Construction And Design Software Market Size, Share, & Trends Analysis Report By Function, By Deployment (Cloud and On-premise), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-344-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

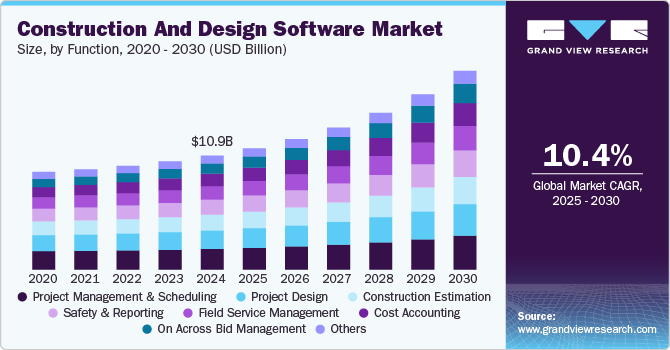

The global construction and design software market size was estimated at USD 10.96 billion in 2024 and is projected to grow at a CAGR of 10.4% from 2025 to 2030. The increasing adoption of AI and ML technology in analytics applications to formulate precise layouts, create simulations, and draft 3D models is expected to drive the growth of the construction and design software market. With data science and analytics, project managers can analyze the undergoing projects with the planned ones at every stage of the construction project lifecycle, along with predicting cost structure, delivery timelines, and resources required to achieve planned objectives.

The construction and design software allows architects to design complex frameworks and layouts, thereby minimizing the need to manually draw, redraft, and remodel construction projects. The software assists businesses with enhanced tools and technologies, enabling them to improve productivity by reducing dependency on paperwork and manual drafting. Moreover, it helps in planning, designing, analyzing, and managing the entire project structure by offering a centralized platform for all stakeholders, such as project managers, project developers, and others.

The construction and design software helps project managers generate accurate measurements and layouts by keeping track of every change and alteration in the plan. The software eliminates the need to manually measure and calculate different aspects of the construction site, as it offers all the necessary tools and technology to generate automated sketches, layouts, themes, and structures. The software incorporates all the regulatory and safety norms necessary for formulating a building plan. Thus, it assists project managers in drafting precise and accurate models by detecting errors such as incorrect calculations and inaccurate dimensions. The construction and design software also ensures effective communication among parties involved in the project by keeping each member informed about various details of the project.

End users implement construction and design software with advanced capabilities, including BIM, 2D, and 3D modeling, to create drawings and blueprints for home renovations, mechanical drafts, landscaping, and commercial buildings. Moreover, contractors are using this software to design complex project layouts in a limited time and budget. Industry players are customizing their construction and design software as per client needs to improve their brand loyalty and become long-term software vendors for the clients. Companies such as Autodesk Inc., RIB Software, Sage Group plc, and Trimble Inc. offer construction and design software for builders and architects. With this software, architects and construction engineers can effectively collaborate to prepare a project design and enhance project delivery time.

Function Insights

The project management & scheduling segment accounted for the largest market share of over 18% in 2024. Construction projects are inherently complex, requiring the coordination and collaboration of multiple teams to stay on schedule and meet deadlines. Construction companies rely on construction and design software to streamline this process for effective project management and scheduling. Since these projects often encompass residential, commercial, institutional construction, renovations, and various engineering initiatives, they require a diverse range of expertise. Thereby, construction and design software are a powerful tool for efficiently managing these critical elements, such as Proper planning, leadership, and resource management, which are essential for the successful execution of a particular project, and construction and design software serves essential for their successful execution of a particular project.

The on across bid management segment is expected to grow significantly during the forecast period. Bid management is a crucial process for construction companies when hiring contractors to carry out various tasks related to a construction project. This process involves defining the scope of work, setting completion timelines, outlining pre-qualification requirements, and detailing penalties for delays or non-compliance during project execution. As a result, a large volume of data is exchanged between clients and contractors. To efficiently handle this information, construction companies adopt bid management software. This software helps manage project targets, supports contractors in organizing and sharing essential data, and streamlines the entire bidding process.

Deployment Insights

The on-premise segment accounted for the largest market share of over 54% in 2024. On-premise construction and design software refers to applications installed and run directly on an organization's internal servers and computers, offering clients complete ownership of the infrastructure. This model provides enhanced control over data security, as critical project information remains confined within the organization’s systems. Additionally, on-premise software allows for scalable operations, enabling businesses to increase computational power, storage capacity, and software licenses as needed. This setup ensures secure data management and greater control over all operational processes, making it ideal for companies prioritizing data privacy and internal oversight.

The cloud segment is expected to grow at a significant rate during the forecast period. Cloud deployment enhances cost-efficiency and boosts productivity by leveraging data to optimize workflows. Cloud-based construction and design software offers on-demand, self-service capabilities for provisioning servers, allowing for a flexible, pay-as-you-go model. With AI-powered cloud computing, companies can operate more strategically, improve efficiency, and gain data-driven insights. Many large enterprises are also launching innovative cloud software solutions, further driving advancements in the market.

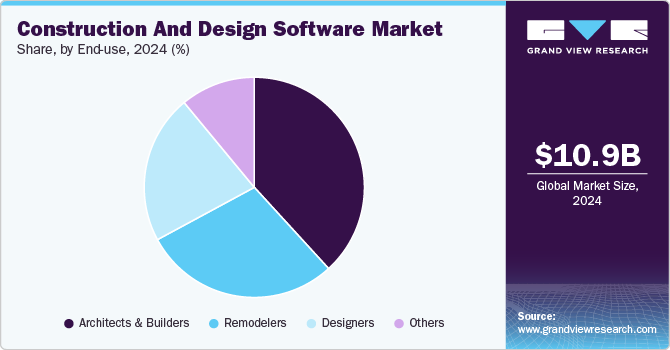

End-use Insights

The architects & builders segment accounted for the largest market share of over 38% in 2024. The rising demand for advanced design skills to maximize project potential, coupled with growing concerns over securing necessary approvals, is anticipated to drive segment growth. Architects and builders can customize designs to fit clients' budgets, provide critical construction data to reduce costs and ensure timely project completion. With construction and design software, engineers and architects can develop precise floor plans, incorporating accurate measurements for walls, windows, doors, and other elements, ensuring a high level of detail and accuracy in the planning process.

The designers segment is expected to grow at a significant rate during the forecast period driven by the rising demand among end users for enhanced interior design and decor. Many designers are increasingly utilizing construction software to boost productivity, streamline design drafting, and efficiently manage design development, optimization, and modifications. These tools enable the creation of more intricate and detailed designs, allowing for virtual manipulation and refinement. Additionally, Building Information Modeling (BIM) and Computer-Aided Design (CAD) solutions play a key role in enabling seamless collaboration among remote design teams.

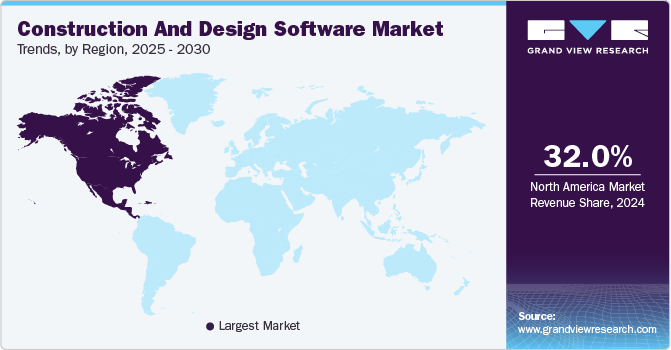

Regional Insights

The Construction and Design Software Market in North America held a market share of over 32% in 2024. The North American construction and design software market is driven by the rapid adoption of digital solutions in the construction sector, with a focus on improving project efficiency and reducing costs. A significant trend is the integration of cloud-based platforms that enable real-time collaboration across project teams. The rise of smart cities and sustainable construction projects across the US and Canada is accelerating demand for advanced design tools that incorporate green building standards. Additionally, government initiatives supporting infrastructure development are creating new opportunities for software providers to introduce innovative solutions tailored to large-scale public projects.

U.S. Construction and Design Software Market Trends

The construction and design software market in the U.S. is growing significantly at a CAGR of 8.5% from 2025 to 2030. The construction software market in the US is benefiting from increased investment in infrastructure, fueled by federal funding and state-level development projects. The shift towards Building Information Modeling (BIM) has become a key driver, as the US construction industry looks to enhance design accuracy, minimize errors, and streamline workflows. Opportunities are growing for software companies to offer solutions that integrate with emerging technologies like drones, IoT, and augmented reality, helping firms improve construction site management and design visualization. Sustainability requirements in construction are also opening doors for software that supports energy-efficient designs.

Asia Pacific Construction and Design Software Market Trends

The construction and design software market in Asia Pacific is growing significantly at a CAGR of 11.4% from 2025 to 2030. The APAC market is witnessing robust growth, driven by rapid urbanization and infrastructure development across countries like China, India, and Southeast Asia. Adopting advanced design tools is rising as governments push for smart city initiatives and sustainable urban development. Cloud-based construction management platforms and mobile applications are increasingly being used to manage large-scale projects in real time. The region’s booming construction market offers substantial opportunities for software vendors to introduce localized solutions that address regulatory requirements, labor challenges, and complex project management needs.

China construction and design software market is driven by rapid urbanization, government investments in smart cities, and the push for sustainable infrastructure. With China's focus on green building practices, there is a growing demand for Building Information Modeling (BIM) solutions to improve efficiency in construction projects and minimize resource waste. The country's ambitious infrastructure development under initiatives like the Belt and Road Initiative (BRI) also propels the need for advanced design and project management software.

Construction and design software market in Japan is propelled by its aging infrastructure and the need for renovation and earthquake-resistant building designs. The country’s focus on smart construction practices and integrating robotics in building processes drives demand for advanced design tools like 3D modeling and AI-powered project management platforms.

India construction and design software market is experiencing robust growth due to a significant rise in infrastructure projects and the government’s "Smart Cities Mission." The increasing adoption of cloud-based design software to improve project coordination and reduce costs is a key trend, driven by India's large-scale urban development initiatives.

Europe Construction and Design Software Market Trends

The construction and design software market in Europe is growing significantly at a CAGR of 10.2% from 2025 to 2030. In Europe, the market is being propelled by strict regulatory frameworks that enforce energy-efficient and sustainable building practices. The European Union’s Green Deal and stringent environmental standards are pushing construction firms to adopt design software that can meet these requirements. There is a growing opportunity for software providers to expand into green building design and retrofitting existing structures to be more energy efficient. Additionally, the increasing use of AI and machine learning to optimize construction processes and reduce material waste is a key trend driving market growth in this region.

UK construction and design software market are driven by the country's increasing adoption of Building Information Modeling (BIM) standards and the digital transformation of the construction sector. The government’s mandate for Level 2 BIM on public sector projects has accelerated the adoption of advanced design and collaboration tools.

Construction and design software market in Germany is experiencing growth due to the nation’s push for Industry 4.0 and the integration of advanced technologies in construction processes. The construction sector is adopting digital twins and 3D modeling software to enhance precision and reduce project timelines, especially for large-scale infrastructure projects like highways and commercial buildings.

Key Construction and Design Software Company Insights

Some of the key players operating in the market include Autodesk Inc.; Oracle Corporation; Microsoft Corporation; Trimble Inc.; Constellation Software Inc.; SAP; Vectorworks, Inc.; Sage Group plc; BENTLEY SYSTEMS; and RIB Software SE among others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Construction and Design Software Companies:

The following are the leading companies in the construction and design software market. These companies collectively hold the largest market share and dictate industry trends.

- Autodesk Inc.

- Oracle Corporation

- Microsoft Corporation

- Trimble Inc.

- Constellation Software Inc.

- SAP SE

- Vectorworks, Inc.

- Sage Group plc

- BENTLEY SYSTEMS

- RIB Software SE

Recent Developments

-

In February 2024, Autodesk Informed Design is a new cloud-based solution that simplifies the building design and construction process by connecting design and manufacturing workflows. This solution empowers architects to utilize customizable, pre-defined building products, ensuring accurate results. Manufacturers can easily share its products with design stakeholders, streamlining collaboration. Informed Design promotes industrialized construction, where manufacturing principles are applied to the built environment, helping transform the AECO industry.

-

In November 2023, Trimble's construction management software, Viewpoint Spectrum, and Viewpoint Vista feature an Automatic Invoicing function powered by Azure AI Document Intelligence. This integration automatically processes paper and PDF invoices, turning them into validated but unapproved entries within the software. This enables faster, more accurate workflows, saving contractors time, effort, and money.

Construction and Design Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 11.67 billion |

|

Revenue forecast in 2030 |

USD 19.12 billion |

|

Growth rate |

CAGR of 10.4% from 2025 to 2030 |

|

Base year estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Function, deployment, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa. |

|

Key companies profiled |

Autodesk Inc.; Oracle Corporation; Microsoft Corporation; Trimble Inc.; Constellation Software Inc.; SAP; Vectorworks, Inc.; Sage Group plc; BENTLEY SYSTEMS; RIB Software SE |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Construction And Design Software Market Report Segmentation

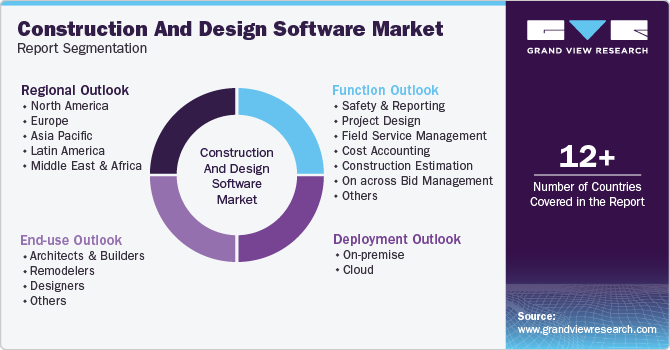

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global construction and design software market report based on function, deployment, end-use, and region:

-

Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Safety & Reporting

-

Project Management & Scheduling

-

Project Design

-

Field Service Management

-

Cost Accounting

-

Construction Estimation

-

On across Bid Management

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Architects & Builders

-

Remodelers

-

Designers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global construction and design software market was valued at USD 10.96 billion in 2024 and is expected to reach USD 11.67 billion in 2025.

b. The global construction and design software market is expected to grow at a compound annual growth rate is 10.4% from 2025 to 2030 to reach USD 19.12 billion by 2030.

b. The project management & scheduling segment accounted for the largest market share of over 18 % in 2024. Construction projects are inherently complex, requiring the coordination and collaboration of multiple teams to stay on schedule and meet deadlines.

b. Some key players operating in the construction and design software market include Autodesk Inc.; Oracle Corporation; Microsoft Corporation; Trimble Inc.; Constellation Software Inc.; SAP; Vectorworks, Inc.; Sage Group plc; BENTLEY SYSTEMS; and RIB Software SE among others.

b. The increasing adoption of AI and ML technology in analytics applications to formulate precise layouts, create simulations, and draft 3D models is expected to drive the growth of the construction and design software market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."