- Home

- »

- Petrochemicals

- »

-

Compressor Oil Market Size & Share, Industry Report, 2030GVR Report cover

![Compressor Oil Market Size, Share & Trends Report]()

Compressor Oil Market (2025 - 2030) Size, Share & Trends Analysis Report By Compressor (Positive Displacement Compressor, Dynamic Compressor), By Base Oil (Synthetic, Mineral, Bio-based), By End-use (Manufacturing, Oil & Gas), By Region, And Segment Forecasts

- Report ID: 978-1-68038-906-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Compressor Oil Market Summary

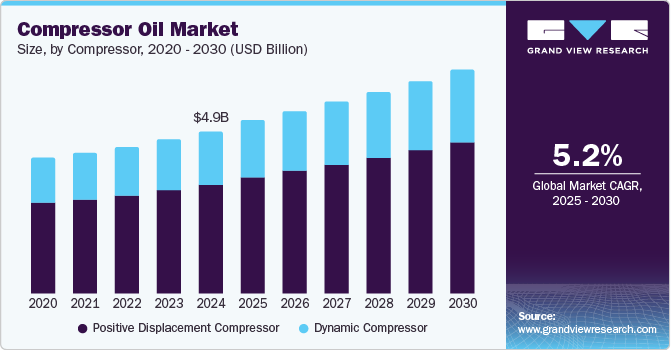

The global compressor oil market size was estimated at USD 4.92 billion in 2024 and is projected to reach USD 6.79 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. This is attributed to the expansion of end use industries, including manufacturing, food processing, chemical, automotive, construction, and aerospace.

Key Market Trends & Insights

- The Asia Pacific compressor oil market dominated the global market and accounted for the largest revenue share of 41.6% in 2024.

- The compressor oil market in China led the Asia Pacific market with the highest revenue share in 2024.

- Based on compressor, the positive displacement compressor segment dominated the market, with a revenue share of % in 2024.

- Based on base oil, the synthetic segment led the market, with a revenue share of % in 2024.

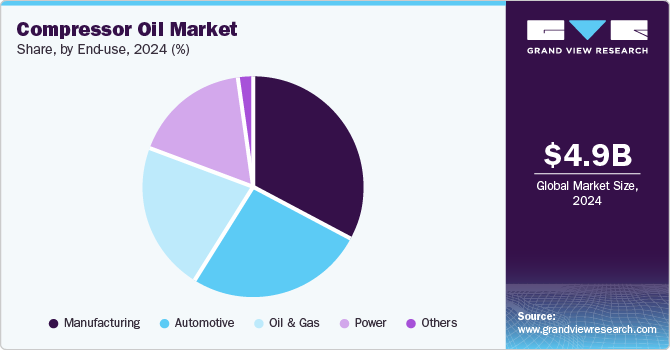

- Based on end use, the manufacturing segment dominated the market, with a revenue share of 66.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.92 Billion

- 2030 Projected Market Size: USD 6.79 Billion

- CAGR (2025-2030): 5.2%

- Asia Pacific: Largest market in 2024

Compressor oils ensure smoother operation and help reduce the machine's downtime and repair. Moreover, heat generated by compressors during operations results in more power consumption and wear & tear on the machine. These lubricants assist in heat dissipation, keeping the equipment temperature in control.

The adoption of cost optimization practices is one of the key trends escalating market growth. Organizations that implement such continuous improvements have been observed to have reduced their power consumption and ensure constant operational flow as a result of good lubrication practices. The growing demand for cost optimization is anticipated to be a key driver of market growth. Several incidents of rotary screw gas compressor shutdowns have been reported due to wear, with viscosity and gas solubility being identified as critical factors contributing to these failures.

The HVAC sector is a major user of compressor oils, with rising global temperatures fueling increased demand for air conditioning systems and, subsequently, compressor oils. The growth of the automotive industry, especially in emerging markets, is also driving the need for compressor oils in air conditioning systems. Industries also prioritize improving compressor performance and durability, boosting the demand for high-quality compressor oils.

Compressor Insights

The positive displacement compressor dominated the compressor oil market, with a revenue share of % in 2024. They are used in different manufacturing sectors, including chemical, petrochemical, metal production, construction, and mining equipment. They capture a volume of air into the chamber and reduce the chamber's volume to compress the air. Positive displacement compressors are prized for energy efficiency, helping businesses reduce costs amid rising energy prices and stricter regulations. As demand for specialized equipment grows, they're increasingly used in renewable energy sectors, such as hydrogen production and energy storage.

The dynamic compressor segment in the compressor oil market is expected to grow significantly at a CAGR of 4.9% over the forecast period. Dynamic compressors are widely used in petroleum refining, pulp and paper, mining, food processing, and automotive industries. Rising demand for gas turbine maintenance services and oil refinery processes are anticipated to fuel the product demand. The oil and gas industry, with its need for high-pressure and high-flow gas compression, remains a major consumer of dynamic compressors, particularly for pipeline transmission and petrochemical applications.

Base Oil Insights

Synthetic base oil led the compressor oil market, with a revenue share of % in 2024. Synthetic oils are cleaner, less expensive, last longer, and are less prone to contamination than conventional ones. Soaring need to minimize downtime and maintenance requirements is estimated to foster their growth. As industries seek higher efficiency and reliability, synthetic oils are favored for their stability, performance in extreme temperatures, and low volatility. The automotive sector, particularly with the rise of fuel-efficient, electric, and hybrid vehicles, drives demand for synthetic lubricants, enhancing engine performance, fuel efficiency, and meeting stringent specifications.

The bio-based oil segment in the compressor oil market is estimated to grow at the fastest CAGR of 5.4% over the forecast period. As sustainability becomes a priority for both consumers and industries, bio-based oils derived from renewable resources are gaining traction due to their lower environmental impact. These oils reduce reliance on petroleum products and offer biodegradable, eco-friendly alternatives. In the automotive industry, bio-based oils are used in lubricants and systems, providing superior performance, reducing wear, and supporting sustainable automotive solutions.

End-use Insights

The manufacturing industry dominated the compressor oil market, with a revenue share of 66.8% in 2024. The sector's growth can be attributed to rising maintenance activities and lubrication applications. Compressor oils are essential for the smooth operation of various manufacturing processes, including machinery, equipment, and systems that require continuous and reliable lubrication. The growing industrialization and demand for more efficient and durable equipment fuel this sector's increasing need for high-quality compressor oils.

The oil and gas industry in the compressor oil market is expected to grow significantly at a CAGR of 5.2% over the forecast period. Rising oil and gas demand has led to increased exploration and production, requiring high-quality compressor oils for equipment efficiency and longevity. The global growth in liquefied natural gas (LNG) production further boosts the need for specialized oils to support compressors in LNG production and transport. As machinery complexity grows, maintaining equipment is vital, with compressor oils reducing wear, minimizing downtime, and improving efficiency, driving the demand for advanced lubricants.

Regional Insights

The North America compressor oil market held a substantial market share in 2024. North America's manufacturing sector, including automotive, aerospace, and heavy machinery, depends on compressors for production, driving the need for high-performance lubricants to enhance operation and minimize downtime. As industries grow and modernize, the demand for compressor oils increases. Additionally, rising temperatures and growing urban populations boost the demand for air conditioning and refrigeration systems, which rely on compressors, further increasing the need for reliable compressor oils in both residential and commercial sectors.

U.S. Compressor Oil Market Trends

The compressor oil market in the U.S. dominated the North America market, with the highest revenue share of 85.3% in 2024. The rise in U.S. shale gas production has boosted compressor use in natural gas extraction, storage, and transportation, driving the demand for high-performance oils that ensure efficiency under high-pressure conditions. Additionally, increasing infrastructure projects in energy, construction, and power generation require compressors for various applications, further elevating the need for reliable and efficient compressor oils to support large-scale operations and maintain the smooth functioning of essential machinery.

Asia Pacific Compressor Oil Market Trends

The Asia Pacific compressor oil market dominated the global market and accounted for the largest revenue share of 41.6% in 2024, owing to the high growth rate of major end use industries such as metalworking, food processing, chemicals, and textiles, coupled with rapid urbanization and industrialization. The regional market presents numerous opportunities for innovators to introduce new products with advantageous product characteristics to tap into niche applications. As countries such as China, India, and Southeast Asian nations continue to industrialize and urbanize, there is an increasing demand for energy and infrastructure.

The compressor oil market in China led the Asia Pacific market with the highest revenue share in 2024. China remains a global manufacturing hub, with extensive use of compressors in industries such as automotive, electronics, textiles, and refrigeration. As China’s industrial sector continues to expand and modernize, the demand for compressor oils to maintain the efficiency and longevity of equipment increases. As one of the world’s largest energy producers and consumers, China’s oil and gas sector is seeing steady growth in exploration, production, and transportation activities.

Middle East & Africa Compressor Oil Market Trends

The Middle East & Africa compressor oil market is expected to grow significantly at a CAGR of 5.3% over the forecast period as the region is home to some of the largest oil and gas reserves in the world and with continued exploration, extraction, and transportation activities. Multiple countries in the MEA region are experiencing rapid industrialization, especially in the Gulf Cooperation Council (GCC) countries. The hot climate in the MEA region drives demand for air conditioning and refrigeration systems, which depend on compressors, thereby increasing the need for compressor oils to maintain efficiency and prevent breakdowns across sectors.

The compressor oil market in Saudi Arabia dominated the Middle East & Africa market with the highest revenue share in 2024. Saudi Arabia, a leading oil producer, relies on compressors for exploration, extraction, and transportation, increasing demand for high-quality compressor oils to maintain performance and minimize downtime. As part of Vision 2030, the country is diversifying its economy into manufacturing, petrochemicals, and power generation, raising the need for compressor oils in these sectors. Infrastructure investments, such as NEOM and the Red Sea project, further boost demand as compressors are essential in construction and energy production, driving the need for reliable lubricants.

Key Compressor Oil Company Insights

Key global compressor oil market companies include Shell plc, Chevron Corporation, Exxon Mobil Corporation, and Repsol, among others. Major compressor oil companies are focusing on technological innovation, sustainability, and expanding product portfolios. They invest in developing high-performance, eco-friendly oils that meet industry standards and regulatory requirements. Companies are also strengthening their global supply chains, enhancing customer service, and targeting emerging markets. Strategic partnerships, acquisitions, and increased R&D in compressor oil formulations help them address evolving customer needs and maintain market leadership.

-

Shell plc is an energy company headquartered in The Hague, Netherlands. It operates across all sectors of the energy industry, including exploration, production, refining, and distribution of oil and natural gas. The company produces a wide range of products, including fuel, lubricants, and chemicals, and investments in renewable energy, such as wind and solar power.

-

Chevron Corporation provides lubricants designed to optimize compressor performance and ensure the longevity of equipment across various industries, including oil and gas, manufacturing, and refrigeration. Its compressor oils include Chevron Rando HD Series and Chevron Delo 400 LE Multigrade, among others. The company is headquartered in San Ramon, California, U.S.

Key Compressor Oil Companies:

The following are the leading companies in the compressor oil market. These companies collectively hold the largest market share and dictate industry trends.

- Shell plc

- Chevron Corporation

- Exxon Mobil Corporation

- Repsol

- FUCHS

- Atlas Copco Group

- Hitachi, Ltd.

- Siemens AG

- KAESER KOMPRESSOREN

- MITSUBISHI HEAVY INDUSTRIES, LTD.

Recent Developments

-

In February 2025, Shell plc (SHEL) announced the purchase of 1,495,840 shares for cancellation as part of its share buyback program, executed across multiple platforms, including the London Stock Exchange (LSE), Chi-X, BATS, XAMS, and CBOE DXE. The buyback, managed by Natixis until April 2025, follows a strategic capital allocation decision aiming to optimize liquidity and minimize market impact. This move reflects strong cash flow, with potential earnings per share growth for investors.

-

In February 2025, Chevron confirmed plans to reduce its workforce by 15% to 20%, affecting approximately 6,830 to 9,100 jobs, as part of an organizational restructuring. The layoffs, impacting its over 45,000 employees, are aimed at improving efficiency, centralization, and results. Vice Chairman Mark Nelson stated the changes would enhance long-term competitiveness, with the reductions expected to be completed by the end of 2026. Chevron did not specify which areas would be impacted by the layoffs.

Compressor Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.28 billion

Revenue forecast in 2030

USD 6.79 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Compressor, base oil, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Russia; China; India; Japan; South Korea; Australia; Saudi Arabia; South Africa; Kuwait; Iraq; Brazil; Argentina; Venezuela

Key companies profiled

Shell plc; Chevron Corporation; Exxon Mobil Corporation; Repsol; FUCHS; Atlas Copco Group; Hitachi, Ltd.; Siemens AG; KAESER KOMPRESSOREN; MITSUBISHI HEAVY INDUSTRIES, LTD.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Compressor Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global compressor oil market report based on compressor, base oil, end-use, and region:

-

Compressor Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Positive Displacement Compressor

-

Dynamic Compressor

-

-

Base Oil Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Synthetic

-

Semi-Synthetic

-

Mineral

-

Bio-Based

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Manufacturing

-

Oil & Gas

-

Power

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Kuwait

-

Iraq

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.