Consumer Electronics Repair And Maintenance Market Size, Share & Trends Analysis Report By Product (Entertainment Devices, Personal Devices), By Service Provider, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-413-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

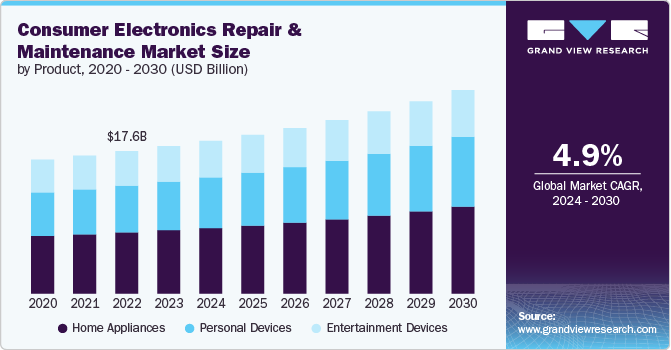

The global consumer electronics repair and maintenance market size was estimated at USD 18.23 billion in 2023 and is expected to grow at a CAGR of 4.9% from 2024 to 2030. Electronic equipment has experienced significant digital transformation, leading to a surge in devices with AI-driven smart features. This rise in digitalization extends to the consumer electronics repair and maintenance sector, which now faces a growing need due to the increasing prevalence of smart appliances, AI-powered technologies, touchscreen computers, and advanced washing machines.

As consumer goods become more digitized, a trend known as the consumerization of information technology emerges. The Internet of Things (IoT) further integrates consumer electronics and IT by introducing many connected devices. Today's electronic devices are more advanced than fifty years ago but more accessible, diverse, and affordable. This growing sophistication has heightened the demand for repair and maintenance services, prompting market players to expand their service networks in developing countries. In contrast, the market remains well-established in industrialized regions.

The proliferation of consumer electronics in daily life has significantly contributed to the growing demand for repair and maintenance services. The International Data Corporation (IDC) indicates that global shipments of smartphones, tablets, and PCs reached over 2.8 billion units in 2022. With such widespread adoption, the frequency of device issues has naturally increased. The average lifespan of electronic devices has also contributed to the rising demand for repairs. According to a study by the Consumer Technology Association (CTA), the average lifespan of a smartphone is around 2.5 years. As devices end their typical lifespan, they are more likely to require repairs or maintenance, increasing the demand for professional services. The CTA's survey found that 45% of consumers prefer repairing their devices rather than replacing them, driven by cost and environmental concerns.

The repair and maintenance industry has seen significant improvements in service offerings, contributing to its growth. Repair businesses have invested in advanced diagnostic tools and equipment, enabling them to handle a wider range of issues more effectively. Many repair services now offer on-site repairs, mail-in options, and quick turnaround times, enhancing convenience for consumers. For instance, companies like uBreakiFix and Gazelle have expanded their service offerings to include walk-in repairs, mail-in services, and even same-day repairs, catering to diverse consumer needs.

Environmental concerns have become a major driver of the consumer electronics repair market. According to the Global E-Waste Monitor, the global electronic waste (e-waste) market was valued at approximately $50 billion in 2022, with projections indicating it could reach USD 79 billion by 2026. The environmental impact of e-waste, including pollution and resource depletion, has prompted increased consumer awareness and a shift towards sustainable practices.

The right-to-repair movement has gained traction, advocating for consumers' ability to repair their devices and reduce e-waste. According to a survey by Repair.org, 80% of consumers support legislation that makes it easier to repair electronics. This support has led to increased availability of repair resources and services, further driving market growth. In addition, many manufacturers are now offering repair kits and manuals, making it easier for consumers to perform repairs and contributing to the growth of the repair market.

Product Insights

Home appliances repair and maintenance accounted for a revenue share of 42.94% in 2023. The rise in smart home technologies and AI-driven appliances has led to more complex devices that require specialized repair services. As more households adopt these advanced appliances, the need for skilled technicians to address technical issues grows. Moreover, the increased lifespan of high-quality appliances means that consumers are more likely to seek repair services rather than replacements, driving demand for maintenance. Furthermore, home appliances' growing complexity and connectivity fuel a rising demand for dedicated repair and maintenance solutions.

The personal device repair and maintenance market is projected to grow at a CAGR of 5.5% from 2024 to 2030. The proliferation of personal devices such as smartphones, tablets, and laptops has led to a higher volume of these items needing repair services. Frequent use of these devices often results in issues such as screen damage, battery wear, and software malfunctions, driving the need for repair. Furthermore, the rapid advancement of technology means that these devices are becoming more complex, requiring specialized repair skills and parts.

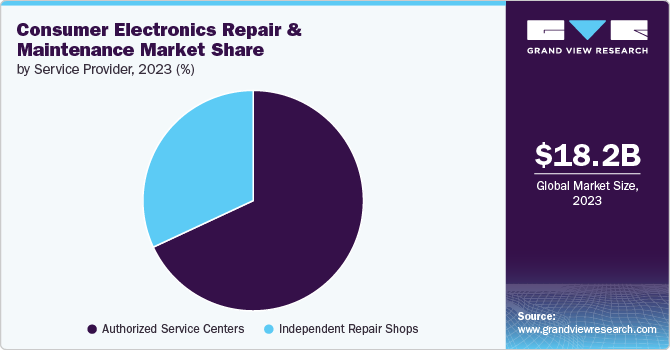

Service Provider Insights

The authorized service centers accounted for a revenue share of 68.07% in 2023. Consumers seek assurance of quality and reliability, which authorized centers provide through manufacturer-trained technicians and genuine parts. As electronic devices become more complex and sophisticated, the need for specialized expertise and access to original components drives customers to choose authorized centers over independent repair shops. Warranty protection is another key factor, as repairs at authorized centers ensure that warranties remain valid, offering peace of mind to consumers. In addition, the increasing focus on device performance and safety compliance means that repairs must adhere to strict standards authorized centers are equipped to meet.

Independent repair shops are projected to grow at a CAGR of 5.4% over the forecast period of 2024 to 2030. Independent shops often offer more competitive pricing compared to authorized service centers, making them an attractive option for cost-conscious consumers. They also provide flexible and quick service, particularly appealing to those needing immediate repairs. Unlike authorized centers, independent shops are not restricted to specific brands, allowing them to service a wider range of devices. Moreover, many consumers appreciate independent shops' personalized service and community-oriented approach.

Regional Insights

The consumer electronics repair and maintenance market in North America held 25.18% of the global revenue in 2023. The high penetration of advanced electronic devices, such as smartphones, laptops, and smart home systems, drives the need for frequent repair services. The increasing complexity of these devices necessitates specialized repair expertise, which fuels demand for professional services. Furthermore, the trend towards extending the lifespan of electronics rather than replacing them supports the need for repair and maintenance.

U.S. Consumer Electronics Repair And Maintenance Market Trends

The consumer electronics repair and maintenance market in the U.S. is expected to grow at a CAGR of 4.8% from 2024 to 2030. The widespread use of advanced electronic devices, including smartphones, tablets, and smart home appliances, creates a consistent need for repair services. These devices' high value and complexity often lead consumers to seek professional help to ensure quality repairs. In addition, the U.S. market's emphasis on high-quality service and maintaining warranties encourages the use of professional repair services.

Asia Pacific Consumer Electronics Repair And Maintenance Market Trends

The consumer electronics repair and maintenance market in Asia Pacific is projected to grow at a CAGR of 5.5% from 2024 to 2030. The rapid growth in electronic device ownership across diverse countries drives a high volume of repair needs. The region's expanding middle class and increasing disposable income are leading to greater adoption of advanced electronics, including smartphones, laptops, and home appliances, raising the demand for repair services. Furthermore, consumers strongly prefer cost-effective repairs over purchasing new devices.

Europe Consumer Electronics Repair And Maintenance Market Trends

The consumer electronics repair and maintenance market in Europe accounted for a revenue share of 30.45% in the year 2023. European consumers increasingly opt for repairs over replacements, driven by a strong emphasis on sustainability and reducing electronic waste. The region's stringent environmental regulations and focus on extending the lifecycle of electronics further support this trend. Moreover, the complexity of modern devices requires specialized repair expertise, which boosts demand for professional services.

Key Consumer Electronics Repair And Maintenance Company Insights

The market features both established global firms and emerging players. Leading industry players focus on innovating within their categories to align with changing consumer preferences. Utilizing their extensive global distribution networks, these major firms successfully connect with a wide range of customers and explore new and emerging markets.

Key Consumer Electronics Repair And Maintenance Companies:

The following are the leading companies in the consumer electronics repair and maintenance market. These companies collectively hold the largest market share and dictate industry trends.

- The Cableshoppe

- Redington Services

- Electronix Services

- B2X Care Solutions

- Encompass Parts

- uBreakiFix

- iCracked

- Asurion, LLC

- Best Buy Co., Inc.

- American Home Shield Corporation

Recent Developments

-

In September 2022, Asurion, LLC launched a new electronics repair location, Asurion Tech Repair & Solutions, in Eagan. This new facility provides expert repairs for consumer electronics and various other repair services.

-

In July 2022, Best Buy Co., Inc. has revealed plans to open its inaugural small-format, digital-first store in Monroe. The new location will showcase a carefully chosen range of top-tier products and offer specialized expert services.

Consumer Electronics Repair And Maintenance Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 18.87 billion |

|

Revenue forecast in 2030 |

USD 25.15 billion |

|

Growth rate |

CAGR of 4.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, service provider, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa |

|

Key companies profiled |

The Cableshoppe; Redington Services; Electronix Services; B2X Care Solutions; Encompass Parts; uBreakiFix; iCracked; Asurion, LLC; Best Buy Co., Inc.; American Home Shield Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Consumer Electronics Repair And Maintenance Market Report Segmentation

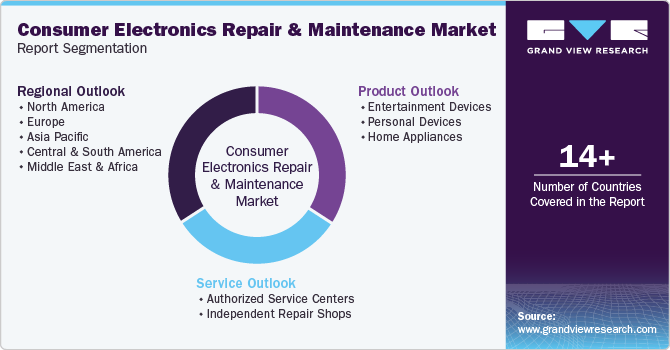

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the consumer electronics repair and maintenance market based on product, service provider, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Entertainment Devices

-

Televisions

-

Audio Devices

-

Others

-

-

Personal Devices

-

Mobiles And Tablets

-

PCs

-

Laptops/Notebooks

-

Digital Cameras

-

Others

-

-

Home Appliances

-

Refrigerators

-

Washing Machines

-

Grinder (Mixer)

-

Dishwasher

-

Microwaves and Oven

-

Others

-

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Authorized Service Centers

-

Independent Repair Shops

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global consumer electronics repair and maintenance market was estimated at USD 18.23 billion in 2023 and is expected to reach USD 18.87 billion in 2024.

b. The global consumer electronics repair and maintenance market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 25.15 billion by 2030.

b. Asia Pacific dominated the consumer electronics repair and maintenance market with a share of over 35.47% in 2023. The growth of the regional market is mainly driven by the rapid growth in electronic device adoption, driven by rising disposable incomes, and expanding middle-class populations, significantly boosts demand for repair services.

b. Some of the key players operating in the consumer electronics repair and maintenance market include Heritage The Cableshoppe, Redington Services, Electronix Services, B2X Care Solutions, Encompass Parts, uBreakiFix, iCracked, Asurion, LLC, Best Buy Co., Inc., and American Home Shield Corporation.

b. Key factors that are driving the consumer electronics repair and maintenance market growth include technological advancements, increased usage of devices, economic considerations, environmental awareness, shifting consumer preferences, enhanced service offerings, and regulatory support.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."