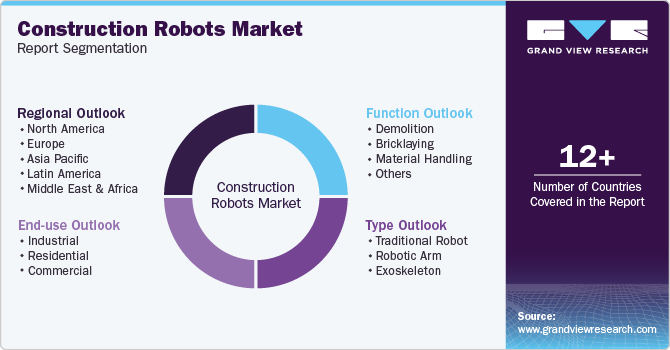

Construction Robots Market Size, Share & Trends Analysis Report By Function (Demolition, Bricklaying, Material Handling), By Type (Traditional Robot, Robotic Arm, Exoskeleton), By End-use (Industrial, Residential, Commercial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-032-8

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Construction Robots Market Size & Trends

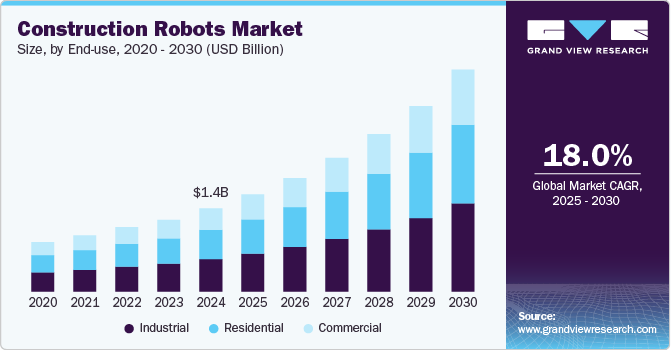

The global construction robots market size was estimated at USD 1.37 billion in 2024 and is projected to grow at a CAGR of 18.0% from 2025 to 2030. Various factors, such as reduced labor costs, increased safety due to robotic automation, and rapid urbanization and industrialization, are contributing to growth. Global demand for construction robots is expected to increase as more construction firms undertake automation initiatives and increase funding toward modernizing their construction activities.

The increasing need for advanced infrastructure, coupled with the ever-increasing population, is expected to drive demand for automated construction solutions. According to a report by Autodesk Inc., around 13,000 buildings need to be constructed daily by 2050 to accommodate the increasing population. The reason for the shift toward construction robots is smart agility, convenience, and cost-effectiveness. The growing emphasis of construction firms on reducing resource wastage and overall costs is expected to drive the construction robot industry. In addition, emphasis on reducing the turnaround time of construction projects is motivating market players to launch new and innovative products with increased efficiency and speed.

For instance, in April 2022, PrintStones, a manufacturer of mobile 3D printing construction robots, announced the launch of Baubot, a mobile robot for 3D printing and on-site construction. Printstones also released a specialized software development kit (SDK) for use with the Baubot to make construction sites efficient and safer for laborers. Customers can customize their robots with new applications and tools as they see fit, resulting in a truly adaptable product suitable for any manufacturing site.

Labor shortages in the construction industry, driven by an aging workforce and declining interest in trade professions, are pushing companies to adopt robotic solutions to maintain productivity. Construction robots can perform repetitive and hazardous tasks, reducing reliance on manual labor while improving operational efficiency. In addition, these robots enhance workplace safety by minimizing human exposure to dangerous environments, leading to fewer accidents and compliance with stricter safety regulations. This dual benefit of addressing workforce gaps and prioritizing safety is significantly fueling the growth of the global construction robot industry.

Technological advancements in AI and robotics are transforming the global construction robot industry by enabling machines to perform complex tasks with greater precision and autonomy. AI-driven systems allow robots to adapt to real-time conditions, enhancing efficiency in activities such as material handling, precision assembly, and on-site problem-solving. These innovations reduce errors, speed up project timelines, and optimize resource utilization, addressing key challenges in the construction industry. As a result, these advancements are accelerating the adoption of robotics and reshaping traditional construction processes.

Function Insights

Based on function, the material handling segment led the market with the largest revenue share of 32.7% in 2024. The growth of the segment is driven by the need to improve efficiency and safety in transporting heavy and repetitive loads on construction sites. Robotic material handlers reduce labor costs, minimize the risk of workplace injuries, and enhance overall productivity by automating tasks like lifting, moving, and positioning materials. In addition, advancements in AI and sensor technologies enable these robots to navigate complex environments with precision, further boosting their adoption. This focus on streamlining operations and addressing labor shortages is propelling the demand for material-handling construction robots.

The demolition segment is expected to grow at a significant CAGR during the forecast period. The segment is driven by the increasing demand for efficient and safe demolition processes in urban redevelopment and infrastructure projects. Robotic demolition machines offer precise performance, even in confined or hazardous environments, significantly reducing risks to human workers. In addition, these robots can handle heavy workloads, minimize waste, and comply with stringent environmental and safety regulations. This combination of safety, efficiency, and environmental sustainability is fueling the adoption of demolition robots globally.

End-use Insights

Based on end use, the industrial segment accounted for the largest revenue share in 2024. The growth of the segment is driven by the increasing demand for automation in large-scale industrial projects, such as manufacturing facilities, power plants, and warehouses. Construction robots enhance efficiency and precision in activities like site preparation, structural assembly, and maintenance, helping industries meet tight project deadlines and quality standards. In addition, the adoption of robots in industrial construction reduces reliance on manual labor and ensures greater safety in hazardous environments.

The residential segment is expected to grow at a significant CAGR from 2025 to 2030. The growth of the segment is driven by the rising demand for efficient, cost-effective, and high-quality housing solutions. Construction robots are increasingly used for tasks such as bricklaying, painting, and 3D printing of housing components, significantly reducing project timelines and labor costs. In addition, the growing focus on sustainability and precision in residential construction aligns with the capabilities of robotic systems. This adoption is further supported by advancements in automation technology, making robotic solutions more accessible for residential construction projects.

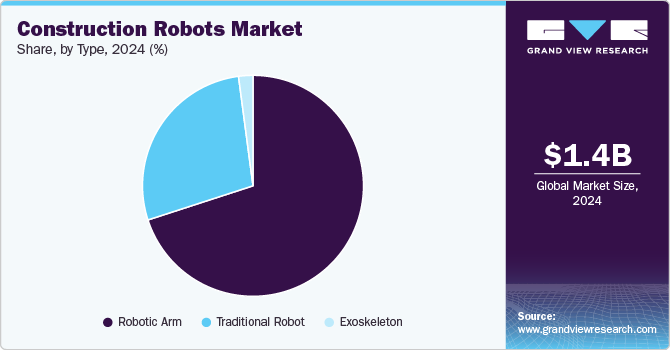

Type Insights

Based on type, the robotic arm segment accounted for the largest market revenue share in 2024. Construction industry trends such as refined construction, rapid construction, and standardized design have aided in the adoption of innovative technologies. Market players operating in the robotic arm segment have to constantly develop and design new and innovative products to cope with the increasing demand. For instance, in April 2021, PrintStones, an autonomous 3D printing and construction robot provider, announced the launch of a new variant of Baubot. The new robot is an autonomous construction assistant with a robotic arm mounted on top that carries out functions such as security, drywall, 3D printing, painting, welding, and bricklaying.

The traditional robot segment is expected to witness at the fastest CAGR during the forecast period. Increasing awareness of benefits brought about by the adoption of robotic automation in the construction industry has fueled demand for innovative construction robots and products. The traditional robot segment has witnessed significant new innovative products launched by market players to address the evolving needs of the construction industry. For instance, in October 2022, Built Robotics, a provider of construction automation products, announced the launch of its Ecosystems platform in the European market. Exosystems can transform excavators into autonomous robots.

Regional Insights

The construction robots market in North America is expected to grow at a significant CAGR from 2025 to 2030. The growth of the construction robots industry in North America is driven by the region's advanced adoption of automation technologies and a strong focus on addressing labor shortages in the construction industry. Increased investment in large-scale infrastructure projects, combined with the need to enhance productivity and safety, has spurred demand for robotic solutions. In addition, supportive government initiatives and funding for smart construction technologies further accelerate market growth, making North America a leading hub for construction robotics innovation.

U.S. Construction Robots Market Trends

The construction robots market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The U.S. market is growing due to a surge in urbanization and large-scale infrastructure modernization projects, such as smart cities and green building initiatives. The industry's push to address labor shortages with advanced robotics is further fueled by a strong emphasis on cost efficiency and project timelines. In addition, U.S.-based construction firms' investment in cutting-edge technologies, including AI-powered robots for precision and automation, positions the country as a leader in driving innovation in construction robotics.

Asia Pacific Construction Robots Market Trends

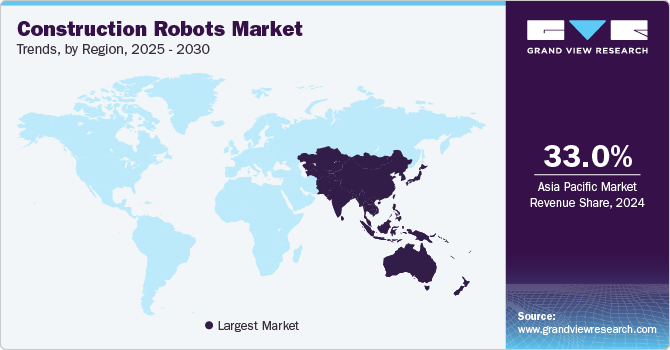

Asia Pacific construction robots market dominated the global market with the largest revenue share of 33.0% in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The increasing adoption of robotic automation and tools in this region is the major factor driving the growth. The region is likely to witness significant growth owing to the increasing government spending on the construction industry and increasing competition among the market players.

In addition, Asia Pacific has a high population, resulting in the increasing demand for residential and industrial infrastructure, which makes Asia Pacific a promising region. For instance, instance in February 2022, Schindler announced the deployment of its Schindler R.I.S.E robot in the Asia Pacific region. Schindler R.I.S.E is an autonomous, self-climbing robot that is used for installation activities in elevator shafts.

The construction robots market in Japan growth is driven by the country's aging population and labor shortage, which is increasing the demand for automated solutions to maintain productivity in construction. Japan's strong focus on technological innovation and smart city development further fuels the adoption of robotics in construction to ensure high efficiency and precision in projects.

The China construction robots market held a substantial market share in Asia Pacific in 2024, driven by rapid urbanization and large-scale infrastructure projects, which created a significant demand for efficient construction technologies. China's government has been actively promoting the adoption of robotics and automation in construction, aiming to enhance productivity and reduce labor costs.

Europe Construction Robots Market Trends

The construction robots market in Europe is expected to grow at a significant CAGR from 2025 to 2030. The growth of the construction robots industry in Europe is driven by the region's stringent sustainability regulations and increasing adoption of green building practices. Governments and private sectors are investing in automation to meet energy efficiency targets and reduce carbon footprints in construction. In addition, the region's emphasis on modular construction and precision engineering further supports the adoption of advanced robotic technologies.

The UK construction robots market growth is driven by the government's push for modernization in the construction sector through initiatives like the Construction 2025 strategy, which aims to enhance productivity and sustainability. In addition, the UK's focus on high-tech infrastructure projects and sustainable urban development is creating new opportunities for robotic solutions.

The construction robots market in Germany growth is driven by the country’s strong emphasis on innovation and technological leadership in the engineering and construction sectors. Germany’s high standards for quality and precision in construction projects are fostering demand for robotic solutions that enhance efficiency and reduce human error. Furthermore, the country’s push towards sustainable and energy-efficient buildings, supported by government incentives, is encouraging the use of robotics for tasks like material handling and energy-efficient construction. The shortage of skilled labor in the construction sector is also prompting greater reliance on automation to meet project demands.

Key Construction Robots Company Insights

Some of the key companies in the construction robots industry include Construction Robotics, ABB, Advanced Construction Robotics, Inc., Brokk Global, and others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

ABB is a global company in industrial automation and robotics, providing advanced robotic solutions for the construction industry. The company's cutting-edge technology enhances construction efficiency, safety, and precision through automation, contributing significantly to the growth of construction robots in sectors like infrastructure and smart buildings.

-

Advanced Construction Robotics, Inc. specializes in developing innovative robotic systems for the construction industry. Its flagship product, the "Tybot," automates rebar-tying tasks, significantly improving efficiency, safety, and cost-effectiveness on construction sites. The company plays a key role in advancing automation within the global construction robots industry.

Key Construction Robots Companies:

The following are the leading companies in the construction robots market. These companies collectively hold the largest market share and dictate industry trends.

- Construction Robotics

- ABB

- Advanced Construction Robotics, Inc.

- Brokk Global

- Ekso Bionics

- Autonomous Solutions, Inc.

- MX3D

- Husqvarna Group

- FBR Ltd

- Conjet

View a comprehensive list of companies in the Construction Robots Market

Recent Developments

-

In March 2024, ABB Robotics partnered with U.K.-based start-up AUAR to advance robotic micro-factories for building affordable, sustainable timber homes. The collaboration aims to address skills shortages, enhance sustainability, and improve quality by automating construction, with robots playing a critical role in reducing waste and increasing efficiency.

-

In March 2023, Advanced Construction Robotics, Inc. unveiled IronBOT, the world's first rebar lifting, carrying, and placing robot, designed to enhance construction crew efficiency. Paired with TyBOT for rebar tying, this technology can reduce rebar installation time by 50%.

Construction Robots Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.60 billion |

|

Revenue forecast in 2030 |

USD 3.66 billion |

|

Growth rate |

CAGR of 18.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, Volume in units, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue and volume forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Function, type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa |

|

Key companies profiled |

Construction Robotics; ABB; Advanced Construction Robotics, Inc.; Brokk Global; Ekso Bionics; Autonomous Solutions, Inc.; MX3D; Husqvarna Group; FBR Ltd; Conjet |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Construction Robots Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction robots market report based on function, type, end-use, and region.

-

Function Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Demolition

-

Bricklaying

-

Material Handling

-

Others

-

-

Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Traditional Robot

-

Robotic Arm

-

Exoskeleton

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Residential

-

Commercial

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global construction robots market size was estimated at USD 1,373.0 million in 2024 and is expected to reach USD 1.60 billion in 2025.

b. The global construction robots market is expected to grow at a compound annual growth rate of 18.0% from 2025 to 2030 to reach USD 3.66 billion by 2030.

b. Asia Pacific dominated the construction robots market with a market share of 33.0% in 2024. Increasing population, rapid urbanization and industrialization, and increasing adoption of robotic automation are some of the factors contributing to regional market growth.

b. Some key players operating in the construction robots market include Construction Robots, ABB, Advanced Construction Robots, BROKK GLOBAL, Esko Bionics, Autonomous Solutions Inc., MX3D, Husqvarna AB, FBR Ltd., and Conjet

b. Key factors driving the market growth include increasing awareness regarding the benefits of robots in construction activities, the ever-increasing population, and the increasing number of initiatives undertaken by governments in the construction industry

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."