- Home

- »

- Plastics, Polymers & Resins

- »

-

Concrete Bonding Agents Market Size & Share Report, 2030GVR Report cover

![Concrete Bonding Agents Market Size, Share & Trends Report]()

Concrete Bonding Agents Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cementitious Latex-based, Epoxy-based), By Application (Repairing, Decorative), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-376-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Concrete Bonding Agents Market Trends

“2030 Concrete Bonding Agents Market value to reach USD 8,418.93 million”

The global concrete bonding agents market size was estimated at USD 4.81 billion in 2023 and is projected to grow at a CAGR of 8.4% from 2024 to 2030. This growth is attributed to the increasing construction projects along with restoration and redevelopment projects has led to a rise in demand for concrete bonding agents.

The product market is used to bond new concrete or plaster with existing concrete. It should be applied to the old concrete to ensure that the new concrete adheres successfully. This is necessary because the cement in a concrete mix does not have natural bonding agents. Therefore, when a fresh batch is added to an old, cured layer, the two will form separate layers unless a product market is applied. This material is primarily used for flooring, repair, decorative applications, and other purposes.

Drivers, Opportunities & Restraints

The demand for repairing existing buildings is increasing as they are often used for repair and restoration. Instead of demolishing old buildings and constructing new ones, many national governments are now investing in repairing and restoring existing structures. The growing compatibility of the product market with Portland and other hydraulic cement is expected to expand the global market.

One of the main issues faced in the market for products market is ensuring compatibility with a wide range of concrete surfaces and conditions. Achieving firm and durable bonds can be challenging when dealing with different concrete compositions, surface conditions, and temperatures. Manufacturers must invest in research and development to create versatile bonding agents that effectively adhere to various substrates. This is necessary to address the diverse needs of construction projects and environmental conditions.

High investments in research and development and the increasing research and development activities further extend profitable opportunities to the market players during the forecast period. In addition, the high investment made by the government in repair and maintenance will further expand the future growth of the market.

Product Insights

“Cementitious Latex-based emerged as the fastest growing product with a CAGR of 8.5% from 2024 to 2030”

Cementitious Latex-based dominated the market and accounted for a revenue share of 67.11% in 2023. This growth is attributed to the wide utilization of cementitious latex based products in various construction projects due to its compatibility with different surfaces and ability to provide a strong bond between new and existing concrete.

The epoxy-based segment is expected to grow at a significant CAGR from 2024 to 2030 due to its exceptional bonding strength, chemical resistance, and ability to withstand extreme conditions. Industries such as automotive, infrastructure, and manufacturing favor epoxy-based bonding agents for superior performance in demanding environments.

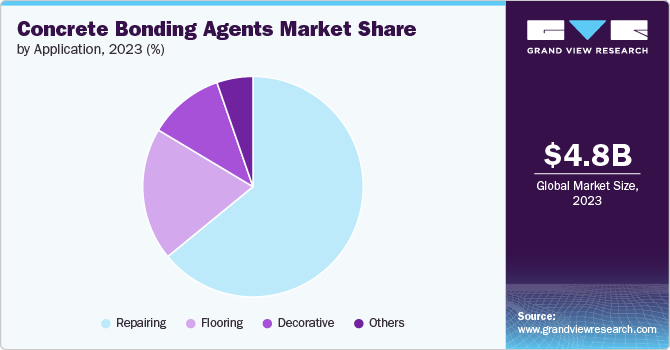

Application Insights

“Flooring emerged as the fastest growing application with a CAGR of 8.8% over the forecast period”

Repairing dominated the market with a market and accounted for a revenue share of 64.02% in 2023.This growth is attributed to increased demand for maintaining and rehabilitating existing structures. Concrete bonding agents are essential for repairing and strengthening deteriorated concrete, thus contributing to infrastructure longevity.

Flooring is expected to witness fastest CAGR from 2024 to 2030. This growth is attributed to increasing demand for high-performance flooring solutions in residential and commercial spaces. They are extensively employed to repair cracks, link distinct concrete sections, and facilitate the application of new concrete over old surfaces. This results in a seamless, strong bond that significantly enhances the floor's resistance to wear and tear, aligning with the demands for higher durability and strength in non-residential environments.

End-use Insights

“Residential emerged as the fastest growing end use with a CAGR of 8.8%”

Non-residential dominated the market with a market and accounted for a revenue share of 57.60% in 2023. Concrete bonding agents are vital in enhancing the integrity and performance of commercial, industrial, and infrastructural projects in non-residential construction. They are extensively used to facilitate the repair of cracks, join different concrete sections, and overlay new concrete on old surfaces in environments that demand higher durability and strength. These agents ensure a robust adhesion between concrete layers, contributing significantly to long-term stability and resilience of non-residential structures.

Concrete bonding agents are critical in residential construction to ensure strong adhesion between new and existing concrete surfaces. They are used in various applications such as repairing cracks, joining sections, or overlaying old concrete with new. These agents improve the durability and longevity of structures by effectively linking the concrete layers, providing a seamless bond that helps prevent future structural failures.

Regional Insights

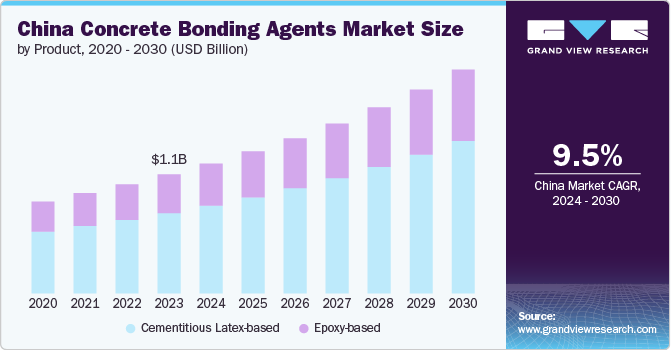

“China emerged as the fastest growing region in the Asia Pacific with a CAGR of 9.5% in 2030”

Asia Pacific concrete bonding agents dominated the global market and accounted for a 47.83% share in 2023. This growth is attributed to increasing usage of the product market for repair and restoration purposes, the necessity to repair existing buildings is growing. The rising construction activity in emerging economies such as China, India, Japan, South Korea, and Australia is expected to further drive the Asia-Pacific market.

The concrete bonding agents market in China dominated the market and accounted for a market share of 46.51% in 2023. This growth is attributed to increasing demand for the product market in the country. The rise in demand is due to the rising construction activity in the country. China’s construction industry is growing leading to a rise in demand for the product market in the region.

North America Concrete Bonding Agents Market Trends

The North America concrete bonding market is expected to grow due to growing reconstruction and restoration segment in the region. This growth will lead to a rise in demand for the product which is used in the reconstruction and restoration projects in the region.

Europe Concrete Bonding Agents Market Trends

Europe plays a significant role in the market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for construction activity in the region leading to increased demand for the product market.

Key Concrete Bonding Agents Company Insights

Some key players operating in the market include

-

BASF SE operates through six business segments, namely chemicals, materials, industrial solutions, surface technologies, nutrition & care, and agricultural solutions. The products offered by the company find application in industries such as agriculture, construction, pharmaceuticals, energy & power, home care & nutrition, automotive & transportation, rubber & plastics, leather & textiles, and personal care & hygiene. The company has a global presence.

-

Dow, Inc. specializes in material science. The company’s product portfolio includes plastics, performance materials, coatings, silicones, and industrial intermediates. It offers a wide range of products and solutions in packaging, infrastructure, mobility, and consumer care segments. Dow’s products are used in various sectors such as homes and personal care, durable goods, adhesives and sealants, coatings and food & specialty packaging.

Sika AG and Fosroc Inc. are some emerging market participants in the market.

-

Sika AG is a specialty chemical company and focuses on the development and production of products for sealing, bonding, reinforcing, damping, and protecting in the building sector and motor vehicle industry. It offers construction and industry solutions. Its construction solutions include cement additives, grouting, industrial coatings, waterproofing systems, rigid bonding, joint sealing, construction adhesives, floor systems, and roof systems. The company’s industry solutions are used in industries such as automotive, transportation, marine, building, components, textiles & consumables, appliances & equipment, renewable energy, automotive aftermarket, and advanced resins.

-

Fosroc Inc. supplies and manufactures high-performance chemicals, primarily for the construction industry. Its major product lines include concrete admixtures, surface treatments, anchors, grouts, waterproofing, industrial flooring, protective coatings, concrete repair, joint sealants, adhesives, and cement grinding aids.

Key Concrete Bonding Agents Companies:

The following are the leading companies in the concrete bonding agents market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Saint-Gobain Weber S.A.

- The Dow Chemical Company

- ChemCo Systems Inc.

- Flowcrete Group Ltd.

- Fosroc Inc.

- GCP Applied Technologies Inc.

- LafargeHolcim

- Mapei S.P.A.

- Sika AG

- The Euclid Chemical Company

- Adhesives Technology Corporation (ATC)

Recent Developments

-

In May 2023, Sika AG announced the acquisition of MBCC Group. The acquisition aims to expand Sika AG's presence in construction chemicals. With the acquisition, Sika expanded its portfolio of solutions and products for the construction industry. It added various sustainable, innovative, and digital offerings for different sectors, such as infrastructure, buildings, and underground construction, for new renovation and construction.

-

In May 2022, The Euclid Chemical Company has announced the acquisition of Chryso’s North American cement grinding aids and additives business. The aim is to enhance cement performance and reduce CO2 emissions during production. Cement plays a crucial role as an ingredient in concrete.

Concrete Bonding Agents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.19 billion

Revenue forecast in 2030

USD 8.42 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan, South Korea, Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Saint-Gobain Weber S.A.; Dow; ChemCo Systems Inc.; Flowcrete Group Ltd; Fosroc Inc.; GCP Applied Technologies Inc.; LafargeHolcim; Mapei S.P.A.; MBCC Group; The Euclid Chemical Company; and Adhesives Technology Corporation (ATC).

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Concrete Bonding Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global concrete bonding agents market report based on product, application, end-use, and region.

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Cementitious Latex-based

-

Epoxy-based

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Repairing

-

Flooring

-

Decorative

-

Others

-

-

End-use Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-Residential

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global concrete bonding agents market size was estimated at USD 4.81 billion in 2023 and is expected to reach USD 5.19 billion in 2024.

b. The global concrete bonding agents market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 8.42 billion by 2030.

b. Asia Pacific dominated the concrete bonding agents market with a share of 47.83%. This growth is attributed to increasing usage of the product market for repair and restoration purposes, the necessity to repair existing buildings is growing.

b. Some key players operating in the concrete bonding agents market include BASF SE; Saint-Gobain Weber S.A.; Dow; ChemCo Systems Inc.; Flowcrete Group Ltd; Fosroc Inc.; GCP Applied Technologies Inc.; LafargeHolcim; Mapei S.P.A.; MBCC Group; The Euclid Chemical Company; and Adhesives Technology Corporation (ATC).

b. Key factors that are driving the market growth include the increasing construction projects along with restoration and redevelopment projects has led to rise in demand for concrete bonding agents.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.