- Home

- »

- Automotive & Transportation

- »

-

Commercial Vehicle Remote Diagnostics Market Report 2030GVR Report cover

![Commercial Vehicle Remote Diagnostics Market Size, Share & Trends Report]()

Commercial Vehicle Remote Diagnostics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Vehicle Type, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-399-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

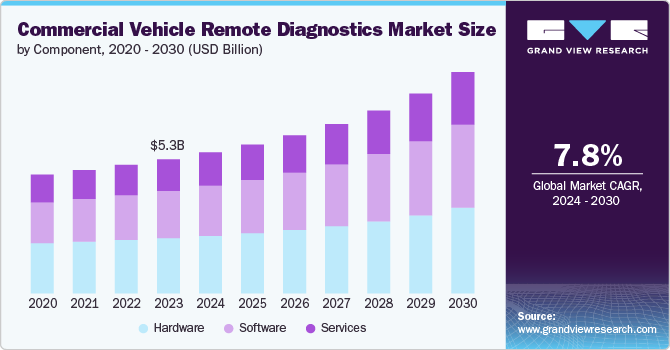

The global commercial vehicle remote diagnostics market size was estimated at USD 5.27 billion in 2023 and is expected to grow at a CAGR of 7.8% from 2024 to 2030. The increasing emphasis on reducing vehicle downtime and maintenance costs is a primary driver, as fleet operators seek to enhance operational efficiency and profitability.

Remote diagnostics enable real-time monitoring and early detection of potential issues, allowing for proactive maintenance and repairs. The stringent regulatory requirements for emissions and safety standards also drive the adoption of remote diagnostics, as these systems help ensure compliance and avoid penalties. The rising adoption of telematics and IoT technologies further boosts the market, providing the necessary infrastructure for remote diagnostics. Additionally, the growing demand for predictive maintenance solutions, which leverage data analytics and AI to forecast potential failures, significantly contributes to market growth.

Several notable trends are shaping the market. One prominent trend is the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in diagnostics solutions. These technologies enhance the accuracy and predictive capabilities of remote diagnostics, enabling more effective maintenance and repair strategies. The shift towards cloud-based diagnostics platforms is another key trend, offering scalability, flexibility, and ease of access to diagnostic data. The increasing focus on cybersecurity is also noteworthy, as the growing reliance on connected systems necessitates robust security measures to protect sensitive vehicle data. Additionally, the trend towards comprehensive fleet management solutions integrating remote diagnostics with other telematics functionalities is gaining traction, providing fleet operators with a holistic view of their operations.

The market presents numerous opportunities for growth and innovation. The expanding commercial vehicle fleets, particularly in emerging economies, offer significant potential for market expansion. As these regions invest in transportation infrastructure and logistics, the demand for remote diagnostics solutions is expected to rise. The aftermarket segment presents another lucrative opportunity, as the retrofitting of existing vehicles with advanced diagnostics systems gains popularity. The development of more sophisticated predictive maintenance solutions, leveraging AI and big data analytics, also holds promise for the market.

Additionally, strategic partnerships and collaborations between OEMs, technology providers, and fleet operators can drive innovation and enhance the adoption of remote diagnostics. The increasing focus on sustainability and reducing the environmental impact of commercial vehicles further creates opportunities for remote diagnostics solutions that contribute to more efficient and eco-friendly fleet operations.

Component Insights

The hardware segment dominated and accounted for more than 41% share of global revenue in 2023. This dominance is driven by the increasing adoption of telematics devices and diagnostic tools in commercial vehicles. The hardware components, including sensors, diagnostic devices, and telematics control units, are essential for collecting and transmitting vehicle data. The demand for hardware is propelled by the growing need for real-time monitoring and diagnostics to ensure vehicle health and optimize fleet performance. Technological advancements in hardware, such as the integration of advanced sensors and connectivity modules, further enhance their functionality and reliability. The emphasis on reducing vehicle downtime and maintenance costs is also contributing to the dominance of this segment.

The software segment is projected to witness significant growth from 2024 to 2030. This growth is fueled by the increasing demand for advanced diagnostic solutions that provide predictive maintenance and real-time analytics. Software platforms enable fleet operators to efficiently manage vehicle data, perform remote diagnostics, and predict potential failures before they occur. The shift towards cloud-based solutions and the integration of artificial intelligence (AI) and machine learning (ML) algorithms in diagnostics software are key factors driving this growth. These technologies enhance the accuracy of diagnostics and enable data-driven decision-making, improving overall fleet efficiency and reducing operational costs.

Vehicle Type Insights

The light commercial vehicles (LCVs) segment dominated the market in 2023 due to their widespread use in various industries, including logistics, retail, and service delivery. The high volume of LCVs in operation creates a substantial demand for remote diagnostics solutions to ensure their efficient operation and reduce downtime. Fleet operators of LCVs prioritize real-time monitoring and predictive maintenance to optimize vehicle utilization and minimize maintenance costs. The adoption of remote diagnostics in LCVs is also driven by regulatory requirements for emissions and safety standards, further contributing to their dominance in the market.

Heavy commercial vehicles (HCVs) are the fastest-growing segment in the market primarily due to the critical role these vehicles play in long-haul transportation and logistics. HCVs are subject to rigorous operational demands, making remote diagnostics essential for ensuring their reliability and safety. The increasing focus on fleet efficiency, fuel management, and compliance with stringent regulations drives the adoption of remote diagnostics solutions in HCVs. Technological advancements, such as advanced telematics and AI-driven predictive maintenance, enhance the effectiveness of diagnostics in HCVs, reducing downtime and operational costs and contributing to the rapid growth of this segment.

Application Insights

The fleet management segment dominated the market in 2023 driven by the need for comprehensive solutions to manage large fleets efficiently. Remote diagnostics plays a vital role in fleet management by providing real-time data on vehicle performance, location, and condition. This data enables fleet operators to make informed decisions regarding vehicle utilization, routing, and maintenance. The emphasis on optimizing fleet operations, reducing fuel consumption, and ensuring compliance with regulations contributes to the dominance of fleet management applications. The integration of telematics and advanced analytics in remote diagnostics solutions further enhances the effectiveness of fleet management, making it a critical focus area for commercial vehicle operators.

The predictive analysis segment is experiencing significant growth in the market driven by the increasing adoption of AI and ML technologies. Predictive analysis leverages data from remote diagnostics to forecast potential issues and recommend preventive measures. This application is gaining traction due to its ability to enhance vehicle reliability, reduce maintenance costs, and improve safety. Fleet operators benefit from predictive analysis by identifying patterns and trends in vehicle data, enabling proactive maintenance and minimizing unplanned downtime. The growing focus on data-driven decision-making and the integration of predictive analytics in fleet management systems contribute to the rapid growth of this application.

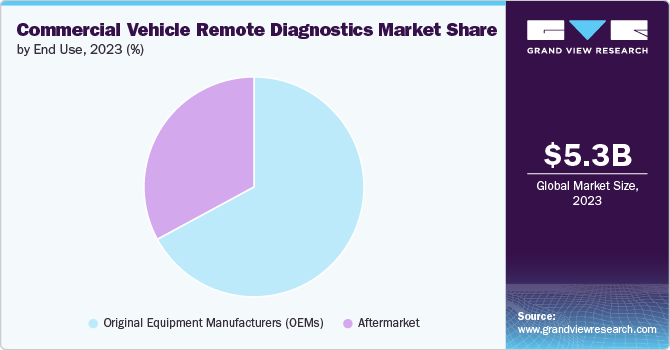

End Use Insights

The original equipment manufacturers (OEMs) segment dominated the market in 2023, leveraging their expertise in vehicle design and manufacturing to integrate advanced diagnostics solutions. OEMs are increasingly incorporating remote diagnostics capabilities into their vehicles to provide value-added services to their customers. This integration enables OEMs to offer comprehensive maintenance and support packages, enhancing customer satisfaction and loyalty. The dominance of OEMs is also driven by their ability to develop proprietary diagnostics systems tailored to their vehicles, ensuring optimal performance and reliability. Additionally, regulatory requirements for emissions and safety standards encourage OEMs to adopt remote diagnostics solutions, further solidifying their position in the market.

The aftermarket segment is experiencing significant growth in the market driven by the increasing demand for retrofitting existing vehicles with advanced diagnostics solutions. Fleet operators and independent service providers seek cost-effective solutions to enhance the performance and reliability of their commercial vehicles. The aftermarket offers a wide range of remote diagnostics products and services, including hardware, software, and support, catering to the diverse needs of the market. The growth of this segment is also fueled by the rising adoption of telematics and IoT technologies, enabling seamless integration of diagnostics solutions into older vehicle models. This flexibility and cost-efficiency make the aftermarket a critical growth area in the market.

Regional Insights

The commercial vehicle remote diagnostics market in North America holds a significant share in 2023, driven by the advanced automotive industry and high adoption of telematics solutions. The presence of leading OEMs and technology providers in the region contributes to the widespread implementation of remote diagnostics systems. Regulatory mandates for emissions control and safety standards also propel the market growth in North America. Fleet operators in the region prioritize vehicle uptime and operational efficiency, driving the demand for advanced diagnostics solutions. The integration of AI and ML technologies in diagnostics and the emphasis on predictive maintenance further enhance the market's growth prospects in North America.

U.S. Commercial Vehicle Remote Diagnostics Market Trends

The U.S. commercial vehicle remote diagnostics marketis a major market driven by the high adoption of telematics and advanced diagnostics solutions among fleet operators. The presence of leading OEMs and technology providers in the country contributes to the widespread implementation of remote diagnostics systems. The emphasis on reducing vehicle downtime, optimizing fleet performance, and ensuring regulatory compliance fuels the market growth in the U.S. The integration of AI and ML technologies in diagnostics and the growing focus on predictive maintenance enhance the effectiveness of remote diagnostics solutions, making them a critical component of fleet management strategies. The U.S. market is also characterized by a strong demand for aftermarket diagnostics solutions, catering to the diverse needs of commercial vehicle operators.

Asia Pacific Commercial Vehicle Remote Diagnostics Market Trends

The commercial vehicle remote diagnostics market in the Asia Pacific region is experiencing rapid growth, driven by the expanding commercial vehicle industry and increasing adoption of telematics solutions. Countries like China, Japan, and India are key contributors to the market growth, with significant investments in transportation infrastructure and logistics. The region's focus on enhancing fleet efficiency, reducing operational costs, and ensuring vehicle safety drives the demand for remote diagnostics solutions. The adoption of advanced technologies, such as IoT and AI, in diagnostics and fleet management is also on the rise in Asia Pacific, contributing to the market's rapid expansion. The increasing number of commercial vehicles and the growing need for efficient maintenance solutions further propel the market growth in the region.

Europe Commercial Vehicle Remote Diagnostics Market Trends

The European commercial vehicle remote diagnostics market is characterized by stringent regulatory requirements for vehicle emissions and safety. The region's focus on sustainability and reducing the environmental impact of commercial vehicles drives the adoption of advanced diagnostics solutions. European OEMs and fleet operators emphasize the use of telematics and remote diagnostics to ensure compliance with regulations and optimize fleet performance. The market growth in Europe is also supported by the presence of established automotive manufacturers and technology providers. The increasing demand for predictive maintenance and data-driven fleet management solutions further boosts the adoption of remote diagnostics in the region.

Key Commercial Vehicle Remote Diagnostics Company Insights

Key players are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Commercial Vehicle Remote Diagnostics Companies:

The following are the leading companies in the commercial vehicle remote diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Tech Mahindra Limited

- Vidiwave Ltd

- VECV (Volvo Eicher Commercial Vehicles)

- ZF Friedrichshafen AG

- Airmax Group

- Robert Bosch GmbH

- Continental AG

- HARMAN International

- Delphi Technologies

- Eltima Software

- WABCO

- Embitel

Recent Developments

-

In February 2024, Eicher Trucks and Buses, has made its debut into the small commercial vehicle segment, by launching its EV-first truck at the Bharat Mobility Global Expo 2024. This truck is designed for suburban and urban distribution and aims to revolutionize last-mile logistics with a gross vehicle weight (GVW) of 2 to 3.5 tonnes.

-

In March 2022, Continental is enhancing its commercial vehicle servicing product lineup by introducing TPMS Update Plus Transport, designed for tire pressure monitoring and maintenance on tractor units and semitrailers. This addition transforms TPMS Pro into a comprehensive TPMS service unit for commercial vehicles.

Commercial Vehicle Remote Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.54 billion

Revenue forecast in 2030

USD 8.70 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE, South Africa

Key companies profiled

Tech Mahindra Limited; Vidiwave Ltd; VECV (Volvo Eicher Commercial Vehicles); ZF Friedrichshafen AG; Airmax Group; Robert Bosch GmbH; Continental AG; HARMAN International; Delphi Technologies; Eltima Software; WABCO, Embitel

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scopes

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Vehicle Remote Diagnostics Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global commercial vehicle remote diagnostics market based on the component, vehicle type, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Vehicle Health Tracking & Diagnosis

-

Vehicle Maintenance & Repair

-

Fleet Management

-

Predictive Analysis

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Original Equipment Manufacturers (OEMs)

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial vehicle remote diagnostics market size was estimated at USD 5.27 billion in 2023 and is expected to reach USD 5.54 billion in 2024.

b. The global commercial vehicle remote diagnostics market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 8.70 billion by 2030.

b. North America dominated the commercial vehicle remote diagnostics market with a share of over 35.0% in 2023 due to the advanced automotive industry and high adoption of telematics solutions. The presence of leading OEMs and technology providers in the region contributes to the widespread implementation of remote diagnostics systems

b. Some key players operating in the commercial vehicle remote diagnostics market include Tech Mahindra Limited, Vidiwave Ltd, VECV (Volvo Eicher Commercial Vehicles), ZF Friedrichshafen AG, Airmax Group, Robert Bosch GmbH, Continental AG, HARMAN International, Delphi Technologies, Eltima Software, WABCO, Embitel.

b. Key factors driving market growth include the increasing emphasis on reducing vehicle downtime and maintenance and the stringent regulatory requirements for emissions and safety standards

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.