- Home

- »

- Plastics, Polymers & Resins

- »

-

Commodity Plastics Market Size, Share, Growth Report 2030GVR Report cover

![Commodity Plastics Market Size, Share & Trends Report]()

Commodity Plastics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polyethylene (PE), Polypropylene (PP), Polyvinyl chloride (PVC), Polystyrene), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-807-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Commodity Plastics Market Size & Trends

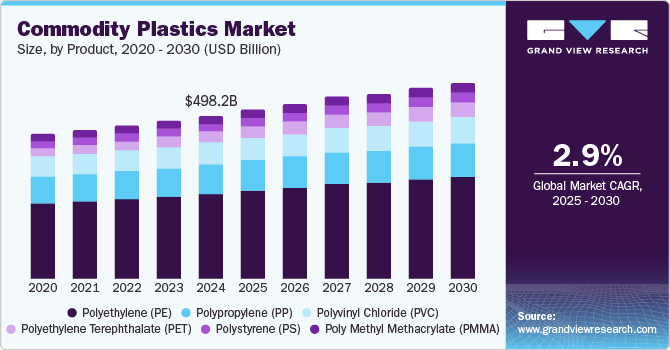

The global commodity plastics market size was valued at USD 498.2 billion in 2024 and is projected to grow at a CAGR of 2.9% from 2025 to 2030. The constantly increasing demand for long-lasting light materials across various industries, from packaging, construction, and automotive, has driven the growth. With the rise in the e-commerce sector, consumer preferences, advancement in recycling technologies, and the introduction of bioplastics have expanded the market.

In addition, there is an increase in demand for construction-grade plastics due to their light weight, durability, resistance, and cost-effectiveness. With the push by sustainability to encourage and innovate recycled materials, technological advancements in the production process to improve efficiency and reduce costs have helped the sector spread and grow.

With the competition and push by sustainability to encourage and innovate recycled materials due to changing consumer preferences, regulatory pressures, and advancement in technologies, the commodity plastics business in the sector is giving rise to implementing collaborative techniques to enhance market reach and innovation, collaborating partnerships with sustainability experts, technology firms in developing biodegradable packaging solutions, and expanding in sustainable technologies.

Innovations in technology have played a crucial role in advancing recycling methods, such as enzymatic and chemical recycling, advancement in production lines, turning waste plastic into raw materials, and promoting a circular economy. In addition, producers have introduced new polymerization techniques to create high-performance plastics with enhanced properties, such as improved thermal resistance, strength, and durability. This has given rise to and created demand for commodity polymers such as polyethylene (PE) and polypropylene (PP), which are lightweight and cost-effective.

Moreover, the automotive sector has driven the market due to the high demand for plastics, such as ABS and polycarbonate, used in exterior and interior parts to reduce vehicle weight and improve fuel efficiency. The construction industry incorporates PVC and PE equally due to their versatility, durability, cost-effectiveness, lightweight nature, chemical stability, and corrosion resistance. Eventually, the overall industry is likely to adapt to changing consumer preferences and regulatory constraints, setting itself for long-term growth with transformation driven by sustainability, technology, and market demand.

Product Insights

The Polyethylene (PE) segment accounted for a significant revenue share of 34.4% in 2024 due to its versatility and extensive application across various industries, with excellent chemical resistance, low density, and durability, making it ideal for any sector. The demand for PE is mostly driven by the packaging sector's use of films, bags, and containers due to their flexibility and lightweight, making them the first choice for packaging. In addition, with advancements, performance variants, such as low-density polyethylene (LLDPE), have been developed with strength and puncture resistance. PE also has a high demand for plumbing and piping applications in construction due to its durability and longevity. Environmental concerns have shaped the market to adapt to sustainable growth, where producers explore bio-based feedstocks and developments in biopolymer combinations driven by innovation and adaptations to traditional and sustainable applications.

The Poly Methyl Methacrylate (PMMA) segment is expected to advance at the fastest CAGR of 5.1% over the forecast period. Its resistance to UV light, clarity, and lightweight make it ideal for lenses, displays, and signage in various sectors. In addition, technological advancements and innovations have enhanced its characteristics, such as biocompatibility. The growing construction sector requires lightweight and durable materials; PMMA provides applications such as skylights, windows, and various decorative materials.

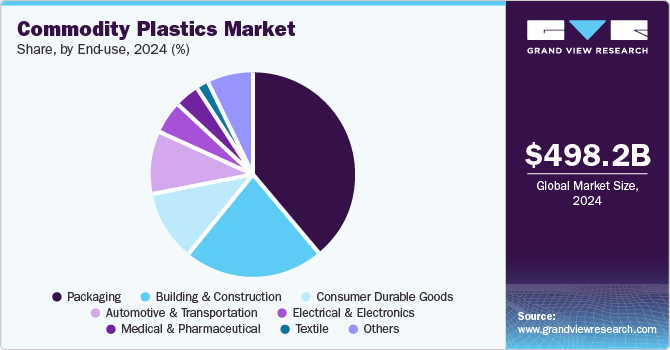

End-use Insights

The packaging segment accounted for the largest revenue share in the global market at 39.2% in 2024, largely due to the importance of packaging in every sector in protecting products from damage and spoiling. Moreover, the growth of e-commerce has expanded the market due to the direct packaging of goods to consumers, which makes storage and transportation simple. Many brands are shifting towards sustainable packaging solutions such as recyclable or biodegradable plastics to satisfy consumer desire and comply with government initiatives for plastic reduction. Moreover, sectors such as food and beverage, personal care, and pharmaceuticals mostly depend on packaging for the safety and longevity of the products.

The medical & pharmaceutical segment is expected to witness the fastest growth (CAGR) over the forecast period, driven by the evolving healthcare sector. Advancements in medical technology have developed plastic-based medical services based on diagnostic tools and variables that are more commonly used. In telehealth, portable, user-friendly gadgets have given a push to the market. They are lightweight, long-lasting, portable, and support home care monitoring with patient comfort. Single-use plastics in medical applications are widely demanded for plastic in this segment to guarantee product safety and sterility.

Regional Insights

The North American commodity plastics market had a significant share in the global market in 2024 due to the region's well-established manufacturing infrastructure, with a strong emphasis on innovation, the widespread use of commodity plastics such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC). Manufacturers such as Ford and General Motors have integrated polymer technology into the automotive industry, enhancing performance, fuel efficiency, and lightweight and aligning with growing environmental regulations for sustainable materials. In addition, e-commerce platforms such as Amazon utilize plastic packing for shipping, minimizing waste through recyclable and biodegradable plastic options.

U.S. Commodity Plastics Market Trends

The commodity plastics market in the U.S. dominated North America, with the largest revenue share in 2024, due to the support of a large manufacturing sector that supports a diverse range of industries, automotive, packaging, construction, and consumer goods. Giant players such as Ford and Tesla in the automotive industry and companies such as Amazon and Walmart in the e-commerce sector have further driven and boosted the market to a new high. In addition, the combination of these industry dynamics has positioned the U.S. commodity plastics market as a leader in North America, with strong continuous growth.

Asia Pacific Commodity Plastics Market Trends

Asia Pacific accounted for the largest revenue share of 48.0% in the global market in 2024, driven by rapid urbanization, industrialization, and significant growth of the middle-class segment, especially in countries such as China and India. Market dynamics have changed due to government initiatives promoting manufacturing and sustainability and influencing the market. This has increased demand for consumer items requiring plastic components and packing with low production costs. These incomparable manufacturing skills have made it a global hub for plastic production. The growth of the e-commerce industry has similarly driven the market with demand, encouraging innovation in sustainable packaging and influencing the market.

China accounted for a significant share of the regional market due to its largest and most efficient manufacturing sector, with numerous plastic production facilities that benefit from economies of scale, reduced production costs, and higher output. The Chinese government has implemented investment incentives, subsidies, and technological advancements to upgrade, promote, and foster the plastics sector. China’s position as a lead exporter significantly impacted its market share, and it anticipated continuing to dominate its leadership position by adapting to new challenges and opportunities, particularly in sustainability and innovation.

Middle East & Africa Commodity Plastics Market Trends

Middle East & Africa is expected to advance at the fastest CAGR of 3.2% from 2025 to 2030, driven by key trends and developments. The major factors contributing to the growth of the demand for plastics across diverse sectors, including packaging, construction, and automotive. Major multinational companies are expanding their operations in MEA as they recognize their potential. The government has implemented favorable policies and regulatory frameworks to promote industrial growth, enhancing competition and innovation in the market. Overall, the MEA commodity plastics market is set to emerge as a dynamic segment driven by economic development, demographic shifts, and evolving consumer preferences, positioning it to lead the market share in the coming years.

The GCC accounts for a significant share of the regional market, driven by rapid urbanization and economic diversification of GCC nations. Initiatives such as Saudi Vision 2030 and UAE’s Industrial Strategy 2021 have aimed to boost domestic manufacturing capacity and reduce reliance on imports, creating a favorable atmosphere for the plastics industry's expansion. GCC countries are rich in hydrocarbon resources, providing an advantage in plastic manufacturing and export. Moreover, the region's favorable trade environment and several free trade agreements enhance market growth.

Key Commodity Plastics Company Insights

Key companies involved in the commodity plastics market include BASF SE., SABIC, Dow Inc., and others.

-

BASF SE produces a wide range of plastics, including polyethylene (PE), polypropylene (PP), and polystyrene (PS), which are widely used in various industries. The company also invests in research and development to create eco-friendly plastics, including bio-based and recycled materials.

-

SABIC (Saudi Basic Industries Corporation) is one of the largest petrochemical companies known for its comprehensive range of high-quality commodity plastic products and innovative solutions.

Key Commodity Plastics Companies:

The following are the leading companies in the commodity plastics market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE.

- SABIC

- DuPont de Nemours Inc.

- Evonik Group

- Sumitomo Chemical Co. Ltd.

- Arkema

- Eastman Chemical Company

- Chevron Phillips Chemical Co., LLC

- Exxon Mobil Corporation

Recent Developments

-

In October 2024, Arkema launched ethyl acrylate, made by bioethanol. With bioethanol supplied sustainably from biomass feedstock, this bio-based ethyl acrylate boasts a 40% biocarbon content (BCC) and achieves a 30% reduction in product carbon footprint (PCF). In rapidly expanding areas such as new energies, e-mobility, living comfort, and building efficiency, the new ethyl acrylate is likely to expand Arkema's line of bio-based and lower-carbon specialized acrylic resins and additives.

-

In July 2024, BASF introduced Haptex 4.0, a sustainable synthetic recyclable leather.Its special formulation and technical approach can be recycled with polyethylene terephthalate (PET) fabric without requiring a layer peel-off procedure. Haptex 4.0's overall durability and affordability, anti-yellowing qualities, heat resistance, and autoclave durability further broaden its application in multiple industries, such as furniture, footwear, fashion, and automobile interiors.

Commodity Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 516.1 billion

Revenue forecast in 2030

USD 595.7 billion

Growth rate

CAGR of 2.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, Mexico, ROMEA, South Africa

Key companies profiled

BASF SE., SABIC, Dow Inc., DuPont de Nemours, Inc., Evonik Group, Sumitomo Chemical Co., Ltd., Arkema, Eastman Chemical Company, Chevron Phillips Chemical Co., LLC, Exxon Mobil Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commodity Plastics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commodity plastics market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polystyrene (PS)

-

Poly Methyl Methacrylate (PMMA)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Packaging

-

Building & Construction

-

Electrical & Electronics

-

Automotive & Transportation

-

Medical & Pharmaceutical

-

Textile

-

Consumer Durable Goods

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

GCC

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.