- Home

- »

- Advanced Interior Materials

- »

-

Construction Anchors Market Size And Share Report, 2030GVR Report cover

![Construction Anchors Market Size, Share & Trends Report]()

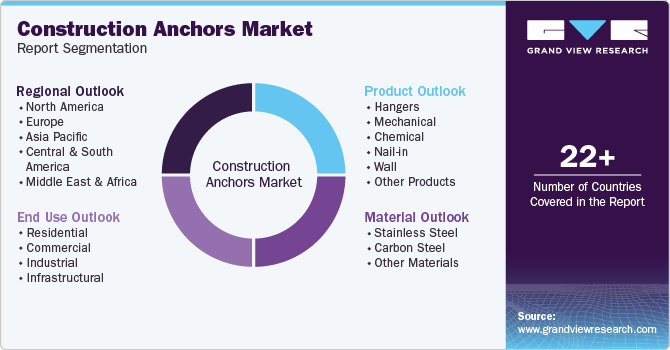

Construction Anchors Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Hangers, Mechanical, Chemical), By Materials (Stainless Steel, Carbon Steel), By End Use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-147-8

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Anchors Market Size & Trends

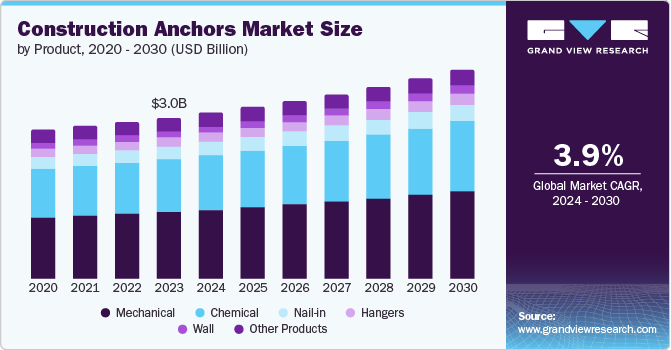

The global construction anchors market size was estimated at USD 3.01 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. This growth can be attributed to the surging demand for advanced construction anchors and fasteners for connecting structural elements. Moreover, the development of new and innovative products and hassle-free installation techniques has considerably driven the market growth.

The growth in construction spending in the emerging Middle Eastern and Asia Pacific economies can be attributed to the strong industrial and economic development coupled with population expansion, which is likely to have a positive impact on the demand for construction anchors in these regions over the forecast period. Furthermore, the governments of emerging economies have invested significantly in public infrastructures such as offices, building hospitals, and housing societies.

The rising working population in the past few years has increased construction spending in key countries of Asia Pacific, including China, Vietnam, Bangladesh, Singapore, India, Thailand, and Malaysia. Emerging regions, especially Latin America and the Middle East & Africa, are expected to depict above-average market growth owing to the development of the hotel sector as a result of increasing government initiatives regarding the tourism industry in these regions. This, in turn, has augmented the demand for new construction in the region.

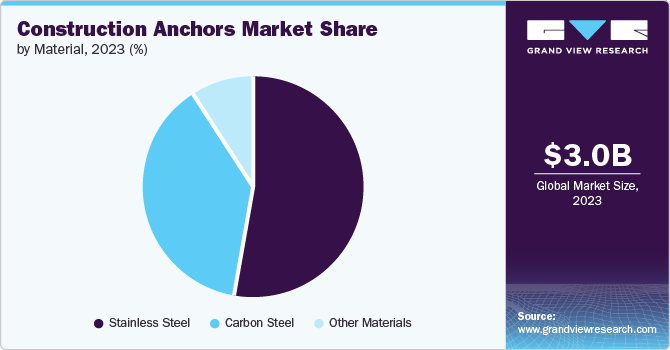

The raw materials for construction anchors include carbon steel and stainless steel. These raw materials are used in the manufacturing of anchors and procured directly by steel manufacturers, distributors, or suppliers. Manufacturers of anchor have signed agreements with manufacturers of steel to ensure smooth and uninterrupted supply.

The price of the overall product is majorly determined by the raw material grade, material availability, production process, and product dimensions. Fluctuations in raw material prices directly impact the prices of fasteners and anchors used in construction applications. Moreover, the involvement of several entities in the supply channel impacts profit margins across the value chain.

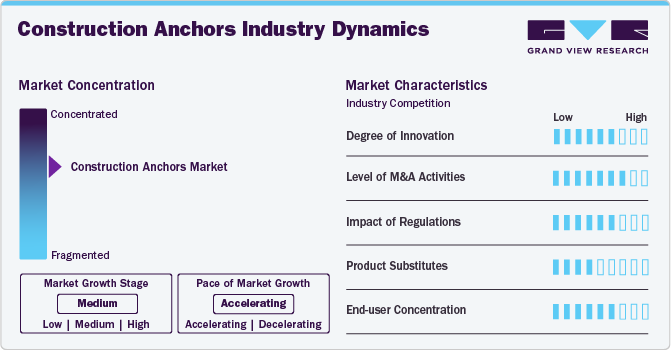

Industry Dynamics

The market growth stage is high, with an accelerating pace. The degree of innovation is moderate, as technologically advanced machinery is required for the production of construction anchors, which safely connect structural or non-structural elements to the base material. Therefore, the use of innovative and technologically sound anchors ensures the safety of residents.

The market is a highly competitive market owing to the presence of a large number of manufacturers. Prominent suppliers are focusing on achieving optimal operational costs, maximizing the efficiency of production facilities, attaining shortened lead times, and enhancing the quality of products to maintain their dominance in the construction anchors market.

Mergers & acquisitions (M&A) are some of the other operating strategies implemented by key market players. For instance, in September 2021, Simpson Strong Tie Company, Inc. announced the acquisition of Etanco Group for USD 725.0 million. Etanco Group is a leading designer, manufacturer, and distributor of fixing and fastening solutions for the construction industry throughout Europe. This move has helped Simpson Strong Tie Company, Inc. to increase its market presence in Europe.

The market is governed by several regulations and standards for its use and production. Several agencies, such as the French for European Conformity, European Organization for Technical Assessment, International Existing Building Code (IBC), Concrete Anchor Manufacturers Association (CAMA), ASTM Standard, and The International Organization for Standardization, have levied regulations for construction anchors.

Similar alternative products, such as other adhesives and fastening systems, are available, resulting in a moderate level of product substitution. The cons associated with the use of mechanical and chemical anchors, such as expansion in the base material, which increases the stress, heavyweight in weak materials, and others, are likely to provide a reason to substitute them with other similar products.

Product Insights

Mechanical anchors dominated the market in 2023 with a revenue share of 45.3% owing to their usage in light-duty and heavy-duty applications. There are various types of mechanical anchors, including sleeve, drop-in, and wedges. The product is mainly used for fastening objects, such as slabs, columns, and beams, to the main structural concrete.

Chemical anchors are expected to grow at the fastest CAGR of 4.1% over the forecast period as they can resist high static loads, and they are approved for seismic applications such as buildings or structures prone to earthquakes. Furthermore, the product can be used in flooded, wet, or dry holes without any loss in performance, thereby driving the product demand.

Wall anchors are ideally used for applications with vertically perforated bricks, such as canopies, pergolas, and carports. The wall anchor has an anchor tube and internal pipe insulation, which ensures a high load transfer, long service life, minimal heat loss, and corrosion protection. In addition, the wall anchor also spans up to 200 mm of thermal insulation, eliminating the need for time-consuming thermal insulation removal.

Material Insights

Stainless steel led the market and was valued at USD 1.60 billion for the year 2023. Stainless steel construction anchors are available in different designs such as sleeves or wedges used for providing reliable fastening solutions in concrete construction. Furthermore, stainless steel is preferred for manufacturing construction anchors owing to its durability, high reliability, and quality in terms of strength.

Carbon steel is expected to grow at a CAGR of 4.1% over the forecast period on account of its wide application scope in the manufacturing of construction anchors, owing to its high load-bearing ability and tensile strength. In addition, carbon steel construction anchors are good at resisting abrasion and retaining their original shape. This makes them a preferred choice as fastening materials for heavyweight structures such as concrete and steel.

End Use Insights

Commercial end use was the largest and fastest-growing segment. The segment accounted for a revenue share of 31.0%for the year 2023. Construction anchors play an essential role in securing commercial structures by offering heating, ventilation, and air conditioning (HVAC). Continuous improvements in anchor technologies, materials, and designs result in the development of efficient and long-lasting anchoring solutions. This is expected to propel market expansion in the coming years.

Critical design and construction considerations for adequate connection of wooden frames and structural systems to concrete or stone bases are the key areas where construction anchors are used in residential applications. In addition, increasing security concerns in residential areas are amplifying the need for railing and fencing, which use anchors fixed to the railing bars with the house's boundary wall. Therefore, the segment is expected to grow at a CAGR of 3.4% from 2024 to 2030.

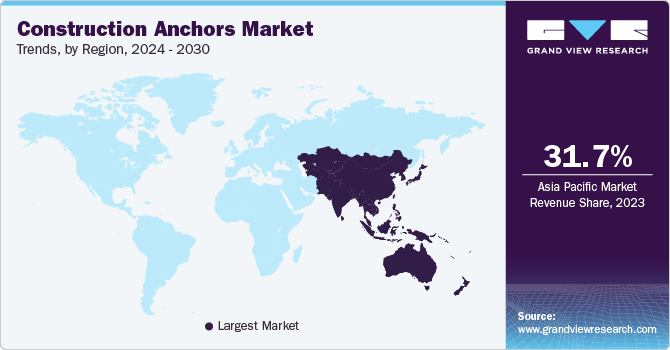

Regional Insights

North America construction anchors market is among the prominent regional markets owing to higher market penetration in the developed economies of the region such as the U.S. and Canada. Growing construction activities in developing economies such as Mexico is the key factor driving product demand.

U.S. Construction Anchors Market Trends

The U.S. construction anchors market growth and dynamics are influenced by several factors. The construction industry in the U.S. is thriving, with continuing residential, commercial, and infrastructural projects generating the demand for construction anchors.

Asia Pacific Construction Anchors Market Trends

Asia Pacific accounted for the largest share of 31.7% in 2023, The Asia Pacific construction anchors market was the largest segment in 2023, valued at USD 0.94 billion in the global market. The increasing number of petrochemical plants and the flourishing construction industry in Asia Pacific are driving market growth in the region. Moreover, rising investments in new infrastructure development projects in India, Australia, Hong Kong, Japan, Thailand, Vietnam, etc. are surging the product consumption in these countries.

The construction anchors market in India is growing at the fastest CAGR of 4.7% over the forecast period of 2024 to 2030. Increasing investments by the government and private corporations in the construction of roads, rails, bridges, etc., and ongoing urbanization in India fuel product consumption in the country.

The China construction anchors market grow this driven by the rising number of commercial buildings, including industrial facilities, complexes, hospitals, hotels & restaurants, and retail spaces, are being developed in the country to cater to the requirements of its increasing population, which, in turn, is expected to support the growth of the construction industry. This, in turn, drives the demand for construction anchors in China.

Europe Construction Anchors Market Trends

The Europe construction anchors market has been experiencing significant growth in recent years. Several European countries, including the UK, Germany, Italy, France, Spain, and the Nordic Region, are major consumers of construction anchors. The rise in construction activities, rapid infrastructure development, and increasing renovation projects are boosting the growth of fiber cement boards in the region, in turn contributing to the rising product demand.

The UK construction anchors market is driven by the significant number of ongoing renovation and retrofit projects, particularly in the residential sector. Construction anchors are commonly used in these projects to link structural and non-structural items to concrete, hence driving the market demand.

The construction anchors market in Germany is driven by the rise in government initiatives for economic recovery led to the development of infrastructure projects, thus accounting for the market growth. Another significant factor contributing to the market growth is the continuous investments in civil and construction engineering projects in both the public and private sectors of the country.

Central & South America Construction Anchors Market Trends

The Central and South American construction anchors market is anticipated to grow at a CAGR of 3.9% from 2024 to 2030. Emerging economies, such as Argentina, Brazil, and Peru, are witnessing population growth and rapid urbanization. These factors are triggering the construction of commercial units in these countries, thereby fueling the demand for construction anchors in the region.

Brazil construction anchors market is driven by the rising investments in the industrial sectors, which are contributing to the construction industry of the country. The overall construction industry is expected to grow the demand for construction anchors in Brazil over the forecast period.

Middle East & Africa Construction Anchors Market Trends

The Middle East and Africa construction anchors market is driven by the improved funding offered by the governments of the region in the form of public-private partnerships, domestic capital, and private investments. This funding is anticipated to fuel the growth of the construction industry in the Middle East and Africa, thereby driving the demand for construction anchors in the region in the coming years.

Saudi Arabia construction anchors market is expected to account for a significant share in the Middle East & Africa region in the coming years owing to continued investments by the government of the country in infrastructure development projects.

Key Construction Anchors Company Insights

Some of the key players operating in the market include Hilti Corporation, Stanley Black & Decker, Inc.-DEWALT, Illinois Tool Works, Inc., Adolf Wurth GmbH & Co. KG, and SFS Group Fastening Technology Ltd.

-

Stanley Black & Decker, Inc.-DEWALT caters to the demand for anchors. It provides a broad spectrum of products, including mechanical and chemical anchors, direct fastening solutions, and screw fasteners.

-

Wurth Group has a core business line that includes screws, screw accessories anchors for tools, chemical-technical products, and personal protection equipment. The Allied Companies of the Würth Group operate in business areas adjacent to the core business.

Fischer Fixings UK Ltd., Mechanical Plastics Corp., Cobra Anchors, and MKT Fastening, LLC are some of the emerging market participants.

-

Cobra Anchors is a direct manufacturer of picture hooks, anchors, and plant hangers. The products offered by the company include masonry, hollow wall, and universal anchors, along with concrete screws, hooks, and hangers.

-

MKT Fastening, LLC is majorly involved in manufacturing plastic, mechanical, and chemical anchoring systems. The company offers its mechanical anchor products through its two subsidiaries, namely the U.S.-based MKT fastening LLS and Germany-based MKT Metall-Kunststoff-Technik GmbH & Co. KG.

Key Construction Anchors Companies:

The following are the leading companies in the construction anchors market. These companies collectively hold the largest market share and dictate industry trends.

- Hilti Corporation

- Stanley Black & Decker, Inc.- DEWALT

- Illinois Tool Works, Inc.

- Wurth Group

- Fischer Fixings UK Ltd.

- Mechanical Plastics Corp.

- Cobra Anchors

- MKT Fastening, LLC

- SFS Group Fastening Technology Ltd.

- Friulsider S.P.A.

- CEAS.

- Sika AG

- Koelner Rawlplug IP

- Guangdong Kin Long Hardware Products Co., Ltd.

Recent Developments

-

In August 2020, MiTEk Inc. announced an expansion of its manufacturing facility in Phoenix, Arizona, State of the U.S. The new plant has a manufacturing capacity of 261,000 square feet and will extend to 153,000 square feet. The expansion, worth USD 5.0 million, helped the company increase its employee strength with 40 new full-time employees.

-

In July 2021, Klimas sp. z o. o. announced the introduction of new products, namely, WEDGE ANCHORS. The product is used for normal uncracked concrete, reinforced and non-reinforced, and cracked concrete. It is available in four variants and 96 sizes (from M8 to M16). The new product launch has helped the company gain market share in Poland.

Construction Anchors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.11 billion

Revenue forecast in 2030

USD 3.90 billion

Growth Rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Nordic Region, China, India, Japan, South Korea, Australia, Brazil, Chile, Argentina, Saudi Arabia, UAE

Key companies profiled

Hilti Corporation, Stanley Black & Decker, Inc.- DEWALT, Illinois Tool Works, Inc., Wurth Group, fischer fixings UK Ltd., Mechanical Plastics Corp., Cobra Anchors, MKT Fastening, LLC, SFS Group Fastening Technology Ltd., Friulsider S.P.A., CEAS., Sika AG, Koelner Rawlplug IP, Guangdong Kin Long Hardware Products Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Anchors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction anchors market report based on product, material, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hangers

-

Mechanical

-

Cast-in Anchors

-

Post-installed Anchors

-

Screw

-

Expansion

-

Undercut

-

-

-

Chemical

-

Nail-in

-

Wall

-

Other Products

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Carbon Steel

-

Other Materials

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Infrastructural

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Nordic Region

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Chile

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.