- Home

- »

- Medical Devices

- »

-

Connected Drug Delivery Devices Market Size Report, 2030GVR Report cover

![Connected Drug Delivery Devices Market Size, Share & Trends Report]()

Connected Drug Delivery Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Route Of Administration (Parenteral, Inhalational), By Application (Asthma, COPD, Diabetes Management, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-651-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

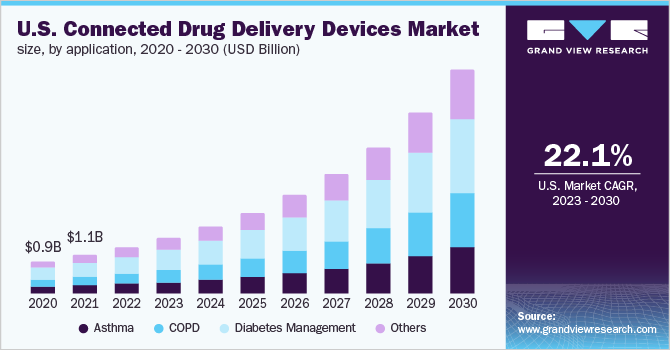

The global connected drug delivery devices market size was estimated at USD 4.84 billion in 2022 and is expected to grow at a lucrative compound annual growth rate (CAGR) of 23.4% during the forecast period. The market is driven by factors such as the need to boost patient medication adherence, R&D activities, and the acceleration of remote digital monitoring conducted by COVID-19. Ypsomed partnered with CamDiab and Abbott to develop and commercialize a new automated insulin delivery system. This initiative aims at integrating Ypsomed’s YpsoPump, with CamDiab’s CamAPS FX App, and Abbott’s FreeStyle Libre sensor. The company intends to complete development by end of 2022.

The COVID-19 pandemic had an overall positive impact on the market with increased awareness of connected devices, adoption by providers & patients, and the importance of remote monitoring for medication adherence. For instance, in 2021 Adherium Limited- a key respiratory eHealth company, reported COVID-driven acceleration in remote patient monitoring across the globe. The company, however, also faced challenges due to the pandemic in progressing with planned pilot evaluations with partners in the U.S. During 2022, the company expects a strong series of positive commercial and R&D activities owing to the easing of movement restrictions and improved hospital access.

The increasing R&D activities are a key driver for the market. It also contributes to an exponential growth rate owing to the robust product pipeline of several key players anticipated to be launched commercially over the forecast period. In May 2021, Eli Lilly and Company, for example, collaborated with 4 companies - Glooko Inc., DexCom, Inc., Roche, and myDiabby Healthcare- to advance connected solutions for diabetics in markets outside of the U.S. The diabetes management platforms being offered by the companies are expected to be compatible with Lilly's Tempo Pen (available in various markets across the globe) and Tempo Smart Button (in late-stage development) to support diabetes patients, thus propelling the market growth.

The growing need to boost patient medication adherence is another key factor driving the business scope. As more and more patients adopt connected drug delivery devices this would support self-management of their treatment more efficiently, thus helping to reduce the number of visits to clinics and hospitals. Connected devices help with correct dosage and administration and support a successful treatment without the need for costly secondary interventions. These systems also offer reminders and adherence trackers that reduce the patient’s effort to comply with the prescribed medication regime. This can also help reduce the wastage of costly medications such as injectable biologics.

Product Insights

The standalone components and software segment dominated the market in 2022. This is due to the increasing demand for connected sensors to transform traditional drug delivery devices into connected drug delivery devices without interfering with their core functionality. The sensors can also be reused even if the device is disposable. Furthermore, the market has witnessed tremendous growth as a result of technological innovation and the increasing connectivity of devices. In February 2022, HeroTracker Sense- a metered-dose inhaler (MDI) add-on was launched by Aptar Pharma- that transforms a standard inhaler into a smart connected drug delivery device.

Integrated devices, on the other hand, are anticipated to grow the fastest at a rate of over 24% during the forecast period. The integrated devices can be employed for injection and Inhalational delivery systems, allowing patients to control their medication therapy even in remote places. The growing availability of integrated connected drug delivery devices is estimated to fuel segment growth. For instance, Elcam's FlexiQ eMU-P connected autoinjector is a self-administration tool for home usage suitable for injection of high-viscosity drugs. It wirelessly transmits injection data to remote storage and also provides calendar settings and injection reminder alerts.

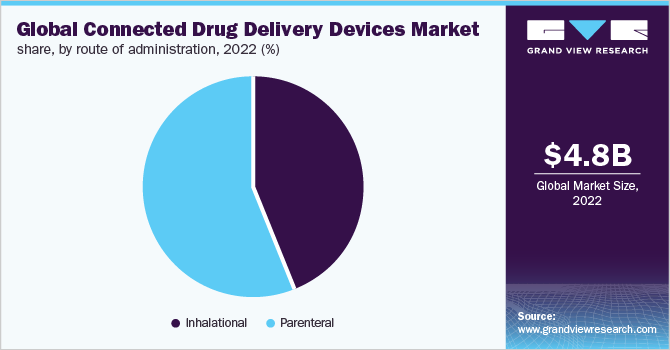

Route Of Administration Insights

The Parenteral devices segment held the highest share of the market in 2022, owing to the numerous advantages offered by smart & connected parenteral devices over conventional ones. The increasing prevalence of chronic diseases such as neurological diseases, diabetes, cancer, and others is also anticipated to drive segment growth during the forecast period. In November 2020, Biocorp launched Mallya- a smart cap for pen injectors that automatically captures data (such as the injection dose, date, and time) and transmits it in real-time via Bluetooth to companion software.

Inhalational devices are projected to grow the fastest at a rate of over 20% during the forecast period. This growth is attributed due to the rising prevalence of respiratory disorders such as asthma, Chronic Obstructive Pulmonary Disorders (COPD), and other respiratory diseases. For instance, according to the Centers for Disease Control and Prevention (CDC), asthma prevalence was estimated at about 25 million across the U.S. in 2020. R&D initiatives and product launches by key companies are also expected to contribute to segment growth in the coming years.

Application Insights

On the basis of application, Diabetes Management dominated the market with a share of over 30% in 2022. This is owing to factors such as the rising prevalence of diabetes, technological advancements, and R&D in insulin delivery devices. For instance, the International Diabetes Federation estimated that about 537 million adults were living with diabetes in 2021. This number is projected to reach 643 million by 2030. The market is anticipated to experience a broad range of developments as connected drug delivery devices are constantly improving, which has the potential to transform the way diabetes is managed.

The other Applications segment is anticipated to grow the fastest at a rate of more than 24% in the next few years. It comprises autoimmune diseases such as multiple sclerosis, migraine, and osteoporosis. In December 2019, the YpsoMate prefilled autoinjector by Ypsomed was selected by Terumo Corporation to assemble its PLAJEX syringe with the osteoporosis drug- Teribone (developed by Asahi Kasei Pharma). The final product was launched in Japan. Similar partnerships and collaborations are expected to propel the segment's growth.

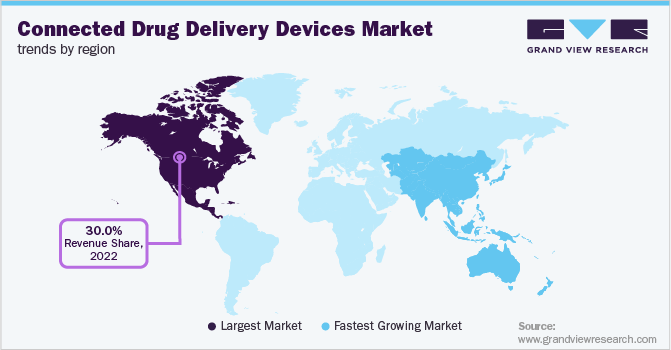

Regional Insights

North America led the global market in 2022 and accounted for a revenue share of over 30% in the year 2022. This is due to the region’s high per capita healthcare spending, rapid adoption of technology presence of key players, and growing adoption of remote monitoring for medication adherence. Cognita Labs, LLC for instance, is headquartered in the U.S. and has developed CapMedic (a Class II device) that works as an inhaler attachment for MDI. It measures the correctness of inhaler use, frequency, and time of its use and provides audio-visual interactive guidance in real-time on correct usage.

Due to the rising prevalence of chronic diseases and the availability of a huge patient population base, the Asia Pacific region is anticipated to have the fastest growth at a rate of over 24% over the forecast period. The growing number of companies and initiatives deployed by them is also expected to fuel regional growth. Adherium for instance, is a New Zealand-based public company focused on developing solutions for remote monitoring, patient adherence, and data management in the respiratory area.

Key Companies & Market Share Insights

The connected drug delivery devices market is competitive in nature with the presence of several large and small players. Large companies are publicly traded and have diverse portfolios with robust R&D, distribution, and sales capabilities. Medium to small companies focuses on specific solutions that cater to customer needs in the market e.g. sensor manufacturing, software for connected devices, etc. Most market players implement strategic initiatives to grow their market presence and share. These include mergers and acquisitions, R&D, partnerships, regional expansion, as well as product launches. For instance, in September 2022, Nemera inaugurated a new facility in Lyon, France which is projected to function as the company’s new headquarters and innovation center in Europe. Some of the prominent players in the global connected drug delivery devices market include:

-

Teva Respiratory, LLC

-

Novo Nordisk A/S

-

Phillips-Medisize, LLC

-

Medtronic

-

Adherium Limited

-

Tandem Diabetes Care, Inc.

-

Biocorp

-

Propeller health

-

Ypsomed AG

-

Aptar Pharma

Connected Drug Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.86 billion

Revenue forecast in 2030

USD 25.6 billion

Growth rate

CAGR of 23.4% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, route of administration, application, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; France; Italy; Spain; U.K.; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Teva Respiratory, LLC; Novo Nordisk A/S; Phillips-Medisize, LLC; Medtronic; Adherium Limited; Tandem Diabetes Care, Inc.; Biocorp; Propeller health; Ypsomed AG; Aptar Pharma

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Connected Drug Delivery Devices Market Segmentation

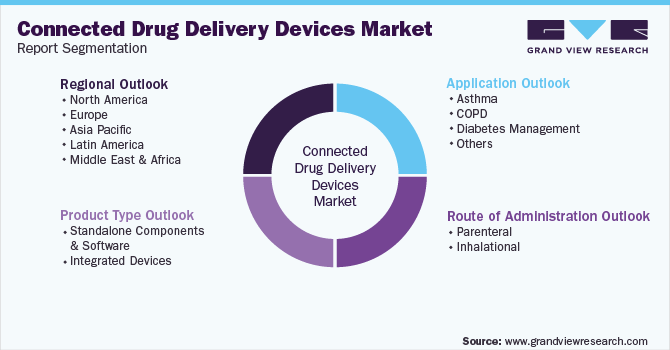

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global connected drug delivery devices market based on product, route of administration, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone Components & Software

-

Integrated Devices

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral

-

Inhalational

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Asthma

-

COPD

-

Diabetes Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

South Arabia

-

-

Frequently Asked Questions About This Report

b. The global connected drug delivery devices market size was estimated at USD 4.84 billion in 2022 and is expected to reach USD 5.86 billion in 2023.

b. The global connected drug delivery devices market is expected to grow at a compound annual growth rate of 23.4% from 2023 to 2030 to reach USD 25.6 billion by 2030.

b. North America dominated the connected drug delivery devices market with a share of 35.68% in 2022. This is attributable to the quick adoption of the latest technologies and devices, high per capita healthcare expenditure, and rising awareness regarding the adverse effects of non-adherence to medication.

b. Some key players operating in the connected drug delivery devices market include Teva Respiratory, LLC; Cognita Labs, LLC; Phillips-Medisize, LLC; Medtronic; Adherium Limited; Amiko Digital Health Limited; Biocorp; Propeller health; Ypsomed AG; Cohero Health Inc.

b. Key factors that are driving the connected drug delivery devices market growth include increased patient engagement and connectivity owing to the rising penetration of the Internet of Things (IoT).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.