Companion Animal Rehabilitation Services Market Size, Share & Trends Analysis Report By Animal (Dogs, Cats, Others), By Therapy (Therapeutic Exercises, Manual, Hydrotherapy, Hot & Cold), By Indication, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-044-1

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

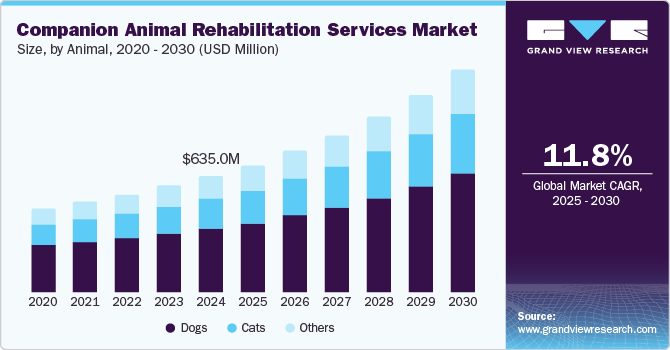

The global companion animal rehabilitation services market size was estimated at USD 635.04 million in 2024 and is projected to grow at a CAGR of 11.77% from 2025 to 2030. The growing awareness among veterinarians & pet parents regarding physical rehab therapies as a drug-free & non-invasive treatment for companion animals, improving trends of pet humanization, and increasing incidence of orthopedic & musculoskeletal problems coupled with respective surgery rates, are some of the key factors driving this market. In addition, the increasing number of organizations recruiting volunteer animal rehabilitators is further boosting market growth. For instance, ‘our companion-animal rescue & sanctuary organization’ in the U.S. offers two different ways for the public to volunteer in rehabilitating stray companion animals.

As pets live longer due to the advancements in veterinary care, they are increasingly affected by age-related issues such as arthritis, joint disorders, and reduced mobility. This has fueled the demand for rehabilitation therapies, such as hydrotherapy and laser therapy, which help improve mobility and quality of life. For instance, studies indicate that nearly 40-50% of dogs over the age of eight suffer from arthritis, making rehabilitation an essential service for managing their well-being. Additionally, chronic conditions like obesity and orthopedic disorders in pets are on the rise, further driving the adoption of these specialized treatments.

In addition, increasing disposable income and growing expenditure on pet care have significantly boosted the companion animal rehabilitation market. Modern pet owners are more willing to invest in advanced care options to enhance their pets’ quality of life, especially as more veterinary clinics and hospitals establish specialized rehabilitation centers equipped with cutting-edge technology. In the U.S., spending on veterinary services reached USD 32 billion in 2023, with a growing share dedicated to advanced therapies like rehabilitation. Moreover, surveys reveal that the majority of pet owners who utilized these services noticed significant improvements in their pets' mobility and recovery. This combination of increasing expenditure, coupled with the expansion of veterinary rehabilitation facilities, is propelling market growth globally.

Animal Insights

The dogs segment held the largest market share of 54.73% in 2024, driven by the high prevalence of orthopedic and age-related conditions in dogs, as well as their increasing adoption worldwide. Dogs are particularly prone to conditions such as arthritis, hip dysplasia, and ligament injuries, which often require long-term rehabilitation to improve mobility and quality of life. For instance, studies show that approximately 20% of dogs are diagnosed with arthritis during their lifetime, and nearly 85% of large breeds are prone to joint-related issues. Additionally, dogs frequently undergo surgical procedures, such as cruciate ligament repairs, which necessitate post-operative rehabilitation for optimal recovery. This demand is further amplified by the growing trend of pet humanization, with dog owners increasingly willing to invest in advanced care options. As a result, the dog segment accounts for a significant share of the market, fueling its continued dominance.

The cats segment is expected to register the fastest CAGR of 12.64% during the forecast period. This growth is attributed to the increasing awareness of feline-specific health needs and a rising prevalence of chronic conditions among cats. Cats are often affected by mobility issues, such as osteoarthritis, which is estimated to impact up to 90% of cats over the age of 12, yet these conditions frequently go undiagnosed. As more veterinary clinics and pet owners recognize the benefits of tailored rehabilitation services for cats, including physical therapy and laser treatments, the demand for feline-specific rehabilitation is surging. Furthermore, the growing adoption of cats as companion animals, coupled with an increasing willingness among owners to invest in preventive and therapeutic care, is fueling growth. This trend is supported by the expansion of advanced rehabilitation facilities offering cat-friendly environments, which are essential for accommodating their unique behavioral needs.

Therapy Insights

Therapeutic exercises segment accounted for 22.04% of revenue share in 2024, owing to its widespread application and effectiveness in improving mobility, strength, and recovery in companion animals. Guided or directed exercises are the most frequently used physical non-invasive therapy for pet animals. It comprises weight shifting, weight loss therapies, balance therapies, and several other exercises using cavalletti rails, water or grounded treadmills, peanut balls, and balance discs, among others. These guided exercises enhance the core & muscle strength of animals and improve flexibility. It is widely recommended for senior pets with musculoskeletal and neurological problems; however, it is also preferred for geriatric, deconditioned patients, and injured sports animals. Additionally, the simplicity and versatility of these exercises, which can be performed in clinical settings or guided at home, have made them a preferred choice among veterinarians and pet owners, ensuring their dominance in the market.

The hydrotherapy segment is anticipated to grow at a CAGR of 12.94% from 2025 to 2030, driven by its proven effectiveness in managing various musculoskeletal and neurological conditions in companion animals. Hydrotherapy, which includes underwater treadmills and swimming exercises, provides a low-impact, high-resistance environment that improves joint mobility, strengthens muscles, and reduces pain. This therapy is particularly beneficial for animals recovering from surgeries, such as cruciate ligament repairs, and for managing chronic conditions like arthritis and obesity. Research indicates that hydrotherapy can improve recovery outcomes as compared to land-based exercises alone. The growing availability of advanced hydrotherapy facilities and the increasing recognition of its benefits among veterinarians and pet owners are further fueling its rapid adoption, making it the fastest-growing segment in the market.

Indication Insights

Post-surgery segment registered the largest revenue share of more than 33% in the global companion animal rehabilitation services industry. The increasing rate of orthopedic or musculoskeletal surgeries performed on pets, with veterinarians referring those patients to rehab for rapid healing & recovery, are greatly contributing to this substantial share. Post-operative veterinary patients are more likely to consider physical therapies to reduce pain & inflammation and to fasten the healing rate. Rehab after surgical procedures has become more common in the veterinary industry with cutting-edge techniques, which further improve segmental growth.

The acute & chronic disease segment is anticipated to grow faster during the projected period, owing to its large prevalence & incidence rates in companion animals. Degenerative joint disorders/arthritis, obesity, neurological disorders, intervertebral disc disease, and others are some of the commonly diagnosed conditions among pet species. For instance, in an article published by Vet Times, Canine Cognitive Dysfunction (CCD) is particularly common in dogs older than eight years, with estimated prevalence rates ranging from 14% to 35% of the domestic canine population, though experts believe this figure may be underestimated. Therefore, the rising risk factors and incidence of such chronic disorders have significantly increased the adoption of veterinary rehabilitation services, which supports market growth.

End-use Insights

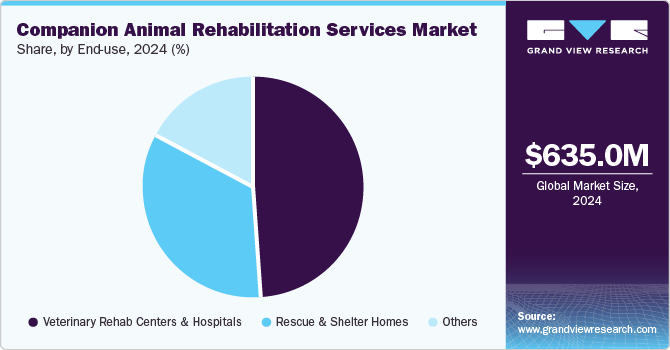

The veterinary rehab centers & hospitals segment dominated the market in 2024 due to a growing number of veterinary rehab centers and hospitals worldwide with advanced cutting-edge infrastructures. These centers are the major spot for veterinary physical therapies due to the availability of licensed rehabilitators. The rising number of veterinary rehab practitioners is another factor propelling the segment’s growth. According to the American Animal Hospital Association (AAHA), several veterinarians and veterinary technicians are trained & certified to rehabilitate companion animals, in veterinary hospitals. These affirmative factors are boosting the growth of the segment.

The rescue & shelter homes segment is projected to grow at the fastest CAGR of 12.52% over the forecast period, driven by the increasing intake of animals and their prolonged stays in shelters. For instance, according to the article published in April 2024, in the last year, approximately 6.5 million animals entered shelters, but only slightly over 6 million were adopted or relocated, leaving a growing population of animals lingering for extended periods-sometimes weeks, months, or even years. Between 2022 and 2023 alone, the number of animals waiting to leave shelters increased by 177,000. This rising trend is amplifying the need for rehabilitation services to address physical and behavioral health challenges in shelter animals, improving their adoptability and overall well-being. Also, animal welfare foundations in several countries are collaborating with rescue or shelter homes to provide better care for old, orphaned, paralyzed, injured, blind, and sick companion animals, nursed and rehabilitated by professionals. These factors support the substantial growth rate of the segment over the forecast period.

Regional Insights

North America companion animal rehabilitation services market held the largest share with a revenue share of 40.90% in 2024. Increasing awareness of animal health and welfare, supported by initiatives such as Animal Health Week (AHW) in Canada fuel the market in the region. Their 2024 theme focusing on "Animal Sentience: Feelings Beyond Words, Compassion Beyond Limits." emphasized understanding and addressing the emotional and sensory experiences of animals, reinforcing the importance of compassionate care. Such awareness efforts encourage pet owners and veterinary professionals to prioritize the physical and emotional well-being of animals, driving demand for rehabilitation services like physical therapy, hydrotherapy, and pain management. North America's strong veterinary infrastructure and public awareness campaigns contribute significantly to the growth of this market.

U.S. Companion Animal Rehabilitation Services Market Trends

The companion animal rehabilitation services market in U.S. dominated the North American region, due to the country's well-established veterinary healthcare system and significant product launches by key players. The market is driven by the growing presence of specialized facilities such as the Animal Rehab Center of Michigan, which pioneered advanced rehabilitation care in the state. As Michigan's first canine rehabilitation center, it introduced cutting-edge services, including hydrotherapy with an underwater treadmill, acupuncture, chiropractic care, therapeutic ultrasound, and Class IV deep tissue laser therapy. Such facilities not only cater to arthritis management and mobility issues but also offer weight management and advanced treatments like extra-corporeal shock wave therapy. Such initiatives highlight the rising demand for comprehensive and specialized rehabilitation services across the U.S., as pet owners increasingly seek advanced, holistic care to improve their animals’ quality of life. This trend underscores the importance of expertise and advanced technologies in driving market growth.

Europe Companion Animal Rehabilitation Services Market Trends

In 2024, Europe companion animal rehabilitation services market was identified as a lucrative region. The market is primarily driven by increasing pet ownership, rising awareness of advanced veterinary care, and the growing prevalence of chronic conditions such as arthritis and obesity in pets. According to the European Pet Food Federation (FEDIAF), Europe had over 104 million pet dogs and 127 million pet cats in 2023, with many requiring specialized care for age-related and mobility issues. Additionally, the expansion of veterinary clinics offering cutting-edge rehabilitation services, such as hydrotherapy and therapeutic laser treatments, is further boosting market growth. This trend is supported by Europe’s strong focus on animal welfare and healthcare advancements.

The companion animal rehabilitation services market in UK is being driven by the rising rates of chronic diseases in pets. For instance, as highlighted in the 2024 UK Pet Food report, the study reveals that 50% of dogs, 43% of cats, and 31% of small mammals in the UK are now classified as overweight and these figures are steadily increasing over the past decade. Despite this, only 4% of pet owners recognize the need for weight loss in their pets, creating a gap in awareness and care. Veterinary professionals are advocating for rehabilitation services such as weight management programs, therapeutic exercises, and hydrotherapy to combat obesity-related health problems. This growing awareness and the urgent need for obesity management are significant drivers for the expansion of the rehabilitation market in the UK.

Asia Pacific Companion Animal Rehabilitation Services Market Trends

The Asia Pacific companion animal rehabilitation services market is anticipated to grow at a CAGR of 13.43% during the forecast period, driven by the rising awareness of animal welfare and the growing efforts to improve the care and rehabilitation of animals, particularly in countries like China. Initiatives such as the China Animal Life Education Center aim to educate the public about animal care and promote the adoption of stray animals, addressing the increasing incidents of abuse. With plans to open 100 branches across six cities by 2024 and leveraging social media platforms like WeChat to connect private shelters with potential adopters, these efforts are boosting demand for rehabilitation services. This reflects a shift in public attitude toward animal welfare, driving growth in the region’s rehabilitation market.

The Companion Animal Rehabilitation Services Market in India is anticipated to grow with the fastest CAGR over the forecast period due to the by the growing presence of advanced facilities such as the VOSD Sanctuary, which recently expanded its capacity to house over 2,000 stray dogs, up from 1,400. As the world’s largest no-kill shelter and home to India’s largest referral veterinary hospital for dogs, VOSD provides state-of-the-art rehabilitation and medical care for animals often neglected due to lack of expertise, intent, or resources. This highlights the rising focus on advanced veterinary and rehabilitation services in India, attributed to foster the market growth.

Latin America Companion Animal Rehabilitation Services Market Trends

The Latin America market is driven by growing initiatives to address the impact of natural disasters on animal welfare, such as the efforts seen during the devastating floods in Brazil’s Rio Grande do Sul. Organizations like the Pantanal Technical Animal Rescue Group (GRETAP) and the IFAW-supported Tamanduás Institute have rescued and cared for over 5,000 animals, providing temporary shelters, veterinary care, and nutritional support. These large-scale rescue and rehabilitation efforts highlight the increasing need for specialized rehabilitation services to address the physical and emotional trauma faced by animals during such crises. The rising frequency of natural disasters and the mobilization of trained responders and resources are fueling growth in Latin America's companion animal rehabilitation market.

Argentina's market is expected to grow significantly over the forecast period. This can be attributed to the increasing life expectancy of companion animals, particularly in urban areas like Buenos Aires, where the average life expectancy for dogs is 11.88 years. With neutered canines demonstrating higher life expectancy compared to non-neutered ones, more pet owners are prioritizing long-term health and wellness for their aging pets. This growing population of older dogs is more susceptible to chronic conditions such as arthritis and mobility issues, fueling demand for rehabilitation services like hydrotherapy, physical therapy, and pain management to enhance their quality of life and ensure healthier aging.

Middle East & Africa Companion Animal Rehabilitation Services Market Trends

The Companion Animal Rehabilitation Services market in the Middle East and Africa is growing due to increasing awareness of animal welfare, coupled with rising pet ownership and the need to address the health challenges faced by companion animals in the region. As the pet population in countries like the UAE and Saudi Arabia continues to rise, there is a growing demand for specialized care, including rehabilitation services for conditions like obesity, arthritis, and post-surgery recovery. Additionally, with a focus on improving veterinary care standards, animal rescue organizations and private veterinary clinics are expanding their rehabilitation services to address the increasing number of abused or neglected animals, especially in areas with less stringent animal protection laws.

South Africa’s market is primarily driven by increasing pet ownership and growing investments in veterinary care increasing efforts to address the country’s street animal crisis, as highlighted by organizations like Action Change. The organization focuses on rescuing, rehabilitating, and rehoming street dogs while also running sterilization programs to reduce the population of stray animals and curb animal cruelty. With hundreds of cases each year involving extreme abuse, such as acid attacks and dog fighting, the demand for rehabilitation services to address the physical and emotional trauma of these animals is growing. Additionally, their weekly vaccination and neutering programs in townships are fostering awareness and building a greater need for rehabilitation facilities and resources to support rescued animals across the country. The continued reliance on donations to fund these efforts underscores the increasing importance of community and organizational support in driving the market forward.

Key Companion Animal Rehabilitation Services Company Insights

The market is relatively competitive and fragmented due to multiple small and large companies. Moreover, companies are increasingly adopting various strategies, such as mergers and acquisitions, geographic expansions, and product launches, to expand their market shares. Owing to constant research initiatives, this industry can be seen as moderate to high innovation.

Key Companion Animal Rehabilitation Services Companies:

The following are the leading companies in the companion animal rehabilitation services market. These companies collectively hold the largest market share and dictate industry trends.

- Back on Track Veterinary Rehabilitation Center, LLC

- Animal Acupuncture and Rehabilitation Center

- BARC

- Treasure Coast Animal Rehab & Fitness

- Animal Rehab Center of Michigan

- Blue Springs Animal Rehabilitation Center

- Essex Animal Hospital

- Triangle Veterinary Referral Hospital

- Butter Wick Animal Rehab

- Animal Rehab and Conditioning Center

View a comprehensive list of companies in the Companion Animal Rehabilitation Services Market

Recent Developments

-

In December 2024, Serco and Assistance Dogs Australia (ADA) have launched the Clarence Assistance Pups (CAP) program, expanding on the success of the Pups in Prison initiative. This partnership is set to enhance the companion animal rehabilitation services industry by supporting the training of assistance dogs for community safety and rehabilitation.

-

In March 2024, Western University of Health Sciences Pet Health Center (PHC) announced the opening of a state-of-the-art Pet Rehabilitation Center, aimed at aiding companion animals in recovery. This strategic move is set to drive growth in the companion animal rehabilitation services market by expanding its customer base and boosting revenue.

Companion Animal Rehabilitation Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 699.47 million |

|

Revenue forecast in 2030 |

USD 1,219.85 million |

|

Growth rate |

CAGR of 11.77% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Animal, Therapy, Indication, End-use, Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Kuwait |

|

Key companies profiled |

Back on Track Veterinary Rehabilitation Center, LLC, Animal Acupuncture and Rehabilitation Center, BARC, Treasure Coast Animal Rehab & Fitness, Animal Rehab Center of Michigan, Blue Springs Animal Rehabilitation Center, Essex Animal Hospital, Triangle Veterinary Referral Hospital, Butter Wick Animal Rehab, Animal Rehab and Conditioning Center |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Companion Animal Rehabilitation Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global companion animal rehabilitation services market report based on animal, therapy, indication, end-use, and region.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Exercises

-

Manual Therapy

-

Hydrotherapy

-

Hot & Cold Therapies

-

Electro Therapies

-

Acupuncture

-

Shockwave Therapy

-

Other Therapies

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Post-Surgery

-

Traumatic Injuries

-

Acute & Chronic Diseases

-

Developmental Abnormality

-

Other Indications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Rehab Centers & Hospitals

-

Rescue & Shelter Homes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global companion animal rehabilitation services market size was estimated at USD 635.04 million in 2024 and is expected to reach USD 699.47 million in 2025.

b. The global companion animal rehabilitation services market is expected to grow at a compound annual growth rate (CAGR) of 11.77% from 2025 to 2030 to reach USD 1,219.85 million by 2030.

b. North American region registered the highest market revenue share of about 40.90% in 2024 owing to the large presence of pet rehab centers and increasing awareness among pet parents regarding non-invasive physical therapies.

b. Some key players operating in the global companion animal rehabilitation services market include Animal Acupuncture and Rehabilitation Center, Back on Track Veterinary Rehabilitation Center, LLC, BARC, Animal Rehab Center Of Michigan, and Treasure Coast Animal Rehab & Fitness, among others.

b. The key factors driving the market growth include the increasing number of veterinary rehabilitators, the growing prevalence of orthopedic and musculoskeletal problems in pet animals, significant pet ownership rates, rising pet humanization trends, and huge animal healthcare spending, among others.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."