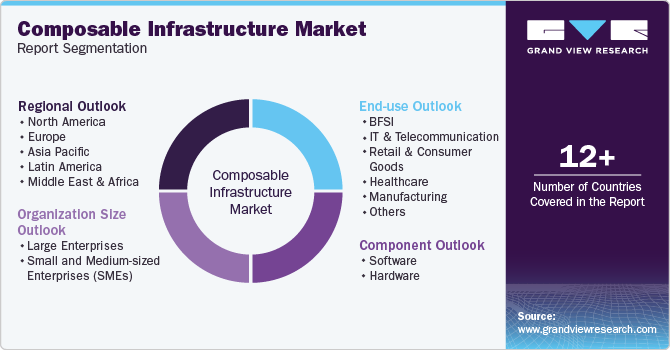

Composable Infrastructure Market Size, Share, & Trends Analysis Report By Component (Software, Hardware), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises), By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-491-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Composable Infrastructure Market Trends

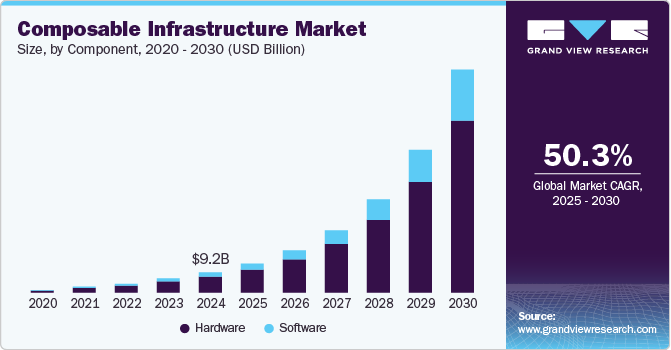

The global composable infrastructure market size was estimated at USD 9.23 billion in 2024 and is projected to grow at a CAGR of 50.3% from 2025 to 2030, driven by the increasing demand for agile, scalable, and cost-efficient IT infrastructure. Organizations in sectors such as IT, telecommunications, and financial services are seeking solutions that allow them to dynamically allocate resources based on workload needs. Composable infrastructure enables businesses to break down traditional hardware silos, using software-defined approaches to optimize the usage of computing, storage, and networking resources, making it more adaptable to changing demands.

Another growth driver is the rising adoption of cloud-native technologies and hybrid cloud models. Composable infrastructure supports the seamless integration of on-premise and cloud environments, which is essential for enterprises that are transitioning to cloud-based applications. The flexibility to pool and manage resources across these environments allows organizations to improve efficiency, reduce operational costs, and enhance performance, driving market adoption.

The shift towards automation and the increasing implementation of DevOps practices also contribute to the growth of the composable infrastructure market. Businesses are investing in automation tools that can accelerate the development and deployment of applications while minimizing human intervention. Composable infrastructure's ability to provide on-demand provisioning of resources, which are aligned well with the automation needs of modern IT environments.

The rise of data-intensive workloads and applications such as artificial intelligence (AI), machine learning (ML), and big data analytics is also propelling the growth. These applications require vast computational resources and high-performance storage systems that can be dynamically allocated based on demand. Composable infrastructure enables organizations to manage and scale these resources efficiently, ensuring they can support the heavy data processing and storage requirements without overprovisioning or underutilizing hardware. The ability to optimize resources in real-time, especially for AI and analytics, is a critical factor pushing the adoption of composable systems. For instance, in October 2024, Thread AI, a U.S.-based Developer of a service collaboration platform launched its composable AI infrastructure platform, Lemma, designed to help enterprises streamline the design, implementation, and management of AI workflows. The platform integrates previously incompatible systems into a unified, secure environment, enabling companies to build automated, mission-critical workflows while incorporating key constraints such as cost and human-in-the-loop processes.

Component Insights

The hardware segment accounted for the largest revenue share of over 79.0% in 2024, owing to the increasing demand for modular, high-performance servers, storage systems, and networking components that can be flexibly assembled and reconfigured based on workload needs. With its fixed configurations, traditional hardware infrastructure struggles to keep up with dynamic computing demands, prompting enterprises to invest in composable systems. These hardware solutions allow for efficient resource utilization, enabling organizations to optimize their data center operations by scaling computing power, memory, and storage independently.

The software segment is expected to grow at a CAGR of 52.7% over the forecast period as organizations increasingly adopt software-defined solutions to enhance flexibility and resource management. The rising demand for software-defined infrastructure (SDI) platforms enables the decoupling of hardware from software. These platforms allow organizations to dynamically allocate computing, storage, and networking resources, providing greater agility and control over their IT environments.

Organization Insights

The large enterprises segment accounted for the largest revenue share of over 60.0% in 2024. Large enterprises typically operate extensive data centers, manage vast amounts of data, and support multiple business-critical applications. Composable infrastructure offers these organizations the ability to allocate computing, storage, and network resources, optimizing the use of their infrastructure to handle varying workloads. This flexibility allows large enterprises to better respond to changing business needs without requiring significant overhauls of their existing hardware, ensuring operational efficiency and cost-effectiveness.

The SMEs segment is expected to grow at a significant CAGR over the forecast period increasing adoption of cloud and hybrid IT environments. SMEs rapidly embrace cloud technologies to gain flexibility, efficiency, and access to advanced tools. Composable infrastructure aligns with this shift by seamlessly integrating on-premise and cloud resources. SMEs can dynamically configure their IT environments to support cloud-native applications and hybrid workloads, enabling them to leverage the best of both worlds.

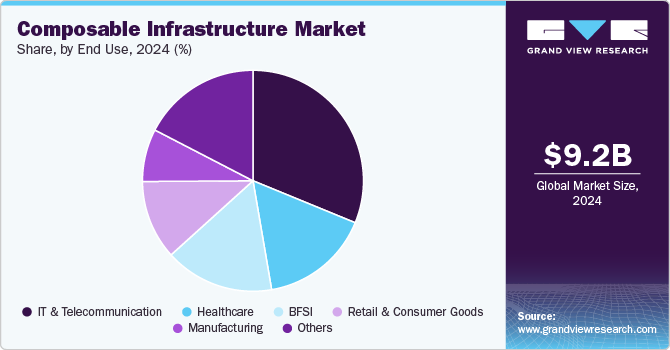

End Use Insights

The IT & telecommunication segment accounted for the largest revenue share of over 31.0% in 2024, driven by the rising adoption of edge computing and network function virtualization (NFV) in the telecom industry. Telecom operators are moving towards decentralized architectures to support edge devices, reduce latency, and improve service delivery. Composable infrastructure helps facilitate this shift by allowing the telecom sector to deploy and manage resources close to the network edge, ensuring faster response times and efficient use of computing and storage resources.

The healthcare segment is expected to grow at a significant CAGR over the forecast period owing to the increasing volume of healthcare data generated from electronic health records (EHRs), medical imaging, wearable devices, and telemedicine. The scale of data requires a flexible and scalable IT infrastructure that can accommodate real-time data processing and analytics. Composable infrastructure allows healthcare organizations to allocate resources as needed, ensuring that they can handle large data volumes without compromising performance.

Regional Insights

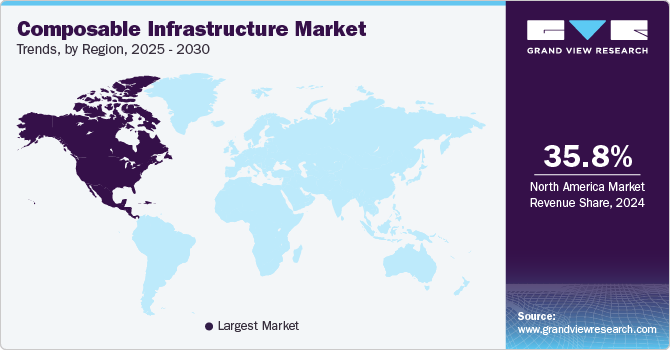

The composable infrastructure market in North America held a share of over 35.0% in 2024 due to the significant presence of large enterprises and technology companies that are heavily investing in digital transformation initiatives. Organizations in sectors such as finance, healthcare, and telecommunications are increasingly adopting composable infrastructure to enhance operational efficiency, agility, and scalability. The ability to dynamically manage and allocate resources is critical for these companies as they seek to optimize their IT environments and respond quickly to changing market demands.

U.S. Composable Infrastructure Market Trends

The composable infrastructure market in the U.S. is expected to grow significantly at a CAGR of 46.5% from 2025 to 2030. Security and compliance concerns are also significant drivers in the U.S. market. With an increasing number of cyber threats and stringent regulatory requirements, organizations are prioritizing secure IT infrastructure. Composable infrastructure offers enhanced security features, allowing businesses to isolate sensitive data and applications while complying with industry standards. This capability is particularly crucial in heavily regulated sectors such as healthcare and finance, where data protection is a legal obligation.

Europe Composable Infrastructure Market Trends

The composable infrastructure market in Europe is growing with a significant CAGR from 2025 to 2030. The growth of hybrid and multi-cloud strategies in Europe plays a crucial role in driving the composable infrastructure market. Organizations are increasingly leveraging a combination of on-premises, private, and public cloud resources to optimize their IT environments. Composable infrastructure provides the flexibility needed to manage these diverse environments efficiently.

The UK composable infrastructure market is expected to grow rapidly in the coming years. With the growing adoption of IoT devices and applications, there is an increasing demand for edge computing solutions that can process data closer to its source. Composable infrastructure facilitates the efficient management of distributed resources, enabling organizations to support edge computing applications effectively.

The composable infrastructure market in Germany held a substantial market share in 2024. As German manufacturers strive for greater efficiency and connectivity through smart manufacturing technologies, they require flexible and scalable IT infrastructure that can support real-time data processing, IoT integration, and advanced analytics. Composable infrastructure provides the agility needed to manage these complex environments, enabling manufacturers to optimize operations and enhance productivity.

Asia Pacific Composable Infrastructure Market Trends

Asia Pacific is growing significantly at a CAGR of 54.5% from 2025 to 2030, owing to the growing adoption of cloud services and hybrid cloud models. As businesses in the Asia Pacific region seek to leverage the benefits of cloud computing, composable infrastructure provides a seamless way to integrate on-premise resources with cloud services. This flexibility allows organizations to optimize their resource usage, improve performance, and reduce costs, which is especially important for SMEs looking to scale their operations without significant upfront investments. The region's increasing reliance on cloud-based solutions is thus driving the demand for composable infrastructure.

The Japan composable infrastructure market in is expected to grow rapidly in the coming years due to the increasing demand for automation and efficiency in IT operations. As organizations seek to automate processes and reduce manual intervention, composable infrastructure aligns well with these goals by facilitating on-demand provisioning and resource management.

The China composable infrastructure market held a substantial market share in 2024, owing to the government's push towards digital innovation and smart manufacturing. The Chinese government has set ambitious goals to enhance the country’s technological capabilities through initiatives such as Made in China 2025 and Internet Plus. These strategies aim to modernize traditional industries and promote the integration of advanced technologies. Composable infrastructure supports these initiatives by providing a scalable and agile IT environment that can adapt to the evolving needs of smart manufacturing, IoT, and other emerging technologies.

Key Composable Infrastructure Company Insights

Some of the key companies in the composable infrastructure market include Hewlett Packard Enterprise Development LP, Cisco Systems, Inc., Dell Technologies Inc., Huawei Technologies Co., Ltd., Lenovo Group Limited, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Composable Infrastructure Companies:

The following are the leading companies in the composable infrastructure market. These companies collectively hold the largest market share and dictate industry trends.

- Hewlett Packard Enterprise Development LP

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Huawei Technologies Co., Ltd.

- Inspur Group Co., Ltd.

- Lenovo Group Limited

- NEC Corporation

- NTT Ltd.

- SAP SE

- TidalScale, Inc.

Recent Developments

-

In March 2024, SAP SE launched a new composable payment solution, the SAP Commerce Cloud open payment framework, designed to help retailers adapt to evolving customer expectations. This solution enhances agility by integrating SAP Commerce Cloud with various third-party payment service providers, including Adyen, Stripe, Worldpay, and Airwallex, based on specific use cases. SAP SE's composable architecture allows retailers to select payment partners that align with their needs, enabling them to scale their businesses rapidly without relying on a single provider.

-

In March 2024, Accenture finalized its acquisition of Mindcurv, a German cloud-native company focused on digital experience and data analytics specializing in composable software, digital engineering, and commerce services. This acquisition enhances Accenture Song, the tech-powered creative group, allowing it to expand its commerce services for clients on a global scale.

Composable Infrastructure Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.24 billion |

|

Revenue forecast in 2030 |

USD 101.55 billion |

|

Growth rate |

CAGR of 50.3% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2030 |

|

Report component |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, organization size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Hewlett Packard Enterprise Development LP; Cisco Systems, Inc.; Dell Technologies Inc.; Huawei Technologies Co., Ltd.; Inspur Group Co., Ltd.; Lenovo Group Limited; NEC Corporation; NTT Ltd.; SAP SE; TidalScale, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Composable Infrastructure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the composable infrastructure market report based on component, organization, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Hardware

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecommunication

-

Retail & Consumer Goods

-

Healthcare

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global composable infrastructure market size was estimated at USD 9.23 billion in 2024 and is expected to reach USD 13.24 billion in 2025.

b. The global composable infrastructure market is expected to grow at a compound annual growth rate of 50.3% from 2025 to 2030 to reach USD 101.55 billion by 2030.

b. The composable infrastructure market in North America held a share of over 35.0% in 2024 due to the significant presence of large enterprises and technology companies that are heavily investing in digital transformation initiatives. Organizations in sectors such as finance, healthcare, and telecommunications are increasingly adopting composable infrastructure to enhance operational efficiency, agility, and scalability.

b. Some key players operating in the composable infrastructure market include Hewlett Packard Enterprise Development LP, Cisco Systems, Inc., Dell Technologies Inc., Huawei Technologies Co., Ltd., Inspur Group Co., Ltd., Lenovo Group Limited, NEC Corporation, NTT Ltd., and SAP SE, TidalScale, Inc.

b. Organizations, in sectors such as IT, telecommunications, and financial services, are seeking solutions that allow them to dynamically allocate resources based on workload needs. Composable infrastructure enables businesses to break down traditional hardware silos, using software-defined approaches to optimize the usage of computing, storage, and networking resources, making it more adaptable to changing demands.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."