- Home

- »

- Specialty Polymers

- »

-

Construction Chemicals Market Size And Share Report, 2030GVR Report cover

![Construction Chemicals Market Size, Share & Trends Report]()

Construction Chemicals Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Admixture, Adhesives, Sealants, Coatings), By Application (Residential, Non-Residential), By Region, And Segment Forecasts

- Report ID: 978-1-68038-812-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Chemicals Market Summary

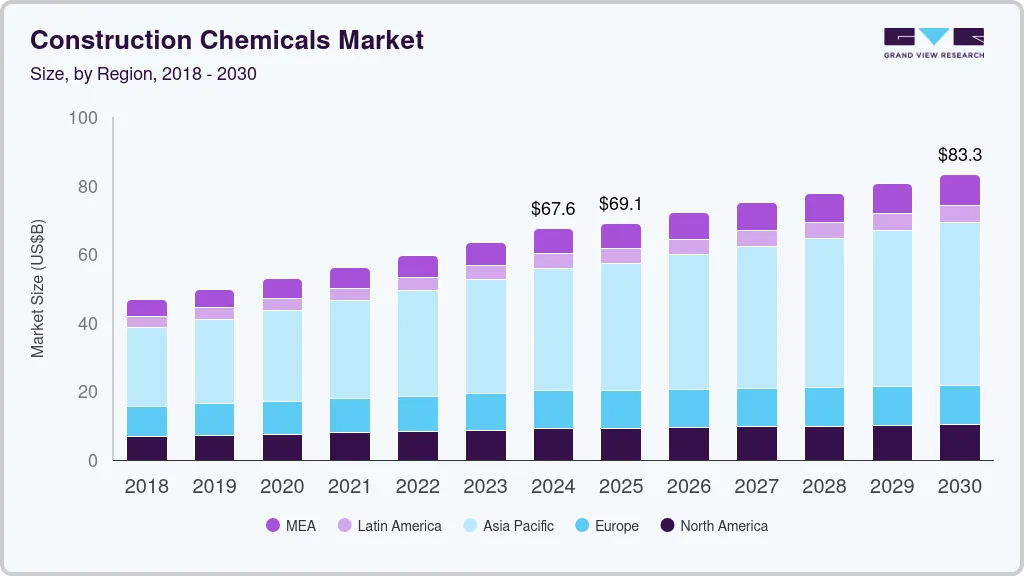

The global construction chemicals market size was valued at USD 67,610.1 million in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2030. The rise in demand for construction chemicals is due to rapid urbanization and industrialization in emerging economies.

Key Market Trends & Insights

- North America market is projected to significantly over the forecast period.

- By product, the admixture segment held the largest market revenue share of 46.0% in 2023.

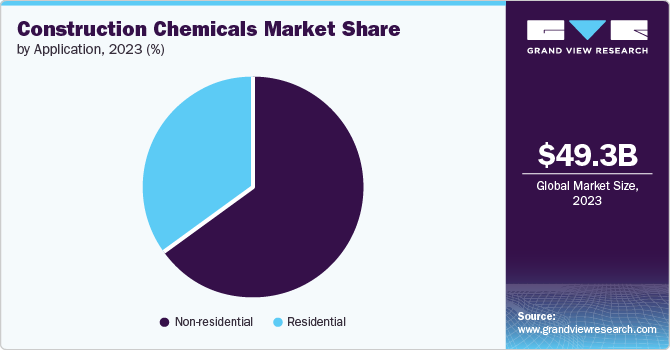

- By application, the non-residential segment held the largest market revenue share in 2023.

- By application, the residential segment is projected to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 67,610.1 Million

- 2030 Projected Market Size: USD 83,342.4 Million

- CAGR (2025-2030): 3.8%

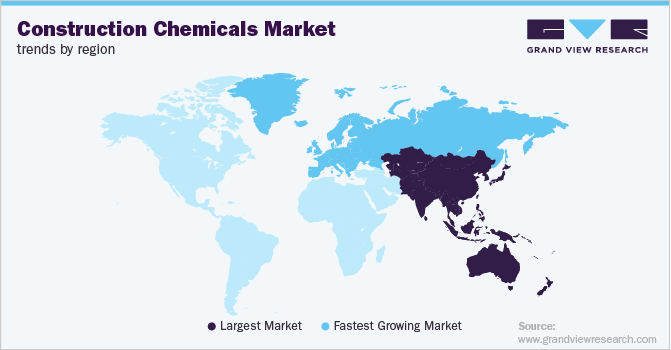

- North America: Largest market in 2024

Countries in Asia, Latin America, and Africa are experiencing a rise in construction fueled by population growth and the need for infrastructure development.

Construction chemicals are widely utilized in construction activities. These additives are mixed into building materials, including cement, concrete, coatings, etc., to enhance strength and durability, speed up construction, and offer extra defenses against environmental threats. Construction chemicals play a significant role in improving concrete performance and offer advantages such as reducing the need for water and cement in construction projects.

Furthermore, advancements in construction technologies are also driving the demand for specialized chemicals. Innovations in building techniques, such as prefabrication and modular construction, require specific types of adhesives, coatings, and sealants that provide quick curing times and strong bonding properties. These specialized chemicals ensure that construction processes are efficient, cost-effective, and meet the high standards required for modern buildings. Additionally, the increasing focus on renovation and retrofitting of older buildings to meet new safety standards and energy efficiency norms has boosted the market for repair and protection chemicals, such as epoxy resins and corrosion inhibitors.

Another factor fueling the demand for construction chemicals is the global rise in infrastructure projects. Governments worldwide invest heavily in infrastructure development, including roads, bridges, airports, and public transportation systems, to support economic growth and urbanization. Construction chemicals play a crucial role in these large-scale projects by providing solutions that increase the durability and longevity of infrastructure. Additionally, the growing awareness and implementation of safety and performance standards in the construction industry drive the demand for construction chemicals. Building codes and regulations are becoming increasingly stringent, requiring certified materials that ensure safety, sustainability, and durability. Construction chemicals help meet these standards by improving the performance characteristics of building materials, such as fire resistance, thermal insulation, and seismic stability.

Product Insights

The admixture segment held the largest market revenue share of 46.0% in 2023. Cement functions as the primary binding component in construction activities. Concrete is made by adding cement in crushed rocks, sand, & water. Admixtures are added to the concrete mixture during the mixing procedure to improve the functioning and strength of the concrete. Admixtures deliver several functionalities, such as minimizing the use of water in concrete preparation and building repair and helping in reducing the infrastructure building period.

The coatings segment is projected to grow at the fastest CAGR of 4.3% over the forecast period. As construction activities increase worldwide, driven by urbanization and infrastructure development, there's a growing need for protective coatings. These coatings enhance the durability and appearance of buildings by protecting surfaces from weather, corrosion, and wear. Additionally, advancements in coating technologies, such as eco-friendly and energy-efficient products, are attracting more consumers and businesses. Regulatory pressures for sustainable building practices also push the adoption of advanced coatings that comply with environmental standards.

Application Insights

The non-residential segment held the largest market revenue share in 2023. The increasing investment in infrastructure projects such as commercial buildings, industrial facilities, and public infrastructure such as highways and bridges drives the market growth. Additionally, the need for sustainable and energy-efficient buildings has led to the adoption of advanced construction chemicals that enhance structures' durability and environmental performance. The expansion of urban areas and the rise in commercial and industrial renovation activities further contribute to this segment's growing demand.

The residential segment is projected to grow at the fastest CAGR over the forecast period. Urbanization and population growth have led to a surge in residential construction projects, particularly in developing regions. Additionally, there is a rising awareness among homeowners and builders about the benefits of using advanced construction chemicals, such as improved durability and energy efficiency. These chemicals, including adhesives, sealants, and concrete admixtures, are essential for enhancing the quality and longevity of residential structures.

Regional Insights

North America market is projected to significantly over the forecast period. The region is experiencing a surge in infrastructure projects, including constructing roads, bridges, and commercial buildings, driven by government initiatives and private investments. Additionally, there is a growing focus on sustainable construction practices, which has increased the use of advanced construction chemicals that improve buildings' durability and environmental performance. The booming residential sector, spurred by urbanization and population growth, also contributes to the increased demand for these chemicals, as they are essential in enhancing the quality and longevity of construction materials.

U.S. Construction Chemicals Market Trends

The U.S. market is projected to proliferate in the coming years. The ongoing growth in infrastructure projects, such as roads, bridges, and commercial buildings, is the primary driver for increasing demand. The residential sector's growth, spurred by low mortgage rates and urbanization trends, contributes to this demand as homeowners seek materials that enhance durability and performance.

Europe Construction Chemicals Market Trends

Europe is projected to grow with a significant CAGR over the forecast period. The region's growing infrastructure development projects, especially in Eastern Europe and urban areas, are boosting the need for specialized chemicals to withstand various environmental conditions. Moreover, stringent regulations regarding construction materials and environmental standards are pushing builders and contractors to use high-performance chemicals that comply with these regulations.

The UK construction chemicals market is projected to grow rapidly in the coming years. The unpredictable UK climate, characterized by frequent rain and humidity, increases the need for waterproofing and weather-resistant construction solutions. Furthermore, the UK's aging buildings require extensive renovation and retrofitting, creating a demand for chemicals like sealants, adhesives, and concrete additives that enhance durability and compliance with modern building regulations.

Asia Pacific Construction Chemicals Market Trends

Asia Pacific held the largest market revenue share of 52.1% in 2023. Countries such as China and India invest heavily in large-scale construction projects, including residential, commercial, and infrastructure developments such as roads, bridges, and airports. The growing emphasis on sustainable construction practices and the need for high-performance materials to enhance the durability and strength of structures are also driving the demand. Additionally, the rising middle-class population and increasing disposable income in the region are boosting the demand for better-quality housing and commercial spaces, further propelling the growth of the construction chemicals market.

China construction chemicals market held the largest regional market revenue share in 2023. China's rapid urbanization and infrastructure development have led to a surge in construction projects, including residential, commercial, and public infrastructure. This has increased the need for advanced construction materials that enhance durability, efficiency, and sustainability. China's focus on green building initiatives and stricter environmental regulations has driven the adoption of eco-friendly construction chemicals.

Key Construction Chemicals Company Insights

Some of the key companies in the global construction chemicals market include ARLANXEO; ENEOS Corporation; Sumitomo Chemical Asia Pte Ltd; Synthos; Trinseo; Versalis SpA; and others.

-

JSW provides a wide range of construction solutions such as tile adhesive, grout, cleaner, high-strength steel grouts, block grip adhesive, and a waterproofing range called JSW SmartBlok. These products enhance construction quality, durability, and performance by providing strong bonds, stain resistance, and waterproof barriers.

-

Sika AG provides polyurethane, silicone, and hybrid sealants with improved adhesion and dirt resistance. Sika’s admixtures improve concrete strength, durability, and finish quality. Sika AG also provides effective waterproofing solutions that adhere strongly to concrete foundations.

Key Construction Chemicals Companies:

The following are the leading companies in the construction chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- JSW

- MAPEI S.p.A.

- Sika AG

- Ashland

- 3M

- Arkema

- Evonik Industries

- Henkel AG & Co. KGaA

- Dow

- Thermax Limited.

- Saint-Gobain

Recent Developments

-

In April 2024 ,MAPEI S.p.A. announced the launch of Mapeflex MS 55, a new hybrid adhesive and sealant with high elasticity. This versatile product is suitable for both professional and domestic use, offering benefits such as initial solid tack, compatibility with damp surfaces, and low VOC emissions.

-

In May 2023, Sika AG announced the acquisition of MBCC. This acquisition aims to enhance Sika AG's admixture solutions. In addition, it will further improve Sika's product portfolio with MBCC's innovative technologies that will assist customers in reducing carbon footprints.

Construction Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 69,082.0 million

Revenue forecast in 2030

USD 83,342.4 million

Growth Rate

CAGR of 3.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, China, India, Japan, Thailand, Indonesia, Malaysia, Vietnam, Australia, Brazil, Argentina, Mexico, Saudi Arabia, UAE, Oman, Kuwait, Qatar.

Key companies profiled

JSW; MAPEI S.p.A.; Sika AG; Ashland; 3M; Arkema; Evonik Industries; Henkel AG & Co. KGaA; Dow; Thermax Limited.; Saint-Gobain

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the construction chemicals market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Admixture

-

Adhesives

-

Sealants

-

Coatings

-

-

Application Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

Indonesia

-

Vietnam

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Oman

-

Kuwait

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.