- Home

- »

- Next Generation Technologies

- »

-

Connected Toys Market Size, Share & Trends Report, 2030GVR Report cover

![Connected Toys Market Size, Share & Trends Report]()

Connected Toys Market Size, Share & Trends Analysis Report By Age Group, By Interfacing Device (Smartphones, Tablets), By Technology (Wi-Fi, Bluetooth, RFID Or NFC), By Distribution Channel, By Type, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-470-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Connected Toys Market Size & Trends

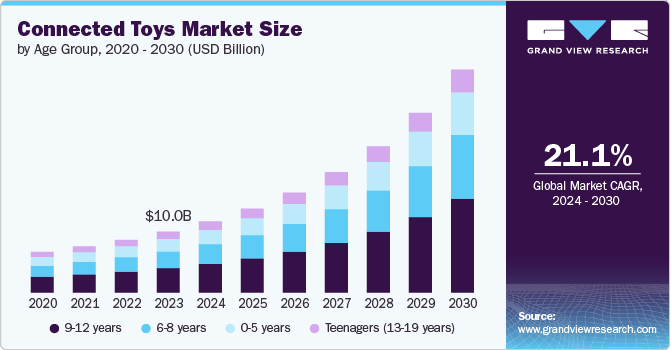

The global connected toys market size was estimated at USD 10.04 billion in 2023 and is expected to expand at a CAGR of 21.1% from 2024 to 2030. Increased demand for interactive and educational toys, rising adoption of smart devices, technological advancements, and growing consumer awareness are primarily contributing to the growth of the connected toys market. Moreover, the integration of connected toys with digital platforms, such as apps and online content, enhances entertainment value and drives market growth. Furthermore, ongoing advancements in technology and product design, such as augmented reality (AR) and virtual reality (VR), offer unique experiences that drive consumer demand.

The increasing emphasis on STEM (Science, Technology, Engineering, Mathematics) education encourages the development and adoption of connected toys that support these educational goals. The widespread use of smart devices facilitates the connectivity and control of connected toys, broadening their appeal and accessibility. Furthermore, the expansion of connected toys into emerging markets and developing regions presents new growth opportunities and increases global market potential. Partnerships between toy manufacturers, technology companies, and content creators are driving the development of innovative and engaging connected toys.

The proliferation of Internet of Things (IoT) and artificial intelligence (AI) technologies enhances interactivity and personalization in connected toys, driving consumer interest and market growth.Parents and educators are increasingly seeking toys that offer interactive and educational value, leading to a growing preference for connected toys that provide engaging and educational content. Features that allow parents to monitor and control their children’s play enhance the adoption of the connected toys.

Age Group Insights

The 9-12 years age group segment led the market in 2023, accounting for over 40.0% share of the global revenue. increasing demand for STEM-based toys, preference for interactive and immersive play, growing interest in social play and collaboration are primarily contributing to the growth of the segment. Children in the 9-12 age group are often more engaged with STEM (Science, Technology, Engineering, and Mathematics) learning. Connected toys that focus on coding, robotics, and problem-solving such as, LEGO Mindstorms, Osmo kits cater to this interest, encouraging skill development while being entertaining.

The 6-8 years age group segment is anticipated to exhibit significant CAGR over the forecast period. Children in this age range are more tech-savvy and comfortable with digital tools. As a result, connected toys that seamlessly integrate with smartphones, tablets, or home assistants such as Alexa are appealing, allowing kids to interact with toys using familiar technology. Moreover, parents tend to invest in toys that promote social, emotional, and cognitive development. Connected toys that encourage creative thinking, cooperation, or social interaction through multiplayer modes or smart features gain traction among this group.

Interfacing Device Insights

The smartphones segment accounted for the largest market revenue share in 2023. Various factors such as widespread smartphone penetration, increased connectivity options, and cost-effective solution are primarily driving the growth of the segment. With the increasing adoption of smartphones globally, parents and children have easy access to devices that can interface with connected toys. This allows toys to leverage smartphone apps for enhanced interactive experiences. Various connected toys are designed to work with companion smartphone apps, allowing for more dynamic features such as game updates, customizable settings, and real-time interactions. The ability to personalize experiences through smartphone apps enhances user engagement.

The wearable segment is anticipated to exhibit the highest CAGR over the forecast period. Wearable interfacing devices, such as smartwatches and fitness trackers designed for children, offer interactive and immersive play experiences. They allow kids to engage with digital environments, track physical activities, and interact with connected toys, driving demand for such innovations. Parents increasingly seek toys that promote physical activity, particularly in an era where children spend more time indoors. Wearable devices that encourage movement through gamified fitness challenges, step tracking, or health monitoring appeal to health-conscious parents, boosting their popularity.

Technology Insights

Bluetooth segment accounted for the largest market revenue share in 2023. Various factors such as ease of connectivity, cost effectiveness, low power consumption, and interactive play experiences are primarily contributing to the growth of the segment. Bluetooth enables easy pairing with smartphones, tablets, and other devices, allowing children to interact with toys through apps or voice commands. This user-friendly connectivity appeals to both parents and children, encouraging broader adoption of Bluetooth-enabled toys.

Artificial Intelligence (AI) segment is anticipated to exhibit the highest CAGR over the forecast period. Numerous factors such as enhanced interactivity, educational value, personalization and customization, and voice and emotion recognition are driving the growth of the segment. AI-powered connected toys offer personalized and adaptive play experiences by recognizing user inputs such as voice, gestures, or behaviors. This level of interaction makes toys more engaging and responsive, driving demand for AI-based toys.

Distribution Channel Insights

Online retail segment accounted for the largest market revenue share in 2023. The rise of e-commerce increased digital marketing, subscription and direct-to-consumer models, and technological advancements are primarily contributing to the growth of the segment. Moreover, online retail platforms offer a wider range of connected toys than physical stores, including international brands, niche products, and customized options. This variety attracts consumers who seek unique or hard-to-find toys. Toy manufacturers are leveraging digital marketing strategies, such as social media campaigns and influencer partnerships, to promote connected toys directly to parents and children. This targeted approach has driven sales growth in the online retail space.

The direct sales segment is anticipated to exhibit a significant CAGR over the forecast period. Direct sales allow companies to engage directly with customers, offering personalized demonstrations and advice on how connected toys work. This approach can lead to higher customer satisfaction and loyalty, particularly for tech-heavy products that may require explanation or guidance.Parents often prefer purchasing toys directly from trusted brands or sales representatives. Direct sales provide a more reliable and trusted purchasing experience, especially for high-tech toys that involve data collection and online connectivity, which can raise privacy concerns.

Type Insights

App-Connected Toys segment accounted for the largest market revenue share in 2023. Increased smartphone penetration, enhanced user experience, and parental control and monitoring are driving the growth of the segment. The widespread use of smartphones and tablets among parents and children encourages the adoption of app-connected toys.App-connected toys are designed to support learning, helping children develop skills in various areas such as STEM, language, and creativity.Apps often offer parents the ability to monitor playtime, set usage limits, and customize learning paths, appealing to safety-conscious caregivers.

The voice-activated toys segment is anticipated to exhibit the highest CAGR over the forecast period. Improvements in voice recognition technology enhance user experience, making toys more interactive and responsive.Voice-activated toys often incorporate educational elements, promoting learning through interaction, which appeals to parents. Moreover, voice-activated toys come with safety features and parental controls, increasing consumer confidence in their use. Furthermore, the growing trend towards personalized play experiences encourages the development of toys that can adapt to a child's voice and preferences.

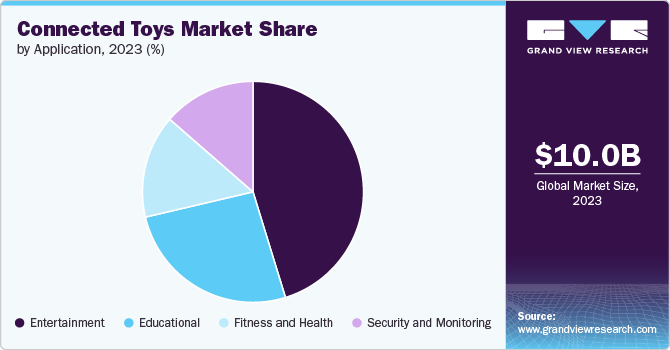

Application Insights

The entertainment segment accounted for the largest market revenue share in 2023. Modern consumers are looking for toys that offer more than traditional play. Connected toys with entertainment applications provide interactive experiences, keeping children engaged for longer periods. This includes features such as games, challenges, and interactive storytelling. The integration of advanced technologies such as augmented reality (AR) and virtual reality (VR) enhances the entertainment value of connected toys. These technologies create immersive experiences that capture children's attention and encourage creative play.

The educational segment is anticipated to exhibit the highest CAGR over the forecast period. Parents increasingly seek toys that provide both entertainment and educational value. Connected toys that incorporate learning through play are appealing, as they help develop skills in an engaging way. Connected toys use artificial intelligence and adaptive learning technologies to tailor experiences to individual children's learning styles and paces. This personalization enhances engagement and educational outcomes.

Regional Insights

North America dominated with a revenue share of over 35.0% in 2023. North America has a well-established technological infrastructure, enabling the rapid adoption of connected toys that utilize IoT, AI, AR, and VR. The presence of tech-savvy consumers supports market growth. Furthermore, the region hosts several prominent toy manufacturers contributing to the development and availability of connected toys in the market. These companies continually invest in product innovation, driving the growth of the connected toys market.

U.S. Connected Toys Market Trends

The U.S. connected toys market is anticipated to exhibit a significant CAGR over the forecast period. Consumers in the country have relatively higher disposable income, enabling them to spend on premium connected toys that offer advanced features and interactive experiences. Furthermore, there is a growing emphasis on child safety and privacy in connected toys. Manufacturers in the U.S. are increasingly incorporating parental control, data protection, and safety features, enhancing consumer trust and adoption.

Europe Connected Toys Market Trends

The connected toys market in the Europe region is expected to witness significant growth over the forecast period. Europe has a large and tech-savvy population with widespread adoption of smartphones, tablets, and other smart devices, which supports the growth of connected toys that rely on these platforms for functionality and interaction. Moreover, various European countries are pushing forward digital education initiatives, further encouraging the use of connected toys that complement learning through digital platforms.

Asia Pacific Connected Toys Market Trends

The connected toys market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The increase in disposable income, particularly in countries such as, China, India, and Japan are leading to higher spending on premium and technologically advanced toys, including connected toys. Moreover, the rapid development of digital infrastructure and the growing use of smartphones and tablets in Asia Pacific enable the adoption of connected toys, especially in urban areas.

Key Connected Toys Company Insights

Key connected toys companies include Hasbro, Mattel, and Sony Corporation. Companies active in the connected toys market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in March 2024, The LEGO Group, collaborated with Hasbro, a toy and game company, to launch LEGO DUPLO PEPPA PIG, a collection of play experiences. LEGO DUPLO collaborated with the popular preschool show to create new sets that feature colorful settings, iconic characters, and imaginative stories to inspire building adventures.

Key Connected Toys Companies:

The following are the leading companies in the connected toys market. These companies collectively hold the largest market share and dictate industry trends.

- Hasbro

- Mattel

- Sony Corporation

- Sphero, Inc.

- Spin Master

- The LEGO Group

- UBTECH ROBOTICS CORP LTD

- VTech Electronics North America, LLC

- Wonder Workshop, Inc.

- WowWee Group Limited

Recent Developments

-

In September 2024, GUND, a company of Spin Master, partnered with Disney, to launch a new Disney x GUND collection, a new line featuring iconic Disney characters. Combining GUND's design with Disney's imagery, these plush toys offer a distinct experience for collectors.

-

In July 2024, Sony Interactive Entertainment Europe collaborated with Spin Master, connected toys developer, to introduce The Shapes Collection, a new line of collectibles, based on hit PlayStation Studios titles. This collection showcases iconic figures from the God of War Ragnarök, Horizon Forbidden West, and Ghost of Tsushima.

-

In April 2024, Hasbro, connected toy company, announced licensing agreement with Playmates Toys Limited, toy designing company, to produce and distribute POWER RANGERS product. Playmates Toys Limited would launch its inaugural POWER RANGERS toy line, focusing on the iconic MIGHTY MORPHIN POWER RANGERS series, designed for children in 2025.

Connected Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.74 billion

Revenue forecast in 2030

USD 37.01 billion

Growth rate

CAGR of 21.1% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age group, interfacing device, technology, distribution channel, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Hasbro; Mattel; Sony Corporation; Sphero, Inc.; Spin Master; The LEGO Group; UBTECH ROBOTICS CORP LTD; VTech Electronics North America, LLC; Wonder Workshop, Inc.; WowWee Group Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Connected Toys Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global connected toys market report based on the age group, interfacing device, technology, distribution channel, type, application, and region.

-

Age Group Outlook (Revenue, USD Million, 2017 - 2030)

-

0- 5 years

-

6-8 years

-

9-12 years

-

Teenagers (13-19 years)

-

-

Interfacing Device Outlook (Revenue, USD Million, 2017 - 2030)

-

Smartphones

-

Tablets

-

Consoles & PCs

-

Wearables

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Wi-Fi

-

Bluetooth

-

Radio Frequency Identification (RFID) or Near Field Communication (NFC)

-

Artificial Intelligence (AI)

-

Augmented Reality (AR) and Virtual Reality (VR)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online Retail

-

Offline Retail

-

Specialty Stores

-

Direct Sales

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

App-Connected Toys

-

Voice-Activated Toys

-

Screenless Connected Toys

-

Smart Toys with Wearable Integration

-

Robotics & Programmable Toys

-

Smart Action Figures and Dolls

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Educational

-

Entertainment

-

Fitness and Health

-

Security and Monitoring

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global connected toys market size was estimated at USD 10.04 billion in 2023 and is expected to reach USD 11.74 billion in 2024.

b. The global connected toys market is expected to grow at a compound annual growth rate of 21.1% from 2024 to 2030 to reach USD 37.01 billion by 2030.

b. North America dominated the connected toys market with a share of 39.7% in 2023. North America has a well-established technological infrastructure, enabling the rapid adoption of connected toys that utilize IoT, AI, AR, and VR. The presence of tech-savvy consumers supports market growth. Furthermore, the region hosts several prominent toy manufacturers contributing to the development and availability of connected toys in the market. These companies continually invest in product innovation, driving the growth of the connected toys market.

b. Some key players in the connected toys market include Hasbro, Mattel, Sony Corporation, Sphero, Inc., Spin Master, The LEGO Group, UBTECH ROBOTICS CORP LTD, VTech Electronics North America, LLC, Wonder Workshop, Inc., and WowWee Group Limited.

b. Increased demand for interactive and educational toys, rising adoption of smart devices, technological advancements, and growing consumer awareness are primarily contributing to the growth of the connected toys market. Moreover, the integration of connected toys with digital platforms, such as apps and online content, enhances entertainment value and drives market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."