- Home

- »

- Animal Health

- »

-

Companion Animal Postoperative Pain Management Therapeutics Market Report, 2030GVR Report cover

![Companion Animal Postoperative Pain Management Therapeutics Market Size, Share & Trends Report]()

Companion Animal Postoperative Pain Management Therapeutics Market Size, Share & Trends Analysis Report By Animal, By Product (NSAIDs, Anesthetics), By Route of Administration, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-019-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

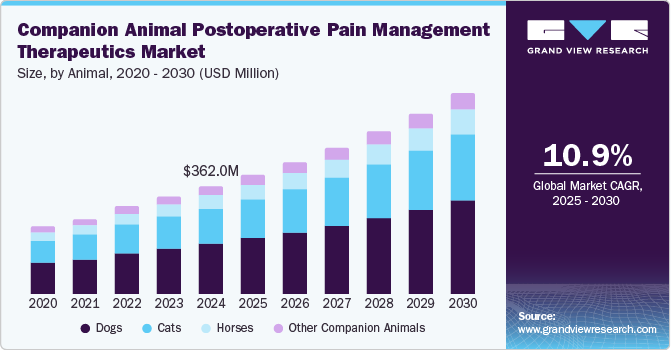

The global companion animal postoperative pain management therapeutics market size was valued at USD 362.0 million in 2024 and is projected to grow at a CAGR of 10.9% from 2025 to 2030. Increasing pet ownership is a significant contributor to this growth, as more households are adopting pets, leading to a higher demand for veterinary services, including surgical procedures that necessitate effective pain management solutions. The rising prevalence of surgical interventions in companion animals further amplifies this demand, as many pets undergo surgeries annually, creating a pressing need for postoperative care.

The humanization trend, in which pets are increasingly viewed as family members, has led to greater expenditures on their health and wellness. This is evident from the rise in pet insurance policies that cover postoperative care and the increased demand for high-quality, specialized veterinary services. The humanization trend not only influences spending habits but also drives innovations to improve the quality of life for pets, further propelling the market for effective postoperative pain management solutions.

Animal Insights

Dogs accounted for 46.8% of revenue share in 2024. This can be attributed to the high number of surgical procedures performed on dogs, particularly orthopedic surgeries and dental procedures. Dogs are also more prone to injuries and conditions that require surgical intervention, leading to a greater need for effective pain management solutions. Products such as non-steroidal anti-inflammatory drugs (NSAIDs), opioids, and local anesthetics are commonly used to manage postoperative pain in dogs.

The cats segment is expected to grow at a CAGR of 11.1% from 2025 to 2030. This growth is driven by the increasing number of pet owners and the rising awareness of the importance of pain management in feline care. Cats are often subjected to surgeries for conditions like urinary tract obstructions, dental issues, and soft tissue injuries. As pet owners become more attentive to their cats' health and well-being, the demand for specialized pain management therapeutics for cats is expected to rise.

Product Insights

NSAIDs held the largest market share of 42.4% in 2024. This dominance is due to the widespread use of NSAIDs in managing pain and inflammation in pets, particularly after surgeries. NSAIDs are favored for their effectiveness in reducing pain, swelling, and fever, making them a go-to choice for veterinarians. Commonly used NSAIDs in veterinary medicine include carprofen, meloxicam, and deracoxib, which are prescribed to manage postoperative pain in both dogs and cats.

The anesthetics segment is expected to register a CAGR of 11.0% during the forecast period. This growth is driven by the increasing number of surgical procedures performed on companion animals and the need for effective pain management during and after surgery. Anesthetics are crucial for ensuring that animals remain pain-free and comfortable during surgical procedures. Innovations in anesthetic drugs and techniques, such as the development of longer-acting local anesthetics and improved delivery methods, are contributing to the segment's rapid growth.

Route of Administration Insights

The oral segment held 86.6% of the market share in 2024 attributed to the ease of administration and the preference for oral medications among pet owners. Oral pain management drugs, such as NSAIDs and opioids, are commonly prescribed for postoperative care in companion animals. These medications are convenient to administer and are often preferred for their effectiveness in managing pain over extended periods. The availability of chewable tablets and flavored liquids also makes oral administration more acceptable to pets, further contributing to the segment's popularity.

The injectable segment is projected to experience the fastest growth over the forecast period driven by the need for rapid pain relief and the effectiveness of injectable medications in managing acute postoperative pain. Injectable anesthetics and analgesics provide immediate pain relief, which is crucial in the immediate post-surgical period. The development of longer-acting injectable formulations and advancements in drug delivery systems are expected to support this growth.

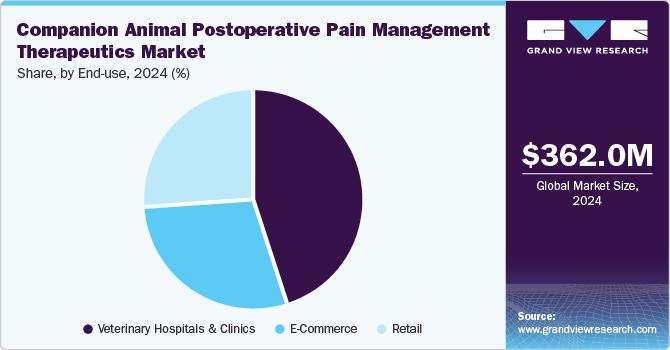

End-use Insights

The veterinary hospitals and clinics segment dominated the market in 2024 due to the high volume of surgical procedures performed in these settings, which necessitates effective pain management solutions. Veterinary hospitals and clinics are equipped with the necessary infrastructure and expertise to administer a range of pain management therapies, including NSAIDs, anesthetics, and opioids. The professional environment ensures that animals receive appropriate care and monitoring during their recovery, contributing to the segment's leading position.

The e-commerce sector is projected to grow at the fastest rate over the forecast period. The convenience of online shopping and the increasing number of pet owners seeking accessible and cost-effective solutions are driving this growth. E-commerce platforms offer various postoperative pain management products, including oral medications, topical treatments, and supplements. The ease of purchasing these products online, along with the availability of customer reviews and detailed product information, makes e-commerce an attractive option for pet owners. Additionally, the rise of direct-to-consumer sales by veterinary pharmaceutical companies further supports the expansion of the e-commerce sector in this market.

Regional Insights

North America held the largest share of the global companion animal postoperative pain management therapeutics market with a revenue share of 39.4% in 2024 attributed to the high adoption rate of pets and the advanced veterinary healthcare infrastructure present in the region. The presence of key market players and the availability of a wide range of pain management products further contribute to the region's dominance. Increasing awareness among pet owners about the importance of postoperative care also drives the demand for effective pain management therapeutics.

U.S. Companion Animal Postoperative Pain Management Therapeutics Market Trends

The U.S. dominated the North American companion animal postoperative pain management therapeutics market in 2024 due to the country's well-established veterinary healthcare system and significant investment in research and development of new therapeutics. The rise in pet ownership and the humanization of pets have led to increased spending on their healthcare needs, including pain management. Additionally, favorable regulations and policies support the introduction of new pain management solutions in the market.

Europe Companion Animal Postoperative Pain Management Therapeutics Market Trends

Europe was identified as a lucrative region for the companion animal postoperative pain management therapeutics market in 2024. The region benefits from a high level of pet ownership and a strong focus on animal welfare. Countries such as Germany, France, and the UK have well-developed veterinary healthcare systems and supportive regulatory frameworks that facilitate the introduction of new therapeutics. The increasing awareness about animal health and well-being, along with rising disposable incomes, drives market growth in this region.

Asia Pacific Companion Animal Postoperative Pain Management Therapeutics Market Trends

The Asia Pacific companion animal postoperative pain management therapeutics market is anticipated to grow at a CAGR of 11.2% during the forecast period driven by increasing pet ownership, rising disposable incomes, and improving veterinary healthcare infrastructure in countries like China, India, and Japan. The growing awareness about pet health and the availability of a wider range of pain management products are also contributing to market expansion. Additionally, the region is witnessing significant investment in veterinary healthcare, further supporting the growth of the market.

Key Companion Animal Postoperative Pain Management Therapeutics Company Insights

Some of the key companies in the companion animal postoperative pain management therapeutics market include Zoetis, Bayer AG, Merck Animal Health, Elanco, Norbrook, Ceva Sante Animale, and others.

-

Zoetis offers a comprehensive range of postoperative pain management therapeutics for companion animals. Their product portfolio includes NSAIDs, local anesthetics, and opioids, which are widely used by veterinarians to manage pain in pets following surgical procedures.

-

Merck Animal Health, also known as MSD Animal Health, is a key player in the market, offering a range of postoperative pain management products. Their portfolio includes NSAIDs, anesthetics, and other pain relief medications designed to ensure pets experience minimal discomfort after surgery.

Key Companion Animal Postoperative Pain Management Therapeutics Companies:

The following are the leading companies in the companion animal postoperative pain management therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Bayer AG

- Merck Animal Health

- Elanco

- Norbrook

- Ceva Sante Animale

- Dechra Pharmaceuticals

- Boehringer Ingelheim International GmbH

- Daiichi Sankyo Co. Ltd.

- Assisi Animal Health

Recent Developments

-

In July 2024, Dechra announced an agreement to acquire Invetx, a worldwide expert in veterinary pharmaceuticals. This acquisition secures an exciting pipeline of pioneering products for dogs and cats and establishes a presence in the expansive and rapidly expanding mAbs market. Additionally, it will enhance Dechra's current pipeline with new technological capabilities and create substantial opportunities for future expansion.

-

In January 2024, Ceva Santé Animale (Ceva) announced the acquisition of Scout Bio. This strategic move grants Ceva access to crucial developments, such as a portfolio of monoclonal antibodies and gene therapy innovations aimed at tackling chronic pet diseases.

Companion Animal Postoperative Pain Management Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 400.0 million

Revenue forecast in 2030

USD 671.4 million

Growth Rate

CAGR of 10.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, product, route of administration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; KSA; UAE; South Africa

Key companies profiled

Zoetis; Bayer AG; Merck Animal Health; Elanco; Norbrook; Ceva Sante Animale; Dechra Pharmaceuticals; Boehringer Ingelheim International GmbH; Daiichi Sankyo Co. Ltd.; Assisi Animal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Companion Animal Postoperative Pain Management Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global companion animal postoperative pain management therapeutics market report based on animal, product, route of administration, end-use, and region:

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Horses

-

Other Companion Animals

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

NSAIDs

-

Anesthetics

-

Opioids

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Veterinary Hospitals & Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."