Computer Vision Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Product (Smart Camera-Based, PC-Based), By Application, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-035-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Computer Vision Market Size & Trends

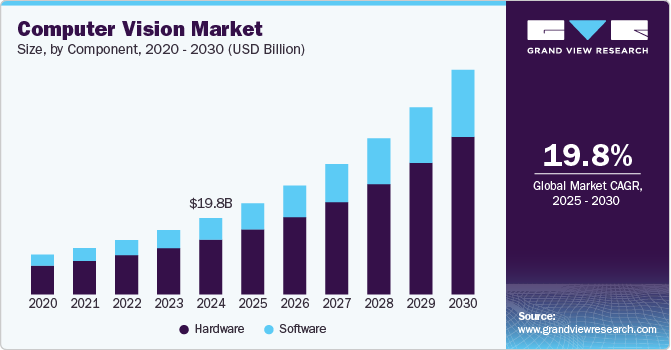

The global computer vision market size was estimated at USD 19.82 billion in 2024 and is projected to grow at a CAGR of 19.8% from 2025 to 2030. Various factors, such as increased demand for automation across industries, growth of AI and Machine Learning (ML) technologies, advancements in hardware and imaging sensors, and rising demand for autonomous vehicles, are the primary driving factors of the market growth. The use of computer vision in surveillance and security systems is growing rapidly.

These systems use vision technologies for facial recognition, behavior analysis, and anomaly detection, enhancing safety and security in public spaces, commercial properties, and critical infrastructure. The rise of Artificial Intelligence (AI), particularly ML and deep learning, has significantly improved the capabilities of computer vision systems. These technologies enhance image recognition, object detection, and pattern analysis, making computer vision applications more sophisticated and applicable to a wider range of industries. Various sectors, such as manufacturing, retail, automotive, and healthcare, are increasingly adopting computer vision technologies for tasks such as quality inspection, inventory management, and medical imaging. Automation enabled by computer vision enhances efficiency, accuracy, and cost-effectiveness in various operations.

The development of advanced imaging sensors (such as CMOS sensors), cameras, and processing units has contributed to improved image quality and processing speed. These innovations are crucial for enabling more accurate and faster computer vision applications, from facial recognition to autonomous driving. The growth of AR and VR technologies in entertainment, gaming, and retail has created new opportunities for computer vision applications. Computer vision enables AR/VR systems to interpret and respond to real-world environments in real time, making these experiences more interactive and immersive.

Component Insights

The hardware segment led the market in 2024, accounting for over 71% share of the global revenue. The hardware segment encompasses a variety of components, such as cameras, processors, frame grabbers, LED lighting, and lenses. Its significant market share is driven by the availability of advanced hardware platforms that enable seamless component integration and offer enhanced features, including fast processing, high-resolution imaging, and full digital data management. In addition, the development of high-performance hardware has simplified the installation of vision systems and supports a wide range of applications through various networking architectures.

The software segment is predicted to foresee the fastest growth in the coming years. The segment covers the scope of various software that enables the computer vision system to deliver optimal identification and inspection. The primary tasks performed by computer vision software include image classification, object detection, object tracking, and content-based image retrieval. However, many organizations lack the resources and computing power to process a vast amount of visual data, which may hamper the software market for computer vision applications.

Product Insights

The smart camera-based computer vision system segment dominated the market in 2024. Smart camera-based vision systems are built with open-embedded processing technology that suppresses the requirement of peripheral devices, such as an external computer or a frame-capture card. This high growth is attributed to cost-effectiveness, compact dimensions, and simple integration of a smart camera-based computer vision system. In addition, smart cameras are built with open-embedded processing technology that suppresses the requirement of peripheral devices, such as an external computer or a frame-capture card. Open-embedded processing-based smart cameras are primarily standalone vision systems that can execute tasks with the least reliance on secondary devices.

The PC-based computer vision systems segment is predicted to foresee significant growth in the coming years. A PC-based vision system is primarily focused on image processing and requires various peripheral devices for additional tasks such as data transfer, frame grabbing, storage, and lighting. Its large market share can be attributed to its affordability, ease of upgrades, and the flexibility to swap components for greater convenience. Furthermore, the integration of ML algorithms and AI with PC-based vision systems enhances their capabilities, enabling more accurate image processing and decision-making.

Vertical Insights

The non-industrial segment dominated the market in 2024. The non-industrial segment includes security & surveillance, agriculture, healthcare, consumer electronics, intelligent transportation systems, sports & entertainment, retail, and autonomous and semiautonomous vehicles, among different verticals involving machine vision applications. The applications of computer vision systems in non-industrial verticals include packaging inspection, barcode reading, product & component assembly, and defect reduction, among others. Mobile devices increasingly incorporate computer vision for augmented reality (AR), virtual reality (VR), facial recognition, and camera enhancements. Applications such as, Snapchat, Instagram, and Google Lens are popularizing these features, driving consumer interest.

The industrial segment is anticipated to witness significant growth in the coming years. The industrial segment includes verticals involving computer vision applications in manufacturing processes, such as automotive, pharmaceuticals, electronics & semiconductors, wood & paper, food & packaging, and machinery. This high growth is attributed to the rapid adoption of computer vision systems in the automotive and transportation industry. Vision systems were introduced earlier in the automotive sector to automate assembling vehicles. However, the scope of computer vision systems in this industry has widened with the advent of automotive driver assistance and traffic management systems.

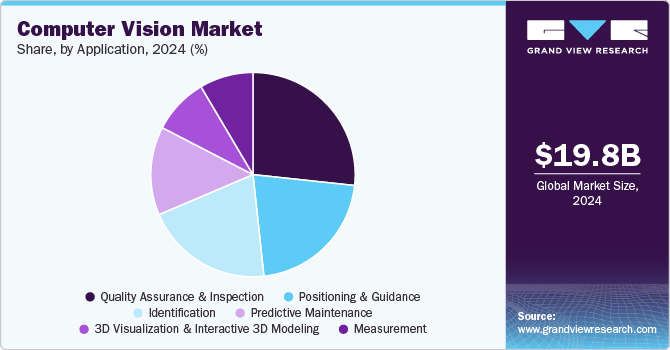

Application Insights

The quality assurance & inspection segment dominated the market in 2024. Numerous factors, such as rising demand for high-quality products and real-time inspection capabilities, are driving the growth of the quality assurance & inspection segment. Moreover, computer vision systems for QA and inspection can be adapted to various industries and applications, from surface defect detection in metals and electronics to ensuring the integrity of packaging in food and beverages. This versatility is driving adoption across a broad range of sectors.

The 3D visualization & interactive 3D modeling segment is anticipated to exhibit a significant CAGR over the forecast period. Rising demand for Virtual and Augmented Reality (VR/AR) applications, advancements in 3D imaging and sensing technologies, and increased adoption in industrial design and manufacturing are driving the segment growth. Moreover, Building Information Modeling (BIM) and 3D architectural visualization are gaining traction in the construction and architecture sectors. 3D models provide detailed representations of structures, enabling more efficient design, construction planning, and facility management. This reduces errors, rework, and project costs.

Regional Insights

The North America computer vision market region is anticipated to register a significant CAGR over the forecast period. Rising adoption of AI and Deep Learning, expanding applications in autonomous vehicles, and growth in the healthcare industry are driving the growth of the North America market.

U.S. Computer Vision Market Trends

The computer vision market in the U.S. held a dominant position in 2024. The U.S. government and military are investing heavily in computer vision for security, surveillance, and defense applications, including drone technology and border surveillance systems. These investments are creating opportunities for growth in the country.

Asia Pacific Computer Vision Market Trends

Asia Pacific computer vision market dominated with a revenue share of over 41% in 2024, attributed to the region's rapid industrialization and automation, strong presence of electronics and semiconductor industries, expanding consumer electronics market, and growth of the automotive sector. Asia-Pacific is a major hub for the automotive industry, with countries such as China, Japan, South Korea, and India being key automotive producers. Computer vision technology is used extensively in vehicle manufacturing, autonomous driving, and safety systems, fueling demand in the region.

Europe Computer Vision Market Trends

The computer vision market in the Europe region is expected to witness a significant CAGR over the forecast period. European industries, particularly manufacturing, automotive, and logistics, are embracing automation to enhance productivity and efficiency. Computer vision plays a crucial role in automating processes such as quality control, defect detection, and robotics navigation, supporting the adoption of Industry 4.0 technologies across Europe.

Middle East & Africa Computer Vision Market Trends

The computer vision market in the MEA region is expected to witness significant growth over the forecast period. Countries in the region, such as the UAE and KSA, are investing in smart cities and digital transformation projects. Computer vision is crucial for technologies such as surveillance systems, traffic monitoring, and smart infrastructure management, which are integral to these projects.

Key Computer Vision Company Insights

Some key players in the market for computer vision include NVIDIA Corporation and Intel Corporation. These companies provide advanced hardware and software platforms that accelerate the adoption and innovation of AI-driven visual applications across a wide range of industries, from automotive and healthcare to smart cities and industrial automation.

-

NVIDIA Corporation provides specialized hardware, such as NVIDIA Corporation’s Jetson series for edge computing and the NVIDIA A100 Tensor Core GPUs, optimized for AI inference, which is essential for deploying computer vision models in real-time environments such as autonomous vehicles, robotics, and smart cities.

-

Intel Corporation’s OpenVINO toolkit is a key platform for accelerating the development and deployment of computer vision and deep learning applications. OpenVINO enables faster inference of deep learning models across Intel hardware, making it easier for developers to optimize their AI models for a range of Intel processors. It is widely used across industries like healthcare, retail, industrial automation, and smart cities for tasks like image recognition, anomaly detection, and video analytics.

Key Computer Vision Companies:

The following are the leading companies in the computer vision market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Basler AG

- Cognex Corporation

- Intel Corporation

- Microsoft

- NVIDIA Corporation

- Omron Corporation

- Qualcomm Technologies, Inc.

- Teledyne Vision Solutions

Recent Developments

-

In August 2024, Zebra Technologies Corp., a mobile computing company, a series of advanced AI features enhanced its Aurora machine vision software to provide deep learning capabilities for complex visual inspection use cases. Zebra Technologies Corp.’s Aurora software suite, equipped with deep learning tools, delivers robust visual inspection solutions for machine and line builders, engineers, programmers, and data scientists across industries such as automotive, electronics, semiconductors, packaging, and food and beverage.

-

In May 2024, Aetina Corporation, an Edge AI solution provider, launched AIP-KQ67 for computing and AI interference. This product is powered by Intel Corporation's 13th/12th generation Core™ i9/i7/i5 processors and carries NVIDIA NCS certification. It includes an NVIDIA A2 Tensor Core GPU and supports high-performance NVIDIA RTX series GPU cards, along with high-speed I/O connections. It is meticulously engineered to handle demanding AI inference and computer vision applications.

-

In April 2024, Cognex Corporation, a provider of industrial machine vision systems, introduced In-Sight L38 3D Vision System, combining AI with 3D and 2D vision technologies to address various inspection and measurement tasks. The system generates unique projection images that merge 3D data into an easily labeled 2D format, simplifying training and uncovering details that traditional 2D imaging cannot detect. AI tools identify variable or undefined features, while rule-based algorithms offer precise 3D measurements, ensuring consistent and accurate inspection results.

Computer Vision Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 23.62 billion |

|

Revenue forecast in 2030 |

USD 58.29 billion |

|

Growth rate |

CAGR of 19.8% from 2025 to 2030 |

|

Base Year |

2024 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, product, application, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Amazon Web Services, Inc.; Basler AG; Cognex Corporation; Google; Intel Corporation; Microsoft; NVIDIA Corporation; Omron Corporation; Qualcomm Technologies, Inc.; and Teledyne Vision Solutions |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Computer Vision Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global computer vision market report based on component, product, application, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Smart Camera-Based Computer Vision System

-

PC-Based Computer Vision System

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Quality Assurance & Inspection

-

Positioning & Guidance

-

Measurement

-

Identification

-

Predictive Maintenance

-

3D Visualization & Interactive 3D Modelling

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Industrial

-

Automotive

-

Pharmaceuticals

-

Electronics & Semiconductor

-

Food & Packaging

-

Wood & Paper

-

Printing

-

Machinery

-

Others

-

-

Non-Industrial

-

Healthcare

-

Consumer Electronics

-

Security & Surveillance

-

Retail

-

Sports & Entertainment

-

Autonomous & Semiautonomous Vehicles

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global computer vision market size was estimated at USD 19.82 billion in 2024 and is expected to reach USD 23.62 billion in 2025.

b. The global computer vision market is expected to grow at a compound annual growth rate of 19.8% from 2025 to 2030 to reach USD 58.29 billion by 2030.

b. The Asia Pacific dominated the computer vision market with a share of 41.7% in 2024. This is attributable to the significantly increasing investments in Chinese companies for computer vision technology.

b. Some key players operating in the computer vision market include Amazon Web Services, Inc.; Basler AG; Cognex Corporation; Google; Intel Corporation; Microsoft; NVIDIA Corporation; Omron Corporation; Qualcomm Technologies, Inc.; and Teledyne Vision Solutions.

b. Key factors that are driving the computer vision market growth include the rapid adoption of process automation in the manufacturing industry; a surge in demand for vision-guided robotic systems; increasing favorable government initiatives; and increasing demand for hybrid and electric cars.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."