- Home

- »

- IT Services & Applications

- »

-

Construction Estimating Software Market Size Report, 2030GVR Report cover

![Construction Estimating Software Market Size, Share, & Trends Report]()

Construction Estimating Software Market (2025 - 2030) Size, Share, & Trends Analysis Report By Software License, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-005-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Estimating Software Market Summary

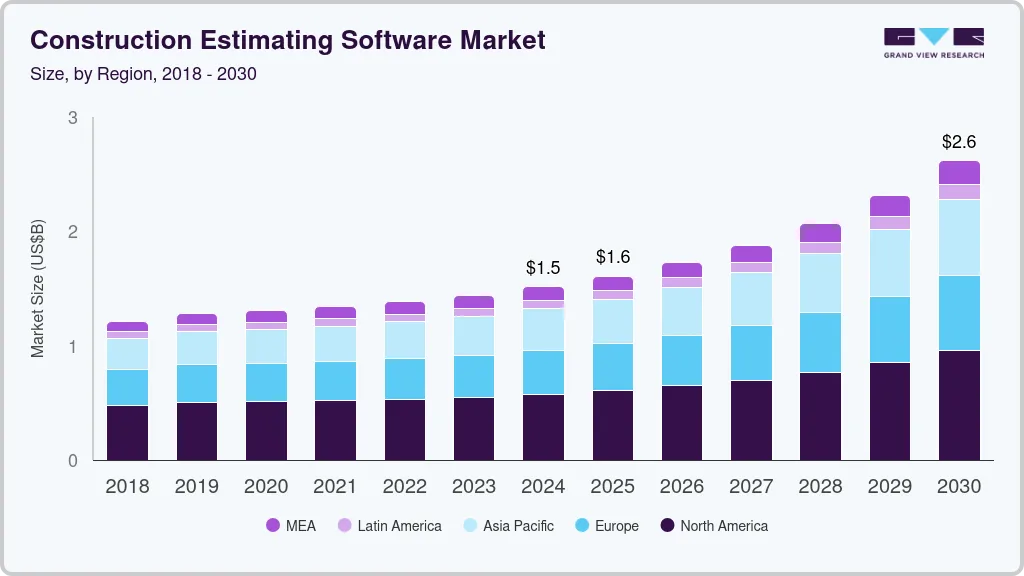

The global construction estimating software market size was estimated at USD 1.5 billion in 2024 and is projected to reach USD 2.62 billion by 2030, growing at a CAGR of 10.2% from 2025 to 2030. The adoption of Building Information Modeling (BIM) technology is revolutionizing construction and design processes by enhancing precision and minimizing errors.

Key Market Trends & Insights

- In terms of region, The construction estimating software market in North America held a share of nearly 38.0% in 2024.

- Country-wise, The construction estimating software market in the U.S. is expected to grow significantly at a CAGR of 8.8% from 2025 to 2030.

- In terms of software license, The subscription license segment accounted for the largest revenue share of over 58.0% in 2024.

- In terms of deployment, The cloud segment accounted for a significant revenue share of over 51.0% in 2024.

- In terms of enterprise size, The large enterprise segment accounted for a significant revenue share of over 60.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.5 Billion

- 2030 Projected Market Size: USD 2.62 Billion

- CAGR (2025-2030): 10.2%

- North America: Largest market in 2024

BIM is a comprehensive digital representation of a building's physical and functional characteristics, enabling construction professionals to streamline planning, design, and management workflows. This technology fosters collaboration among stakeholders by providing a unified platform for sharing real-time information, thereby improving decision-making and project outcomes. The market is experiencing robust growth due to the increasing reliance on BIM for optimizing construction productivity and achieving operational efficiency.As construction projects become larger and more intricate, accurate and dynamic estimating tools have become essential to handle the complexity of material costs, labor rates, and project timelines. Additionally, the shift towards cloud-based software is boosting the market, as these solutions provide greater flexibility, easier collaboration, and access to real-time data across teams, improving project management. Furthermore, the need for better project visibility and reduced inefficiencies is pushing more companies to adopt advanced estimating software. Finally, the increasing trend of integrating artificial intelligence and machine learning into estimating tools is expected to enhance forecasting accuracy and further fuel market growth in the coming years.

The rising demand for automation and digital transformation in the construction industry is expanding the market. As construction firms aim to streamline workflows, reduce human errors, and speed up the estimation process, software solutions are becoming indispensable for enhancing productivity and ensuring cost-effective project execution. Automation also allows for faster bid preparation, improving a company’s ability to respond to more project opportunities.

Another factor contributing to market growth is the growing demand for sustainability in construction. As construction companies face increasing pressure to meet sustainability standards and reduce waste, construction estimating software helps by providing more accurate material usage predictions, optimizing resource allocation, and reducing over-ordering, which ultimately lowers environmental impact. Additionally, the ability of estimating software to handle complex regulatory compliance requirements and building codes is crucial for contractors navigating the ever-changing regulatory landscape, further driving the adoption of these tools.

Software License Insights

The subscription license segment accounted for the largest revenue share of over 58.0% in 2024. The segment growth can be attributed to the evolving preference for subscription-based business models and the strong emphasis of businesses on retaining customers, reducing subscriber churn, and ensuring regulatory compliance. These are some of the key factors driving the growth of the segment. The transition from the perpetual license-based model to a subscription license-based model has been made possible because of advances in cloud computing, which adds flexibility to subscription-based licensing. As a result, several providers of construction estimating software have started partnering with cloud service providers to offer software subscription licenses.

The perpetual license segment is expected to grow at a significant CAGR of 8.7% over the forecast period. A perpetual license segment allows indefinite use of the software for a one-time fee. However, technical support and software updates might be limited for the initial years. After the technical assistance period is over, the customer may opt for new software or continue using the existing perpetual licensed construction estimating software without any software updates and technical support. A perpetual license also involves a high level of customization or integration in line with the customer’s requirement, thereby giving customers more control over security and more insights into the situation. For instance, PlanSwift, a construction estimating software, is available under a perpetual license that includes technical support and software updates for the first year.

Deployment Insights

The cloud segment accounted for a significant revenue share of over 51.0% in 2024. The segment growth is attributed to the construction industry's continued evolution as the adoption of cloud computing is gaining traction. Cloud deployment ensures cost-efficiency while also increasing productivity by allowing the use of data to streamline processes. For instance, in April 2024, Ediphi, a leading cloud-based estimating solution provider based in the Philippines, announced an agreement with DPR Construction, a U.S.-based commercial general contractor. The agreement grants the company's preconstruction teams access to Ediphi's complete suite of estimating tools and software. This collaboration aims to assess how Ediphi's platform can be scaled to enhance DPR's estimating processes and overall project planning capabilities.

The on-premise segment is expected to grow at a significant CAGR over the forecast period. On-premise deployment of construction estimating software solutions offers high data security for construction projects while facilitating functionalities such as budget estimating, job costing, project design and scheduling, and project management, among others.

Enterprise Size Insights

The large enterprise segment accounted for a significant revenue share of over 60.0% in 2024 due to the increasing demand for digital transformation. Large enterprises are investing heavily in modernizing their IT infrastructure, adopting cloud-based solutions, and leveraging emerging technologies like artificial intelligence (AI), machine learning, and data analytics. These technologies enable enterprises to streamline operations, improve decision-making, and enhance customer experiences, thus driving market growth. As businesses look to maintain a competitive edge, their focus on automation, data-driven insights, and digital innovation continues to fuel expansion in this segment.

The small & medium enterprise segment is expected to grow at a significant CAGR over the forecast period due to the increasing accessibility of advanced technologies. SMEs are limited by budget constraints in adopting cutting-edge solutions, but the rise of affordable, cloud-based software has leveled the playing field. Technologies such as cloud computing, software-as-a-service (SaaS), and cost-effective data analytics have made it easier for SMEs to operate more efficiently, scale operations, and compete with larger enterprises. Cloud-based solutions, in particular, enable SMEs to avoid significant upfront investments in IT infrastructure while benefiting from the flexibility and scalability of these technologies.

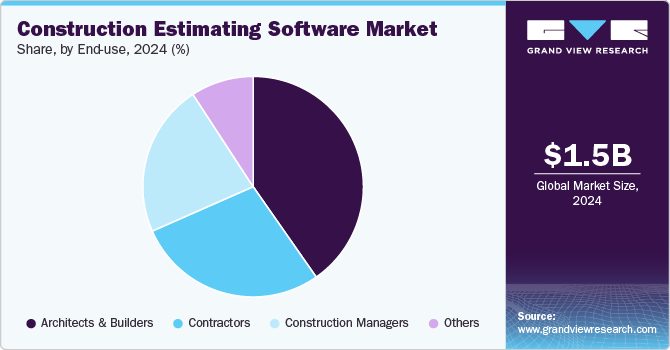

End-use Insights

The architects & builders segment accounted for a significant revenue share of over 40.0% in 2024 due to the adoption of Building Information Modeling (BIM) technology. BIM enables architects and builders to create detailed 3D models of buildings, facilitating more accurate designs, improved collaboration among stakeholders, and efficient project management. The use of BIM helps reduce errors, enhance productivity, and streamline construction processes, making it a crucial tool for architects and builders looking to stay competitive in the market.

The contractors segment is expected to grow at a significant CAGR over the forecast period. The trend toward modular and prefabricated construction is significantly influencing the contractor segment. Modular construction, which involves assembling components off-site and then transporting them to the construction site for assembly, offers contractors faster build times and cost efficiencies. This method is particularly appealing for large-scale residential, commercial, and infrastructure projects, as it reduces labor costs, minimizes waste, and accelerates project timelines. As demand for faster construction grows, the use of modular and prefabricated techniques is expected to expand, providing contractors with more opportunities for growth in the construction estimating software industry.

Regional Insights

The construction estimating software market in North America held a share of nearly 38.0% in 2024. The growth of the North American global construction estimating software can be attributed to the rapid encountering of large-scale projects that require complex construction estimating software to manage multiple features and variables. In North America, several government agencies and municipalities have started implementing Building Information Modeling (BIM) for certain construction projects. BIM software includes forecasting functions as a part of its toolset, boosting the use of technology for estimating. North American Governments have invested significantly in infrastructure projects such as highways, bridges, government structures, and utilities.

U.S. Construction Estimating Software Market Trends

The construction estimating software market in the U.S. is expected to grow significantly at a CAGR of 8.8% from 2025 to 2030. The expansion of public-private partnerships (PPPs) and government-backed projects is another significant growth driver for contractors. Governments around the world are increasingly relying on private contractors to manage large-scale infrastructure and development projects, offering opportunities for contractors to bid on and execute these high-value projects.

Europe Construction Estimating Software Market Trends

The construction estimating software market in Europe is growing with a significant CAGR of from 2025 to 2030.The increasing focus on sustainability and green building practices is a significant driver for the growth of construction estimating software in Europe. As stricter environmental regulations are introduced across European countries, builders and contractors are under pressure to adopt energy-efficient designs, sustainable materials, and environmentally friendly construction practices.

The UK construction estimating software market is expected to grow rapidly in the coming years. The government initiatives and regulatory environment in the UK are driving market growth. The government has introduced several initiatives to digitize the construction sector, such as the Construction 2025 strategy, which focuses on improving the efficiency and sustainability of the industry. This has led to an increased focus on adopting digital tools, including estimating software, to improve project outcomes and meet government standards.

Construction estimating software market in Germany held a substantial market share in 2024 due to the adoption of cloud-based and integrated software solutions. As construction companies in Germany continue to modernize their operations, the shift to cloud-based platforms is becoming increasingly prevalent. These software solutions enable construction firms to collaborate in real-time, track project progress, and access up-to-date cost data from any location.

Asia Pacific Construction Estimating Software Market Trends

Asia Pacific is growing significantly at a CAGR of 11.3% from 2025 to 2030. The rise of smart cities and technological innovations is also a key factor boosting the construction estimating software market. As urban populations in the Asia Pacific region continue to grow, there is an increasing focus on building smart cities that incorporate advanced technologies such as Internet of Things (IoT) devices, smart infrastructure, and automation.

The Japan construction estimating software market is expected to grow rapidly in the coming years. Labor shortages and rising construction costs are contributing to the need for construction estimating software in Japan. Japan’s aging population has resulted in a shortage of skilled workers in the construction industry, leading to delays and inefficiencies in project delivery. With fewer workers available, it is becoming increasingly important to optimize labor allocation, reduce errors, and improve the efficiency of construction processes. Estimating software helps address these challenges by automating cost estimations and resource management, ensuring that projects are completed as efficiently as possible.

The China construction estimating software market held a substantial market share in 2024. With the country’s rapid urbanization and large-scale infrastructure projects such as high-speed railways, new airports, and smart cities, the demand for more sophisticated cost estimation tools has surged. Construction estimating software, especially those with advanced features like artificial intelligence (AI)-driven cost forecasting, predictive analytics, and integrated historical data, provides more accurate and reliable estimates.

Key Construction Estimating Software Company Insights

Key players operating in the construction estimating software market Autodesk Inc., Glodon Company Limited, Trimble Inc., Sage Group plc, and Bluebeam Software Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, Autodesk Inc. announced a new integration with Sterling, a U.K.-based leader in cost, carbon estimating, and life cycle solutions for the construction industry. This integration allows the seamless import of 3D models and associated 2D drawings from Autodesk Docs, Autodesk Build, or BIM 360 into Sterling for more efficient quantity take-off during the cost planning and estimation phases. With this update, project teams can access all project documentation stored within Autodesk Construction Cloud directly within Sterling, ensuring that cost estimators, quantity surveyors, and sustainability experts always have the most up-to-date information, improving accuracy and confidence in their estimates.

-

In June 2024, Trimble Inc. introduced a new software suite, Trimble Unity, designed to streamline asset lifecycle management for owners of capital projects and public infrastructure. The suite integrates Trimble’s top-tier solutions for capital program and asset management, offering a comprehensive platform that supports the entire asset lifecycle from planning and design to construction, operation, and maintenance. By centralizing data and connecting digital workflows, Trimble Unity helps asset owners optimize their processes, enhance project outcomes, and reduce the total cost of asset ownership, providing a unified approach to managing complex infrastructure projects.

Key Construction Estimating Software Companies:

The following are the leading companies in the construction estimating software market. These companies collectively hold the largest market share and dictate industry trends.

- AppliCad Public Company Limited

- Autodesk Inc.

- Bluebeam Software Inc.

- Corecon Technologies, Inc.

- esti-mate

- ETAKEOFF, LLC

- Glodon Company Limited

- Microsoft

- PlanSwift Software

- PrioSoft Construction Software

- ProEst.

- RIB Software SE

- Sage Group plc

- STACK Construction Technologies

- Trimble Inc.

Construction Estimating Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.61 billion

Revenue forecast in 2030

USD 2.62 billion

Growth rate

CAGR of 10.2% from 2025 to 2030

Historical data

2018 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Software license, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

AppliCad Public Company Limited; Autodesk Inc.; Bluebeam Software Inc.; Corecon Technologies, Inc.; esti-mate; ETAKEOFF LLC; Glodon Company Limited; Microsoft; PlanSwift Software; PrioSoft Construction Software; ProEst.; RIB Software SE; Sage Group plc; STACK Construction Technologies; Trimble Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Estimating Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction estimating software market report based on software license, deployment, enterprise size, end-use, and region:

-

Software License Outlook (Revenue, USD Billion, 2018 - 2030)

-

Perpetual License

-

Subscription License

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Architects & Builders

-

Construction Managers

-

Contractors

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global construction estimating software market size was estimated at USD 1.51 billion in 2024 and is expected to reach USD 1.61 billion in 2025.

b. The global construction estimating software market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030 to reach USD 2.62 billion by 2030.

b. North America held the largest share of nearly 38.0% in 2024 due to the rapid industrialization and large-scale adoption of digital technologies such as cloud computing and the Internet of Things (IoT) by engineers, architects, and builders.

b. Some key players operating in the construction estimating software market include AppliCad Public Company Limited, Autodesk Inc., Bluebeam Software Inc., Corecon Technologies, Inc., esti-mate, ETAKEOFF, LLC, Glodon Company Limited, Microsoft, PlanSwift Software, PrioSoft Construction Software, ProEst., RIB Software SE, Sage Group plc, STACK Construction Technologies, Trimble Inc.

b. The growth of the market can be attributed to the advances in Artificial Intelligence (AI), Cloud Computing, and Business Information Modeling (BIM), among other factors. Several vendors have introduced innovative construction estimating tools designed to help reduce the time for completing construction projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.