- Home

- »

- Pharmaceuticals

- »

-

Congestive Heart Failure Drugs Market Size Report, 2030GVR Report cover

![Congestive Heart Failure Drugs Market Size, Share & Trends Report]()

Congestive Heart Failure Drugs Market Size, Share & Trends Analysis Report By Drug (ACE Inhibitors, Angiotensin 2 Receptor Blockers), By Product (Injection, Capsule and Tablets), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-987-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

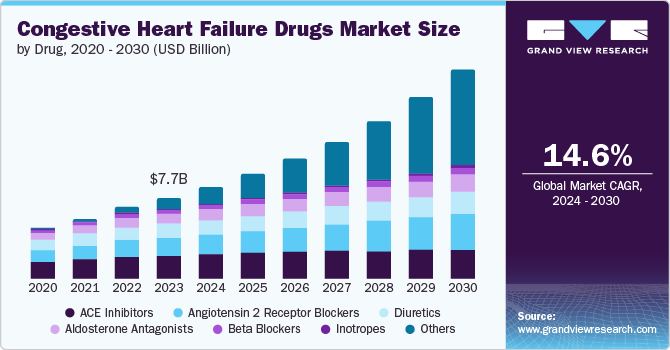

The global congestive heart failure drugs market size was valued at USD 7.69 billion in 2023 and is projected to grow at a CAGR of 14.6% from 2024 to 2030. The aging population with increased life expectancy, rising prevalence of heart failure and cardiovascular diseases, increasing R&D for drug development are driving demand for congestive heart failure (CHF) drugs. Another major factor facilitating growth is the rising burden of diseases such as obesity, diabetes, hypertension, chronic pulmonary diseases, and renal disease as these are considered CHF-associated prominent comorbidities.

The aging population is a significant contributor to the rise in CHF prevalence. As individuals age, they are more susceptible to heart-related conditions, leading to increased demand for CHF medications. According to World Heart Federation, cardiovascular diseases are a major global health problem, affecting over half a billion people and causing millions of deaths each year. The increasing prevalence of risk factors such as obesity, diabetes, hypertension, and sedentary lifestyles contributes to the higher incidence of CHF. Moreover, organizations dedicated to cardiovascular health, such as the World Heart Organization (WHO), American Heart Association (AHA), and various national heart foundations, actively engage in awareness initiatives.

Continuous research and development efforts are leading to the introduction of new and more effective CHF drugs, expanding treatment options. Newer drugs often offer better efficacy and safety profiles, driving market growth. Rising healthcare expenditures are enabling greater access to CHF treatments. Expanding healthcare coverage and infrastructure in developing countries is increasing the market potential. Growing awareness about heart health and the importance of early detection and treatment is further fueling the market growth.

Drug Insights

ACE inhibitors held the largest share of 28.6% in 2023. It is the first treatment choice for treating CHF patients. It includes drugs including Epaned (enalapril), Vasotec, Zestril, Qbrelis, captopril and Prinivil (lisinopril).

Angiotensin 2 receptor blockers (ARBs) are anticipated to witness the significant CAGR of 10.2% over the forecast period. ARBs provide an alternative for patients who cannot tolerate ACE inhibitors due to cough or angioedema, thereby expanding the treatment options available for CHF management.

Product Insights

The tablets segment dominated the market with 38.2% of revenue share in 2023. The convenience and ease of administration offered by tablets have made them a preferred choice for patients managing chronic conditions such as CHF. Moreover, advancements in drug formulation and delivery systems have led to the development of tablets with improved bioavailability and sustained release properties, enhancing treatment efficacy. In addition, the rising geriatric population, a primary demographic for CHF, often prefers tablets due to ease of use, contributing to market growth.

The injection segment is anticipated to witness significant CAGR of 15.2% over the forecast period. This is due to the need for rapid onset of action and higher drug concentrations often required in acute CHF cases. Furthermore, the development of long-acting injectable formulations is gaining traction, reducing the frequency of administration for patients and improving adherence. While traditionally associated with hospital settings, the increasing availability of self-injectable formulations is expanding the use of injections in the outpatient setting, contributing to market growth.

Distribution Channel Insights

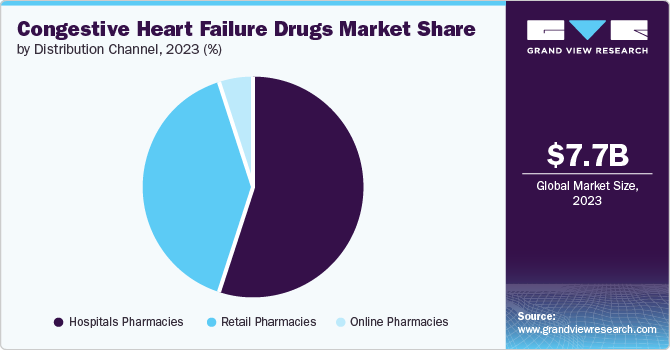

Hospital pharmacies dominated the market with 55.6% share in 2023. These pharmacies are equipped to handle complex drug regimens often required for CHF patients, ensuring timely medication access. The increasing number of CHF patients requiring hospitalization for acute exacerbations or elective procedures drives demand for these drugs through hospital pharmacies.

Retail pharmacies are projected to grow at a CAGR of 15.3% over the forecast period. As CHF management increasingly shifts towards outpatient settings, the accessibility and convenience offered by retail pharmacies have become crucial.

Regional Insights

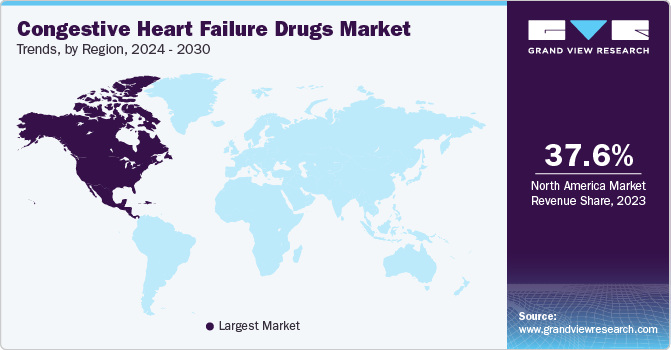

North America congestive heart failure drugs market held the largest share of 37.6% in 2023. This is owing to the rise in patient awareness, high disease burden, and increased healthcare expenditure.

U.S. Congestive Heart Failure Drugs Market Trends

The U.S. congestive heart failure drugs market dominated the North America market in 2023 due to large geriatric population, sedentary lifestyle, and increasing obesity rates. The presence of key pharmaceutical players, coupled with extensive healthcare coverage, fosters a favorable environment for drug development and market expansion. According to National Institutes of Health, the number of Americans living with heart failure is currently 6.7 million and is projected to increase by nearly a third to 8.5 million by 2030.

Europe Congestive Heart Failure Drugs Market Trends

Europe congestive heart failure drugs market was identified as a lucrative region in 2023. As an aging population increases, the risk of heart diseases increases. Furthermore, the region's robust healthcare infrastructure, coupled with advancements in diagnostic technologies, enables early disease detection and improved patient management, driving demand for CHF drugs. The UK congestive heart failure drugs market is expected to grow rapidly in the coming years. According to British Heart Foundation, the number of people living with heart and circulatory diseases in the UK is currently 7.6 million.

Asia Pacific Congestive Heart Failure Drugs Market Trends

Asia Pacific market is anticipated to witness fastest growth in the global congestive heart failure drugs market. The region's burgeoning population, coupled with increasing life expectancy, is leading to a rise in the elderly population susceptible to CHF.

The congestive heart failure drugs market in India held a substantial market share due to country's large population, rising disposable incomes, and increasing healthcare expenditure. In July 2023, AstraZeneca Pharma India received approval from the Indian drug regulator to import dapagliflozin tablets for treating heart failure. This move could benefit a large number of heart failure patients in India.

Key Congestive Heart Failure Drugs Company Insights

Some of the key companies in the Congestive Heart Failure (CHF) drugs market include Bayer AG, Novartis AG, Merck & Co., Inc., AstraZeneca, Bristol-Myers Squibb Company, Pfizer, Inc., Johnson & Johnson Services, Inc. and others. Key players are trying to acquire a greater share through collaborations, partnerships, regional expansions, and other strategic initiatives.

-

Bayer AG is a German multinational corporation that operates in the fields of pharmaceuticals, consumer health products, and biotechnology. In the congestive heart failure drugs market, Bayer AG has established itself as a significant player by offering innovative therapies aimed at improving patient outcomes.

Key Congestive Heart Failure Drugs Companies:

The following are the leading companies in the congestive heart failure drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Novartis AG

- Merck & Co., Inc.

- AstraZeneca

- Bristol-Myers Squibb Company

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- Pfizer, Inc.

- Johnson & Johnson Services, Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Eli Lilly and Company

- Novo Nordisk A/S

View a comprehensive list of companies in the congestive heart failure drugs Market

Recent Developments

-

In May 2024, Novartis AG launched Entresto Granular Tablets, a new formulation of its heart failure drug specifically designed for pediatric patients. This is the first ARNI treatment option for children with chronic heart failure. The drug has been approved for use in children with chronic heart failure, a condition often caused by congenital heart disease or cardiomyopathy.

-

In March 2024, Novo Nordisk A/S entered into an agreement to acquire Cardior Pharmaceuticals, a company specializing in RNA-based therapies for heart disease. This acquisition is expected to strengthen Novo Nordisk's position in the cardiovascular disease market.

-

In March 2024, Bayer AG acquired the exclusive rights to market acoramidis in Europe. It is a potent & selective small molecule, orally administered TTR stabilizer for treating patients who are suffering from ATTR CM.

Congestive Heart Failure Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.74 billion

Revenue forecast in 2030

USD 19.85 billion

Growth rate

CAGR of 14.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug, product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Norway, Sweden, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

Bayer AG; Novartis AG; Merck & Co., Inc.; AstraZeneca; Bristol-Myers Squibb Company; Amgen Inc.; Boehringer Ingelheim International GmbH; Pfizer, Inc.; Johnson & Johnson Services, Inc.; Otsuka Pharmaceutical Co., Ltd.; Eli Lilly and Company; Novo Nordisk A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

Global Congestive Heart Failure Drugs Market Report Segmentation

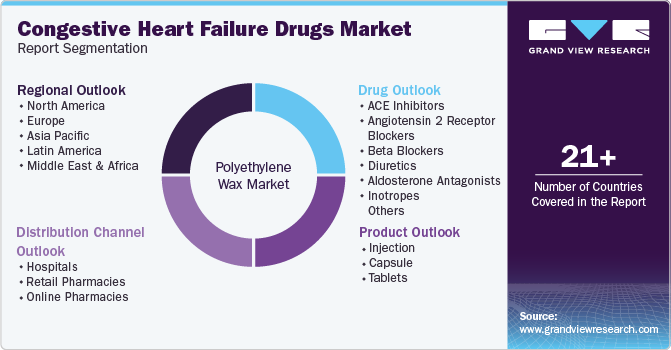

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Congestive Heart Failure (CHF) drugs market report based on drug, product, distribution channel, and region:

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

ACE Inhibitors

-

Angiotensin 2 Receptor Blockers

-

Beta Blockers

-

Diuretics

-

Aldosterone antagonists

-

Inotropes

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Injection

-

Capsule

-

Tablets

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."