- Home

- »

- Advanced Interior Materials

- »

-

Construction Nails Market Size, Share, Growth Report, 2030GVR Report cover

![Construction Nails Market Size, Share & Trends Report]()

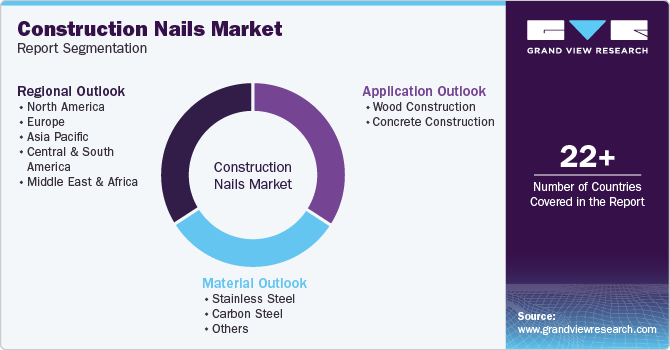

Construction Nails Market Size, Share & Trends Analysis Report By Material (Stainless Steel, Carbon Steel), By Application, By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-089-2

- Number of Report Pages: 98

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Construction Nails Market Size & Trends

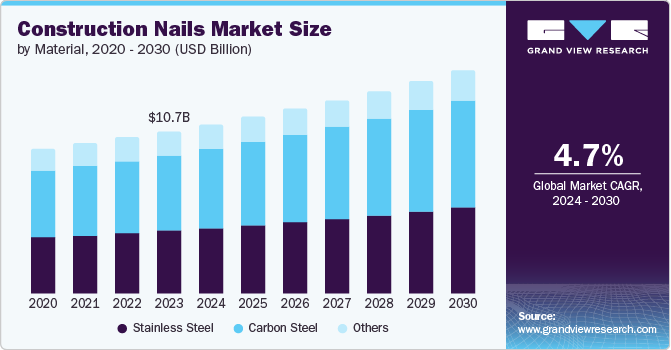

The global construction nails market size was estimated at USD 10.70 billion in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030. The market's growth can be attributed to the flourishing global construction industry, which is a key consumer of these nails. The industry's growth is driven by increasing public and private investments in the development of new infrastructures, residential spaces, and commercial spaces in countries such as India, China, and Mexico. Thus, the rising number of construction activities worldwide fuels the demand for construction nails.

These nails are widely used in wood structures, cabinets, wall-molding applications, sheaths, fence-fixing applications, timber & soft pine frames, composition roofs, underlayment, fiber-cement boards, buildings, home renovation projects, etc. The surge in the development of lightweight wood-based structures in different countries across the world owing to the easy availability of wood, its high mobility rate, reduced taxes, and its low transportation costs, along with the ease of processing offered by it, is also fueling the demand for the product.

Construction nails are manufactured from raw materials, such as stainless steel and carbon steel. Stainless steel is highly preferred in manufacturing these nails owing to its various attributes, such as durability, resistance to corrosion, and high strength. Carbon steel is also used for manufacturing these nails due to its ability to bear loads and high tensile strength. In addition, when made from carbon steel, these nails are relatively less expensive than those made with stainless steel, which is expected to augment the demand for carbon steel nails in the market.

The U.S. is expected to witness significant growth due to its growing construction industry. In addition, wood construction has been followed in the country for a long time on account of the availability of wood. The wood construction trend is still ongoing in the U.S. owing to comparatively low wood prices and the country's growing adoption of sustainable building practices. Therefore, rising wood construction is expected to augment the demand for the product over the coming years.

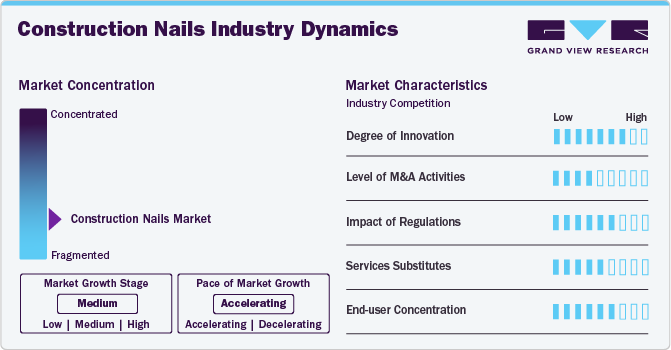

The market is highly competitive, as customers look for specific sizes, types, and quality of nails rather than the brand name. Construction nails are distributed through direct channels, third-party vendors, or online portals. Companies involved in residential and non-residential construction procure these nails in bulk. The purchase volume and duration of contracts with these players in the end-use industry are the two major factors affecting manufacturers' profit margins. As a result, product pricing and profit margins vary across industry players.

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of growth is accelerating. The global market is fragmented due to several suppliers and manufacturers based in China, the U.S., the UK, Canada, and other emerging economies, such as India. These companies continuously invest in various strategies to gain a competitive edge over other market players. The strategies adopted by manufacturers include expansion, product launches, collaborations, and research & development.

The American Society for Testing and Materials (ASTM), the International Standards (IS), the British Standards Institution (BSI), and a few others lay down the rules, regulations, and standards that govern the market globally. The market has witnessed the imposition of standards regarding the production, sales, and application of nails in timber and other construction projects. Furthermore, the manufacturing of nails should also meet the building requirements of various countries worldwide. Thus, manufacturers must follow different standards to fulfill all the requirements.

The threat of substitutes is expected to remain medium over the coming period. Building and construction tapes are projected to witness high demand over the forecast period owing to their cost effectiveness, clean finishing, low weight, and corrosion resistance. However, the rising demand for wooden and concrete construction in countries around the globe is projected to promote the nails. As a result, the threat of substitution is anticipated to be moderate over the forecast period.

Material Insights

The stainless steel segment is expected to grow at a CAGR of 4.7% over the forecast period. Stainless steel nails are used in wood & concrete construction, DIY projects, home decor, and remodeling of homes. Furthermore, the anti-rusting and anti-corrosion properties of stainless steel nails make them suitable for outdoor applications, such as deck and roofing. Stainless steel is preferred for manufacturing nails owing to its properties, such as durability, high reliability, and quality in terms of strength. In addition, the product has corrosion resistance; hence, it is highly recommended in wood construction, where the wood structures are exposed to moisture. Carbon steel gets oxidized when exposed to air. In contrast, stainless steel produces chromium oxide, protecting stainless steel nails from the damage caused by oxygen and chemicals, extending their lifespan.

The carbon steel segment dominated the market with a share of 46.3% in 2023. The segment is expected to grow significantly over the forecast period due to its broad application scope in the manufacturing of nails owing to its high load-bearing and tensile strength. In addition, carbon steel nails are good at resisting abrasion and retaining their original shape. This makes them a preferred choice as fastening materials for heavyweight structures such as concrete and steel. Carbon steel nails lack the property of corrosion resistance; however, they are considered more durable and stronger than stainless steel nails. This increases the application of carbon steel nails in heavyweight wood and concrete structures. Moreover, the growing construction of these structures is further expected to increase the adoption of carbon steel nails over the forecast period owing to their low cost.

Application Insights

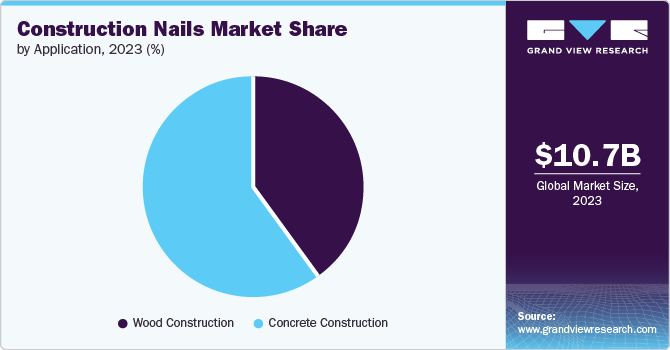

The wood construction segment is expected to grow at a CAGR of 4.4% over the forecast period. This segment includes the development of ceilings, framing, floors, roofing, decking, and walls made using wood. The trend of wood construction is increasing with rising environmental concerns, which are giving rise to sustainable building practices. These factors are expected to increase the trend of wood construction in countries around the globe, thereby fueling market growth. Compared to concrete, wood is more susceptible to damage due to moisture, termites, decay, and fire, affecting the life expectancy of buildings. However, the resistant, durable, and lightweight nature of wooden houses and structures, coupled with their easy-to-work nature, is increasing global demand.

Concrete construction dominated the market, accounting for a revenue share of 59.5% in 2023. It is further anticipated to grow significantly over the forecast period owing to the properties offered by concrete, such as durability, versatility, and strength. These advantages have made concrete an ideal choice for building various commercial as well as residential projects around the globe. Concrete construction is also witnessing increased usage in seismic-prone areas, as the material can withstand natural disasters, such as floods and earthquakes. In addition, concrete can be recycled and reused, increasing the life of structures. This is expected to increase the demand for concrete in the building industry over the coming years.

Regional Insights

The construction nails market in North America is anticipated to grow at a CAGR of 4.7% over the forecast period due to the growing construction industry in the region. The region has been witnessing increased demand for residential and commercial spaces due to the growing population and rising buyer power in countries, such as Canada and Mexico.

U.S. Construction Nails Market Trends

The U.S. construction nails market accounted for the highest revenue share of 75.8 in 2023. Wood construction has been followed in the country for a long time on account of the availability of wood. This trend is still ongoing in the U.S. owing to comparatively low wood prices and the growing adoption of sustainable building practices in the country. Therefore, rising wood construction is expected to augment product demand over the coming years.

The construction nails market in Canada is expected to grow at a CAGR of 5.1% over the forecast period. With increasing buying power, several people prefer to purchase houses in Canada, driving the demand for new residential units in the country.

Asia Pacific Construction Nails Market Trends

The Asia Pacific construction nails market dominated the global construction nails market with the highest revenue share of 42.9% in 2023. The region includes many developing and developed economies, such as India, China, Japan, and Bangladesh. These countries are witnessing growth in infrastructural development, which is driving the demand for these nails.

The construction nails market in China is expected to witness growth at a CAGR of 4.8% over the forecast period. The country has emerged as one of the promising markets in Asia Pacific due to favorable government policies promoting investments in the construction sector. Furthermore, factors, such as population growth, rapid urbanization, and rising disposable income, play an important role in developing the country’s construction sector. Thus, with a rise in construction activities in the country, the market is expected to grow over the forecast period.

The India construction nails market accounted for a revenue share of USD 9.9% in 2023 and is further expected to grow at a CAGR of 6.1% over the forecast period. The growing construction sector is expected to drive the demand for construction nails in the country. India is one of the major developing economies in the world, and its construction industry is growing significantly. Rapid urbanization and a growing population have boosted the country's construction industry.

Europe Construction Nails Market Trends

The construction nails market in Europe is expected to grow at a CAGR of 3.6% over the forecast period. Europe comprises many developed economies, such as Germany, the UK, Russia, Italy, and France, with well-established construction sectors. Governments and private companies in the UK, Germany, France, Italy, and Sweden are making significant investments in building affordable housing units. Expanding commercial and public infrastructures, including healthcare and educational facilities, are expected to drive regional product demand.

The German construction nails market is expected to grow at a CAGR of 3.0% over the forecast period (2024-2030). The country's construction industry is witnessing flourishing growth due to increasing investments in the sector. The factors driving investments include favorable government incentives, resource efficiency in terms of raw materials, and the presence of a circular economy.

The construction nails market in the UK accounted for the revenue share of 12.3% in 2023 due to the extensive construction and restoration activities related to housing units, offices, educational institutes, hotels & restaurants, resorts, transport buildings, and online retail warehousing in the country.

Central & South America Construction Nails Market Trends

The Central & South American construction nails market accounted for a revenue share of 6.2% in 2023 due to the flourishing construction industry. The region's emerging economies, such as Argentina, Brazil, and Peru, are witnessing population growth coupled with rapid urbanization. These factors are triggering the building of residential and commercial units in CSA, fueling the regional product demand.

The construction nails market in Brazil is expected to grow at a CAGR of 2.9% over the forecast period. The Brazilian construction industry is also witnessing growth owing to a rise in investments in infrastructure development projects.

Middle East & Africa Construction Nails Market Trends

The Middle East & Africa construction nails market is expected to grow at the fastest CAGR of 5.3% over the forecast period. The construction industry in the Middle East and Africa is expected to witness exponential growth over the coming years owing to factors, such as increased investments and expansion of oil production.

The construction nails market in Saudi Arabia is expected to grow at a faster rate of 5.8% from 2024-2030. Government policies in South Africa to invest more in the infrastructure sector are likely to boost the growth of the construction sector in this country, which in turn is expected to boost the market growth.

Key Construction Nails Company Insights

Some of the key players operating in the industry include Simpson Strong-Tie Company, Inc., Maze Nails, and TITIBI.

-

TITIBI is an Italy-based manufacturer and supplier of construction materials. The company's product line includes Tool Kits & Accessories, Hardened Steel Nails, Concrete Nails, Thermal Insulation, Gas Nailers

-

Simpson Strong-Tie Company, Inc. was established in 1956 and headquartered in the U.S. The company offers its products through a vast product line that includes Wood Connectors, Fastening Systems, Lateral Systems, Anchoring Systems, Repair, Protection, and Strengthening Systems

Pan Chem Corporation and JE-IL WIRE PRODUCTION are some of the emerging participants in the industry.

-

JE-IL WIRE PRODUCTION is a South Korea-based manufacturer of construction nails. This product line includes concrete nails, collated nails, t-nails and staples, common nails, and special nails

-

Pan Chem Corporation was established in 1999 and has headquarters in India. The company’s product portfolio includes feed, fertilizer, metal finishing, metal treatment, ice melt, pharmaceutical, photography, water treatment, plastic, hardware, moth control, and air fresheners

Key Construction Nails Companies:

The following are the leading companies in the construction nails market. These companies collectively hold the largest market share and dictate industry trends.

- Simpson Strong-Tie

- Grip-Rite

- Shandong Oriental Cherry Hardware Group

- Maze Nails

- TITIBI

- Pan Chem Corporation

- JE-IL WIRE PRODUCTION

- Duchesne

- BECK Fastener Group

- DEACERO

Recent Developments

-

In February 2022, Namakor Holdings acquired Duchesne Ltd. to accelerate the growth of Duchesne. Furthermore, Namakor Holdings also provided financial and human resources to the company

Construction Nails Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.52 billion

Revenue forecast in 2030

USD 14.71 billion

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2023

Actual estimates

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Turkey; China; India; Japan; South Korea; Australia; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Simpson Strong-Tie; Grip-Rite; Shandong Oriental Cherry Hardware Group; Maze Nails; TITIBI; Pan Chem Corp.; JE-IL WIRE PRODUCTION; Duchesne; BECK Fastener Group; DEACERO

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Nails Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction nails market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Carbon Steel

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wood Construction

-

Concrete Construction

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global construction nails market size was estimated at USD 10.70 billion in 2023 and is expected to reach USD 11.52 billion in 2024.

b. The global construction nails market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 14.71 billion by 2030.

b. Carbon steel segment dominated the construction nails market with a market share of 46.3% in 2023. The sub-segment is gaining popularity on account of its wide application scope in manufacturing of nails owing to its high load-bearing and tensile strength.

b. Some of the key players operating in the construction nails market include Simpson Strong-Tie, Grip-Rite, Shandong Oriental Cherry Hardware Group, Maze Nails, Duchesne, BECK Fastener Group, and DEACERO

b. The key factors that are driving the construction nails market include the growing construction activities around the world coupled with rising construction of sustainable wood construction, which uses construction nails.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."