- Home

- »

- Next Generation Technologies

- »

-

Computer Aided Manufacturing Market Size Report, 2030GVR Report cover

![Computer Aided Manufacturing Market Size, Share & Trends Report]()

Computer Aided Manufacturing Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-premise, Cloud) By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-396-1

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Computer Aided Manufacturing Market Summary

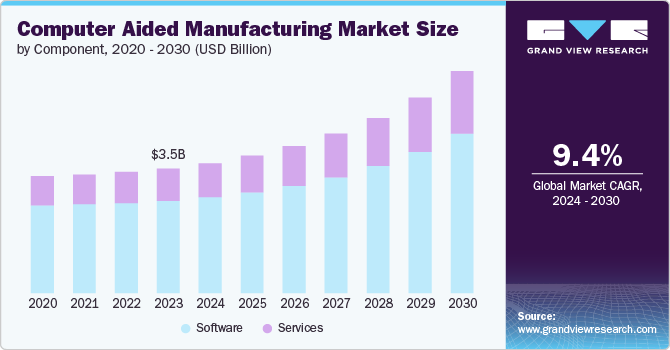

The global computer aided manufacturing market size was estimated at USD 3.47 billion in 2023 and is projected to reach USD 6.20 billion by 2030, growing at a CAGR of 9.4% from 2024 to 2030. This growth can be attributed to the increasing adoption of automation and digitalization across manufacturing industries.

Key Market Trends & Insights

- The North America computer aided manufacturing market dominated the global market, capturing 34.1% of the revenue share in 2023.

- The U.S. computer aided manufacturing market held the largest revenue share in the North American market.

- Based on component, the software segment held the largest revenue share of 74.1% in 2023.

- Based on deployment, the on premise segment's dominant position, capturing 64.0% of the revenue share in 2023.

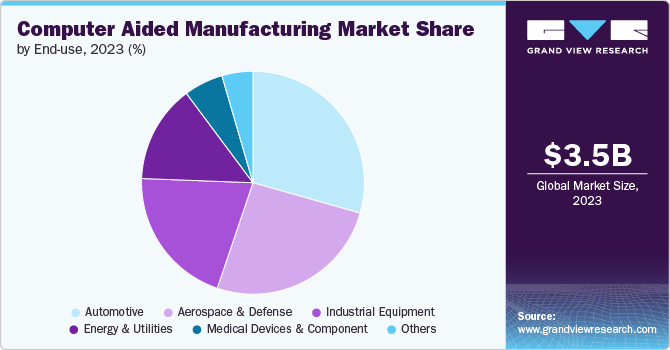

- Based on end use, the automotive segment held the largest revenue share of 29.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.47 Billion

- 2030 Projected Market Size: USD 6.20 Billion

- CAGR (2024-2030): 9.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As companies seek to enhance production efficiency and reduce operational costs, the implementation of computer aided manufacturing (CAM) software offers significant benefits, including improved precision and reduced lead times in manufacturing processes. This trend is particularly evident in sectors such as automotive, aerospace, and electronics, where precision and efficiency are critical.

Another key factor contributing to the market's expansion is the integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) with CAM systems. These technologies enable predictive maintenance, optimization of tool paths, and enhanced quality control, leading to reduced waste and improved product quality. As industries move towards smart manufacturing and Industry 4.0, the demand for sophisticated CAM solutions that can integrate with other digital tools and platforms is expected to rise, further driving market growth.

The increasing complexity of product designs is also a significant driver for the market. As products become more intricate, traditional manufacturing methods become less feasible, necessitating the adoption of CAM systems that can handle complex geometries and multi-axis machining. This need is particularly pronounced in industries such as medical devices and aerospace, where precision and customization are paramount. The capability of CAM software to streamline these complex manufacturing processes and ensure consistency in product quality is a major factor in its growing adoption.

Lastly, the market's growth is supported by the expanding use of additive manufacturing and 3D printing technologies. CAM software plays a crucial role in the design and production of components using these technologies, providing detailed toolpaths and instructions necessary for precise fabrication. As 3D printing becomes more widespread in prototyping and production, the demand for CAM software is expected to grow in parallel, offering manufacturers the tools to efficiently transition from design to production. This integration of traditional and additive manufacturing processes further underscores the versatility and importance of CAM solutions in modern manufacturing landscapes.

Component Insights

The software segment held the largest revenue share of 74.1% in 2023 in the market and is expected to maintain its dominance from 2024 to 2030. This is due to the increasing adoption of digital manufacturing technologies across industries has fueled demand for advanced CAM software. Coupled with the growing need for automation and precision in manufacturing processes, this has led to continuous advancements in CAM software capabilities and features. The integration of artificial intelligence and machine learning in CAM solutions has further enhanced their value proposition. Additionally, the rising need for improved efficiency, reduced production costs, and faster time-to-market has made CAM software indispensable for many manufacturers. The shift towards cloud-based CAM software, offering scalability and accessibility, has also contributed to the segment's strong market position.

The services segment is expected to register the fastest CAGR of 10.6% from 2024 to 2030, attributed to the increasing complexity of CAM systems, which necessitates specialized support and training. As manufacturing processes become more sophisticated, there is a growing demand for customization and integration services to tailor CAM solutions to specific industry needs. Additionally, many companies are opting to outsource CAM-related tasks to reduce in-house costs and improve operational efficiency. The need for continuous software updates, maintenance, and technical support further contributes to the segment's growth. The expansion of cloud-based CAM solutions is also fueling demand for managed services. Furthermore, there is an increasing focus on value-added services, such as consulting and process optimization, as manufacturers seek to maximize their return on investment in CAM technologies.

Deployment Insights

The on premise segment's dominant position, capturing 64.0% of the revenue share in 2023 in the market’s deployment segment. Many large enterprises and industries with sensitive data prefer on premise solutions for enhanced security and control over their manufacturing processes. Additionally, certain industries with complex, high-volume production requirements often choose on premise CAM systems for their robust performance and ability to handle intensive computational tasks without relying on external networks. The segment's dominance also reflects the historical preference for on premise solutions, particularly in industries where CAM systems are deeply integrated with existing infrastructure.

The cloud segment is expected to register the fastest CAGR of 11.9% from 2024 to 2030, attributed to the scalability and flexibility of cloud platforms that allow manufacturers to adjust their resources in response to changing demands. Lower initial capital expenditure and reduced need for on-site infrastructure make cloud solutions financially attractive across various business scales. Remote collaboration capabilities align with evolving work patterns and distributed team structures. Automated updates and maintenance reduce IT overhead and ensure consistent access to current features. Enhanced data security and disaster recovery protocols address critical concerns in manufacturing data management. The cloud segment's growth also aligns with broader industry trends towards digital transformation. These attributes collectively position cloud-based CAM solutions as a high-growth segment in the evolving manufacturing technology landscape.

End-use Insights

The automotive segment held the largest revenue share of 29.4% in 2023 and is also expected to maintain its dominance from 2024 to 2030. This is mainly attributed to the automotive industry's high production volumes and stringent quality requirements necessitates advanced CAM solutions for precision and efficiency. Increasing complexity in vehicle designs and the trend towards electric and autonomous vehicles have further driven the adoption of sophisticated CAM technologies. Additionally, the automotive sector's focus on reducing time-to-market and optimizing production costs aligns well with the benefits offered by CAM systems, contributing to their widespread implementation across the industry.

Furthermore, the automotive industry's global nature and highly competitive landscape have accelerated the adoption of CAM technologies. Automotive manufacturers are increasingly leveraging CAM solutions to streamline their design and production processes across multiple facilities worldwide. The integration of CAM with other digital technologies, such as IoT and AI, has enabled more efficient supply chain management and predictive maintenance in automotive production. Moreover, the industry's push towards lightweight materials and complex geometries for improved fuel efficiency has intensified the need for advanced CAM tools capable of handling intricate machining processes.

Regional Insights

The North America computer aided manufacturing market dominated the global market, capturing 34.1% of the revenue share in 2023, can be attributed to several key factors. The region's strong manufacturing base, particularly in industries such as aerospace, automotive, and healthcare, has driven significant adoption of CAM technologies. North America's leadership in technological innovation and early adoption of advanced manufacturing processes has further fueled market growth. The presence of major CAM software developers and service providers in the region has facilitated robust product development and support ecosystems.

Additionally, substantial investments in research and development, coupled with government initiatives promoting smart manufacturing, have bolstered CAM implementation across various sectors. The region's focus on increasing productivity, reducing operational costs, and maintaining global competitiveness has also contributed to the widespread integration of CAM solutions in manufacturing processes.

U.S. Computer Aided Manufacturing Market Trends

The U.S. computer aided manufacturing market held the largest revenue share in the North American market due to its extensive manufacturing infrastructure and technological leadership. The country's robust aerospace, automotive, and healthcare industries have been early adopters of CAM technologies, driving market growth. Additionally, major CAM software developers and a strong culture of innovation in the U.S. have fostered continuous advancements in CAM solutions. The nation's significant investments in research and development, coupled with supportive government policies promoting advanced manufacturing, have further solidified its market position in the region.

Asia Pacific Computer Aided Manufacturing Market Trends

The computer aided manufacturing market in the Asia Pacific region is expected to grow with the fastest CAGR of 10.0% from 2024 to 2030 which can be attributed to several key factors. The region's expanding manufacturing sector, particularly in countries like China, India, and Southeast Asia, is driving increased adoption of CAM technologies. Significant investments in industrial automation and smart manufacturing initiatives across the region are fueling demand for advanced CAM solutions. Additionally, the growing emphasis on improving production efficiency and quality to meet global standards is prompting manufacturers to integrate CAM systems into their operations. The region's rising technological capabilities and the presence of a skilled workforce are further supporting the target market's growth trend.

Europe Computer Aided Manufacturing Market Trends

The European computer aided manufacturing market's growth is primarily driven by the region's strong focus on Industry 4.0 initiatives and digital transformation in manufacturing. Countries like Germany, France, and Italy are investing heavily in advanced manufacturing technologies to maintain their competitive edge in high-value industries such as automotive, aerospace, and precision engineering. The European Union's supportive policies and funding for research and development in smart manufacturing technologies are also contributing to the adoption of CAM solutions. Additionally, the region's emphasis on sustainable and efficient manufacturing processes is prompting companies to implement CAM systems to optimize resource utilization and reduce waste.

Key Computer Aided Manufacturing Company Insights

Some key companies operating in the market include Dassault Systemes, and Siemens, among others.

-

Dassault Systemes develops 3D digital mock-up, 3D design, and product lifecycle management software. The company’s products and services include ENOVIA, CATIA, 3DEXCITE, SOLIDWORKS, DELMIA, GEOVIA, BIOVIA, SIMULIA, 3DVIA, EXALEAD, and NETVIBES. The company caters its products to the incumbents of aerospace & defense, industrial equipment, energy, process & utilities, consumer goods, retail, life sciences, marine & offshore, and transportation & mobility, among other industries and industry verticals. The company also offers training services, including classes & course catalogs, certification programs, e-learning, and customized services. Dassault Systemes operates as a subsidiary of Dassault Group. The company is listed on Euronext Paris as Euronext Paris: DSY. The company has a vast geographic presence spanning North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Autodesk, Inc. and Symscape Technologies are some emerging market companies in the target market.

-

Autodesk, Inc. is based in the U.S. The company provides design software and services to the incumbents of engineering, architecture, manufacturing, construction, and media & entertainment, among other industries and industry verticals. The company operates through one business segment, namely the AEC segment, which offers the Autodesk building design suite, Autodesk Revit, the Autodesk infrastructure design suites, AutoCAD civil 3D, and AutoCAD map 3D as well as the Autodesk product design suites, Autodesk inventor, AutoCAD Mechanical, and Autodesk Moldflow. The company offers flexible product licenses as part of its efforts to expand its customer base. Autodesk, Inc. is a publicly-traded firm listed on the NASDAQ Stock Market as NASDAQ: ADSK. The company has a vast geographic presence spanning the Americas, Europe, Asia Pacific, and Middle East & Africa.

Key Computer Aided Manufacturing Companies:

The following are the leading companies in the computer aided manufacturing (CAM) market. These companies collectively hold the largest market share and dictate industry trends.

- ANSYS, Inc.

- Altair Engineering Inc.

- Autodesk, Inc.

- Bentley Systems, Incorporated.

- Dassault Systemes

- ESI Group

- Rockwell Automation

- Siemens

- BETA CAE Systems

- COMSOL

- PTC

- Hexagon AB

- Symscape

Recent Developments

-

In April 2024, ESI Group and FAW-Volkswagen (FAW-VW) TE signed a Memorandum of Understanding (MoU) to advance intelligent simulation technology in the automotive industry, addressing China's automotive safety regulations. The partnership aims to establish a localized automotive industry material database and enhance cooperation in intelligent simulation, making significant strides in automotive innovation and research.

-

In February 2024, Hexagon AB collaborated with Augment Technologies in Western Australia to assist mines in optimizing ore yield and operational efficiencies through precise blast movement tracking. This partnership integrates block model data, artificial intelligence, and measured 3D movement data to develop a blast movement solution, enabling mines to access substantial value.

Computer Aided Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.63 billion

Revenue forecast in 2030

USD 6.20 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

ANSYS, Inc.; Altair Engineering Inc.; Autodesk, Inc.; Bentley Systems; Incorporated.; Dassault Systemes; ESI Group; Rockwell Automation; Siemens; BETA CAE Systems; COMSOL; PTC; Hexagon AB; Symscape

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computer Aided Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global computer aided manufacturing market report based on component, deployment, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On premise

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace & Defense

-

Industrial Equipment

-

Medical Devices & Component

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global computer aided manufacturing market size was estimated at USD 3.47 billion in 2023 and is expected to reach USD 3.63 billion in 2024.

b. The global computer aided manufacturing market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 6.20 billion by 2030.

b. North America dominated the computer aided manufacturing market with a share of over 34.1% in 2023. This is attributable to the region's strong manufacturing base, particularly in industries such as aerospace, automotive, and healthcare, has driven significant adoption of CAM technologies. North America's leadership in technological innovation and early adoption of advanced manufacturing processes has further fueled market growth. The presence of major CAM software developers and service providers in the region has facilitated robust product development and support ecosystems.

b. Some key players operating in the computer aided manufacturing market include ANSYS, Inc., Altair Engineering Inc., Autodesk, Inc., Bentley Systems, Incorporated., Dassault Systemes, ESI Group, Rockwell Automation, Siemens, BETA CAE Systems, COMSOL, PTC, Hexagon AB, and Symscape.

b. Key factors driving market growth include the increased adoption of automation, rising demand for precision and quality, and expansion of smart manufacturing and industry 4.0.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.