- Home

- »

- Sensors & Controls

- »

-

Consumer Electronics Sensors Market Size Report, 2030GVR Report cover

![Consumer Electronics Sensors Market Size, Share & Trends Report]()

Consumer Electronics Sensors Market Size, Share & Trends Analysis Report By Product, By Application (Communication, Entertainment, Home Appliances, IT, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-183-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

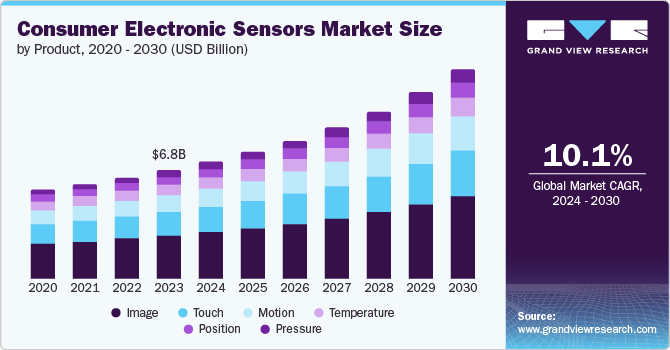

The global consumer electronics sensors market size was valued at USD 6.80 billion in 2023 and is projected to grow at a CAGR of 10.1% from 2024 to 2030.This growth is primarily driven by increased investments in research and development, resulting in the continuous introduction of innovative products that attract and influence consumers. Intense market competition has spurred new consumer preferences, including demands for smaller sizes, lower power consumption, and wearable technology. Consequently, manufacturers are tailoring their products to meet these specific attributes, contributing to the overall development of the market.

The growth of digitization and technology in every sector has significantly driven market demand. In the manufacturing industry, the Internet of Things (IoT) is helping boost productivity. Similarly, the home appliances sector has experienced a surge in demand for IoT-enabled security solutions. The gaming and Entertainment industry has also seen significant changes due to the market introducing a wide range of variety products such as VR in gaming, 3D experiences in sound, and visual effects in entertainment has led to an increase in the growth of the market.

The market is poised for growth as the demand for Micro Electro Mechanical Systems (MEMS) in communication, entertainment, and home appliances continues to rise. These devices are mainly integrated into smartphones and tablets because of their compact size and improved efficiency. MEMS contribute significantly to enhancing communication, visual, sound, navigation & control, and tactile interface experiences. Nevertheless, challenges such as lack of product differentiation and price pressures could impede industry growth in the next seven years.

Product Insights & Trends

The image segment accounted for a revenue share of 39.8% in 2023.Due to an increase in investments in research and development, companies are creating new sensors that are affordable, small, and use less energy. This has opened up fresh possibilities in the market, which has gotten more competitive. New companies are joining the fray with all sorts of products and unique marketing strategies. This competition is a major reason the market is booming. As the smartphone market keeps growing, it will also create a positive ripple effect for the image sensor market.

The motion sensor segment is projected to grow at a CAGR of 10.9% from 2024 to 2030. Motion sensors are now an integral part of various industries including automotive, consumer electronics, aerospace, healthcare, and others. The increase in the construction of smart houses and advancement in domestic applications like home control, light control, security control, and automatic others has been a driving force in the growth of the motion sensors market. The market is also expected to be supported by the proliferation of smartphones, tablets, and wearable technologies such as watches.

The pressure sensor market has seen significant growth in recent years and is going to continue in the same manner in upcoming years.Increased demand for pressure sensors in automotive applications, particularly for functionalities like tire pressure monitoring and engine management systems, fuels market expansion. The growing integration of pressure sensors in consumer electronics, such as smartphones and wearables, and medical devices for patient monitoring further propels market expansion. Additionally, the rise of industrial automation and the incorporation of pressure sensors in HVAC systems and household appliances create significant growth opportunities.

Applications Insights &Trends

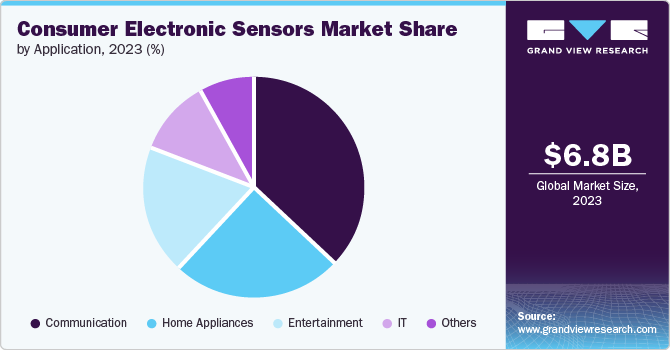

Communications applications accounted for the largest market revenue share of 36.8% in 2023. The rising demand for smart devices and IoT products has fueled the need for high-quality sensors. Also, the growing focus on user experience and interactivity in consumer electronics has necessitated the integration of advanced sensors. Lastly, the trend towards miniaturization in electronics has also played a crucial role, as smaller devices require compact yet powerful sensors.

Home appliances accounted for the second-largest revenue share of 24.7% in 2023. As the number of smart homes continues to increase, the need for sensors in home appliances follows a similar trajectory. In the domestic market, there is a long way to move still around very low power applications in home energy efficiency and sensors means more intelligence for managing electricity. Moreover, the increasing customer preference for ease and automation in house appliances has led to an increased requirement for advanced sensors. Finally, the need to execute on a connected home ecosystem has necessitated the use of sensors for seamless interoperability.

The entertainment applications segment is expected to grow at a CAGR of 10.6% from 2024 to 2030. The rapid advancement in technology is leading to the development of more immersive and interactive entertainment experiences, such as virtual and augmented reality, which heavily rely on sensors. The rise in the gaming industry has increased demand for a variety of products with better user experience and improved sensory effects.

Regional Insights & Trends

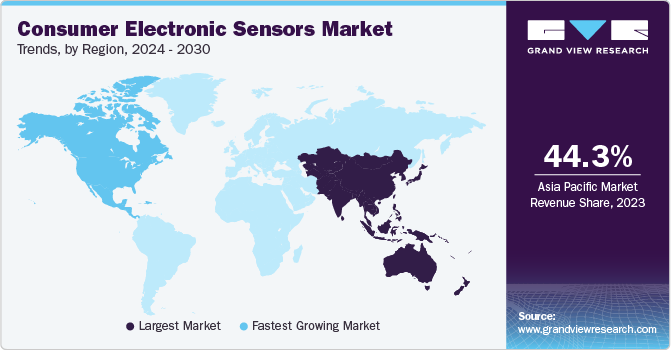

North American is anticipated to grow at the highest CAGR of 15.6% from 2024 to 2030. The convergence of IoT with its rising device ecosystem, alongside surging automation demands, a flourishing virtual reality market, continuous smart city initiatives, and escalating security anxieties are all fueling the market growth.

U.S. Consumer Electronic Sensors Market Trends

The consumer electronic sensors market in the U.S. dominated the North American market with a share of 78.6% in 2023. The surge in the market demand for intelligent sensors can be attributed to the rising necessity for energy-conserving devices. Given that businesses are actively adopting energy-saving practices, the evolving landscape calls for energy-efficient equipment and products.

Asia Pacific Consumer Electronic Sensors Market Trends

APAC dominated the market with a share of 44.3% in 2023. The driving forces behind this are the rising youth population in countries like India who are interested in Electronics. China, India, and South Korea being the manufacturing houses of many smartphones and other electronic sensor products also led to an increase in the market size in the region.

Indian consumer electronic sensor markets have been on the rise and are going to be the same in the upcoming years. Government initiatives such as building smart cities, Digital India, and Make in India have increased the production of Electronic sensors which has significantly increased the players in the market of the region.

Europe Consumer Electronic Sensors Market Trends

Europe captured the second-largest market share of 22.8% in 2023. The growth of the European consumer electronic sensor market is attributed to advancements in key sectors such as healthcare, automotive, defense and aerospace, and consumer electronics. Additionally, government investments and initiatives aimed at enhancing semiconductor production capabilities are driving the market forward.

Key Consumer Electronics Sensors Company Insights

Some of the key companies in the Consumer Electronic Sensor market include Sony Corporation, SAMSUNG, and Panasonic Corporation. Companies in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Consumer Electronics Sensors Companies:

The following are the leading companies in the consumer electronics sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Sony Corporation

- SAMSUNG

- Bosch Sensortec GmbH

- DigiKey.

- STMicroelectronics

- OMNIVISION

- Analog Devices

- Panasonic Corporation

- Knowles Electronics

- InvenSense

Recent Developments

-

In April 2024, Sony Semiconductor Solutions Corporation (SSS) launched and implemented an edge AI-driven vision detection solution at 500 convenience store sites across Japan. The primary objective behind this initiative is to enhance the effectiveness of in-store advertising and maximize its advantages.

-

In December 2023, Samsung introduced two cutting-edge ISOCELL Vizion sensors specifically designed to cater to the needs of robotics and XR applications.

-

In December 2023, Panasonic introduced a cutting-edge 6-in-1 inertial sensor. This groundbreaking sensor is set to revolutionize automotive safety and performance, taking it to new heights.

Consumer Electronics Sensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.32 billion

Revenue forecast in 2030

USD 13.07 billion

Growth Rate

CAGR of 10.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Sony Corporation; SAMSUNG; Bosch Sensortec GmbH; DigiKey.; STMicroelectronics; OMNIVISION; Analog Devices; Panasonic Corporation; Knowles Electronics; InvenSense

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

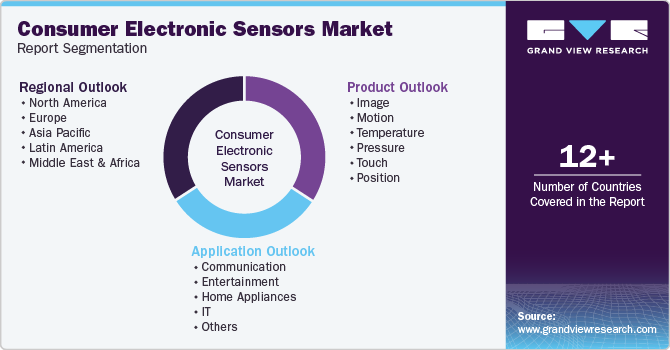

Global Consumer Electronics Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global consumer electronic sensors market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Image

-

Motion

-

Temperature

-

Pressure

-

Touch

-

Position

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication

-

Entertainment

-

Home Appliances

-

IT

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."