Companion Animal Health Market Size, Share & Trends Analysis Report By Animal (Dogs, Cats), By Product (Diagnostics, Pharmaceuticals), By Distribution Channel (E-commerce, Retail), By End-Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-260-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

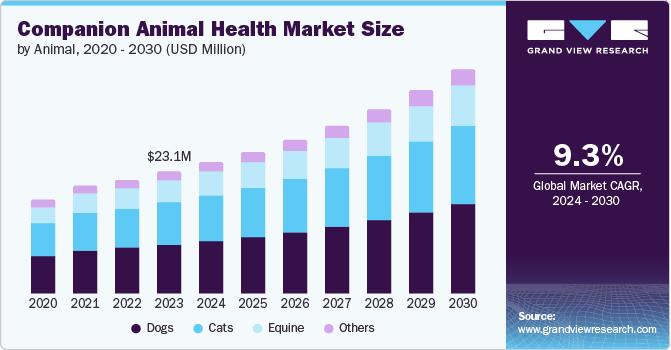

The global companion animal health market size was estimated at USD 23.08 billion in 2023 and is projected to grow at a CAGR of 9.3% from 2024 to 2030, owing to increasing pet ownership rates, rise of pet insurance,growing preference for personalized pet care, and advancements in animal healthcare technology. According to the Global State of Pet Care statistics published by HealthforAnimals in September 2022, more than 50% of the world's population is estimated to own a pet at home. This rising pet ownership among people about the importance of regular pet care is fueling the market growth.

Rise in cancer cases among companion animals, particularly dogs, significantly influences market. A study by the Royal Veterinary College (RVC) in June 2023 shed light on the prevalence and risk factors associated with osteosarcoma, a form of bone cancer, in various dog breeds in the UK. This emphasizes necessity for advanced healthcare strategies, especially in cancer treatment, which should receive backing from governmental and private entities.

Growing prevalence of pet illness is also driving market growth. Some of the most commonly reported illnesses in dogs include cardiovascular diseases, parvovirus, cancer, rabies, heartworm, kennel cough, ringworm, and diabetes. For instance, in May 2024, there was a rise in cases of cardiovascular diseases among pet dogs in Kerala, India. Veterinarians noted that over 10% of the examined pet dogs had cardiovascular ailments. Failure to promptly detect and treat these conditions often results in fatalities among canines. In addition, the growing prevalence of infectious diseases among cats, such as feline panleukopenia (parvovirus), is expected to accelerate the uptake of medications and vaccinations, further driving the market growth.

Advancements in animal healthcare technology, such as the development of new diagnostic tools, treatments, and vaccines, have further propelled the market growth. These technological advancements not only enhance the quality of care provided to companion animals but also contribute to improved outcomes and overall patient satisfaction. For Instance, in October 2023, Zoetis’s Basepaws, a company known for its feline DNA testing services, has expanded its offerings to include an extensive DNA test for dogs. This new test utilizes advanced Next-Generation Sequencing (NGS) technology to give pet owners valuable insights into their dog’s health risks and breed characteristics.

In addition, worldwide pet insurance acceptance rates have risen as a result of the increasing pet humanization and pet ownership in various countries. According to the North American Pet Health Insurance Association (NAPHIA), in 2023, the total number of insured pets increased by 17.1% compared to the previous year. This impressive expansion has been sustained over the past few years, with the average annual growth rate reaching 22.6% since 2020. Dogs remain the most commonly insured pets in the U.S., making up 78.6% of all insured pets, while cats make up 21.4%. Medication coverage is common in pet insurance plans, typically for prescription-only pharmaceuticals. Therefore, market growth is being boosted by the increasing use of companion animal insurance.

Market Concentration & Characteristics

The degree of innovation is high with companies investing heavily in R&D, technological advancements, and strategic acquisitions to drive the development of new and improved products and solutions. For Instance, in June 2024,Merck Animal Health, also known as MSD Animal Health outside the U.S. and Canada, received approval from the U.S. Department of Agriculture (USDA) for NOBIVAC NXT Canine Flu H3N2. This innovative solution aims to protect dogs from the persistent risk of canine influenza, representing notable progress in addressing highly transmissible respiratory illnesses.

Market players are actively expanding their portfolios through strategic acquisitions. This allows them to offer more comprehensive solutions and capitalize on innovative technologies and products. For Instance, in January 2024, Ceva Santé Animale announced the acquisition of Scout Bio, a pioneer in biotechnology focused on developing advanced therapies for pets. The acquisition represents a major leap forward in innovation for Ceva as it seeks to accelerate biotherapeutic innovation for pet health.

Regulatory agencies like the U.S. Department of Agriculture (USDA) approve animal health products in the U.S., and the European Medicines Agency (EMA) evaluates and monitors the safety of veterinary medicines in the European Union. These regulatory bodies play a crucial role in ensuring companion animal health products' safety, efficacy, and quality while facilitating international trade and harmonizing regulatory approaches across different regions.

The highly specialized nature of many companion animal health products, coupled with the regulatory landscape, limits the availability of direct substitutes in the market. While some general pet care products may be substitutes, they often provide a different targeted treatment and efficacy than the specialized companion animal health solutions.

North America and Europe currently lead the market due to the region's technological advancements, strong livestock industry, and increasing pet adoption drive the demand for veterinary products and services; significant growth opportunities exist in emerging markets across Asia-Pacific, Latin America, and the MEA region.

Animal Insights

Based on animal, the dogs segment led the market with the largest revenue share of 40.91% in 2023. Dogs hold the majority of the market share due to rising pet healthcare costs, particularly in developed regions. One of the primary factors promoting segment growth is the rising prevalence of chronic disorders in dogs. VCA Animal Hospitals 2022 claims that the most prevalent preventive condition affecting dogs is obesity. In North America, between 25% and 30% of all dogs are obese, while between 40% and 45% of dogs between the ages of 5 and 11 are overweight. Similar to humans, 14.0 million adult dogs in the U.S. suffered from osteoarthritis, according to a July 2024 article by the Morris Animal Foundation. Osteoarthritis is the primary cause of persistent pain in dogs, affecting a significant portion of canines over the age of 8 and potentially impacting up to 35% of dogs across all age groups. It is a notable concern for the well-being of companion animals such as dogs, particularly if not addressed promptly.

The cats segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by the increasing adoption of cats as companion animals, particularly in developed regions. According to the American Veterinary Medical Association (AVMA), the proportion of households that possess at least one cat saw a slight increase from 25% in 2016 to 26% in 2020, followed by a further rise to 29% in 2022. The rising prevalence of feline-specific diseases, such as feline panleukopenia (parvovirus), and the growing trend of pet humanization have further contributed to the surge in demand for specialized veterinary care, diagnostics, and cat treatments.

Product Insights

The pharmaceuticals segment led the market with the largest revenue share of 44.43% in 2023. The continuous development and innovation of veterinary drugs and medicines have driven the growth of the pharmaceutical segment. This includes the introduction of new and improved parasiticides, anti-inflammatory drugs, antibiotics, and other specialized pharmaceuticals to address a wide range of health conditions in companion animals. For Instance, in August 2023, Boehringer Ingelheim, a leading global animal health company, launched NexGard SPECTRA in India after receiving approval from the Central Drugs Standard Control Organization (CDSCO). This new addition to their product line is aimed at dogs aged two months and older, weighing two kilograms or more.

The diagnostics segment is anticipated to grow at a significant CAGR during the forecast period. The rising prevalence of various diseases and health conditions in companion animals, such as cancer, cardiovascular diseases, infectious diseases such as parvovirus and heartworm, and metabolic disorders, has significantly increased the demand for advanced diagnostic tools and technologies. Pet owners are becoming more proactive in monitoring their pets' health and are willing to invest in comprehensive diagnostic services to detect issues early and provide appropriate treatment. For instance, IDEXX Laboratories launched the first veterinary diagnostic test for detecting kidney injury in cats and dogs in June 2023. The test aims to cater to the growing market demand for comprehensive diagnostic capabilities.

Distribution Channel Insights

Based on distribution channel, the hospital pharmacies segment led the market with the largest revenue share of 47.12% in 2023. Hospital pharmacies offer a wide range of pharmaceutical products specifically tailored for companion animals, ensuring easy access to necessary medications for pet owners. In addition, these pharmacies often have specialized staff with expertise in veterinary medicine, providing valuable guidance and recommendations to pet owners regarding their pets' health needs. Moreover, hospital pharmacies typically maintain stringent quality control measures, ensuring their products' safety and efficacy. This focus on quality and expertise enhances customer trust and loyalty towards hospital pharmacies as reliable sources for companion animal health products.

The e-commerce segment is projected to grow at a significant CAGR over the forecast period. The increasing adoption of online shopping among pet owners, who seek the convenience and wide selection of products available on e-commerce platforms, has been a significant driver for the growth of this segment. The COVID-19 pandemic further accelerated this trend, as lockdowns and social distancing measures prompted pet owners to turn to e-commerce for their pet care needs. For instance, in October 2023, Amazon considered offering veterinary telehealth services to compete with Walmart's free access to pet telehealth for its subscribers, highlighting the growing demand for online pet care services. In addition, the rise in pet ownership rates, coupled with the increasing humanization of pets and the willingness of owners to invest in their pets' health and wellness, has fueled the demand for specialized pet care products and services available through e-commerce channels.

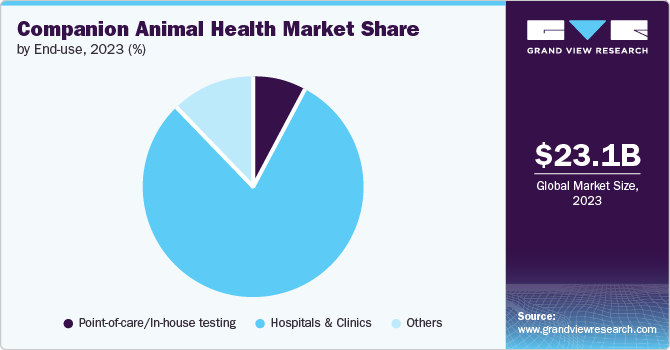

End-Use Insights

Based on end use, the hospitals & clinics segment led the market with the largest revenue share of 80.43% in 2023. This is due to an expansion of veterinary hospitals and clinics with innovative infrastructure worldwide. Another aspect influencing the segment is a rise in the number of veterinarians. According to the AVMA, 124,069 veterinarians worked in the US in 2022. In addition, the Canadian Veterinary Medical Association estimated that 2022, there were about 15,322 veterinarians in Canada, with about 3,825 of them engaged in clinical practice. The expansion of veterinary facilities in Canada results from owners spending more on pet care and the growing significance of pets in Canadian homes.

The point-of-care/in-house testing segment is expected to grow at a significant CAGR during the forecast period, due to increasing demand for rapid and accurate diagnostic solutions in veterinary settings has led to the adoption of point-of-care/in-house testing technologies. These technologies enable veterinarians to perform tests and receive results quickly, allowing for timely interventions and improved patient outcomes. For Instance, in October 2023, Fluxergy has introduced a new rapid PCR test for detecting Streptococcus equi ss equi, the bacteria responsible for causing “strangles” in horses. This assay offers a convenient and cost-effective solution for obtaining results within an hour in a veterinary hospital laboratory setting.

Regional Insights

North America dominated the companion animal health market with a revenue share of 35.82% in 2023. This is attributed to the existence of numerous well-established pharmaceutical companies that are actively expanding their global reach and commercializing their products. Overall, rising pet ownership, advances in veterinary medicine, and expansion of pet insurance coverage, which makes it easier for pet owners to afford veterinary care, are expected to fuel the market growth in North America.

U.S. Companion Animal Health Market Trends

The companion animal health market in the U.S. is expected to grow at a rapid CAGR over the forecast period. The market is driven by the country's high pet ownership rates. According to the 2023-2024 APPA National Owner Pet Survey, 66% of American households, totaling 86.9 million households, are pet owners. The growing pet ownership of dogs and cats has increased concerns among pet owners regarding their animals' health, thereby driving the demand for companion animal health products and services.

Europe Companion Animal Health Market Trends

The companion animal health market in Europe is anticipated to grow at a lucrative CAGR during the forecast period. The market is defined by a robust focus on research and development on animal welfare. The European Partnership on Animal Health and Welfare (EUPAHW) emerge s as a pivotal research and innovation endeavor supported by the European Commission (EC) funding. This initiative, initiated in January 2024 and led by the University of Ghent, signifies a substantial investment totaling €360 million over seven years. The primary objective of EUPAHW is to combat infectious diseases in animals while also elevating animal welfare standards through intensified research endeavors and enhanced collaboration across various stakeholders.

The UK companion animal health market is projected to grow at the fastest CAGR during the forecast period, due to the launch of innovative initiatives to support start-ups and the increasing focus on animal welfare and technological advancements. For Instance, in April 2024, the UK's first animal healthcare start-up incubator launched at the University of Surrey's Vet School. This incubator aims to provide a supportive environment for early-stage companies working on solutions to improve animal health and welfare. By fostering innovation and collaboration, this initiative is expected to contribute to developing novel products and services that will drive the market growth.

The companion animal health market in Germany is expected to grow at a rapid CAGR during the forecast period. Advancements in veterinary medicine and technology are driving innovation in the market growth in Germany. Companies are developing new vaccines, treatments, and diagnostic tools to improve the quality of care provided to pets. These innovations not only enhance the treatment options available but also contribute to better outcomes for companion animals.

Asia Pacific Companion Animal Health Market Trends

The companion animal health market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. The market is fueled by significant R&D investments made by international firms and ongoing initiatives to commercialize veterinary medicines and vaccines at cheaper costs. Moreover, the urgent need to reduce the frequency of zoonotic illnesses is anticipated to fuel market growth in the coming years. One of the main reasons influencing market is increased pet adoption. The perception of pet owners in the region is changing due to growing pet humanization and rising adoption of the western lifestyle. This shift in pet adoption practices is anticipated to fuel market growth.

The China companion animal health market is witnessing robust growth driven by rising pet health awareness and the increasing demand for preventive treatments like vaccines and pharmaceuticals. For instance, in 2021, Boehringer Ingelheim's equine product GastroGard received the first-ever approval for an imported veterinary drug in China, marking a significant milestone and underscoring the market's expansion potential as pet owners prioritize their animals' well-being.

The companion animal health market in India is projected to grow at the fastest CAGR during the forecast period, due to the surge in zoonotic diseases and government efforts to enhance animal healthcare. The rapid spread of zoonotic diseases poses a significant challenge for healthcare professionals in India. For instance, in April 2023, the Union Minister introduced the Animal Health System Support for One Health (AHSSOH) and Animal Pandemic Preparedness Initiative (APPI) project to enhance India’s preparedness for animal pandemics, with a focus on zoonotic diseases, veterinary services, disease surveillance, and the One Health approach.

Latin America Companion Animal Health Market Trends

The companion animal health market in Latin America is expected to grow at a rapid CAGR during the forecast period. Countries in Latin America are investing in expanding veterinary clinics, hospitals, and diagnostic facilities to cater to the growing pet population. This includes public and private initiatives to improve access to quality animal healthcare. The advancements in companion animal healthcare, such as improved treatment products for different conditions, are positively influencing the market growth.

The Argentina companion animal health market is expected to grow at the fastest CAGR over the forecast period, due to the Argentine government implementing stricter regulations and guidelines to promote animal welfare, driving investments in companion animal healthcare infrastructure and services. For Instance, in December 2022 , Ceva Santé Animale's acquired Argentinian companies Zoovet and Biotecnofe. This strategic move has provided Ceva with significant benefits, including access to an advanced biotechnology campus in Santa Fe, Argentina, which houses over 200 experts in the field. This new addition to Ceva's resources will enable the company to strengthen its pharmaceutical innovation capabilities, particularly for ruminants.

Middle East & Africa Companion Animal Health Market Trends

The companion animal health market in Middle East & Africa was identified as a lucrative region in this industry. The MEA market is witnessing consolidation, with major global players acquiring regional companies to expand their footprint and product portfolios in this growing market. Governments and private sector players are investing in expanding the network of veterinary clinics, hospitals, and diagnostic facilities to cater to the growing pet population in the MEA region, improving access to quality animal healthcare.

The UAE companion animal health market shows opportunities. The UAE government and private entities are investing in expanding veterinary services to meet the needs of the increasing companion animal population. For Instance, in April 2022, a project in Abu Dhabi will introduced advanced veterinary facilities, including a vaccine manufacturing unit and two modern hospitals. This development signifies a major progression in the local animal healthcare sector, enhancing Abu Dhabi’s reputation as a premier provider of veterinary care for horses and camels while contributing to the production of advanced vaccines for the MEA region.

Key Companion Animal Health Company Insights

The market is fragmented and competitive due to several small to large market players. These organizations carry out several strategies to increase their market presence and share. These initiatives include partnerships & collaborations, mergers & acquisitions, R&D, regional expansion, product launches, and more.

Key Companion Animal Health Companies:

The following are the leading companies in the companion animal health market. These companies collectively hold the largest market share and dictate industry trends.

- Agrolabo S.p.A.

- Boehringer Ingelheim International GmbH

- Ceva

- Elanco

- IDEXX Laboratories, Inc.

- Indian Immunologicals Ltd.

- Merck & Co., Inc.

- Norbrook

- Vetoquinol

- Virbac

- Zoetis Services LLC

Recent Developments

-

In June 2024, Merck Animal Health, a Merck & Co., Inc. division, has introduced the NOBIVAC NXT Rabies portfolio in Canada. This new series of rabies vaccines utilizes advanced RNA-particle technology to safeguard cats and dogs against rabies. The NOBIVAC NXT Rabies portfolio comprises NOBIVAC NXT Feline-3 Rabies and NOBIVAC NXT Canine-3 Rabies.

-

In January 2024, TheraVet, a company that manages pet osteoarticular diseases, launched BIOCERA-VET products in Germany. This move signifies the expansion of TheraVet’s innovative solutions for addressing osteoarticular issues in pets to a new market, providing German pet owners with access to advanced treatments for their furry companions.

-

In January 2024, Zoetis Inc. has expanded its Vetscan Imagyst diagnostics platform by integrating AI Urine Sediment analysis, allowing veterinarians to quickly and accurately analyze samples in their clinics. This advancement helps speed up treatment decisions and improve care for dogs and cats.

Companion Animal Health Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 24.86 billion |

|

Revenue forecast in 2030 |

USD 42.50 billion |

|

Growth rate |

CAGR of 9.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Animal, product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa;Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Agrolabo S.p.A.; Boehringer Ingelheim International GmbH; Ceva; Elanco; IDEXX Laboratories, Inc.; Indian Immunologicals Ltd. ; Merck & Co., Inc.; Norbrook; Vetoquinol; Virbac; Zoetis Services LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Companion Animal Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global companion animal health market report based on animal, product, distribution channel, end use, and region:

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Equine

-

Cats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vaccines

-

Pharmaceuticals

-

OTC

-

Prescription

-

-

Feed Additives

-

Diagnostics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Hospital pharmacies

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Point-of-care/In-house testing

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global companion animal health market size was estimated at USD 23.08 billion in 2023 and is expected to reach USD 24.86 billion in 2024.

b. The global companion animal health market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 42.50 billion by 2030.

b. The dogs animal type segment dominated the global market with a revenue share of more than 40% in 2023. One of the primary factors promoting segment growth is the rising prevalence of chronic disorders in dogs.

b. The global companion animal health market was dominated by the pharmaceuticals segment in 2023 with overall revenue of over 44.43%.

b. The hospital pharmacies segment led the global companion animal health market and accounted for a revenue share of 47.12% in 2023.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."