telecommunications, and automotive, among other industries and industry verticals, are focusing on adopting new, innovative solutions based on Artificial Intelligence (AI). As a result, investments in advancing AI technology are growing continuously. Continued advances in AI are poised to drive innovation and lead to the introduction of consumer NAS devices with faster data transfer speeds and larger storage capacities for home offices and small businesses. The growing demand for feature-rich consumer NAS systems is also opening significant opportunities for market growth.

Vendors of consumer NAS solutions are investing aggressively in research and development (R&D) to introduce efficient NAS solutions. For instance, in September 2023, QNAP Systems, Inc. announced the launch of TS-AI642, an AI-powered NAS solution. Designed to meet the video surveillance and image storage and backup needs of small- and medium-sized businesses, the solution offers a storage capacity of up to 110 TB and features a built-in Neural Processing Unit (NPU) to enable high-speed AI applications.

Impact of COVID-19

The COVID-19 pandemic led governments worldwide to implement lockdowns and strict social distancing norms to reduce the spread of the virus. The COVID-19 pandemic led to supply chain disruptions as a result of demand shifts, labor shortages, and travel restrictions. This posed a threat to the ability of the consumer NAS industry players to ensure continuous manufacturing and supply of their products and services. The COVID-19 pandemic led market players to make significant changes to their operations. For instance, NETGEAR, a U.S.-based company, transitioned to a work-from-home model for a majority of its employees, and additional safety measures were implemented for employees working on-site in the first quarter of 2020.

The COVID-19 pandemic accelerated business transformation, driving the need for increased storage demands. It highlighted the need for digital technology adoption among SMEs. With the growing digitalization among SMEs post the COVID-19 pandemic, the demand for consumer NAS solutions is expected to grow. Acceleration in remoting working models due to the COVID-19 pandemic positively impacted market growth. The need for access to data while working from home fueled the market growth post the onset of the COVID-19 pandemic.

Design Insights

In terms of design, the market is classified into 1-Bay, 2-Bays, 5-Bays, 4-Bays, 6-Bays, and above 6-Bays. 4-Bays dominated with a market share of over 28% in 2024 and is expected to grow at a CAGR of 12.8% throughout the forecast period. The segment’s growth can be attributed to better specifications of 4-bay consumer NAS devices in comparison to 1-bay and 2-bay consumer NAS devices and the ability to support large volumes of data. A 4-bay consumer NAS device is a better option for users requiring more than 18 TB of storage space. Moreover, it is a better option than 1-bay and 2-bay consumer NAS devices regarding security and data write speeds.

2-Bays is anticipated to grow at the fastest CAGR of 13.6% throughout the forecast period. The segment’s growth can be attributed to the ability of 2-bay consumer NAS devices to offer better security and storage capacity compared to a 1-bay consumer NAS device and lower costs compared to a 4-bay consumer NAS device. Many market players offer 2-bay consumer NAS devices. Moreover, these companies constantly innovate and launch new 2-bay devices to meet customer demands.

Mount Type Insights

In terms of mount type, the market is classified into standalone and rackmount. Standalone dominated the market, with a market share of more than 67% in 2024. It is expected to grow at the fastest CAGR of 12.5% throughout the forecast period. The cost-effectiveness and compactness of standalone mounting devices drive the segment’s growth. Standalone NAS devices produce less noise in comparison to rackmount variants, chiefly owing to the smaller and fewer fans in operation. Desktop units are compact and work well for applications that require a self-contained solution for media streaming, archiving, and data backup.

Rackmount is expected to grow at a considerable CAGR of 11.4% during the forecast period. The ability of rackmount NAS devices to operate over longer periods and provide advanced hardware continues to drive the segment’s growth. Rackmount NAS devices are suitable for long hours of operation. This can be attributed to significant airflow through the cabinet and the availability of bigger and more powerful fans compared to standalone NAS devices. This maintains a low temperature, preventing the device from heating over extended periods of operation.

Storage Type Insights

In terms of storage type, the market is classified into Hard Disk Drive (HDD), flash storage, and hybrid. The Hard Disk Drive (HDD) segment dominated the market, with a share of more than 65% in 2024. It is expected to grow at a CAGR of 12.2% throughout the forecast period. New product launches are anticipated to propel the segment growth owing to benefits such as cost-effectiveness, compatibility with existing infrastructures, and diverse application possibilities such as data centers, cloud storage, and video surveillance. For instance, In September 2023, TOSHIBA CORPORATION, an international electronics company based in Japan, announced a new 22 Terabytes (TB) model, MG10F. The design uses Conventional Magnetic Recording (CMR) HDD with the company’s mature 10-disk helium-sealed technology.

The hybrid segment is expected to grow at the highest CAGR of 13.7% from 2025 to 2030. The need for efficient and versatile storage devices for a wide range of applications in consumer NAS environments drives the segment’s growth. Hybrid storage in consumer NAS combines the strengths of hard disk drives and solid-state drives to offer an optimal balance of performance and storage capacity. This technology excels in scenarios where users require faster access to frequently used data, making it suitable for tasks such as multimedia editing, gaming, and small business operations.

Storage Capacity Insights

In terms of storage capacity, the market is classified into less than 1 TB, 1 TB to 20 TB, and more than 20 TB. The 1 TB to 20 TB segment dominated the market, with a market share of more than 63% in 2024. It is expected to grow at the fastest CAGR of 13.0% throughout the forecast period. The 1 TB to 20 TB range is suitable for the storage needs of home users and small businesses. These capacities provide ample space for storing personal files, multimedia content, documents, and backups without being overly complex or expensive. These factors are driving the growth of the segment.

The more than 20 TB segment is expected to grow at a considerable CAGR of 10.7% during the forecast period. The growing demand for very high storage capacities for demanding, data-intensive applications among consumers and small businesses drives the segment’s growth. Data analytics, machine learning, and scientific research typically rely on large datasets for their operations. A high-capacity NAS solution offers the necessary storage space to store these extensive datasets and facilitate efficient data processing and analysis. A NAS solution with over 20 TB of storage capacity can guarantee the necessary storage capacity for such applications without compromising resource allocation and management.

Deployment Insights

In terms of deployment, the market is classified into on-premise, hybrid, and cloud/remote. The on-premise segment dominated the consumer NAS market, with a market share of over 50% in 2024. It is expected to grow at a considerable CAGR of 10.9% throughout the forecast period. On-premise deployment gives users direct control over their data, enhancing security and privacy. Consumers prefer to keep their personal and sensitive data within their premises, reducing reliance on external servers or cloud services, which is driving the segment growth. On-premise deployment represents a traditional approach to implementing scalable NAS solutions in enterprises. This method grants organizations full control over platforms, applications, systems, and data.

The hybrid segment is likely to grow at the fastest CAGR of 13.7% during the forecast period. The growing need for consumer NAS solutions offering high performance and minimizing downtime and maintenance costs drives segment growth. The hybrid deployment approach delivers highly efficient solutions in terms of performance, scalability, manageability, and cost reduction to customers. Unlike solely on-premises or remote deployments, hybrid storage solutions offer advantages and disadvantages. These systems operate seamlessly, utilizing mechanisms to keep active data on-premises while moving inactive data to remote locations based on policies defined by sophisticated engines.

End User Insights

In terms of end user, the market is classified into residential and business. The business segment dominated with a market share of more than 59% in 2024 and is expected to witness a CAGR of 12.0% during the forecast period. The growing need for dependable data management and backup solutions among businesses owing to growing volumes of unstructured data drives segment growth. Consumer NAS devices provide a convenient and accessible way for small businesses to store and secure their data. NAS devices serve as centralized storage solutions, enabling small businesses to store and organize their data in a single location. This simplifies data access and management, ensuring efficient storage and retrieval.

The residential segment is anticipated to grow at the fastest CAGR of 12.3% throughout the forecast period. The need for centralized storage has influenced the adoption of consumer NAS in the residential segment, the demand for file sharing and collaboration, and the rising preference for remote work, particularly due to the COVID-19 pandemic. With the shift to remote work practices, there has been an increased demand for cloud-based solutions, including NAS devices, to support remote collaboration and data access.

Regional Insights

North America consumer network attached storage market dominated in 2024, with a share of over 34.2%. It is expected to grow at a CAGR of 11.6% throughout the forecast period. The booming startup ecosystem in North America drives market growth in the region. North America has emerged as a global hub for technology startups. The region fosters a vibrant ecosystem, attracting entrepreneurs, venture capital investments, and technological innovation. Numerous startups in North America create a significant demand for storage solutions such as NAS devices. In addition, the rising number of smart homes in North America positively impacts the demand for consumer NAS devices.

U.S. Consumer Network Attached Storage Market Trends

The consumer network attached storage market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. This growth is attributed to the increasing demand for efficient data storage solutions, particularly among households and small businesses. The U.S. market is characterized by a high adoption rate of advanced technologies, including cloud storage and AI-powered NAS devices. The increasing popularity of remote work and online education is further driving the demand for reliable and scalable NAS solutions.

Asia Pacific Consumer Network Attached Storage Market Trends

The consumer network attached storage market in Asia Pacific is expected to grow at the fastest CAGR of 13.5%. The growing trend of urbanization in the Asia Pacific has positively impacted market growth. The urban lifestyle involves a degree of mobility, with individuals requiring access to their data on the go. Therefore, as more people move to urban areas, there is a corresponding increase in the demand for advanced and convenient technologies to manage and access digital data. Moreover, the rising number of SMEs in Asia Pacific is likely to contribute to an increased demand for consumer NAS solutions.

Japan consumer network attached storage market is expected to grow significantly from 2025 to 2030. Japan is a technologically advanced nation with a strong emphasis on data security and privacy. The increasing adoption of IoT devices and the generation of vast amounts of digital content fuel the demand for robust NAS solutions. Furthermore, the aging population in Japan is driving the need for efficient data backup and management solutions.

The consumer network attached storage market in India is expected to grow at a significant CAGR from 2025 to 2030. India's burgeoning middle class and the rapid digitization of the economy are driving the demand for affordable and reliable NAS solutions. The increasing popularity of online streaming services, cloud computing, and social media is further contributing to the growth of the NAS market. However, challenges such as poor internet connectivity and a lack of awareness about NAS technology may somewhat hinder market growth.

Europe Consumer Network Attached Storage Market Trends

The consumer Network Attached Storage (NAS) industry in Europe is expected to grow at a significant CAGR from 2025 to 2030. Europe is a diverse region with varying levels of technological adoption across different countries. The increasing demand for remote work, online education, and digital entertainment is driving the demand for efficient and secure NAS solutions. However, stringent data privacy regulations and concerns about data security may pose challenges for the European NAS industry.

The UK consumer network attached storage market is expected to grow significantly from 2025 to 2030. The UK is a technologically advanced nation with a strong emphasis on data security and privacy. The increasing adoption of IoT devices and the generation of vast amounts of digital content fuel the demand for robust NAS solutions. Moreover, the increasing popularity of online streaming services and cloud computing is driving the demand for efficient and scalable NAS solutions.

The consumer network attached storage market in France is expected to grow at a significant CAGR from 2025 to 2030. France is a technologically advanced nation with a strong emphasis on data security and privacy. The increasing adoption of IoT devices and the generation of vast amounts of digital content fuel the demand for robust NAS solutions. In addition, the increasing popularity of online streaming services and cloud computing is driving the demand for efficient and scalable NAS solutions.

Key Consumer Network Attached Storage Company Insights

The market is moderately consolidated, with a few companies providing consumer NAS devices. Some prominent players in the market include ASUSTOR Inc., D-Link Corporation, Dell Inc., NEC Corporation, NETGEAR, QNAP Systems, Inc., Seagate Technology LLC, Synology Inc., Western Digital Corporation, Zyxel, TerraMaster, and BUFFALO INC., among others. These players are adopting strategies such as expansion to gain a competitive edge. For instance, in June 2022, QNAP Systems, Inc. inaugurated a new facility in Willich, Germany. It comprises training facilities, modern office space, a servicing area, and a warehouse. The company was expecting the new facility to serve as its European head office, a service center, and a logistics hub and to aid in cementing its foothold in the European market.

Some of the key companies operating in the market include Dell Inc., Western Digital Corporation, and NEC Corporation.

-

Dell Inc. holds a strong competitive advantage in the market due to its robust brand reputation, extensive product portfolio, and strong customer support. Dell's NAS solutions offer high performance, scalability, and reliability, making them suitable for both home and small business users. Dell's integration with other IT solutions and seamless data management capabilities also provide a comprehensive storage solution.

-

Western Digital Corporation, a leading storage solutions provider, benefits from its deep expertise in storage technologies and strong brand recognition. The company offers a wide range of NAS devices catering to various consumer needs, from personal file storage to home media servers. Western Digital's focus on ease of use, reliable performance, and data security features has positioned it as a strong contender in the NAS market.

-

NEC Corporation, a global technology leader, leverages its advanced technologies and innovative solutions to offer high-performance NAS devices. NEC's NAS solutions are designed to meet the demanding needs of professional users and small businesses, providing efficient data storage, sharing, and backup capabilities. The company's strong focus on security and data protection ensures the safety of critical data, further solidifying its position in the NAS market.

ASUSTOR Inc. and Zyxel are some of the emerging companies in the target market.

-

ASUSTOR Inc. differentiates itself by offering a user-friendly, app-based NAS experience. Their ADM operating system provides a wide range of customizable applications, making it suitable for various user needs, from personal file storage to professional media workflows. ASUSTOR's focus on performance, reliability, and data security, coupled with competitive pricing, positions them as a strong contender in the NAS market.

-

Zyxel, a well-established networking brand, leverages its expertise to provide robust and feature-rich NAS solutions. Their devices offer a balance of performance and affordability, making them attractive to both home and small business users. Zyxel's emphasis on ease of use and seamless integration with other network devices further strengthens its position in the competitive NAS market.

Key Consumer Network Attached Storage Companies:

The following are the leading companies in the consumer network attached storage market. These companies collectively hold the largest market share and dictate industry trends.

- ASUSTOR Inc.

- D-Link Corporation

- Dell Inc.

- NEC Corporation

- NETGEAR

- QNAP Systems, Inc.

- Seagate Technology LLC

- Synology Inc.

- Western Digital Corporation

- Zyxel

- TerraMaster

- BUFFALO INC.

Recent Developments

-

In March 2024, QNAP Systems, Inc. launched the TS-216G, a high-performance 2-bay NAS designed for individuals and small businesses. It features a powerful ARM quad-core processor, 2.5GbE port, 4GB RAM, and a built-in NPU for accelerated AI-powered photo management. This NAS offers efficient file management, seamless data sharing, and smooth media streaming, making it a reliable and cost-effective storage solution.

-

In September 2023, Huawei launched the OceanStor Pacific 9920, an entry-level NAS array offering up to 92TB raw capacity in a 2U rack space. It is part of the OceanStor Pacific NAS family and can be combined into clusters or used as a SAN device. This move by Huawei aims to expand its data center storage solutions and bypass restrictions in the equipment operator market.

-

In August 2022, Agility acquired John Menzies PLC and merged it with its NAS business. The combined company, Menzies Aviation, is now the world's largest aviation services company by country count and the second largest by airport count. The company operates across six continents, providing air cargo, fuel, and ground services at numerous airports worldwide.

-

In July 2022, Western Digital launched new 22TB HDDs for various applications. These drives, featuring OptiNAND technology, ePMR, TSA, and HelioSeal, offer the highest areal density of 2.2TB per platter. The new HDDs are designed for IT/data center, NAS, and smart video/surveillance segments, catering to diverse storage needs. This advancement solidifies Western Digital's position as a technology leader in the HDD industry.

Consumer Network Attached Storage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.79 billion

Revenue forecast in 2030

USD 12.04 billion

Growth rate

CAGR of 12.1% from 2025 to 2030

Market size volume in 2025

11.6 million units

Volume forecast in 2030

21.7 million units

Actual year

2017 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Design, mount type, storage type, storage capacity, deployment, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; KSA; South Africa

Key companies profiled

ASUSTOR Inc.; D-Link Corporation; Dell Inc.; NEC Corporation; NETGEAR; QNAP Systems, Inc.; Seagate Technology LLC; Synology Inc.; Western Digital Corporation; Zyxel; TerraMaster; BUFFALO INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Consumer Network Attached Storage Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global consumer network attached storage (NAS) market based on design, mount type, storage type, storage capacity, deployment, end user, and region:

-

Design Outlook (Volume, Thousand Units; Revenue, USD Billion, 2017 - 2030)

-

1-Bay

-

2-Bays

-

4-Bays

-

5-Bays

-

6-Bays

-

Above 6-Bays

-

-

Mount Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2017 - 2030)

-

Standalone

-

Rackmount

-

-

Storage Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2017 - 2030)

-

Hard Disk Drive (HDD)

-

Flash Storage

-

Hybrid

-

-

Storage Capacity Outlook (Volume, Thousand Units; Revenue, USD Billion, 2017 - 2030)

-

Less than 1 TB

-

1 TB to 20 TB

-

More than 20 TB

-

-

Deployment Outlook (Volume, Thousand Units; Revenue, USD Billion, 2017 - 2030)

-

On-Premise

-

Cloud/ Remote

-

Hybrid

-

-

End User Outlook (Volume, Thousand Units; Revenue, USD Billion, 2017 - 2030)

-

Residential

-

Business

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global consumer network attached storage market size was estimated at USD 6.10 billion in 2024 and is expected to reach USD 6.79 billion in 2025.

b. The global consumer network attached storage market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2030 to reach USD 12.04 billion by 2030.

b. North America dominated the consumer network attached storage market with a share of over 34.2% in 2024. This is attributable to the presence of prominent market players in the region and significant investments made by them in R&D.

b. Some key players operating in the consumer network attached storage market include ASUSTOR Inc., D-Link Corporation, Dell Inc., NEC Corporation, NETGEAR, QNAP Systems, Inc., Seagate Technology LLC, Synology Inc., Western Digital Corporation, Zyxel, TerraMaster, and BUFFALO INC.

b. Key factors that are driving the market growth include growing volumes of unstructured data and acceleration of digital transformation among small and medium-sized enterprises (SMEs).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.