Confidential Computing Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (Data Security, Security Enclaves), By Deployment (On premise, Cloud), By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-344-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Confidential Computing Market Size & Trends

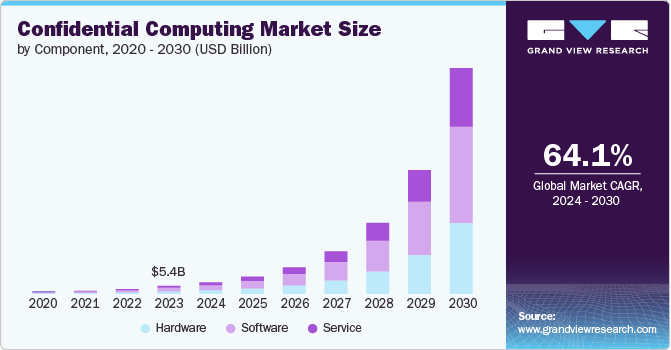

The global confidential computing market size was estimated at USD 5,463.0 million in 2023 and is projected to grow at a CAGR of 64.1% from 2024 to 2030. The increasing sophistication of cyberattacks highlights the need for enhanced protection of data in use, which traditional encryption methods often fail to provide. Confidential computing mitigates risks by ensuring data remains encrypted even during processing, safeguarding it from potential breaches. This approach addresses vulnerabilities posed by insider threats and advanced persistent threats that can compromise sensitive data. The rising frequency and complexity of cyber threats are driving organizations to adopt confidential computing as a critical component of their cybersecurity strategies.

Increasing emphasis on digital sovereignty is driving the need for confidential computing to ensure data control and compliance with local regulations. Nations and organizations seek to maintain sovereignty over their data by protecting it during processing, even when utilizing global cloud services. Confidential computing helps achieve this by providing secure environments that comply with jurisdictional data protection requirements. This trend is particularly significant for sectors handling sensitive or classified information, where control over data processes is critical.

Technological advancements, such as improved Trusted Execution Environments (TEEs) and sophisticated encryption methods, are enhancing the effectiveness of confidential computing. Innovations in both hardware and software are reducing performance overheads, making confidential computing more practical and efficient. These developments are lowering barriers to adoption and enabling broader implementation across various sectors. As technology evolves, confidential computing solutions are becoming more integrated and user-friendly.

Component Insights

The software segment led the market and accounted for 44.9% of the global revenue in 2023. The increasing demand for secure and high-performance computing in enterprise solutions drives the integration of advanced hardware like Intel's 4th Gen Xeon Scalable processors into software platforms. As businesses handle more complex and data-intensive applications, they require robust computing capabilities that enhance both performance and security to remain competitive.

For instance, In May 2023, Intel collaborated with SAP, a leading enterprise software provider. This collaboration focuses on equipping SAP clients with Intel's 4th Gen Xeon Scalable processors, aimed at enhancing the speed, security, and integration of their business operations. The initiative leverages Intel’s cutting-edge technology to boost the efficiency and security of SAP's software solutions, thereby optimizing business processes for clients. This partnership exemplifies how hardware innovations can be integrated into enterprise software to deliver more robust and secure processing capabilities.

The growing need for secure data processing is fueling the rise of CONFIDENTIAL COMPUTING as a Service (CCaaS) solutions. Cloud providers are embedding confidential computing capabilities into their offerings, enabling businesses to leverage secure data processing without the burden of managing the underlying infrastructure. This shift makes confidential computing more accessible to a wider range of organizations by delivering it as a managed service. Therefore, businesses can concentrate on their core competencies while entrusting reputable providers to handle their confidential computing requirements.

Application Insights

The data security segment holds the highest market share of the global revenue in 2023. The increasing integration of artificial intelligence (AI) into cybersecurity operations is revolutionizing how organizations detect and respond to threats. AI enhances Security Operations Centers (SOCs) by providing advanced threat detection, automated incident response, and continuous monitoring, addressing the growing complexity and volume of cyber threats. This trend enables more efficient and effective security measures, improving organizations' overall security posture and response capabilities.

For instance, In June 2024, Thales partnered with Google Cloud to develop a next-generation global SOC platform. This innovative platform empowers Thale’s clients with advanced capabilities for detecting and responding to cyber threats. By leveraging Thales' expertise in cyber threat detection and response alongside Google Cloud's industry-leading AI-powered SecOps solutions, this collaboration delivers a comprehensive security solution for organizations of all sizes.

There is a growing emphasis on auditable and verifiable data operations within confidential computing solutions to achieve pellucidity between users. Organizations require mechanisms to track and audit how data is processed, accessed, and utilized across different user interactions. Solutions that provide transparent logging, auditing trails, and verifiable computations are becoming essential for maintaining trust and accountability in collaborative data environments.

This trend supports the increasing demand for technologies that ensure clear visibility and traceability of data operations while preserving confidentiality. Key aspects include the need for transparent logging and auditing, techniques like zero-knowledge proofs enabling verifiable computations, and the importance of aligning with data governance policies to foster trusted data collaboration by providing assurance that sensitive data usage can be monitored and verified.

Deployment Insights

The on premise segment has the highest revenue share in 2023. The rise of hybrid IT environments, where companies mix on-premises data centers with cloud services, is driving a surge in confidential computing adoption. This is because organizations need their security measures to seamlessly work across both environments. Confidential computing offers a solution by letting businesses leverage the cloud's flexibility while keeping sensitive data processing in-house. This approach addresses concerns about data location regulations, vendor lock-in, and compliance, giving companies more control over their information in a hybrid world.

Confidential computing is increasingly merging with cloud-native architectures, strengthening security in modern app development and deployment. This integration embeds data protection features into platforms such as Kubernetes and serverless environments, enhancing security across distributed cloud ecosystems. The result is a more agile development process and scalable secure data processing. Organizations gain improved security controls that extend to microservices and containerized apps, ensuring robust protection of sensitive data during use. This trend highlights the critical need to incorporate security-by-design principles in cloud-native architectures, driving innovation while maintaining strong security measures.

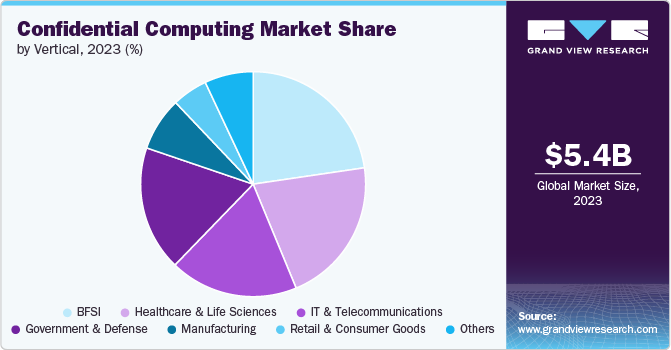

Vertical Insights

The BFSI segment holds the highest market share of the global revenue in 2023. BFSI firms are increasingly embracing hybrid cloud models to strike a balance between agility and robust security. By integrating confidential computing solutions with hybrid environments, these institutions can harness scalable resources while safeguarding sensitive data across their distributed IT landscape. This approach supports regulatory compliance, bolsters disaster recovery strategies, and enhances operational resilience, ensuring uninterrupted financial services without compromising data integrity.

The fusion of on-premises infrastructure with cloud-based confidential computing enables BFSI organizations to optimize resource allocation and scale effectively, meeting evolving customer needs and adapting to market shifts. This strategic integration empowers financial institutions to leverage cutting-edge technology while maintaining the highest standards of data protection and operational efficiency.

Government and defense agencies are leveraging confidential computing to bolster the security of mission-critical systems and connected devices used in intelligence gathering and operations. This integration safeguards data processing and communication across diverse environments like battlefield networks, surveillance systems, and drones. By employing confidential computing, these agencies can enhance situational awareness, streamline operations, and make better decisions while keeping sensitive information shielded from cyberattacks and unauthorized access.

Regional Insights

North America confidential computing marketdominated the market and accounted for a 37.39% share in 2023. The market is expected to continue its strong growth in North America, maintaining the region's global leadership position. This prominence is driven by a robust ecosystem of major technology companies and cloud service providers, serving a dense population of businesses seeking advanced secure data processing technologies. The region's sophisticated IT landscape and emphasis on digital transformation reinforce its market dominance. Moreover, the implementation of strict data protection laws serves as a key driver for the widespread adoption of confidential computing technologies across various industries in North America.

U.S. Confidential Computing Market Trends

The confidential computing market of the U.S. is witnessing a robust upward trend fueled by heightened awareness of data privacy risks and stringent regulatory requirements. Companies are increasingly adopting confidential computing technologies to ensure the protection of sensitive data throughout its lifecycle, from processing to storage. This trend is driving innovation in secure computing solutions and fostering collaborations between tech giants and cybersecurity firms to meet the growing demand for robust data protection measures.

Europe Confidential Computing Market Trends

Europe confidential computing market is expected to witness a significant rise during the forecast period.Rising cyber threats are prompting European organizations to invest in advanced data protection technologies. Confidential computing offers a new layer of security by protecting data in use, and addressing a critical vulnerability in the data lifecycle. This technology is increasingly seen as a vital component of comprehensive cybersecurity strategies for European businesses.

Asia Pacific Confidential Computing Market Trends

The confidential computing market of Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The data security segment holds the largest market share in the Asia Pacific region, as confidential computing can isolate sensitive data in protected CPU enclaves during processing. This enables organizations in the Asia Pacific to leverage the benefits of cloud computing, such as scalability and cost-effectiveness, while maintaining robust data protection and addressing concerns around data residency, vendor lock-in, and regulatory compliance.

Key Confidential Computing Company Insights

The market is characterized by intense competition and a significant concentration of market share among leading players such as Amazon Web Services, Google, and Microsoft as of 2023. These companies focus on expanding their customer bases to maintain a competitive advantage, employing strategic initiatives such as partnerships, mergers, acquisitions, collaborations, and the development of new products and technologies. For instance, in May 2022, Google Cloud partnered with AMD, an American semiconductor company, aiming to enhance its confidential computing offerings by utilizing 3rd Gen AMD EPYC processors. This partnership ensures that memory encryption for virtual machines does not compromise workload performance.

Key Confidential Computing Companies:

The following are the leading companies in the confidential computing market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc

- Alibaba Cloud

- Amazon Web Services, Inc.

- Arm Limited

- Fortanix

- IBM

- Intel Corporation

- Microsoft

- Swisscom

Recent Developments

-

In May 2023, Microsoft partnered with Habu, a data clean room software provider, to integrate Habu's Data Clean Room applications with Azure confidential computing. This partnership aims to enable organizations to achieve a more secure environment for processing sensitive data. By leveraging Azure confidential computing, the integrated solution will allow organizations to unlock insights from sensitive data without compromising privacy, performance, or security. The partnership highlights the growing demand for confidential computing technologies that enable secure data collaboration and insights while maintaining robust data protection.

-

In January 2023, Intel unveiled its Trust Domain Extension (TDX) solution, which is designed to provide VM isolation and protect data stored within virtual machines. The TDX technology creates a trusted execution environment (TEE) that isolates the VM's data and operations from the underlying hardware, including the hypervisor and other privileged software. This allows organizations to run sensitive workloads on shared infrastructure, such as public clouds while maintaining control and visibility over their data. The introduction of Intel TDX highlights the growing importance of confidential computing solutions that enable the secure processing of sensitive data in virtualized and cloud-based environments.

-

In February 2022, IBM acquired Neudesic, LLC, a leading U.S. cloud consultancy. This strategic acquisition expands IBM's portfolio of hybrid multi-cloud services, bolstering its capabilities to support clients on their digital transformation journeys. Neudesic's expertise in cloud advisory, application modernization, and data and AI services strengthens IBM's offerings, allowing them to provide more comprehensive solutions. With a focus on hybrid cloud and AI as key growth drivers, IBM is better equipped to help clients navigate the complexities of multi-cloud environments and unlock the full potential of their data and AI initiatives.

Confidential Computing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7,868.8 million |

|

Revenue forecast in 2030 |

USD 153,843.1 million |

|

Growth rate |

CAGR of 64.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, applications, deployment, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Advanced Micro Devices, Inc; Alibaba Cloud; Amazon Web Services, Inc.; Arm Limited; Fortanix; Google; IBM; Intel Corporation; Microsoft; Swisscom |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Confidential Computing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global confidential computing market report based on component, application, deployment, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Security

-

Secure Enclaves

-

Pellucidity Between Users

-

Other Applications

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On premise

-

Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government & Defense

-

Healthcare & Life Sciences

-

IT & Telecommunications

-

Manufacturing

-

Retail & Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global confidential computing market size was estimated at USD 5,463.0 million in 2023 and is expected to reach USD 7,868.8 million in 2024.

b. The global confidential computing market is expected to grow at a compound annual growth rate of 64.1% from 2024 to 2030, reaching USD 153,843.1 million by 2030.

b. North America dominated the confidential computing market with a share of 37.4% in 2023. The Confidential Computing market is expected to continue its strong growth in North America, maintaining the region's global leadership position. This prominence is driven by a robust ecosystem of major technology companies and cloud service providers, serving a dense population of businesses seeking advanced secure data processing technologies.

b. Some key players operating in the confidential computing market include Advanced Micro Devices, Inc., Alibaba Cloud, Amazon Web Services, Inc., Arm Limited, Fortanix, Google, IBM, Intel Corporation, Microsoft, and Swisscom.

b. Key factors that are driving the market growth include Growth of Cloud Adoption, Rising Need for Secure Data Processing, and Stringent Data Protection Regulations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."