Complementary And Alternative Medicine Market Size, Share & Trends Analysis Report By Intervention (Botanicals, Mind Healing, Body Healing, External Energy, Sensory Healing), By Distribution Method, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-725-4

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The global complementary and alternative medicine market size was valued at USD 144.68 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 25.3% from 2024 to 2030. The growing awareness regarding Complementary and Alternative Medicine (CAM), increasing disposable income, and government initiatives to boost CAM are some of the major factors driving the market growth.

Rising adoption of electronic methods is also expected to boost the market growth as this increases reach of many alternative treatments and supplements. In order to increase penetration rate of CAM, several governments and regulatory bodies are undertaking efforts for finding clinical support for considering these techniques as alternative medicines.

In addition, increased penetration of the internet and social media to promote & offer CAM services or therapies has strengthened the market. For instance, The Healing Company Ltd. treats individuals through energy healing techniques and offers distance healing therapies using a teleconference or video conference. Many natural supplements and botanicals are made available online to improve product reach. Virtual reality and holographic presence have proven their potential to enhance treatment methods and their accessibility.

Meanwhile, Coworth Park introduced a new Hebridean sound treatment in October 2023. This exceptional offering provides individuals with a calming sound therapy experience, offering a moment of relaxation and revitalization. Sound therapy, known for its calming effects, adds another dimension to the growing array of wellness offerings, highlighting the industry's commitment to holistic well-being.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. Alternative medicine is overly reliant on technology. However, advancements such as increasing internet usage, are driving the sale of these products via online distribution channels, and even Yoga classes are being conducted online. Growing incidence of chronic diseases, rising geriatric population, and increasing awareness regarding Complementary & Alternative Medicine (CAM) are driving its adoption. As per reports from the National Center for Complementary and Integrative Health, around 40% of American adults and 12% children use some form of alternative medicine for treatment of chronic disease and general health.

The space witnesses a notable M&A and products launches activity by the leading players. For instance, in January 2023, Adoratherapy launched its Alkemie Chakra Healing line, an innovative offering comprising dry touch body oils, body lotions, lotion candles, and aroma perfume sprays, all infused with scents carefully designed to foster balance and healing through the power of aromatherapy. Aromatherapy harnesses the therapeutic potential of essential oils, making it a significant addition to the wellness landscape.

While most of the products or services offered as a part of CAM need to be registered with country-specific regulatory bodies, and there are no stringent requirements in terms of product quality orefficacy. For instance, Ayurvedic practices are a state issue, and the states only are required to register such practices, however, no license is required to sell ayurvedic medicines

Factors such as lack of specific regulations for alternative medicine such as auriculotherapy, osteomyology, therapeutic touch, and aromatherapy, among others, may lead to low adoption of these therapies. In addition, ayurvedic and homeopathic treatments are not covered in insurance plans, due to which patients have to pay out-of-pocket for these treatments.

Regulatory organizations are also working on the development of medical tourism, which attracts people from all over the world and allows them to seek world-class alternative medical care. For instance, in several areas, Indian regulatory authorities have made major investments in the creation and standardization of alternative medical services. In India, a government entity known as the "Ministry of Ayush" has been established to oversee education, product creation, research, and other services related to yoga, ayurveda, homeopathy, and naturopathy.

Conventional medicine still serves as a notable alternative to CAM, but the increasing consumer inclination toward holistic health and wellness sustains the demand for CAM therapies such as acupuncture and naturopathy, indicating the enduring popularity of alternative treatments.

Intervention Insights

In 2023, traditional alternative medicine dominated the complementary and alternative medicine market with a share of 34.02%. The traditional alternative medicine/botanicals segment has been growing at a lucrative growth rate as more people turn to natural remedies for a variety of health concerns. As consumer demand increased, many companies expanded their product lines to include more natural remedies and botanicals. For instance, the wellness company GNC now offers a wide range of herbal supplements, including ashwagandha, echinacea, and turmeric. Ayurveda subsegment is expected to dominate the traditional alternative medicine market owing to technological advancements and increased government support. The Ayurveda market is leveraging technology to improve product quality, increase efficiency, and enhance the consumer experience. For instance, the Indian government launched a digital platform called the Ayurveda Health and Wellness Centre to provide telemedicine and e-consultation services to patients.

The mind healing segment is anticipated to witness the fastest growth rate between 2024 and 2030. The mind healing market presents several opportunities for growth, including development of new mental health treatments and therapies, expansion of mental health services to underserved populations, and integration of mental healthcare into primary care. For instance, integration of mental healthcare into primary care has been an area of growth in recent years. Many primary care clinics now offer mental health services alongside physical health services, which has helped increase the accessibility of mental healthcare and reduce the stigma surrounding mental health treatment. Transcendental Meditation (TM) subsegment is expected to dominate the mind healing market driven by programs and institutes such as the Maharishi University of Management in Iowa, U.S., which offers a comprehensive education in transcendental meditation and its related practices.

Distribution Method Insights

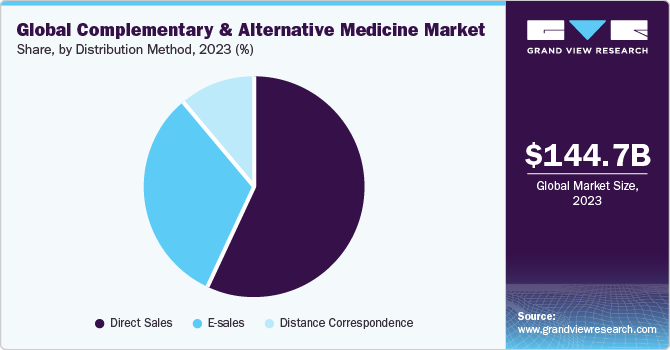

In 2023, direct sales had the largest revenue size. This can be attributed to high rates of self-prescribed use of Complementary and Alternative Medicine (CAM) products, especially botanicals and traditional medicine. Pharmacists and healthcare professionals are recommended to conduct community-based programs aimed at spreading awareness about botanicals, which can boost the usage of CAM services accessed directly by physicians.

E-sales distribution channel is expected to grow at a fastest CAGR over the forecast period due to increased adoption of internet and online methods, such as video training, to communicate & train the patient. Several CAM treatments, such as hypnotherapy, meditation, yoga, and energy healing, can be conducted through videos, e-manuals, e-teaching including hypnotism, and making mind-influencing speeches, sounds, & music. This method of alternative treatment is growing rapidly owing to the penetration of internet-based A/V learning and coaching practices around the world, enabling patients to access these treatments via electronic means. This is strongly supported by many factors, such as increasing investments in the improvement of internet connectivity, rising adoption of mobile devices, and awareness created through social media.

Regional Insights

Europe held the largest share of 33.98% in 2023 of the complementary & alternative medicine market. UK dominates the complementary & alternative medicine industry in Europe. Acupuncture, chiropractic, homoeopathy, hypnosis, medical herbalism, and osteopathy together account for about USD 543.71 million in annual spending in UK, where over four out of ten people use complementary medicine at some point in their lives. 60% of people with musculoskeletal disorders and arthritis, whose symptoms are frequently chronic, are especially drawn to these medications. Additionally, it is reported that 92% of the public wants alternative therapies to be enlisted by NHS, however, it has limited coverage for alternative therapies. NHS states that it does not cover most of the therapies and in contrast, recommends consulting a general practitioner in the first instance.

Asia Pacific is expected to grow at a lucrative rate during the forecasted period. The increased demand for herbal supplements is driving the expansion of the complementary & alternative medicine industry in Asia-pacific. China held the largest market share and India is estimated to grow at a fastest CAGR over the forecast period. A study says that about 80% of people in China opt for traditional medicine supplements, reiki, and acupuncture to cure chronic illnesses and many other diseases. China also has abundant resources to continue using alternative medicine for a long time.

Additionally, as per the NCBI article published in September 2023, the National Medical Commission (NMC) in India made it a requirement for each medical college to establish a "Department of Integrative Medicine Research." This move aims to foster the collaboration of modern medicine with practices like homeopathy and traditional Indian medical systems such as Ayurveda. This development is anticipated to have a positive impact on industry growth.

Key Companies & Market Share Insights

Some of the key players operating in the industry John Schumacher Unity Woods Yoga Centre, Nordic Nutraceuticals, Pure encapsulations, LLC. The leading players in CAM industry are focusing on growth strategies, such as, services and product launches.

Siddhalepa Ayurveda GmbH, BGG Europe SA, DRONANIA pharmaceuticals GmbH are some of the emerging market participants in the space. Emerging companies are employing various strategies such as mergers & acquisitions to expand their footprint and grow at a fast pace.

Key Complementary And Alternative Medicine Companies:

- Columbia Nutritional

- Nordic Nutraceuticals

- Ramamani Iyengar Memorial Yoga Institute

- The Healing Company Ltd.

- John Schumacher Unity Woods Yoga Centre

- Sheng Chang Pharmaceutical Company

- Pure encapsulations, LLC.

- Herb Pharm

- AYUSH Ayurvedic Pte Ltd.

Recent Developments

-

In April 2023, SHA Wellness Clinic expanded its presence in the Middle East. This initiative was anticipated to boost the company’s overall revenue.

-

In March 2023, Ayurveda femtech brand Gynoveda secured USD 10 million in Series A funding, with India Alternatives Fund leading the investment. The funds will be utilized to intensify research and development efforts, introduce new Ayurvedic products, and enhance brand visibility. Gynoveda aims to expand its team to more than 50 members, focusing on ayurveda, technology, content, and community aspects to further support women's healthcare. The investment is expected to propel the company's growth trajectory.

-

In February 2023, NatureKue introduced Nafliva LiverSmart, a nutritional supplement, which helps promote healthy liver function. The active ingredient of this product includes combination of pu'er tea, known as Deepure tea extract, and silybin from Milk Thistle.

-

In February 2023, SEVA Experience entered into a partnership with The Standard, Huruvalhi Maldives for a wellness program, which included meditation, yoga, and holistic practices.

Complementary And Alternative Medicine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 179.17 billion |

|

Revenue forecast in 2030 |

USD 694.22 billion |

|

Growth rate |

CAGR of 25.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Intervention, distribution method, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Columbia Nutritional; Nordic Nutraceuticals; Ramamani Iyengar Memorial Yoga Institute; The Healing Company Ltd.; John Schumacher Unity Woods Yoga Centre; Sheng Chang Pharmaceutical Company; Pure encapsulations, LLC.; Herb Pharm; AYUSH Ayurvedic Pte Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Complementary And Alternative Medicine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, grand view research has segmented the global complementary and alternative medicine market report based on intervention, distribution method, and region:

-

Intervention Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Alternative Medicine/Botanicals

-

Ayurveda

-

Apitherapy

-

Bach Flower Therapy

-

Naturopathic Medicine

-

Traditional Chinese Medicine

-

Traditional Korean Medicine

-

Traditional Japanese Medicine

-

Traditional Mongolian Medicine

-

Traditional Tibetan Medicine

-

Zang Fu Theory

-

-

Mind Healing

-

Autosuggestion

-

Hypnotherapy

-

Neuro-linguistic Programming

-

Self-hypnosis

-

Spiritual Mind Treatment

-

Transcendental Meditation

-

-

Body Healing

-

Acupressure

-

Acupuncture

-

Alexander Technique

-

Auriculotherapy

-

Autogenic Training

-

Chiropractic

-

Cupping Therapy

-

Kinesiology

-

Osteomyology

-

Osteopathy

-

Pilates

-

Qigong

-

Reflexology

-

Yoga

-

-

External Energy

-

Magnetic Therapy

-

Bio-magnetic Therapy

-

Magnetic Resonance Therapy

-

-

Radionics

-

Reiki

-

Therapeutic Touch

-

Chakra Healing

-

Sensory Healing

-

-

Aromatherapy

-

Music therapy

-

Sonopuncture

-

Sound Therapy

-

-

-

Distribution Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Sales

-

E-sales

-

Distance Correspondence

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global complementary and alternative medicine market size was estimated at USD 117,210.3 million in 2022 and is expected to reach USD 144,676.5 million in 2023.

b. The global complementary and alternative medicine market is expected to grow at a compound annual growth rate of 25.1% from 2023 to 2030 to reach USD 694.22 billion by 2030.

b. Direct sales distribution dominated the complementary & alternative medicine market with a share of 57.4% in 2022. This is attributed to the fact that most frequently performed complementary and alternative therapies require direct interaction with the patient.

b. Some key players operating in the complementary & alternative medicine market include Nordic Nutraceuticals, Columbia Nutritional, Ramamani Iyengar Memorial Yoga Institute, Herb Pharm, John Schumacher Unity Woods Yoga Centre, Pure Encapsulations, LLC., The Healing Company Ltd, AYUSH Ayurvedic Pte Ltd, and Sheng Chang Pharmaceutical Company.

b. Key factors that are driving the complementary and alternative medicine market growth include wide acceptance of alternative treatments among the general population, further causing an upswing in the number of yoga studios, meditation centers, spas, and complementary wellness facilities.

Table of Contents

Chapter 1. Complementary And Alternative Medicine Market: Methodology and Scope

1.1. Information Procurement

1.2. Information or Data Analysis

1.3. Market Scope & Segment Definition

1.4. Market Model

1.4.1. Market Study, By Company Market Share

1.4.2. Regional Analysis

Chapter 2. Complementary And Alternative Medicine Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Complementary And Alternative Medicine Market: Variables, Trends, & Scope

3.1. Market Segmentation and Scope

3.2. Market Lineage Outlook

3.2.1. Parent Market Outlook

3.2.2. Related/Ancillary Market Outlook

3.3. Market Trends and Outlook

3.4. Market Dynamics

3.4.1. Growing awareness of wellness medicine

3.4.2. Growing recognition and coverage

3.4.3. Government initiatives and changing regulatory status

3.4.4. Demographic changes drive demand

3.5. Market Restraint Analysis

3.5.1. Lack of scientific results

3.5.2. Poor understanding of alternative medicine

3.6. Penetration and Growth Prospect Mapping 2022

3.7. Business Environment Analysis

3.7.1. SWOT Analysis; By Factor (Political & Legal, Economic And Technological)

3.7.2. Porter’s Five Forces Analysis

3.8. COVID-19 Impact Analysis

Chapter 4. Intervention Business Analysis

4.1. Complementary And Alternative Medicine Market: Intervention Movement Analysis

4.2. Traditional Alternative Medicine/Botanicals

4.2.1. Traditional Alternative Medicine/Botanicals Market, 2018 - 2030 (USD Million)

4.2.1.1. Ayurveda

4.2.1.1.1. Ayurveda Market, 2018 - 2030 (USD Million)

4.2.1.2. Apitherapy

4.2.1.2.1. Apitherapy Market, 2018 - 2030 (USD Million)

4.2.1.3. Bach Flower Therapy

4.2.1.3.1. Bach Flower Therapy Market, 2018 - 2030 (USD Million)

4.2.1.4. Naturopathic Medicine

4.2.1.4.1. Naturopathic Medicine Market, 2018 - 2030 (USD Million)

4.2.1.5. Traditional Chinese Medicine

4.2.1.5.1. Traditional Chinese Medicine Market, 2018 - 2030 (USD Million)

4.2.1.6. Traditional Korean Medicine

4.2.1.6.1. Traditional Korean Medicine Market, 2018 - 2030 (USD Million)

4.2.1.7. Traditional Japanese Medicine

4.2.1.7.1. Traditional Japanese Medicine Market, 2018 - 2030 (USD Million)

4.2.1.8. Traditional Mongolian Medicine

4.2.1.8.1. Traditional Mongolian Medicine Market, 2018 - 2030 (USD Million)

4.2.1.9. Traditional Tibetan Medicine

4.2.1.9.1. Traditional Tibetan Medicine Market, 2018 - 2030 (USD Million)

4.2.1.10. Zang Fu Theory

4.2.1.10.1. Zang Fu Theory Market, 2018 - 2030 (USD Million)

4.3. Mind Healing

4.3.1. Mind Healing Market, 2018 - 2030 (USD Million)

4.3.1.1. Autosuggestion

4.3.1.1.1. Autosuggestion Market, 2018 - 2030 (USD Million)

4.3.1.2. Hypnotherapy

4.3.1.2.1. Hypnotherapy Market, 2018 - 2030 (USD Million)

4.3.1.3. Neuro-linguistic Programming

4.3.1.3.1. Neuro-linguistic Programming Market, 2018 - 2030 (USD Million)

4.3.1.4. Self-hypnosis

4.3.1.4.1. Self-hypnosis Market, 2018 - 2030 (USD Million)

4.3.1.5. Spiritual Mind Treatment

4.3.1.5.1. Spiritual Mind Treatment Market, 2018 - 2030 (USD Million)

4.3.1.6. Transcendental Meditation

4.3.1.6.1. Transcendental Meditation Market, 2018 - 2030 (USD Million)

4.4. Body Healing

4.4.1. Body Healing Market, 2018 - 2030 (USD Million)

4.4.1.1. Acupressure

4.4.1.1.1. Acupressure Market, 2018 - 2030 (USD Million)

4.4.1.2. Acupuncture

4.4.1.2.1. Acupuncture Market, 2018 - 2030 (USD Million)

4.4.1.3. Alexander Technique

4.4.1.3.1. Alexander Technique Market, 2018 - 2030 (USD Million)

4.4.1.4. Auriculotherapy

4.4.1.4.1. Auriculotherapy Market, 2018 - 2030 (USD Million)

4.4.1.5. Autogenic Training

4.4.1.5.1. Autogenic Training Market, 2018 - 2030 (USD Million)

4.4.1.6. Chiropractic

4.4.1.6.1. Chiropractic Market, 2018 - 2030 (USD Million)

4.4.1.7. Cupping Therapy

4.4.1.7.1. Cupping Therapy Market, 2018 - 2030 (USD Million)

4.4.1.8. Kinesiology

4.4.1.8.1. Kinesiology Market, 2018 - 2030 (USD Million)

4.4.1.9. Osteomyology

4.4.1.9.1. Osteomyology Market, 2018 - 2030 (USD Million)

4.4.1.10. Osteopathy

4.4.1.10.1. Osteopathy Market, 2018 - 2030 (USD Million)

4.4.1.11. Pilates

4.4.1.11.1. Pilates Market, 2018 - 2030 (USD Million)

4.4.1.12. Qigong

4.4.1.12.1. Qigong Market, 2018 - 2030 (USD Million)

4.4.1.13. Reflexology

4.4.1.13.1. Reflexology Market, 2018 - 2030 (USD Million)

4.4.1.14. Yoga

4.4.1.14.1. Yoga Market, 2018 - 2030 (USD Million)

4.5. External Energy

4.5.1. External Energy Market, 2018 - 2030 (USD Million)

4.5.1.1. Magnetic Therapy

4.5.1.1.1. Magnetic Therapy Market, 2018 - 2030 (USD Million)

4.5.1.1.1.1. Bio-magnetic Therapy

4.5.1.1.1.1.1. Bio-magnetic Therapy Market, 2018 - 2030 (USD Million)

4.5.1.1.1.2. Magnetic Resonance Therapy

4.5.1.1.1.2.1. Magnetic Resonance Therapy Market, 2018 - 2030 (USD Million)

4.5.1.2. Reiki

4.5.1.2.1. Reiki Market, 2018 - 2030 (USD Million)

4.5.1.3. Therapeutic Touch

4.5.1.3.1. Therapeutic Touch Market, 2018 - 2030 (USD Million)

4.5.1.4. Chakra Healing

4.5.1.4.1. Chakra Healing Market, 2018 - 2030 (USD Million)

4.5.1.5. Sensory Healing

4.5.1.5.1. Sensory Healing Market, 2018 - 2030 (USD Million)

4.5.1.5.2. Aromatherapy

4.5.1.5.2.1. Aromatherapy Market, 2018 - 2030 (USD Million)

4.5.1.5.3. Music therapy

4.5.1.5.3.1. Music therapy Market, 2018 - 2030 (USD Million)

4.5.1.5.4. Sonopuncture

4.5.1.5.4.1. Sonopuncture Market, 2018 - 2030 (USD Million)

4.5.1.5.5. Sound Therapy

4.5.1.5.5.1. Sound Therapy Market, 2018 - 2030 (USD Million)

Chapter 5. Distribution Method Business Analysis

5.1. Complementary And Alternative Medicine Market: Distribution Method Movement Analysis

5.2. Direct Sales

5.2.1. Direct Sales Market, 2018 - 2030 (USD Million)

5.3. E-Sales

5.3.1. E-Sales Market, 2018 - 2030 (USD Million)

5.4. Distance Correspondence

5.4.1. Distance Correspondence Market, 2018 - 2030 (USD Million)

Chapter 6. Regional Business Analysis

6.1. Complementary And Alternative Medicine Market Share By Region, 2022 & 2030

6.2. North America

6.2.1. SWOT Analysis

6.2.2. North America Complementary and Alternative Medicine Market, by Intervention, 2018 - 2030 (USD Million)

6.2.3. North America Complementary And Alternative Medicine Market, By Distribution Method, 2018 - 2030 (USD Million)

6.2.4. U.S.

6.2.4.1. Key Country Dynamics

6.2.4.2. Target Disease Prevalence

6.2.4.3. Competitive Scenario

6.2.4.4. Regulatory Framework

6.2.4.5. Reimbursement Scenario

6.2.4.6. U.S. Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.2.5. Canada

6.2.5.1. Key Country Dynamics

6.2.5.2. Target Disease Prevalence

6.2.5.3. Competitive Scenario

6.2.5.4. Regulatory Framework

6.2.5.5. Reimbursement Scenario

6.2.5.6. Canada Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.3. Europe

6.3.1. SWOT Analysis

6.3.2. Europe Complementary and Alternative Medicine Market, by Intervention, 2018 - 2030 (USD Million)

6.3.3. Europe Complementary And Alternative Medicine Market, By Distribution Method, 2018 - 2030 (USD Million)

6.3.4. Germany

6.3.4.1. Key Country Dynamics

6.3.4.2. Target Disease Prevalence

6.3.4.3. Competitive Scenario

6.3.4.4. Regulatory Framework

6.3.4.5. Reimbursement Scenario

6.3.4.6. Germany Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.3.5. U.K.

6.3.5.1. Key Country Dynamics

6.3.5.2. Target Disease Prevalence

6.3.5.3. Competitive Scenario

6.3.5.4. Regulatory Framework

6.3.5.5. Reimbursement Scenario

6.3.5.6. U.K. Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.3.6. France

6.3.6.1. Key Country Dynamics

6.3.6.2. Target Disease Prevalence

6.3.6.3. Competitive Scenario

6.3.6.4. Regulatory Framework

6.3.6.5. Reimbursement Scenario

6.3.6.6. France Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.3.7. Italy

6.3.7.1. Key Country Dynamics

6.3.7.2. Target Disease Prevalence

6.3.7.3. Competitive Scenario

6.3.7.4. Regulatory Framework

6.3.7.5. Reimbursement Scenario

6.3.7.6. Italy Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.3.8. Spain

6.3.8.1. Key Country Dynamics

6.3.8.2. Target Disease Prevalence

6.3.8.3. Competitive Scenario

6.3.8.4. Regulatory Framework

6.3.8.5. Reimbursement Scenario

6.3.8.6. Spain Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.3.9. Denmark

6.3.9.1. Key Country Dynamics

6.3.9.2. Target Disease Prevalence

6.3.9.3. Competitive Scenario

6.3.9.4. Regulatory Framework

6.3.9.5. Reimbursement Scenario

6.3.9.6. Denmark Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.3.10. Sweden

6.3.10.1. Key Country Dynamics

6.3.10.2. Target Disease Prevalence

6.3.10.3. Competitive Scenario

6.3.10.4. Regulatory Framework

6.3.10.5. Reimbursement Scenario

6.3.10.6. Sweden Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.3.11. Norway

6.3.11.1. Key Country Dynamics

6.3.11.2. Target Disease Prevalence

6.3.11.3. Competitive Scenario

6.3.11.4. Regulatory Framework

6.3.11.5. Reimbursement Scenario

6.3.11.6. Norway Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.4. Asia Pacific

6.4.1. SWOT Analysis

6.4.2. Asia Pacific Complementary and Alternative Medicine Market, by Intervention, 2018 - 2030 (USD Million)

6.4.3. Asia Pacific Complementary And Alternative Medicine Market, By Distribution Method, 2018 - 2030 (USD Million)

6.4.4. Japan

6.4.4.1. Key Country Dynamics

6.4.4.2. Target Disease Prevalence

6.4.4.3. Competitive Scenario

6.4.4.4. Regulatory Framework

6.4.4.5. Reimbursement Scenario

6.4.4.6. Japan Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.4.5. China

6.4.5.1. Key Country Dynamics

6.4.5.2. Target Disease Prevalence

6.4.5.3. Competitive Scenario

6.4.5.4. Regulatory Framework

6.4.5.5. Reimbursement Scenario

6.4.5.6. China Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.4.6. India

6.4.6.1. Key Country Dynamics

6.4.6.2. Target Disease Prevalence

6.4.6.3. Competitive Scenario

6.4.6.4. Regulatory Framework

6.4.6.5. Reimbursement Scenario

6.4.6.6. India Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.4.7. South Korea

6.4.7.1. Key Country Dynamics

6.4.7.2. Target Disease Prevalence

6.4.7.3. Competitive Scenario

6.4.7.4. Regulatory Framework

6.4.7.5. Reimbursement Scenario

6.4.7.6. South Korea Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.4.8. Australia

6.4.8.1. Key Country Dynamics

6.4.8.2. Target Disease Prevalence

6.4.8.3. Competitive Scenario

6.4.8.4. Regulatory Framework

6.4.8.5. Reimbursement Scenario

6.4.8.6. Australia Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.4.9. Thailand

6.4.9.1. Key Country Dynamics

6.4.9.2. Target Disease Prevalence

6.4.9.3. Competitive Scenario

6.4.9.4. Regulatory Framework

6.4.9.5. Reimbursement Scenario

6.4.9.6. Thailand Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.5. Latin America

6.5.1. SWOT Analysis

6.5.2. Latin America Complementary and Alternative Medicine Market, by Intervention, 2018 - 2030 (USD Million)

6.5.3. Latin America Complementary And Alternative Medicine Market, By Distribution Method, 2018 - 2030 (USD Million)

6.5.4. Brazil

6.5.4.1. Key Country Dynamics

6.5.4.2. Target Disease Prevalence

6.5.4.3. Competitive Scenario

6.5.4.4. Regulatory Framework

6.5.4.5. Reimbursement Scenario

6.5.4.6. Brazil Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.5.5. Mexico

6.5.5.1. Key Country Dynamics

6.5.5.2. Target Disease Prevalence

6.5.5.3. Competitive Scenario

6.5.5.4. Regulatory Framework

6.5.5.5. Reimbursement Scenario

6.5.5.6. Mexico Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.5.6. Argentina

6.5.6.1. Key Country Dynamics

6.5.6.2. Target Disease Prevalence

6.5.6.3. Competitive Scenario

6.5.6.4. Regulatory Framework

6.5.6.5. Reimbursement Scenario

6.5.6.6. Argentina Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.6. MEA

6.6.1. SWOT Analysis

6.6.2. MEA Complementary and Alternative Medicine Market, by Intervention, 2018 - 2030 (USD Million)

6.6.3. MEA Complementary And Alternative Medicine Market, By Distribution Method, 2018 - 2030 (USD Million)

6.6.4. South Africa

6.6.4.1. Key Country Dynamics

6.6.4.2. Target Disease Prevalence

6.6.4.3. Competitive Scenario

6.6.4.4. Regulatory Framework

6.6.4.5. Reimbursement Scenario

6.6.4.6. South Africa Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.6.5. Saudi Arabia

6.6.5.1. Key Country Dynamics

6.6.5.2. Target Disease Prevalence

6.6.5.3. Competitive Scenario

6.6.5.4. Regulatory Framework

6.6.5.5. Reimbursement Scenario

6.6.5.6. Saudi Arabia Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.6.6. UAE

6.6.6.1. Key Country Dynamics

6.6.6.2. Target Disease Prevalence

6.6.6.3. Competitive Scenario

6.6.6.4. Regulatory Framework

6.6.6.5. Reimbursement Scenario

6.6.6.6. UAE Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

6.6.7. Kuwait

6.6.7.1. Key Country Dynamics

6.6.7.2. Target Disease Prevalence

6.6.7.3. Competitive Scenario

6.6.7.4. Regulatory Framework

6.6.7.5. Reimbursement Scenario

6.6.7.6. Kuwait Complementary And Alternative Medicine Market 2018 - 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Participant’s overview

7.2. Financial performance

7.3. Participant categorization

7.3.1. Market Leaders

7.3.2. Complementary And Alternative Medicine Market Share Analysis, 2022

7.3.3. Company Profiles

7.3.3.1. Abbott

7.3.3.2. PerkinElmer, Inc

7.3.3.3. BioView

7.3.3.4. Agilent Technologies, Inc

7.3.3.5. Merck KGaA

7.3.3.6. Bio-Rad Laboratories, Inc

7.3.3.7. Oxford Gene Technology IP Limited

7.3.3.8. Leica Biosystems Nussloch GmbH

7.3.3.9. F. Hoffman-La Roche Limited

7.3.3.10. NeoGenomics Laboratories, Inc

7.3.3.11. Advanced Cell Diagnostics, Inc

7.3.4. Strategy Mapping

7.3.4.1. Expansion

7.3.4.2. Acquisition

7.3.4.3. Collaborations

7.3.4.4. Product/Service Launch

7.3.4.5. Partnerships

7.3.4.6. Others

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviations

Table 3 Global Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 4 Global Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 5 North America Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 6 North America Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 7 North America Complementary and alternative medicine market by Country, 2018 - 2030 (USD Million)

Table 8 U.S. Complementary and alternative medicine market By intervention, 2018 - 2030 (USD Million)

Table 9 U.S. Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 10 Canada Complementary and alternative medicine market By intervention, 2018 - 2030 (USD Million)

Table 11 Canada Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 12 Europe Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 13 Europe Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 14 Europe Complementary and alternative medicine market by Country, 2018 - 2030 (USD Million)

Table 15 U.K. Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 16 U.K. Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 17 Germany Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 18 Germany Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 19 France Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 20 France Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 21 Italy Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 22 Italy Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 23 Spain Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 24 Spain Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 25 Denmark Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 26 Denmark Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 27 Sweden Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 28 Sweden Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 29 Norway Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 30 Norway Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 31 Asia Pacific Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 32 Asia Pacific Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 33 Asia Pacific Complementary and alternative medicine market by Country, 2018 - 2030 (USD Million)

Table 34 China Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 35 China Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 36 Japan Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 37 Japan Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 38 India Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 39 India Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 40 Australia Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 41 Australia Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 42 Thailand Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 43 Thailand Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 44 South Korea Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 45 South Korea Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 46 Latin America Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 47 Latin America Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 48 Latin America Complementary and alternative medicine market by Country, 2018 - 2030 (USD Million)

Table 49 Brazil Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 50 Brazil Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 51 Mexico Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 52 Mexico Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 53 Argentina Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 54 Argentina Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 55 Middle East & Africa Complementary and alternative medicine market By intervention, 2018 - 2030 (USD Million)

Table 56 Middle East & Africa Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 57 Middle East & Africa Complementary and alternative medicine market by Country, 2018 - 2030 (USD Million)

Table 58 South Africa Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 59 South Africa Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 60 Saudi Arabia Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 61 Saudi Arabia Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 62 UAE Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 63 UAE Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 64 Kuwait Complementary and alternative medicine market by intervention, 2018 - 2030 (USD Million)

Table 65 Kuwait Complementary and alternative medicine market by distribution method, 2018 - 2030 (USD Million)

Table 66 Participant’s overview

Table 67 Financial performance

Table 68 Key companies undergoing expansions

Table 69 Key companies undergoing acquisitions

Table 70 Key companies undergoing collaborations

Table 71 Key companies launching new products/services

Table 72 Key companies undergoing partnerships

Table 73 Key companies undertaking other strategies

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Market summary, 2022 (USD Million)

Fig. 9 Market segmentation & scope

Fig. 10 Market driver impact

Fig. 11 Market restraint impact

Fig. 12 Penetration & growth prospect mapping

Fig. 13 Porter’s analysis

Fig. 14 SWOT analysis

Fig. 15 Complementary and alternative medicine market: Intervention outlook and key takeaways

Fig. 16 Complementary and alternative medicine market: Intervention movement analysis

Fig. 17 Global traditional alternative medicine/botanicals complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 18 Global traditional alternative medicine/botanicals complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 19 Global Ayurveda complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 20 Global apitherapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 21 Global Bach flower therapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 22 Global naturopathic medicine complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 23 Global traditional Chinese medicine complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 24 Global traditional Korean medicine complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 25 Global traditional Japanese medicine complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 26 Global traditional Mongolian medicine complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 27 Global traditional Tibetan medicine complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 28 Global Zang Fu theory complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 29 Global mind healing complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 30 Global autosuggestion complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 31 Global hypnotherapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 32 Global neuro-linguistic programming complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 33 Global self-hypnosis complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 34 Global spiritual mind treatment complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 35 Global transcendental meditation complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 36 Global body healing complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 37 Global acupressure complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 38 Global acupuncture complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 39 Global Alexander technique complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 40 Global auriculotherapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 41 Global autogenic training complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 42 Global chiropractic treatment complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 43 Global cupping therapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 44 Global kinesiology complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 45 Global osteomyology complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 46 Global osteopathy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 47 Global Pilates complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 48 Global qigong complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 49 Global reflexology complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 50 Global yoga complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 51 Global external energy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 52 Global magnetic therapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 53 Global bio-magnetic therapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 54 Global magnetic resonance therapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 55 Global radionics complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 56 Global reiki complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 57 Global therapeutic touch complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 58 Global chakra healing complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 59 Global sensory healing complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 60 Global aromatherapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 61 Global music therapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 62 Global sonopuncture complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 63 Global sound therapy complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 64 Top five energy healing complementary and alternative medicine therapies that are most effective

Fig. 65 Industry participants expected to propel the regional hypnotherapy CAM demand

Fig. 66 Complementary and alternative medicine market: Distribution method outlook key takeaways

Fig. 67 Complementary and alternative medicine market: Distribution method market movement analysis

Fig. 68 Global direct sales complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 69 Global E-sales complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 70 Global distance correspondence complementary and alternative medicine market, 2018 - 2030 (USD Billion)

Fig. 71 Complementary and alternative medicine regional marketplace: Key takeaways

Fig. 72 Complementary and alternative medicine market regional outlook, 2021 & 2030

Fig. 73 Complementary and alternative medicine market: Regional outlook and key takeaways

Fig. 74 North America: SWOT Analysis

Fig. 75 North America Complementary and alternative medicine market, 2018-2030 (USD Million)

Fig. 76 U.S. key country dynamics

Fig. 77 U.S. Complementary and alternative medicine market, 2018-2030 (USD Million)

Fig. 78 Canada key country dynamics

Fig. 79 Canada Complementary and alternative medicine market, 2018-2030 (USD Million)

Fig. 80 Europe: SWOT Analysis

Fig. 81 Europe Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 82 Germany key country dynamics

Fig. 83 Germany Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 84 France key country dynamics

Fig. 85 France Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 86 U.K. key country dynamics

Fig. 87 U.K. Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 88 Italy key country dynamics

Fig. 89 Italy Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 90 Spain key country dynamics

Fig. 91 Spain Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 92 Denmark key country dynamics

Fig. 93 Denmark Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 94 Sweden key country dynamics

Fig. 95 Sweden Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 96 Norway key country dynamics

Fig. 97 Norway Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 98 Rest of Europe key country dynamics

Fig. 99 Rest of Europe Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 100 Asia-Pacific: SWOT Analysis

Fig. 101 Asia-Pacific Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 102 China key country dynamics

Fig. 103 China Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 104 India key country dynamics

Fig. 105 India Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 106 South Korea key country dynamics

Fig. 107 South Korea Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 108 Japan key country dynamics

Fig. 109 Japan Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 110 Australia key country dynamics

Fig. 111 Australia Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 112 Thailand key country dynamics

Fig. 113 Thailand Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 114 Rest of APAC key country dynamics

Fig. 115 Rest of APAC Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 116 Latin America: SWOT Analysis

Fig. 117 Latin America Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 118 Brazil key country dynamics

Fig. 119 Brazil Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 120 Mexico key country dynamics

Fig. 121 Mexico Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 122 Argentina key country dynamics

Fig. 123 Argentina Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 124 Rest of LATAM key country dynamics

Fig. 125 Rest of LATAM Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 126 MEA: SWOT Analysis

Fig. 127 MEA Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 128 South Africa key country dynamics

Fig. 129 South Africa Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 130 Saudi Arabia key country dynamics

Fig. 131 Saudi Arabia Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 132 UAE key country dynamics

Fig. 133 UAE Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 134 Kuwait key country dynamics

Fig. 135 Kuwait Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 136 Rest of MEA key country dynamics

Fig. 137 Rest of MEA Complementary and alternative medicine market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 138 Heat map analysis

Fig. 139 Market participant categorization

Fig. 140 Complementary and alternative medicine market share analysis, 2022

Fig. 141 Strategy framework

Market Segmentation

- Intervention Outlook (Revenue, USD Million, 2018 - 2030)

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Distribution Method Outlook (Revenue, USD Million, 2018 - 2030)

- Direct Sales

- E-sales

- Distance Correspondence

- Complementary and alternative medicine market Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- North America Complementary and alternative medicine market, by distribution method

- Direct Sales

- E-sales

- Distance Correspondence

- U.S.

- U.S. Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- U.S. Complementary and Alternative Medicine Market, By Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- U.S. Complementary and Alternative Medicine Market, by Intervention

- Canada

- Canada Complementary and Alternative Medicine Market, By Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- Canada Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- Canada Complementary and Alternative Medicine Market, By Intervention

- North America Complementary and Alternative Medicine Market, by Intervention

- Europe

- EuropeComplementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- EuropeComplementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- U.K.

- U.K. Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- U.K. Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- U.K. Complementary and Alternative Medicine Market, by Intervention

- Germany

- Germany Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- Germany Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- Germany Complementary and Alternative Medicine Market, by Intervention

- France

- France Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- France Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- France Complementary and Alternative Medicine Market, by Intervention

- Italy

- Italy Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- Italy Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- Italy Complementary and Alternative Medicine Market, by Intervention

- Spain

- Spain Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- Spain Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- Spain Complementary and Alternative Medicine Market, by Intervention

- Denmark

- Denmark Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- Denmark Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- Denmark Complementary and Alternative Medicine Market, by Intervention

- Sweden

- Sweden Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- Sweden Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- Sweden Complementary and Alternative Medicine Market, by Intervention

- Norway

- Norway Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- Norway Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- Norway Complementary and Alternative Medicine Market, by Intervention

- Asia Pacific

- Asia PacificComplementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- Asia PacificComplementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- Japan

- Japan Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- Japan Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- Japan Complementary and Alternative Medicine Market, by Intervention

- China

- China Complementary and Alternative Medicine Market, by Intervention

- Traditional Alternative Medicine/Botanicals

- Ayurveda

- Apitherapy

- Bach Flower Therapy

- Naturopathic Medicine

- Traditional Chinese Medicine

- Traditional Korean Medicine

- Traditional Japanese Medicine

- Traditional Mongolian Medicine

- Traditional Tibetan Medicine

- Zang Fu Theory

- Mind Healing

- Autosuggestion

- Hypnotherapy

- Neuro-linguistic Programming

- Self-hypnosis

- Spiritual Mind Treatment

- Transcendental Meditation

- Body Healing

- Acupressure

- Acupuncture

- Alexander Technique

- Auriculotherapy

- Autogenic Training

- Chiropractic

- Cupping Therapy

- Kinesiology

- Osteomyology

- Osteopathy

- Pilates

- Qigong

- Reflexology

- Yoga

- External Energy

- Magnetic Therapy

- Bio-magnetic Therapy

- Magnetic Resonance Therapy

- Radionics

- Reiki

- Therapeutic Touch

- Chakra Healing

- Magnetic Therapy

- Sensory Healing

- Aromatherapy

- Music therapy

- Sonopuncture

- Sound Therapy

- Traditional Alternative Medicine/Botanicals

- China Complementary and Alternative Medicine Market, by Distribution Method

- Direct Sales

- E-sales

- Distance Correspondence

- China Complementary and Alternative Medicine Market, by Intervention

- India