Composite Doors And Windows Market Size, Share & Trends Analysis Report By Resin Type (Polyester, PVC), By End Use, And By Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-432-8

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

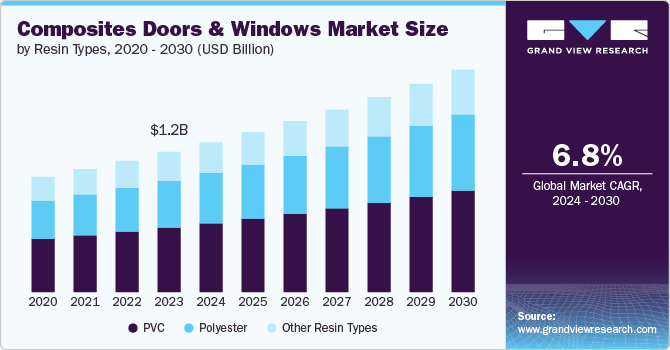

The global composite doors and windows market was estimated at USD 1.22 billion in 2023 and is forecasted to grow at a CAGR of 6.8% from 2024 to 2030. This growth is attributed to the strength and resistance to weathering of composite doors and windows, which reduces the need for frequent maintenance compared to traditional materials. Furthermore, these products often offer superior thermal insulation, which helps in reducing energy consumption for heating and cooling, appealing to energy-conscious consumers.

Composite materials have the ability to be designed to imitate various traditional finishes, such as wood, while providing a modern, sleek look, offering aesthetic flexibility. In addition to this, increasing awareness of environmental sustainability is driving the adoption of composite materials, which are often designed to be more eco-friendly compared to conventional materials.

The production process for composite materials can be more complex and resource-intensive, potentially leading to higher production costs and longer lead times. Furthermore, a few other factors such as limited market penetration and lower brand awareness in certain regions can restrict the growth of composite window and door products. These products can also have a higher upfront cost compared to traditional materials like vinyl or aluminum, which might impact their adoption by budget-conscious consumers.

Technological advancements in terms of composite materials and manufacturing processes can lead to improved product performance and reduced costs, further driving market growth. Moreover, policies and incentives promoting energy efficiency and sustainable building practices can boost the adoption of composite windows and doors over coming years.

Expansion of construction activities, especially in emerging markets, provides significant growth opportunities for composite windows and doors. In addition to this, increasing trend of home renovations and retrofits offers a substantial opportunity for composite windows and doors as replacements for outdated or less efficient products.

Resin Type Insights

Based on resin, market is segmented into PVC and polyester. PVC dominated the market with a revenue share of 46% in 2023 and is further expected to grow at a significant rate over forecast period. PVC resins are generally more affordable than polyester resins, which can make them a more attractive option for budget-conscious projects. Furthermore, PVC windows and doors are highly regarded for their low maintenance needs. They do not require painting and are easy to clean, which makes them a popular choice in residential application. Additionally, rise in green building practices and energy efficiency standards supports the use of PVC due to its insulating properties.

Polyester resins are known for their excellent durability and resistance to environmental factors, such as UV radiation and moisture, making them suitable for windows and doors exposed to varying weather conditions. Due to their strength and aesthetic flexibility, polyester resin composites are used in manufacturing both residential and commercial windows and doors.

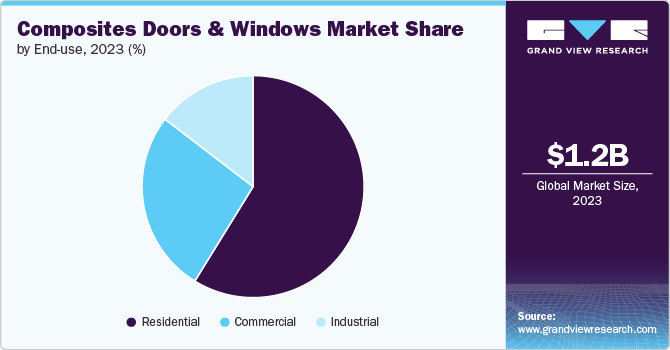

End Use Insights

Based on end use, the market is segmented into residential, commercial, and industrial. Among these, residential end use accounted for largest revenue share of 58.7% in 2023 and is further expected to grow at a fastest rate over forecast period. Composite windows and doors used in residential buildings often emphasize on aesthetic appeal and design flexibility. Furthermore, as the importance of energy efficiency is increasing, consumers are inclining over this material as it offers superior insulation properties, helping to reduce energy consumption for heating and cooling.

In commercial end use, composite windows and doors which can withstand high traffic and heavy use are installed. Furthermore, commercial applications often require enhanced security features and performance standards, including sound insulation and fire resistance. These factors are further driving product demand as composite materials can be engineered to meet these requirements. In addition to this, commercial buildings are increasingly focusing on green building certifications, which drive the demand for energy-efficient and sustainable composite products.

Regional Insights

The composites doors and window market in North America is expected to grow at a significant pace over years. This demand is supported by strong focus on energy efficiency, driven by regulations and consumer awareness. In addition to this, North America has presence of areas consisting of harsh climates, which increases the demand for product as these provide better durability and weather resistance compared to traditional materials.

U.S. Composites Doors and Windows Market Trends

The U.S. composite doors and windows market is growing at a CAGR of 6.8% over the forecast period. The U.S. has adopted various energy efficiency standards and codes that encourage the use of composite materials for their superior insulating properties. Furthermore, the presence of robust home renovation market contributes to the demand for composite windows and doors, as homeowners seek upgrades that offer long-term benefits.

Asia Pacific Composite Doors And Windows Market Trends

The composite doors and windows market in Asia Pacific dominated in 2023 with the revenue share of 43.1% and is further expected to grow at a significant rate over forecast period. Asia Pacific is experiencing rapid urbanization and growth in construction activities, increasing the demand for modern, durable composite windows and doors.

Europe Composites Doors And Windows Market Trends

Europe Composite Doors and Windows Market is projected to witness growth owing tohas stringent building codes and regulations aimed at improving energy efficiency. Composite windows and doors, known for their superior insulation properties, align well with these regulations, which supports market growth in region.

Key Composite Doors And Windows Company Insights

Some of the key players operating in the market Andersen Corporation and The Pella Corporation:

-

Andersen Corporation offers awnings, bay and bow, casement, double- & single-hung, gliding, picture, specialty, and pass-through windows. This company has categorized its products under series including E-series, A-series, big doors, 400 series, 200 series, 100 series, Andersen aluminum, and renewable by Andersen. Furthermore, its products are manufactured from several materials such as wood, vinyl, composite, fiberglass, and aluminum.

-

The Pella Corporation offers windows and doors for residential and commercial applications such as educational facilities, multifamily buildings, healthcare buildings, office buildings, and commercial hospitality windows. It offers casement, awning, specialty, double-hung, single-hung, and sliding windows. In addition to this, it offers patio, front, and storm doors of various types.

Starline uPVC Window Systems and Fenesta are some of the emerging participants in the market.

-

Starline uPVC Window Systems is engaged in manufacturing and installing uPVC doors and windows. Its window types include grill, sliding, trapezoid, casement, fixed, fixed panel, top hung, vertical slider, arch, and bay. Furthermore, its door types include sliding, tilt, casement, and multi-fold.

-

Fenesta is involved in manufacturing of windows, doors, and accessories. It offers aluminum and uPVC windows, glass panel and solid panel doors, and various accessories such as georgian bar, sliding bug screen, pull down bug screen, pleated bug screen, grill blocks, decorative trims, and handles.

Key Composite Doors And Windows Companies:

The following are the leading companies in the composite doors and windows market. These companies collectively hold the largest market share and dictate industry trends.

- Andersen Corporation

- The Pella Corporation

- Profine International Group

- Starline uPVC Window Systems

- Marvin

- Prestige Windows and Doors

- Signature Windows & Doors

- Fenesta

- Windoorz Inc

- PolyTech Products LTD

Recent Developments

-

In March 2022, Marvin announced the expansion of its operations in the West Fargo distribution center located in West Fargo, New Dakota. This is expected to help the company grow its footprint in New Dakota and offer over 150 job opportunities to the people.

Composite Doors And Windows Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.30 billion |

|

Revenue forecast in 2030 |

USD 1.93 billion |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Resin type, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina |

|

Key companies profiled |

Andersen Corporation; The Pella Corporation; Profine International Group; Starline uPVC Window Systems; Marvin; Prestige Windows and Doors; Signature Windows & Doors; Fenesta; Windoorz Inc; PolyTech Products LTD |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Composite Doors And Windows Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the composite doors and windows market based on resin type, end use, and region:

-

Resin Type Outlook (Revenue, USD Million; 2018 - 2030)

-

PVC

-

Polyester

-

Other Resin Types

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global composite doors and windows market size was estimated at USD 1.22 billion in 2023 and is expected to reach USD 1.30 billion in 2024.

b. The global composite doors and windows market is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030 to reach USD 1.93 billion by 2030.

b. Residential end use accounted for largest revenue share of 58.7% in 2023 as composite windows and doors are used in residential buildings as they often emphasize on aesthetic appeal and design flexibility.

b. Some key players operating in the composite doors and windows market include Andersen Corporation, The Pella Corporation, Profine International Group, Starline uPVC Window Systems, Marvin, Prestige Windows and Doors, Signature Windows & Doors, Fenesta, Windoorz Inc, and PolyTech Products LTD.

b. The key factors that are driving the composite doors and windows market growth is the strength and resistance to weathering of composite doors and windows, which reduces the need for frequent maintenance compared to traditional materials.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."