Conjugate Vaccine Market Size, Share & Trends Analysis Report By Product (Monovalent, Multivalent), By Brand (Prevnar, CAPVAXIVE), By Disease, By Pathogen, By Patient, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-349-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Conjugate Vaccine Market Size & Trends

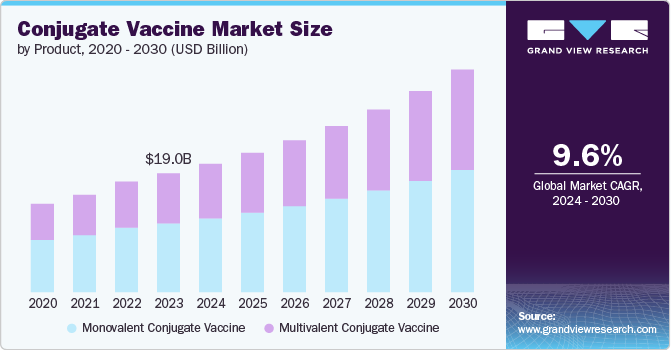

The global conjugate vaccine market size was estimated at USD 19.01 billion in 2023 and is expected to grow at a CAGR of 9.60% from 2024 to 2030. The rising incidence of infectious diseases globally is a significant driver for the growth of the conjugate vaccines market. Conjugate vaccines help protect against several serious bacterial diseases, including Haemophilus influenzae disease b (Hib, Pneumococcal infections, and Meningococcal infections. According to the CDC, pneumococci, specifically Streptococcus pneumonia bacteria, are a significant cause of bacterial meningitis in the U.S. highlighted the significant health burden posed by this bacterium. As infectious diseases threaten public health, there is a growing need for effective vaccination strategies, driving the demand for conjugate vaccines.

Another crucial factor driving the conjugate vaccines market is the rising regulatory approvals for new conjugate vaccine products. The increasing number of regulatory approvals expands the market and drives innovation within the industry. Companies are encouraged to develop novel conjugate vaccines to address unmet medical needs and target emerging infectious diseases. For Instance, in June 2024, the U.S. FDA approved CAPVAXIVE, a pneumococcal 21-valent conjugate vaccine for adults, to prevent invasive and pneumococcal disease. This approval marks a significant milestone in the fight against pneumococcal infections, which can lead to serious health issues and even death, especially among high-risk groups such as the elderly and those with specific pre-existing health problems.

Governmental initiatives and immunization programs worldwide have significantly influenced the growth of the conjugate vaccines market. For Instance, the WHO recommended including Pneumococcal Conjugate Vaccines (PCVs) in childhood immunization programs globally. Specifically, countries with high rates of childhood mortality, such as an under-5 mortality rate exceeding 50 deaths per 1000 births, should prioritize the introduction of these multicomponent PCVs.

Increasing emphasis on preventive healthcare practices among individuals and healthcare providers drives the demand for vaccines that offer long-term protection against infectious diseases. Conjugate vaccines, with their ability to enhance immune responses, align well with this preventive healthcare approach.

Product Insights

Monovalent conjugate vaccine segment dominated the market and accounted for a share of 57.92% in 2023. These vaccines are highly effective, readily available, and offer numerous advantages that contribute to their increasing popularity. These vaccines can enhance antibody avidity, herd immunity, immunologic memory, and antibody persistence, making them a highly effective disease of vaccination. Monovalent conjugate vaccines are widely preferred for immunizing against specific infectious diseases and have proven effective in controlling diseases such as Haemophilus influenzae type b (Hib) and pneumococcal infections.

The multivalent conjugate vaccine segment is projected to grow at a significant rate over the forecast period. This growth is driven by the rising demand for vaccines that defend against multiple pathogen strains or serogroups, ensuring broader immunity. Moreover, technological advancements in vaccine development have led to more advanced multivalent conjugate vaccines targeting a more comprehensive array of diseases. This has made them more appealing to healthcare providers and patients alike.

Brand Insights

The Prevnar segment held the largest share of 29.17% in 2023. This dominance is primarily driven by Prevnar's strong clinical profile, widespread adoption, and its manufacturer, Pfizer's continuous innovation and expansion of the product line. Prevnar 13, a 13-valent pneumococcal conjugate vaccine, has been a blockbuster product for Pfizer, with its use becoming a standard of care in childhood immunization programs globally. The subsequent introduction of Prevnar 20, which protects against 20 pneumococcal serotypes, has further solidified the brand's market leadership position. The ability of the Prevnar vaccines to provide comprehensive protection against the most prevalent and deadly pneumococcal strains has been a key factor driving their widespread acceptance and uptake worldwide. Pfizer's robust clinical development, regulatory approvals, and effective commercialization strategies have maintained Prevnar's dominance in the conjugate vaccine market.

The CAPVAXIVE segment is experiencing the fastest growth within the brand segment of the global conjugate vaccines market, attributed to its innovative approach in addressing a broader spectrum of diseases beyond those covered by traditional vaccines. With a focus on combining multiple antigens into a single vaccine, CAPVAXIVE aims to improve immunization efficiency and patient compliance, particularly in pediatric populations. The segment's growth is fueled by strategic collaborations for research and development, leading to faster regulatory approvals and market penetration.

Disease Insights

The DTP segment held the largest share of 34.58% in 2023. This dominance is primarily driven by the high prevalence and highly contagious nature of the respiratory tract infections caused by the diphtheria, tetanus, and pertussis pathogens. These diseases are particularly hazardous, pose significant risks, and can lead to severe complications and even death if left untreated. As a result, DTP conjugate vaccines have become essential components of comprehensive childhood immunization programs worldwide. According to the CDC, between 2021 and 2022, worldwide immunization with the initial dose of the vaccine protecting against diphtheria, tetanus, and pertussis increased from 86% to 89%. This highlights the essential role of these combination vaccines. The widespread inclusion of DTP conjugate vaccines in national childhood immunization schedules has been a key factor in the growth of the segment.

The meningococcal segment is anticipated to grow significantly during the forecast period. This growth is primarily driven by the rising prevalence of meningococcal infections, particularly in developing regions such as Africa, and the urgent need to address this public health challenge. For instance, in July 2023, the WHO prequalified an innovative multivalent meningococcal conjugate vaccine. This vaccine is notable for its ability to protect against the five primary serogroups of meningococcal meningitis prevalent in Africa - A, C, W, Y, and X, making it the first vaccine to offer defense against serogroup X.

Pathogen Insights

The viral segment held the largest share of 63.17% in 2023. This dominance is driven by the increasing prevalence of viral diseases and the growing demand for effective vaccines to combat these infections. Pharmaceutical companies have focused on developing conjugate vaccines targeting viruses such as influenza, varicella-zoster, adenovirus, and human parainfluenza virus. The rising investments in research and development by various players to bring innovative viral conjugate vaccine solutions to the market are further propelling the growth of this segment.

The bacterial segment is anticipated to witness significant growth over the forecast period. This growth is driven by the rising prevalence of bacterial infections, especially in the Middle East and Africa region, and increased research and development efforts around bacterial conjugate vaccines. The development of expanded-valency pneumococcal conjugate vaccines that protect against different Streptococcus pneumonia serodiseases has been a critical driver of the bacterial conjugate vaccines market, as these vaccines offer more comprehensive protection against pneumococcal disease in high-risk populations.

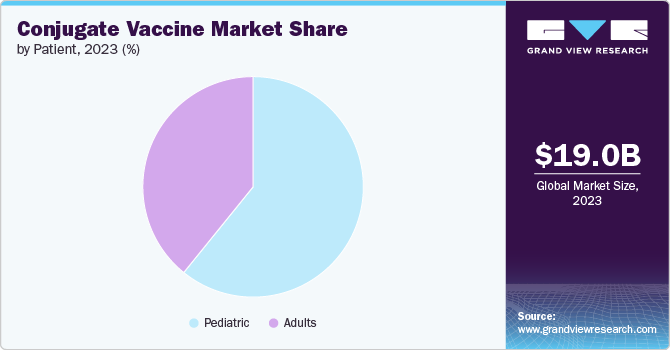

Patient Insights

The pediatric segment held the largest share of 60.83% in 2023 and is anticipated to grow rapidly over the forecast period. This is primarily driven by the high susceptibility of infants and young children to bacterial infections and the critical need to protect this vulnerable population. Haemophilus influenzae disease b (Hib) conjugate vaccines have dramatically reduced the incidence of invasive Hib disease in childhood. According to the CDC, Hib, or Haemophilus influenzae disease b, is a severe infection that poses a significant risk, particularly to children. Approximately 1 out of every 20 children affected by Hib meningitis succumbs to the illness. Moreover, up to 1 in 5 children who survive Hib meningitis may experience brain damage or hearing loss.

In addition, the increasing adoption of pneumococcal conjugate vaccines (PCVs) in national immunization programs worldwide, especially PCV13 and the newer PCV15 and PCV20 formulations, has been a key driver of the pediatric conjugate vaccines market. These vaccines offer broader protection against pneumococcal disease in children. The growing awareness among parents about the importance of childhood vaccination and the implementation of favorable government policies to improve pediatric vaccination coverage are further propelling the growth of this segment.

Regional Insights

The conjugate vaccines market in North America accounted for the largest revenue share of 37.67% in 2023, driven by increasing awareness about the importance of vaccination, the rising prevalence of infectious diseases, and favorable government initiatives promoting immunization. The region has a well-established healthcare infrastructure and high healthcare expenditures further boost the demand for conjugate vaccines. Companies are focusing on research and development to introduce innovative vaccines catering to the specific needs of the population.

U.S. Conjugate Vaccines Market Trends

The conjugate vaccines market in the U.S. is expected to grow substantially over the forecast period. This can be attributed to the robust healthcare system, high adoption rates of advanced medical technologies, and strong regulatory framework. The U.S. market benefits from a supportive regulatory framework maintained by the Food and Drug Administration (FDA). For instance, in June 2021, the FDA approved Pfizer's PREVNAR 20, a vaccine with a 20-valent conjugate that protects against pneumococcal disease in adults 18 years old and older. This robust regulatory environment for the approval and commercialization of conjugate vaccines contributes to the growth of the market.

Europe Conjugate Vaccines Market Trends

Europe conjugate vaccines market is expected to witness lucrative growth over the forecast period. This can be attributed to increasing government funding for vaccination programs and raising awareness about disease prevention. The region is witnessing significant investments in research and development activities focused on developing new and improved conjugate vaccines to address evolving healthcare needs. For Instance, in February 2022, the European Medicines Agency approved Pfizer's 20-valent pneumococcal conjugate vaccine for adults to prevent invasive pneumococcal disease and pneumonia. This approval marks a significant advancement in the fight against pneumococcal infections, which can lead to serious health complications, especially in vulnerable populations such as the elderly and individuals with weakened immune systems.

Asia Pacific Conjugate Vaccines Market Trends

Asia Pacific conjugate vaccines market is anticipated to witness the fastest growth of 25.13% CAGR over the forecast period. Rapid urbanization, growing population density, and increasing healthcare expenditure drive market growth. Countries including China and India are witnessing a surge in vaccine demand due to rising awareness about infectious diseases and government-led immunization campaigns. A large pediatric population in Asia Pacific fuels the need for childhood vaccinations, including conjugate vaccines targeting various bacterial infections.

Key Conjugate Vaccine Company Insights

Some of the key players operating in the market include Sanofi, Pfizer, Inc., Merck & Co., Inc., GSK plc and Bharat Biotech. These players are using various strategies, such as new launches, forming partnerships, expanding their operations, making acquisitions, and engaging in collaborations, to enhance their presence and gain a competitive advantage over other competitors.

Key Conjugate Vaccine Companies:

he following are the leading companies in the conjugate vaccine market. These companies collectively hold the largest market share and dictate industry trends.

- Bavarian Nordic

- Bharat Biotech

- Biological E. Ltd

- Bio-Med

- CSL Limited

- GSK plc

- GSPBL

- Merck & Co., Inc.

- Novartis AG

- Pfizer, Inc.

- Sanofi

- Serum Institute of India Pvt. Ltd.

- Taj Pharmaceuticals Ltd.

Recent Developments

-

In March 2024, Pfizer Inc. received marketing authorization from the European Commission for its 20-valent pneumococcal conjugate vaccine, PREVENAR 20, for active immunization in infants, children, and adolescents from 6 weeks to less than 18 years of age.

-

In February 2024, SK Bioscience, in collaboration with the International Vaccine Institute (IVI), has announced that its typhoid conjugate vaccine, developed through technology transferred from IVI, has been prequalified by the World Health Organization (WHO). This milestone allows the vaccine to be purchased by UN agencies, thereby enhancing the worldwide supply of TCV (Typhoid Conjugate Vaccine).

Conjugate Vaccine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 20.56 billion |

|

Revenue forecast in 2030 |

USD 35.64 billion |

|

Growth rate |

CAGR of 9.60% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, brand, disease, pathogen, patient, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Bavarian Nordic; Bharat Biotech; Biological E. Ltd; Bio-Med; CSL Limited; GSK plc; GSPBL; Merck & Co., Inc.; Novartis AG; Pfizer, Inc.; Sanofi; Serum Institute of India Pvt. Ltd.; Taj Pharmaceuticals Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Conjugate Vaccine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global conjugate vaccine market report on the basis of product, brand, disease, pathogen, patient, and region

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Monovalent Conjugate Vaccine

-

Multivalent Conjugate Vaccine

-

-

Brand Outlook (Revenue, USD Million, 2018 - 2030)

-

Prevnar

-

Synflorix

-

PedvaxHIB

-

Hiberix

-

ACT-HIB

-

Pentacel

-

Menveo

-

Menactra

-

MenQuadfi

-

VAXNEUVANCE

-

CAPVAXIVE

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Pneumococcal

-

Influenza

-

DTP

-

Meningococcal

-

Typhoid

-

-

Pathogen Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacterial

-

Viral

-

Combination

-

-

Patient Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adults

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global conjugate vaccine market size was estimated at USD 19.01 billion in 2023 and is expected to reach USD 20.56 billion in 2024.

b. The global conjugate vaccine market is expected to grow at a compound annual growth rate of 9.60% from 2024 to 2030 to reach USD 35.64 million by 2030.

b. The Prevnar segment held the largest share of 29.17% in 2023. This dominance is primarily driven by Prevnar's strong clinical profile, widespread adoption, and its manufacturer, Pfizer's continuous innovation and expansion of the product line.

b. Some key players operating in the conjugate vaccine market include Bavarian Nordic; Bharat Biotech; Biological E. Ltd; Bio-Med; CSL Limited; GSK plc; GSPBL; Merck & Co., Inc.; Novartis AG; Pfizer, Inc.; Sanofi; Serum Institute of India Pvt. Ltd.; Taj Pharmaceuticals Ltd.

b. The rising incidence of infectious diseases globally is a significant driver for the growth of the conjugate vaccine market. Conjugate vaccines help protect against several serious bacterial diseases, including Haemophilus influenzae disease b (Hib, Pneumococcal infections, and Meningococcal infections. As infectious diseases threaten public health, there is a growing need for effective vaccination strategies, driving the demand for conjugate vaccines.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."