- Home

- »

- Medical Devices

- »

-

Condom Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Condom Market Size, Share & Trends Report]()

Condom Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type (Latex, Non-latex), By Product (Male Condom, Female Condom), By Distribution Channel (Public Health Distribution, E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-272-3

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Condom Market Summary

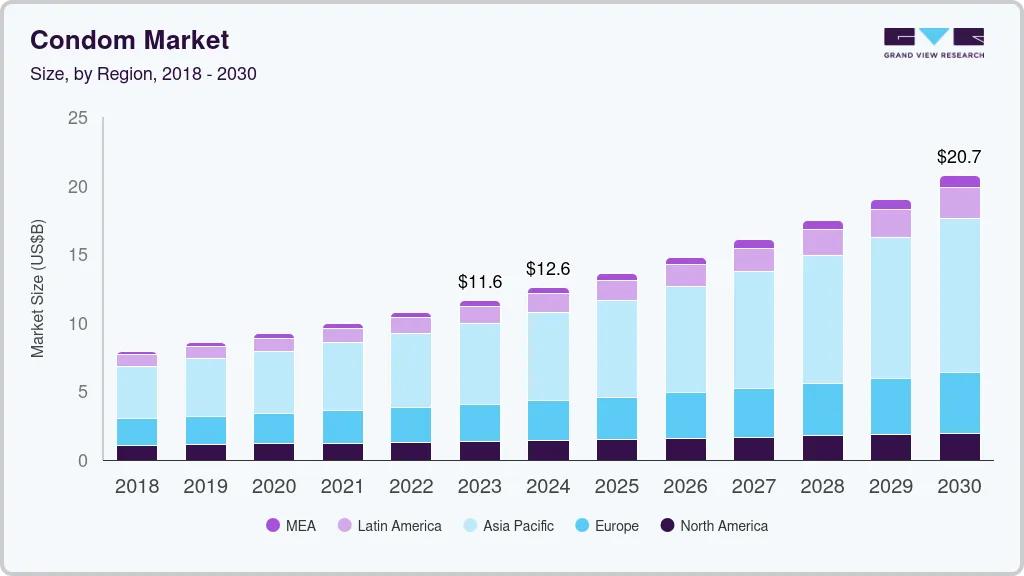

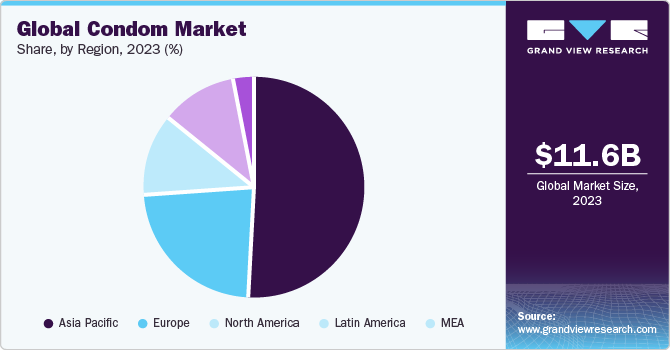

The global condom market size was estimated at USD 11.59 billion in 2023 and is projected to reach USD 20.73 billion by 2030, growing at a CAGR of 8.72% from 2024 to 2030. The increase in awareness regarding the use of condoms, measures to reduce the spread of HIV & other Sexually Transmitted Infections (STIs), and the availability of different types of products to suit consumer needs are likely to drive market growth during the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the global condom market with a share of 50.91% in 2023.

- Based on material type, the latex condom segment held the largest market share of 88.41% in 2023.

- Based on product, male condom segment dominated the market with a revenue share of 98.74% in 2023.

- Based on distribution channel, the public health distribution segment dominated the market with the largest revenue share of 41.18% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.59 Billion

- 2030 Projected Market Size: USD 20.73 Billion

- CAGR (2024-2030): 8.72%

- Asia Pacific: Largest market in 2023

According to the World Health Organization (WHO) in 2023, approximately 374 million new cases of syphilis, gonorrhea, chlamydia, and trichomoniasis were reported annually. In the same year, WHO reported that 39.0 million people were living with HIV globally, with two-thirds of them residing in the African countries. This can lead to serious complications beyond the immediate effect of the infection itself. If left untreated, STDs can lead to complications such as impotence and infertility. According to a study published on Factors associated with adverse pregnancy outcomes of maternal syphilis in Henan, China, 2016-2022, in 2016, around 1 million pregnant women were detected with active syphilis, which resulted in 200,000 stillbirths and 350,000 adverse birth outcomes. This is expected to boost demand for the use of condoms during the forecast period.

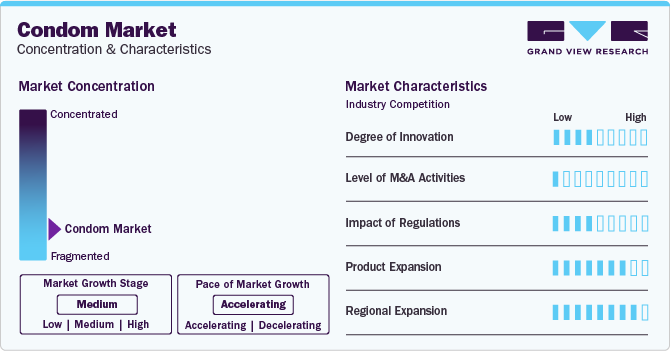

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of M&A activities, impact of regulations, and geographic expansion. For instance, the condom market is highly competitive with the presence of well-established global brands, such as Durex and Trojan. The degree of innovation is medium, and the level of M&A activities is low. The impact of regulations is medium, and the geographic expansion of the market is high. However, product expansion is high as many local companies in various countries are trying to gain market share with the launch of innovative products, packaging, and promotion to cater to the demands of local customers.

The continuous innovation and improvements in product materials and designs have led to enhanced product quality, comfort, and effectiveness. The market is expected to see new opportunities arising from the integration of technological advancements, including the introduction of smart condoms, as well as the development of eco-friendly and sustainable condom options.

Several companies in the market are currently involved in merger and acquisition activities. These companies want to expand their reach and explore new territories through M&A deals. For instance, in December 2022, Linden Capital Partners acquired LifeStyles Healthcare, a global sexual health and wellness platform, from a consortium of investors, including Humanwell Healthcare and Trustar Capital. It is a significant acquisition for Linden, a Chicago-based private equity firm focusing exclusively on the healthcare industry.

Condoms are highly regulated in the U.S. and are classified as Class II medical devices by the U.S. FDA. These Class II medical devices have to comply with specific performance and labeling standards. As per the FDA standards, 996 out of 1,000 condoms should pass the water leak test to receive FDA approval, which accounts for at least a 99.6% efficacy rate in laboratory tests. Latex condom manufacturing and testing are governed by FDA regulations with stringent standards.

Companies are focusing on developing novel product designs to attract consumers, such as condoms with innovative flavors, textures, and lubricants. For example, flavored products designed for oral sex aim to enhance the user experience and increase demand.

The condom industry is growing globally due to its potential to improve accessibility, cost-effectiveness, and outcomes. This growth is fueled by established industry leaders expanding into emerging marketplace and indigenous startups experiencing growth. Companies are expanding by launching facilities or plants in new geographies merging with or acquiring companies based in different locations. For example, in May 2023, Church & Dwight Co. Inc. expanded its operations at the Trojan Condom Plant in southeastern Chesterfield.

Material Type Insights

The latex condom segment held the largest market share of 88.41% in 2023. This can be attributed to its effectiveness, durability, and flexibility. In addition, these condoms, made from high-quality latex rubber, offer effective protection against unwanted pregnancies, which is expected to drive their demand. Furthermore, manufacturers are focusing on researching & developing new products to meet the growing demand for high-quality latex condoms. The launch of new products and rising demand are expected to boost the growth of latex condoms over the forecast period.

The non-latex segment is expected to witness lucrative growth during the forecast period. This can be attributed to various advantages, such as its thinness, lack of odor, and its nonallergenic nature over latex. The demand for non-latex condoms surged due to the growing need for latex alternatives and the increasing number of allergy cases reported for latex condoms. Latex contains proteins that result in allergic symptoms, such as swelling, itchiness, sneezing, and breathlessness. According to the Allergy & Asthma article, around 1% to 6% of the global population has a latex allergy.

Furthermore, the market benefits from favorable government initiatives supporting the use of non-latex condoms, such as polyurethane and polyisoprene.Several new polyurethane & polyisoprene condoms have recently been launched, catering to diverse consumer needs and preferences. For instance, in March 2023, Durex launched RealFeel condoms, a notable addition to the market made with polyisoprene to provide a skin-on-skin experience, enhancing comfort and sensitivity.

Some of the top brands that provide non-latex condoms include:

-

SKYN Elite non-latex condoms, recommended for their quality and effectiveness.

-

Trojan Supra BareSkin non-latex condoms, known for their reliability and performance.

-

Durex Real Feel Avanti Bare Polyisoprene non-latex condoms, offering a latex-free option for protection.

-

Okamoto Zero One 001, one of the popular choice for non-latex condoms.

-

Sagami Original 0.01, known for its ultra-thin design and reliability.

Product Insights

The male condom segment dominated the market with a revenue share of 98.74% in 2023. The growth can be attributed to factors such as manufacturers' focus on the production of male condoms, open-mindedness regarding their use as compared to female condoms, and diverse portfolios. Underdeveloped countries in Africa have a high unmet demand for male condoms due to the increasing prevalence of HIV/AIDS. These are mostly the preferred option among couples, resulting in higher demand.

Moreover, male condoms have a variety of options in terms of materials, thickness, designs, and colors, which promotes their use. They are commonly used methods of contraception. According to the U.S. Census data and Simmons National Consumer Survey data, around 33.44 million Americans used condoms in 2020. This is anticipated to drive the segment growth during the forecast period.

The female condom segment is estimated to witness the fastest CAGR during the forecast period. These are being increasingly accepted for reducing the risk of STIs and unplanned pregnancies. Despite female condoms being a lifesaving product and easy availability, their distribution & use are quite low as most of the family planning and HIV prevention programs have not embraced female condoms. However, female condoms are gaining immense popularity of late, especially among single women.

Top Brands For Female Condoms

Brand

Description

FC2 Condom

An internal condom manufactured by Veru Inc. developed from Nitrile Butadiene Rubber (NBR).

Trojan Supra Non-Latex Bareskin Condoms

Trojan Supra is recognized as a top brand for female condoms, offering non-latex options for reliable protection.

Ormelle, VA W.O.W, Pasante:

These brands offer female condoms that are designed from a woman’s perspective, providing hormone-free protection.

Original Condoms, Bareskin Premium Latex Condoms

These brands are highlighted as top picks for female condoms, offering comfortable and worry-free protection.

TROJAN ENZ Classic Reservoir End

Trojan is known for its classic reservoir end condoms, which are recommended as the best overall condom choice.

SKYN Elite

SKYN is recognized for its non-latex condoms like SKYN Elite, offering an alternative for those with latex allergies

LifeStyles Skyn

LifeStyles Skyn is considered as the best average-fit condom, providing a comfortable and reliable option for women

Okamoto 004

Okamoto’s 004 condoms are recommended for their quality and fit, making them a top choice for female condom users.

Distribution Channel Insights

The public health distribution segment dominated the market with the largest revenue share of 41.18% in 2023. Condom distribution plays a crucial role in public health, particularly in preventing HIV, STIs, and unplanned pregnancies. Organizations such as CDC and WHO emphasize the effectiveness of condom distribution programs as a cost-effective structural intervention. Research studies have shown that free condom distribution leads to increased condom use at public sex venues and decreases the risk for HIV & other STIs.

Moreover, in African countries, condoms are distributed free of cost by the public sector. Government allocated budgets and funding from global healthcare bodies such as UNFPA help increase access to condoms in rural & high-risk areas. Each country has a special brand under which free condoms are distributed. For instance, the Kenyan government distributes condoms of Sure brand under its HIV prevention and control initiatives.

The e-commerce segment is expected to exhibit the fastest CAGR during the forecast period. The boom of online sales channels in developed as well as developed countries is expected to increase access to and distribution of contraceptives. With the penetration of the internet and smartphones, the e-commerce sector has witnessed prominent growth in various marketplaces. Key players in the sexual wellness industry are also increasing their presence on online retail channels. In African countries, the market is divided into different segments based on distribution channels. These segments include the public sector, social marketing, and commercial sector.

Regional Insights

North America held a significant share of the market in 2023, as the adoption of condoms is expected to grow, especially among women who use the product less than men, and awareness regarding sexual wellness is anticipated to contribute to the cause.

U.S. Condom Market Trends

The U.S. Condom Market held the largest share in 2023.The relaxation of COVID-19 restrictions has led to an increase in the demand for contraceptives and can be linked to an increase in social interaction & vaccination drive. The increasing number of STDs and a high number of unintended pregnancies in the country provide condom manufacturers with growth opportunities.

Asia Pacific Condom Market Trends

Asia Pacific dominated the global condom market with a share of 50.91% in 2023 and is expected to register the fastest growth over the forecast period. Growth can be attributed to the large adult population, the presence of manufacturers involved in the export of condoms, and increasing awareness about sexual wellness products.

China condom market held the largest share in 2023, owing to the demand for the use of contraceptives in the country is rising with ease in lockdowns. Durex reported significant revenue growth in the country after the launch of PU ultra-thin condoms.

Condom market in India is expected to witness growth in the near future. India has growth potential, as 50% of its population is below 24 years of age and 65% is below 35 years. Moreover, there is a significant prevalence of HIV infection & other STDs, unsafe abortions, unplanned pregnancies, and a rise in the prevalence of STIs. There is an increase in awareness regarding the use of contraceptives.

Europe Condom Market Trends

The rising prevalence of HIV/AIDS & STD, the growing presence of the LGBTQ community, the increasing use of contraceptive measures against unplanned pregnancies, and rising awareness among the young population about sexual health have increased the adoption of condoms in European countries.

Germany condom market held the largest share in 2023, owing to the social tendency of several sexual partners in European nations and the higher rate of contraceptive product usage in the country.

Condom market in Norway is expected to witness the fastest CAGR over the forecast period. The growth can also be influenced by factors like government initiatives promoting sexual health, educational campaigns, and the normalization of discussions around sexual health and contraception.

Latin America Condom Market Trends

The countries in Latin America have committed to condom programming, an initiative that ensures easy access to condoms and their consistent use by sexually active individuals. The Vive condom brand has been a market leader since 1996 in Latin America, with a core focus on marketing, distribution, and building demand for condoms. Vive's approach involves using creative messaging that resonates with youthful consumers, emphasizing the fun and enjoyment of safe sex. This strategy has led to a 9% growth in volume from 2021 to 2022, resulting in Vive holding 62% of the overall condom industry in Latin America.

MEA Condom Market Trends

The MEA condom market is expected to showcase the fastest growth rate during the forecast period. The MEA is largely impacted by a lack of awareness regarding HIV transmission through unprotected sex, and limited distribution in the majority of the African countries in this region. Furthermore, MEA region is largely impacted by limited distribution in most of the countries in this region.

Nigeria condom market is anticipated to witness high growth over the forecast period, owing to the rise of online sales channels which is expected to increase access and distribution of condoms in Nigeria, aligning with the global trend of increased e-commerce penetration.

Key Condom Company Insights

The market is highly competitive, with the presence of multiple major players. The market is witnessing the presence of numerous country-level players, alongside the introduction of smaller competitors poised to gain a substantial market share. This trend is reflective of the competitive landscape in the industry. Some emerging players in the market are, Jems and Slipp in Canada, Bleu in India, Get Down and Jonny in Australia, and Hanx in the UK.

Key Condom Companies:

The following are the leading companies in the condom market. These companies collectively hold the largest market share and dictate industry trends.

- FUJILATEX CO.,LTD

- Reckitt Benckiser Group PLC

- Church & Dwight Co., Inc.

- Karex Berhad

- LELO iAB

- Lifestyles

- Veru Inc.

- Okamoto Industries, Inc

- MAYER LABORATORIES, INC.

- Cupid Limited

- RITEX GMBH

- Pasante Healthcare Ltd.

- CPR GmbH

- Mankind Pharma

- Sagami Rubber Industries Co., Ltd.

- rrtMedcon

Recent Developments

-

In April 2023, Veru Inc. has entered into a Purchasing Agreement with Afaxys Group Services, LLC (AGS) to offer Veru’s FC2 Female Condom (internal condom) through the AGS Group Purchasing Organization (GPO). This agreement will benefit up to 31 million women and men who depend on community & public health centers for essential healthcare.

-

In May 2021, SKYN, the leading sexual wellness brand and maker of the nonlatex condom, has launched SKYN Excitation, a new condom with a unique wave design featuring raised dots on the most sensitive areas. This new product is set to enhance the sexual experience for those who use it.

Condom Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.56 billion

Revenue forecast in 2030

USD 20.73 billion

Growth rate

CAGR of 8.72% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in ‘000, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Nigeria; Saudi Arabia; UAE; Kenya; Zambia; Zimbabwe; Uganda; Egypt; Turkey; Ghana

Key companies profiled

FUJI LATEX CO., LTD.; Reckitt Benckiser Group PLC; Church & Dwight Co., Inc.; Karex Berhad; LELO iAB; Lifestyles; Veru Inc.; Okamoto Industries, Inc.; MAYER LABORATORIES, INC.; Cupid Limited; RITEX GMBH; Pasante Healthcare Ltd.; CPR GmbH; Mankind Pharma; Sagami Rubber Industries Co., Ltd.; and rrtMedcon.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Condom Market Segmentation

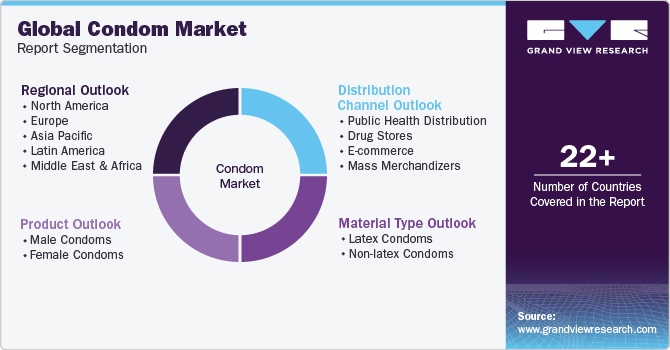

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global condom market report based on material type, product, distribution channel, and region:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Latex Condoms

-

Non-latex Condoms

-

Polyurethane and Polyisoprene

-

Lambskin

-

Nitrile Butadiene Rubber (NBR)

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Male Condoms

-

Female Condoms

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Health Distribution

-

Drug Stores

-

E-commerce

-

Mass Merchandizers

-

-

Regional Outlook (Volume in ‘000; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Nigeria

-

Kenya

-

Zambia

-

Zimbabwe

-

Uganda

-

Egypt

-

Turkey

-

Ghana

-

-

Frequently Asked Questions About This Report

b. The global condom market size was estimated at USD 11.59 billion in 2023 and is expected to reach USD 12.56 billion in 2024.

b. The global condom market is expected to grow at a compound annual growth rate of 8.72% from 2024 to 2030 to reach USD 20.73 billion by 2030.

b. The latex condoms dominated the condom market with share of 88.41% of in 2023. This is attributed to its effectiveness, durability, and flexibility of latex condoms.

b. Some key players operating in the speech therapy servics market include FUJI LATEX CO., LTD.; Reckitt Benckiser Group PLC; Church & Dwight Co., Inc.; Karex Berhad; LELO iAB; Lifestyles; Veru Inc.; Okamoto Industries, Inc.; MAYER LABORATORIES, INC.; Cupid Limited; RITEX GMBH; Pasante Healthcare Ltd.; CPR GmbH.

b. Key factors that are driving the condom market growth include rising awareness among adolescents about Sexually Transmitted Diseases (STDs) and HIV, easy availability, and increased access to drug stores.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.