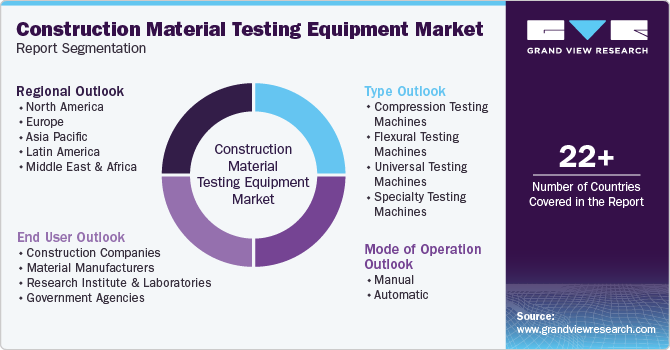

Construction Material Testing Equipment Market Size, Share & Trends Analysis Report By Mode of Operation (Manual, Automatic), By Type (Compression Testing Machines), By End User (Construction Companies), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-511-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

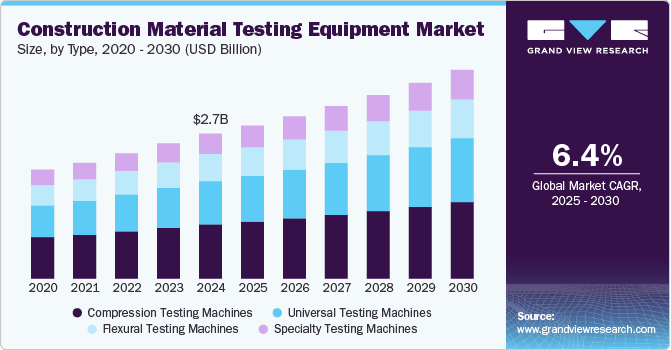

The global construction material testing equipment market size was estimated at USD 2.73 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. The increasing demand for infrastructure development worldwide, especially in emerging economies, plays a pivotal role. As countries invest heavily in infrastructure projects like roads, bridges, and buildings, the need for quality control and testing of construction materials becomes more critical to ensure safety and durability.

Stricter building regulations and a growing focus on material performance are driving the construction material testing equipment market. As compliance with international standards becomes essential, demand for advanced testing solutions is rising to ensure quality, durability, and safety in construction projects.

Market Concentration & Characteristics

The global construction material testing equipment industry is moderately concentrated, with a mix of large multinational corporations and regional players competing for market share. Leading manufacturers focus on diverse testing solutions tailored for construction, infrastructure, and industrial applications. The market is driven by technological advancements, with companies prioritizing automation, real-time data analysis, and integrated testing systems to enhance accuracy, efficiency, and ease of use. These innovations are crucial for meeting stringent regulatory standards and addressing the evolving quality assurance needs of the construction industry.

Regulatory bodies, such as ISO (International Organization for Standardization) and ASTM International, play a crucial role by setting stringent standards for testing accuracy, reliability, and safety. Companies must adhere to these regulations to maintain product quality and ensure the safety and compliance of the materials tested, which is essential for successful project execution.

The competitive landscape of the construction material testing equipment market is increasingly shaped by the growing emphasis on sustainable construction. This trend has created opportunities for manufacturers to develop advanced testing solutions that assess the environmental impact and performance of materials used in green building projects. As demand for eco-friendly construction materials rises, companies are innovating to ensure compliance with sustainability standards like LEED certification.

Additionally, the integration of digital technologies and smart systems is enhancing testing efficiency by enabling real-time data analysis and seamless connectivity with building management systems. However, the market faces competition from alternative testing methods that may offer cost-effective or streamlined solutions. To stay ahead, manufacturers must prioritize continuous innovation, align with industry trends, and meet the growing demand for sustainability, quality assurance, and regulatory compliance.

Drivers, Opportunities & Restraints

The growth in residential and commercial construction is driving demand for construction material testing equipment, ensuring structural integrity and compliance with industry standards. Increasing focus on sustainability and eco-friendly construction has further elevated the need for testing solutions that assess material environmental impact. Additionally, advancements in automation and real-time data analysis are enhancing testing efficiency and accuracy, accelerating market adoption and supporting the industry's shift toward higher quality and regulatory compliance.

The high initial cost of advanced construction material testing equipment remains a key challenge, particularly for smaller construction firms in developing economies, where budget constraints may limit adoption. Additionally, the need for regular maintenance and complex calibration can further deter investment in these technologies.

However, the market also presents significant growth opportunities, driven by the rising demand for sustainable and eco-friendly construction practices. As regulatory standards tighten and builders prioritize environmental impact reduction, there is an increasing need for testing equipment capable of evaluating material sustainability. This shift encourages manufacturers to develop innovative, specialized solutions that align with evolving market demands for compliance, efficiency, and sustainability.

Mode of Operation Insights

In 2024, the automatic segment led the construction material testing equipment market, capturing 72.5% of the global revenue share. The growing adoption of automated testing machines is driven by their high efficiency, precision, and ability to process large test volumes with minimal human intervention. Automation enhances accuracy, reduces human error, and accelerates testing workflows, making it the preferred choice for large-scale construction and infrastructure projects that demand consistent and reliable results.

Conversely, manual testing equipment remains relevant, particularly for small-scale operations and budget-conscious businesses. Lower upfront costs, ease of use, and flexibility make manual systems a practical choice for laboratories and construction firms that do not require high-throughput testing. While automation is reshaping the industry, the demand for cost-effective manual solutions continues in segments where simplicity and affordability outweigh the need for high-speed precision testing.

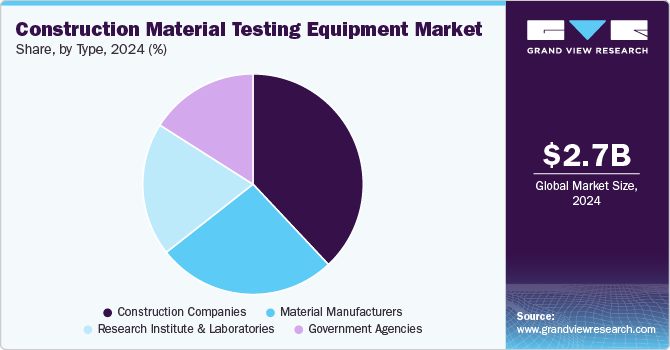

End User Insights

The construction companies segment dominated the market in 2024, capturing 38.0% of the share. Construction firms are key consumers of testing machines, as they require precise and reliable testing solutions to ensure the structural integrity of materials like concrete, steel, and asphalt. The surge in large-scale infrastructure projects and stringent quality assurance mandates continues to drive the adoption of high-performance material testing equipment, reinforcing its critical role in modern construction practices.

The government agencies segment in the construction material testing equipment industry is projected to grow at a CAGR of 7.8% from 2025 to 2030, driven by increasing regulatory standards and quality control measures in construction projects. Government bodies play a crucial role in enforcing compliance with safety, durability, and environmental standards, fueling demand for advanced testing equipment across public infrastructure developments.

Type Insights

The compression testing machines segment dominated the market in 2024, accounting for a share of 37.4%. Compression testing machines are crucial for evaluating the compressive strength of materials like concrete, which is fundamental in construction and civil engineering. As construction projects continue to grow globally, the demand for these machines to ensure material quality and safety increases significantly.

Universal Testing Machines (UTMs) are experiencing rising demand due to their ability to perform a broad spectrum of tests, including tensile, compression, and flexural tests, making them highly versatile for use across various industries. In the construction material testing equipment market, UTMs are particularly sought after for their flexibility in testing different material types, such as concrete, steel, and composites, which are critical for ensuring the quality and performance of construction materials.

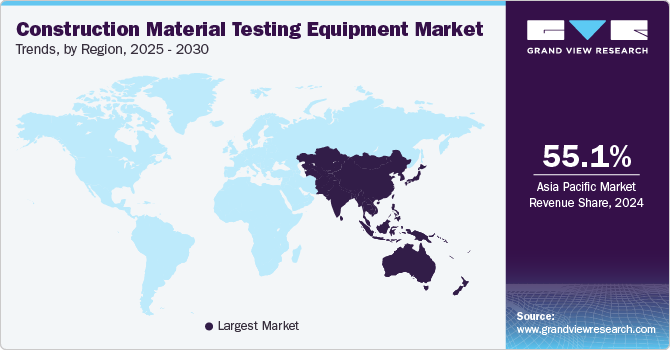

Regional Insights

Asia Pacific Construction Material Testing Equipment Market Trends

The construction material testing equipment industry in Asia Pacific dominated in 2024, accounting for 55.1% of the market. Asia Pacific experiences rapid growth due to booming industrialization, infrastructure development, and urbanization. Increasing manufacturing activities, coupled with rising investment in construction and research sectors, drives the demand for advanced testing machines.

The China construction material testing equipment marketis expected to grow at a CAGR of 7.4% over the forecast period. Rapid industrialization, booming construction, and significant investments in manufacturing and infrastructure are key drivers for testing equipment demand, particularly in the construction and automotive sectors.

The construction material testing equipment market in India is expected to grow at a rapid CAGR of 7.8% over the forecast period. India’s fast-growing infrastructure and construction sectors, coupled with rising industrial manufacturing, are increasing the need for reliable and efficient testing machines to meet quality standards.

Europe Construction Material Testing Equipment Market Trends

Europe's construction material testing equipment industry is driven by a strong industrial base, rigorous regulatory frameworks, and a focus on quality control within manufacturing and construction sectors. The region's emphasis on innovation and sustainability further accelerates the demand for precision testing machinery to ensure compliance with evolving standards.

Germany construction material testing equipment market is expected to grow at a CAGR of 3.8% over the forecast period. Germany’s established industrial foundation, commitment to high-quality manufacturing, and continuous push for technological innovation significantly contribute to the demand for precision testing machines, especially in the automotive and engineering sectors.

Theconstruction material testing equipment market in theUK is forecasted to expand at a CAGR of 5.0% during the same period. Growth in the UK is primarily driven by investments in infrastructure, construction, and research sectors, alongside stringent quality control regulations in industries such as construction and material testing. This environment fosters the need for advanced testing equipment to meet the region's high standards for quality assurance and performance evaluation.

North America Construction Material Testing Equipment Market Trends

The growth in North America is driven by stringent regulatory standards, the booming construction sector, and increasing investment in infrastructure. Advancements in technology and strong research and development capabilities also fuel the demand for advanced testing equipment.

The construction material testing equipment industry in the U.S. is projected to expand at a CAGR of 5.3% in 2024. Strong demand for advanced testing equipment in sectors like construction, aerospace, and manufacturing, coupled with stringent regulatory standards and increasing automation in industries.

Middle East & Africa Construction Material Testing Equipment Market Trends

The Middle East and Africa are witnessing growth in the construction material testing equipment industry, driven by large-scale infrastructure projects, particularly in the construction and energy sectors. Increasing investments in industrial development and a heightened focus on safety and regulatory compliance are major factors fueling the demand for advanced testing equipment in the region.

The construction material testing equipment market in Saudi Arabia is projected to grow at a CAGR of 4.3% over the forecast period. Saudi Arabia’s market growth is propelled by large-scale construction and energy projects, coupled with government investments in quality testing for safety and compliance in materials

Latin America Construction Material Testing Equipment Market Trends

Market growth in Latin America is fueled by expanding construction projects, growing manufacturing sectors, and rising government initiatives to improve infrastructure. The region’s emphasis on quality assurance and standard compliance also drives the demand for testing equipment.

The Brazil construction material testing equipment market is expected to expand at a CAGR of 8.3% over the forecast period. In Brazil, increasing infrastructure development and the expansion of industrial sectors, along with growing regulations for material testing, contribute to market growth.

Key Construction Material Testing Equipment Company Insights

Some of the key players operating in the market include Safariland, LLC and Point Blank Enterprises, Inc.

-

Matest S.p.A. is a global company manufacturing material testing equipment for the construction industry. Offering an extensive and growing range of advanced products, the company provides solutions for both on-site and laboratory testing of materials such as concrete, cement, mortar, bitumen, asphalt, soil, aggregates, rocks, and steel.

-

Olson Instruments, Inc. is a manufacturer of Nondestructive Testing (NDT) equipment for the construction industry. Specializing in testing structures, pavements, and foundations, the company offers a range of products including deflectometers, resonance test systems, and borehole seismic instrumentation.

Key Construction Material Testing Equipment Companies:

The following are the leading companies in the construction material testing tquipment market. These companies collectively hold the largest market share and dictate industry trends.

- Aimil

- Controls S.p.A.

- ELE International

- Humboldt Mfg. Co.

- Matest S.p.A.

- Applied Test Systems

- Shimadzu Corporation

- Olson Instruments

- Illinois Tool Works (Instron)

- Canopus Instruments

- Qualitest International

- Tinius Olsen Testing Machine Company

- Wirsam Scientific

- Zwick Roell Group

- MTS Systems

- GlobalGilson

- IMP Scientific

- NL Scientific Instruments

Recent Developments

-

In January 2024, CONTROLS S.p.A. announced the launch of the Automax ULTIMATE, their latest Automatic Computerized Control Console designed for testing concrete, cement, and steel rebar. Featuring a modular design, it offers flexibility for both basic and advanced testing, including Fiber Reinforced Concrete characterization.

-

In January 2024, Humboldt Mfg. Co. introduced the Asphalt Mixture Automated Testing System, a solution designed to eliminate human error and improve efficiency in asphalt testing. The system offers automated Balanced Mix Design (BMD) and comprehensive testing to industry-leading standards. With capabilities including ASTM D3549, D2726, D6927, D6931, D8225, and D8360, it emphasizes precision and reliability in asphalt mixture testing.

Construction Material Testing Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 2.89 billion |

|

Revenue forecast in 2030 |

USD 3.94 billion |

|

Growth rate |

CAGR of 6.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion & CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

|

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK, Germany, France, Spain, Italy, China, India, Japan, Australia, South Korea, Brazil, Argentina, Saudi Arabia, and UAE |

|

Key companies profiled |

Aimil, Controls S.p.A.; ELE International; Humboldt Mfg. Co.; Matest; Applied Test Systems; Shimadzu Corporation; Olson Instruments; Illinois Tool Works (Instron); Canopus Instruments; Qualitest International; Tinius Olsen Testing Machine Company; Wirsam Scientific; Zwick Roell Group; MTS Systems; GlobalGilson; IMP Scientific; NL Scientific Instruments. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Construction Material Testing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global construction material testing equipment market report based on mode of operation, end user, type, and region:

-

Mode of Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automatic

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction Companies

-

Material Manufacturers

-

Research Institute & Laboratories

-

Government Agencies

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Compression Testing Machines

-

Flexural Testing Machines

-

Universal Testing Machines

-

Specialty Testing Machines

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global construction material testing equipment market size was estimated at USD 2.73 billion in 2024 and is expected to reach USD 2.89 billion in 2025.

b. The global construction material testing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 3.94 billion by 2030.

b. The market in Asia Pacific dominated the market in 2024 accounting for 55.1% of the market share. The region’s expanding infrastructure as a result of government initiatives and investments is expected to bolster market growth in the region. Moreover, the construction industry countries such as China and India is expected to expand significantly and is thereby expected to foster market growth.

b. Some of the key players operating in the market are Aimil, Controls S.p.A., ELE International, Humboldt Mfg. Co., Matest, Applied Test Systems, Shimadzu Corporation, Olson Instruments, Illinois Tool Works (Instron), Canopus Instruments, Qualitest International, Tinius Olsen Testing Machine Company, Wirsam Scientific, Zwick Roell Group, MTS Systems, GlobalGilson, IMP Scientific, and NL Scientific Instruments.

b. The construction material testing equipment market is driven by the growing demand for high-quality infrastructure, strict regulatory standards, and increased construction activities globally. Advancements in technology and automation also significantly improve testing efficiency and accuracy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."