- Home

- »

- Medical Devices

- »

-

Compression Therapy Market Size, Industry Report, 2030GVR Report cover

![Compression Therapy Market Size, Share & Trends Report]()

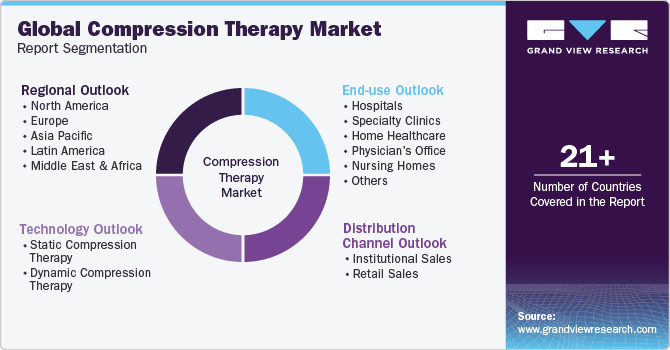

Compression Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Static Compression Therapy, Dynamic Compression Therapy), By End-use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-502-1

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Compression Therapy Market Summary

The global compression therapy market size was estimated at USD 4.25 billion in 2024 and is projected to reach USD 5.34 billion by 2030, growing at a CAGR of 3.8% from 2025 to 2030. The market growth can be attributed to the increasing prevalence of vein disorders such as leg ulcers, Deep Vein Thrombosis (DVT), lymphedema, varicose veins, and blood clots.

Key Market Trends & Insights

- North America compression therapy market dominated the global market with a revenue share of 42.43% in 2024.

- The compression therapy market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

- Based on technology, the static compression therapy segment led the market with the largest revenue share of 69.08% in 2024.

- Based on end-use, the hospitals segment led the market with the largest revenue share in 2024.

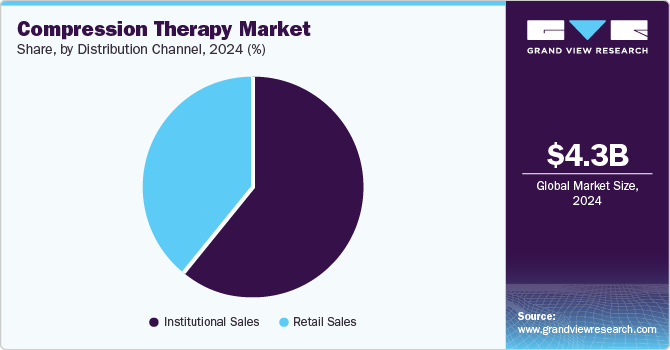

- Based on distribution channel, the institutional sales led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.25 Billion

- 2030 Projected Market Size: USD 5.34 Billion

- CAGR (2025-2030): 3.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As per the CDC updated on May 2024, in the U.S., DVT affects up to 900,000 people each year. DVT is a blood clot in a vein, usually in the lower body. As per a report by Frontiers Media S.A. in September 2023, the global occurrence of DVT is five instances per 100,000 individuals annually. The incidence of this condition varies with age, affecting about 2-3 individuals per 100,000 in the 30 to 49 age group and around 20 individuals per 100,000 in those aged 70 to 79. Products, especially stockings and bandages, are increasingly used to treat disorders, thus driving market growth. Such factors propel industry growth.

Conditions such as chronic venous insufficiency and venous ulcers impact many people worldwide, with factors such as aging populations, inactive lifestyles, and obesity playing a major role. Compression therapy for venous ulcers is a highly effective treatment; therefore, the increasing prevalence rate of venous ulcers will drive market growth in the near future. Moreover, compression therapy for varicose veins is a highly effective treatment compared to other options. For instance, according to the Society for Vascular Surgery data, as many as 40 million Americans have varicose veins. Moreover, according to an article published by NCBI, around 150,000 new cases of chronic venous insufficiency are diagnosed each year, with approximately USD 500 million spent on the care of these patients.

Compression therapy works by applying controlled pressure to the affected limbs, which helps ease symptoms, enhance blood flow, and reduce swelling, aiding healing and preventing complications. Thus, the growing awareness about the effectiveness of compression therapy in managing chronic vein issues is expected to contribute to market growth.

The growing number of orthopedic procedures is leading to an increased need for compression therapy as a component of postoperative care and rehabilitation protocols. Orthopedic surgeries, including joint replacements (such as knee or hip replacements), fracture repairs, ligament reconstructions, and arthroscopic surgeries, are becoming more common due to factors such as an aging population, sports-related injuries, and advancements in surgical techniques. For instance, according to data from the American College of Rheumatology, the number of knee and hip replacements performed annually in the U.S. is rising due to the aging population, with approximately 790,000 knee replacements and 544,000 hip replacements performed each year, as per data published by the Australian Orthopedic Association National Joint Replacement Registry (AOANJRR) in 2024, more than 2.1 million orthopedic procedures done in Australia.

After an orthopedic procedure, patients commonly experience swelling, inflammation, and reduced mobility in the operated limbs. Compression therapy plays a vital role in managing these postoperative symptoms and in providing recovery by improving blood circulation, reducing swelling, and supporting the surgical site.

The increasing cases of obesity have led to an increase in the adoption of compression therapy as a crucial device in managing health-related concerns. Obesity, characterized by excessive body fat accumulation, not only increases the risk of chronic disorders such as CVD, diabetes, & hypertension but also contributes to venous insufficiency and associated disorders. For instance, an article published in the International Journal of Medical Science and Clinical Invention suggests that obesity increases the risk of venous insufficiency and associated complications by more than six-fold. As per the World Obesity Federation, in 2024, more than one billion people worldwide were living with obesity, which is about one in eight people. This includes nearly 880 million adults and 159 million children and adolescents aged 5-19.

Obesity can worsen venous insufficiency by increasing pressure on the veins, especially in the lower limbs. The additional weight strains the venous system, hindering blood flow back to the heart and resulting in venous congestion, swelling, and discomfort. Over time, this chronic venous insufficiency can progress to more serious conditions such as varicose veins, venous ulcers, and DVT. This factor is expected to surge demand for compression therapy, thereby driving market growth.

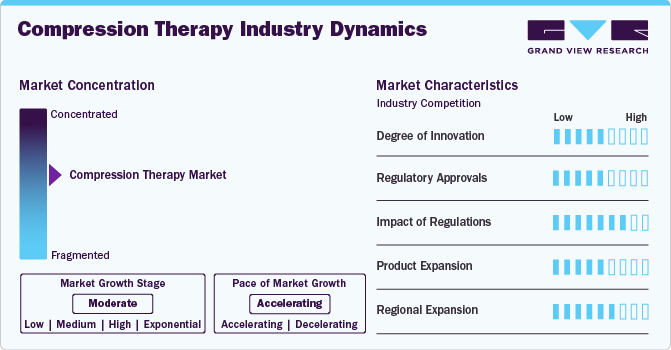

Market Concentration & Characteristics

The market’s growth stage is moderate, and the pace is accelerating. The market is characterized by a high degree of growth owing to rising cases of chronic vein disorders, a growing number of orthopedic procedures, and an increasing incidence of obesity.

Key strategies implemented by market players include new product launches, expansion, acquisitions, partnerships, and other strategies. In October 2023, Medi GmbH & Co. launched Medi Rehab, a compression stocking available in thigh stocking and calf stocking versions with either open or closed toe. Particularly in the conservative or postoperative treatment of ankle joint injuries or Achilles tendon ruptures, the calf stocking with an open toe makes it easy and comfortable to put on and take off.

Integrating smart technology into compression therapy products can enhance monitoring and management capabilities. This might include wearable sensors, mobile apps, or remote monitoring devices that track compression therapy adherence, pressure levels, and patient outcomes.

Compression therapy products are medical devices subject to strict regulatory standards. Regulatory bodies, such as the U.S. FDA in the United States or CE (Conformité Européene) marking in Europe, set guidelines and standards to ensure these devices' safety, effectiveness, and quality. Innovation in compression therapy product design, materials, and features often requires regulatory approvals. Manufacturers are required to navigate the regulatory landscape to ensure that new and improved products meet the necessary standards.

Regulatory bodies set quality and safety standards for medical equipment, including compression therapy. Compliance with these standards is essential for manufacturers to ensure the safety of patients during transportation. In addition, regulations may require manufacturers to adhere to eco-friendly practices when producing and disposing of compression therapy.

Product expansion in the global market involves introducing new products or enhancing existing ones to meet evolving patient needs, technological advancements, and market demands. Companies can introduce new product lines to address specific segments of the market. This might include developing compression garments for different anatomical areas (e.g., arms, legs, torso) or specific conditions (e.g., lymphedema, venous insufficiency).

The market exhibits elements of both fragmentation and consolidation, varying depending on factors such as product type, geographical region, and market segment. In certain segments of the market, particularly in regions with a wide range of manufacturers and suppliers, the market can be fragmented. This fragmentation may be due to numerous small and medium-sized companies offering various compression therapy products, including compression garments, bandages, stockings, and devices. These companies often compete based on factors such as price, product differentiation, and distribution channels. Conversely, the market is also characterized by consolidation, particularly in segments dominated by large companies with significant market share. These companies may have established brand recognition, extensive distribution networks, and diverse product portfolios encompassing a range of compression therapy solutions.

The market is influenced by various factors, including advancements in healthcare infrastructure, rising prevalence of chronic diseases, and technological innovations in compression therapy technology, such as the development of innovative and improved designs that enhance patient comfort & compliance. Regional expansion scenarios in the market are propelled by factors such as an aging population, increasing prevalence of chronic diseases, rising awareness of venous disorders, and the overall development of healthcare infrastructure.

Technology Insights

Based on technology, the static compression therapy segment led the market with the largest revenue share of 69.08% in 2024. Static compression therapy involves applying consistent pressure to affected areas to increase blood flow and reduce swelling. This method utilizes compression garments such as stockings, bandages, or wraps, known for their ease and effectiveness in treating conditions like varicose veins, Deep Vein Thrombosis (DVT), and lymphedema. The therapy is favored for its ease of use and convenience, making it a preferred choice for both patients and physicians. It offers effective pressure & pain relief, speedy functional recovery, and reduction of swelling, which is crucial for treating various sports injuries & conditions. Static compression devices are versatile, suitable for various medical conditions, and offer various levels of compression. They are relatively more affordable than dynamic compression devices, making them a cost-effective option for patients and healthcare providers, especially in regions with limited healthcare budgets.

The dynamic compression therapy segment is expected to register the fastest during the forecast period. This therapy is gaining traction in the market, driven by several key factors and trends. This therapy involves the application of pressure to the affected area, which is adjusted over time to promote blood flow and reduce swelling. The therapy products include dynamic compression pumps. Dynamic compression therapy offers a flexible approach, adjusting pressure levels based on patient needs, unlike static compression therapy, which applies constant pressure. This flexibility makes it effective for treating various conditions, including postsurgical wounds and injury pains.

End-use Insights

Based on end-use, the hospitals segment led the market with the largest revenue share in 2024. Hospitals are preferred over other healthcare facilities due to their capability to provide comprehensive care to patients with complex medical needs. Hospitals have the necessary infrastructure, medical expertise, and resources to effectively manage & monitor patients' conditions, ensuring optimal treatment outcomes. In addition, they can provide immediate access to advanced medical care in case of any complications or emergencies. Compression therapy products are widely used in hospitals for the treatment of various medical conditions, including venous disorders, lymphedema, and postsurgical recovery. The use of these products in hospitals has increased due to their proven efficacy in managing conditions, reducing complications, and improving patient outcomes.

The home healthcare segment is expected to register at the fastest CAGR in the forecast period. Compression therapy at home healthcare is utilized for the management of conditions such as varicose veins, DVT, lymphedema, orthostatic hypotension, sports injuries, and leg ulcers. The home-based healthcare and patient self-management strategies have increased the demand for user-friendly, wearable compression therapy devices. These devices are designed to be easily used at home, allowing patients to manage their conditions without frequent visits to healthcare facilities. Integrating compression therapy consultations, fitting services, and patient education into telemedicine platforms further enhances access to care, supporting remote patient monitoring initiatives.

Distribution Channel Insights

Institutional sales led the market with the largest revenue share in 2024. Institutional sales in the global market involve distributing products through channels such as hospitals, clinics, & nursing homes and offer several advantages over retail sales. These advantages include selling products in larger quantities, reduced marketing costs, and the potential to establish long-term business relationships with key institutional customers. The dominance of institutional sales in the market is attributed to the increasing demand for these products in healthcare settings. As the global population ages, there is a growing need for compression therapy solutions to treat conditions such as chronic venous insufficiency, lymphedema, and DVT. Institutional sales offer an effective and dependable way to deliver these products to healthcare providers who require them.

The retail sales segment is expected to register at the fastest CAGR during the forecast period. Retail sales in the market encompass the distribution of products through channels such as pharmacies, medical supply stores, and online retailers. Retail sales offer greater accessibility to compression therapy products for consumers, providing a wide range of options and allowing consumers to compare & select the best products for their needs. In addition, retail sales offer convenience, enabling consumers to purchase products directly without a prescription or a visit to a healthcare provider. Hence, rising benefits associated with retail sales are anticipated to boost the segment growth.

Regional Insights

North America compression therapy market dominated the global market with a revenue share of 42.43% in 2024, propelled by a combination of factors such as technological advancements, the rising prevalence of chronic diseases, and government initiatives. The market's expansion is further bolstered by advancements in compression therapy technology, such as the development of innovative materials and improved designs that enhance patient comfort & compliance. The increasing prevalence of chronic diseases such as diabetes and obesity, which often lead to circulatory issues, significantly contributes to market growth. The National Institutes of Health reported that varicose veins affect more than 25 million people in the U.S., and over 6 million suffer from severe venous disease, making Chronic Venous Disease (CVD) a prevalent health condition. This highlights the importance of compression therapy in managing and treating these conditions.

U.S. Compression Therapy Market Trends

The compression therapy market in U.S. is expected to dominate the market over the forecast period. The U.S. population's aging demographic is leading to an increased prevalence of conditions such as Peripheral Artery Disease (PAD), a common indication for compression therapy. According to a research article published by Vascular Disease Management in April 2023, the U.S. population's PAD prevalence has increased from 11.3 million in 1995 to an estimated 26 million in 2020. This increase can be attributed to an aging population, and the number is projected to reach 23.8 million by 2030 due to the aging population. Furthermore, growing awareness about the benefits of compression therapy in managing various conditions, including PAD, Deep Vein Thrombosis (DVT), and post-thrombotic syndrome, is driven by research, clinical trials, and patient testimonials.

Europe Compression Therapy Market Trends

The compression therapy market in Europe is expected to grow at a significant CAGR over the forecast period. This growth can be attributed to the rising geriatric population and market advancements. Moreover, the region's advanced healthcare infrastructure, coupled with a focus on minimally invasive medical interventions, fosters the adoption of compression therapy products.

The UK compression therapy market is expected to grow at a moderate CAGR over the forecast period.The aging population in the UK, prone to venous ulcers, foot ulcers, and edema, necessitates the use of compression therapy to prevent recurrence & manage symptoms. The high incidence of DVT, affecting 1 to 2 out of every 1,000 people annually, which increases with age, underscores the importance of compression therapy in DVT management. Compression therapy, including compression hosiery, bandaging, or other devices, plays a critical role in DVT management.

The compression therapy market in France is expected to grow at the fastest CAGR over the forecast period, owing to the rising geriatric population and increasing prevalence of CVDs in this region.

Germany compression therapy market is anticipated to witness a steady CAGR over the forecast period. The increasing demand for better healthcare facilities and equipment, the aging population, and the growing prevalence of chronic diseases are driving the demand for compression therapy.

Asia Pacific Compression Therapy Market Trends

The compression therapy market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. The market in the Asia Pacific region has been experiencing significant growth, driven by several key factors, such as the increasing prevalence of chronic diseases, including venous disorders, lymphedema, and DVT, among the region's population. According to an article published in 2023, “Epidemiology and prevention of venous thromboembolism,” in Asia, the rates of VTE are lower than in Europe and the U.S. For instance, the incidence of VTE in South Korea was estimated to be 0.2 per 1,000 person-years. Moreover, the rising geriatric population, coupled with the growing awareness about the benefits of compression therapy in managing such conditions, has further fueled market expansion. Technological advancements, such as innovative compression garment designs & materials, have enhanced patient comfort and compliance, boosting market demand.

China compression therapy market is expected to grow at the fastest CAGR over the forecast period,owing to the growing geriatric population and the increasing prevalence of chronic disorders, such as diabetes & cardiovascular conditions, which have heightened the demand for compression therapy products.

The compression therapy market in India is propelled by factors such as the country’s escalating burden of chronic diseases, such as diabetes, obesity, and venous disorders. These diseases necessitate effective management of related symptoms such as poor circulation and swelling, thereby driving demand for compression therapy solutions. For instance, as per the Indian Council of Medical Research, India Diabetes (ICMR INDIAB) study published in 2023, the prevalence of diabetes is 10.1 crores.

Japan compression therapy market is expected to grow at the fastest CAGR over the forecast period, owing to several key factors, such as the rising geriatric population, technological advancements, and product innovations.

Middle East & Africa Compression Therapy Market Trends

The compression therapy market in Middle East and Africa is expected to witness a significant CAGR during the forecast period, due to increasing investments in healthcare infrastructure, and rising prevalence of chronic diseases. Advancements in the healthcare system are expected to boost the development of the medical device industry in this region. Growing health insurance penetration, increasing privatization, and rising regional disease burden are factors expected to drive regional market growth.

Saudi Arabia compression therapy market is expected to grow at the fastest CAGR over the forecast period. In Saudi Arabia, the prevalence of CVI is significantly high, with 45.6% of the adult population affected, especially in the Western region. This high prevalence, higher than in Western countries, is linked to lifestyle factors and risk factors such as age, family history, prolonged standing occupation, and use of hormonal therapy. This scenario presents a competitive market for CVI treatment products and services, emphasizing the need for innovative solutions & targeted interventions to address the prevalent risk factors.

The compression therapy market in Kuwait is expected to grow at a significant CAGR over the forecast period, due to escalating prevalence of chronic conditions and rising healthcare expenditure.

Here are several key advancements in the area of compression garments:

-

Modern compression garments use breathable fabrics, moisture-wicking technology, and antimicrobial and hypoallergenic materials to improve comfort, reduce skin irritation, and prevent bacterial growth, while also reducing the risk of allergies and skin irritation

-

Advanced knitting techniques enable varying compression levels within a garment, enhancing blood circulation by being strongest at the extremities and decreasing towards the core

-

Advancements in body scanning and 3D printing technology enable personalized compression garments, providing optimal comfort and minimal waste, while 3D knitting technology enhances comfort and sustainability

-

Modern compression garments use embedded sensors to monitor physiological parameters, enabling real-time performance optimization and health monitoring. Integration with mobile apps allows users to track progress, adjust training or treatment, and share information

-

Compression garments offer fashionable options in various colors, patterns, and styles, and are designed for specific user groups like pregnant women, athletes, or patients recovering from specific surgeries

-

Modern compression garments are enhanced by durable fabrics and easy care routines, making them resistant to wear and tear, deformation, and loss of compression

A patient-centric approach to compression therapy: the use and adoption of a novel mobile application to support the clinical selection of medical compression hosiery

Compression therapy is widely recognized as an effective treatment option for the management of lower limb conditions; however, clinicians do not always apply it appropriately. A lack of knowledge and clinical uncertainty, combined with an increased workload and less time with patients, might lead to inappropriate compression decisions.

A research article published in wound.uk, in November 2023 studied the use of the Hosiery Hunter app (medi UK) and its role in clinical decision-making. The Hosiery Hunter app is a new mobile application that simplifies the selection of medical compression hosiery for patients with lower limb conditions. According to qualitative data from a user feedback survey, the Hosiery Hunter app made it easier to choose the most suitable compression therapy, saved time and delivered swift and timely access to codes for prescription.

Clinical Results and Studies

Tactile Medical has invested in several research studies that generate clinical and economic outcome data supporting their product and demonstrate its effectiveness.To date, more than 25 studies concerning the safety and efficacy of the firm’s products have been completed, in which above 2,100 subjects have been included. Few of them studying the efficacy of Flexitouch System are listed below:

-

Economic Impact of Tactile Medical’s Flexitouch System in Patients with Phlebolymphedema

-

Impact on Clinical Outcomes and Healthcare Costs with Use of Flexitouch System

-

Flexitouch System Impact on Limb Volume and Patient-Reported Outcome

-

Comparison of Flexitouch System with Simple Pneumatic Compression Devices

-

Study of Patient-Reported Satisfaction with Use of Flexitouch System

-

Flexitouch System Impact on Patient-Reported Improved Quality-of-Life

Shift Towards E-commerce

Digitalization transforms the way the company markets and sell products, solutions, and services, as well as build relationships with consumers, patients, and caregivers. Essity's focus on digital channels reflects a broader trend in the industry towards investing in e-commerce to cater to evolving consumer needs and behaviors.

Essity has expanded its distribution channels from offline to digital in recent years. Digital interactions with customers and consumers help understand their needs and improve communication and engagement. In 2023, Essity's e-commerce sales increased by 9.8% to SEK 14 billion (USD 1.29 billion), accounting for roughly 9% of the company's net sales. In addition, Direct-to-Consumer marketing can help attract new customers, strengthen existing relationships, and increase brand loyalty.

Key Compression Therapy Company Insights

Cardinal Health, Julius Zorn GmbH, 3M Health Care, Spectrum Healthcare, Bio Compression Systems, Inc., Stryker, and Gottfried Medical are some of the major players in the global market. The market has been witnessing notable trends that are impacting the activities of emerging players in the industry. These companies offer a wide range of compression garments, stockings, wraps, and devices for various medical conditions, including venous disorders, lymphedema, and wound healing. A growing number of emerging players and startups are also entering the market, offering innovative solutions and disrupting traditional market dynamics. These companies often focus on niche segments or develop novel technologies to address unmet needs in wound care management and vascular health.

Moreover, advancements in compression therapy technologies have led to the development of innovative products and treatment modalities. Some notable advancements include smart compression technology, 3D printing, gradient compression systems, cold compression therapy, and hydrotherapy compression devices. In addition, companies in the global market are increasingly focusing on developing patient-centric solutions that prioritize comfort, convenience, and usability.

Key Compression Therapy Companies:

The following are the leading companies in the compression therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Essity Aktiebolag (publ).

- Cardinal Health

- Julius Zorn GmbH

- Hartmann AG

- Medi GmbH & Co.

- SIGVARIS

- BSN Medical GmbH

- ArjoHuntleigh

- 3M Health Care

- Spectrum Healthcare

- Bio Compression Systems, Inc.

- Stryker

- Gottfried Medical

- Tactile Medical

Recent Developments

-

In November 2024, Cardinal Health launched the Kendall SCD SmartFlow Compression System, an advanced medical device designed to enhance venous thromboembolism prevention in hospitalized patients. The system provides sequential compression therapy, which helps reduce the risk of deep vein thrombosis and pulmonary embolism.

-

In November 2024, Scottish scientists from the University of Edinburgh developed a low-cost, flexible device to prevent blood clots. This represents a significant advancement in post-surgical care, particularly for patients at risk of developing conditions like deep vein thrombosis (DVT). The device, a polymer-based sensor, fits under bandages and compression stockings and uses a handheld reader to measure whether the bandage exercises the correct pressure on the body.

-

In October 2024, Tactile Medical launched the next-generation Nimbl Pneumatic Compression Platform, designed to enhance lymphedema management. This chronic condition results in swelling in the arms or legs due to a blockage in the lymphatic system. This innovative platform offers an advanced solution for patients suffering from lymphedema, providing an improved, more comfortable, and effective form of treatment.

-

In June 2023, Medi GmbH & Co. introduced new medical compression offerings, including circular & flat-knit variants, designed to cater to diverse needs and preferences in the healthcare sector

-

In October 2023, MediWound announced its strategic partnership with 3M Health Care for EscharEx’s Phase III Clinical Trial, strengthening their alliance in the medical industry

Compression Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.43 billion

Revenue forecast in 2030

USD 5.34 billion

Growth rate

CAGR of 3.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Technology, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Essity Aktiebolag (publ); Cardinal Health; Julius Zorn GmbH; Hartmann AG; Medi GmbH & Co.; SIGVARIS; BSN Medical GmbH; ArjoHuntleigh; 3M Health Care; Spectrum Healthcare; Bio Compression Systems, Inc.; Stryker; Gottfried Medical; Tactile Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Compression Therapy Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global compression therapy market report based on technology, end-use, distribution channel, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Static Compression Therapy

-

Compression Bandages

-

Compression Stockings

-

Compression Tape

-

Others Compression Garments

-

-

Dynamic Compression Therapy

-

Compression Pumps

-

Compression Sleeves

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global compression therapy market size was estimated at USD 4.25 billion in 2024 and is expected to reach USD 4.43 billion in 2025.

b. The global compression therapy market is expected to grow at a compound annual growth rate of 3.80% from 2025 to 2030 to reach USD 5.34 billion by 2030.

b. North America dominated the compression therapy market, with a share of 42.43% in 2024. This is attributable to favorable government reimbursement plans, the high incidence of chronic venous disorders, and the growing healthcare awareness level.

b. The key players operating in the compression therapy market are EBio Compression Systems, Inc., Cardinal Health, 3M, Juzo, PAUL, HARTMANN AG, medi GmbH & Co. KG, SIGVARIS GROUP, BSN Medical GmbH (Essity Health & Medical), Arjo (GETINGE GROUP), Smith+Nephew, Tactile Systems Technology Inc., Zimmer Biomet, DJO, LLC, Lympha Press USA, and Medline.

b. Key factors that are driving the market growth include the increasing prevalence of venous disorders, rising significance in the treatment of sports injuries and a significant increase in orthopedic surgeries across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.