- Home

- »

- Next Generation Technologies

- »

-

Commercial UAV Market Size, Share & Growth Report, 2030GVR Report cover

![Commercial UAV Market Size, Share & Trends Report]()

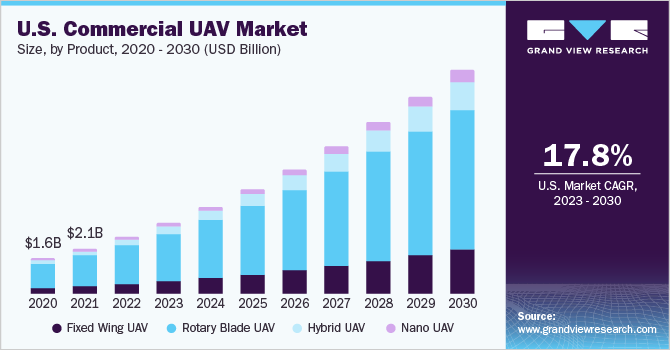

Commercial UAV Market Size, Share & Trends Analysis Report By Product (Fixed Wing, Rotary Blade, Nano, Hybrid), By Application (Agriculture, Energy, Government, Media & Entertainment, Construction), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-584-7

- Number of Report Pages: 171

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Commercial UAV Market Size & Trends

The global commercial UAV market size was valued at USD 9,393.0 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.5% from 2023 to 2030. The growth can be credited to the increasing commercial UAV applications that are set to transform the outlook of various industries. The ongoing technological developments and declining costs are impelling the demand for UAVs in commercial applications, ranging from aerial photography and filming to mapping and surveying, inspections, spraying and seeding, and delivery. The growing significance of UAVs in industries, including agriculture, energy, utilities, retail, media, entertainment, etc. is expected to accelerate the demand for commercial UAVs in the coming years.

The expansion of the global construction sector is positively influencing the growth of the market for commercial UAVs, as they are primarily engaged in the development of buildings or engineering projects. UAVs find important usage in site surveys, the creation of 3D maps, and tracking the progress of projects.

In September 2022, researchers from Imperial College London and Empa developed a fleet of 3D printing drones for constructing and repairing structures in-flight. The drones, collectively known as Aerial Additive Manufacturing, function co-operatively from a single blueprint. They are completely autonomous during flight; however, a human controller monitors them to track progress and intervene whenever required, according to the information provided by the fleet.

UAVs can produce impressive aerial views that provide clients with valuable insights into the project’s progress, especially when they are not physically present on-site. Besides client communications, UAVs can facilitate effective internal collaboration between teams by sending information over connected software during flyovers. This allows design teams, construction managers, engineers, owners, and workers to access the data and identify any discrepancies that might have occurred.

Commercial UAVs are transforming the way law enforcement agencies respond to incidents and maintain public safety, on account of various advantages associated with them. Prominent benefits of commercial UAVs in this area include improved visual capacities, rapid response, high return on investment, etc. They offer improved safety for security personnel as UAVs can quickly fly beforehand and detect threats in advance while providing aerial images and real-time footage. This allows security staff to understand the level of danger and take the appropriate response.

Another crucial factor enhancing the commercial UAV industry is the significant advancements in drone technology being achieved in various other domains. Drones are likely to be able to direct and guide autonomous vehicles in the future. Amazon and other manufacturers are known to have tested systems that combine UAVs with autonomous vehicles. Similar technology could help in directing construction vehicles and transporting building materials.

Product Insights

The rotary blade segment held the dominant revenue share of over 68.0% in 2022 and is expected to record exceptional growth over the forecast period. This can be credited to their ability to traverse several directions as well as hover in a particular position, which makes them ideal for several applications. These UAVs can fly in narrow spaces and around obstacles, owing to which they are used in inspection applications such as machine and industrial plant monitoring. They are also used in aerial mapping and surveying, crop monitoring, photography/videography, and search & rescue operations.

The hybrid UAV segment is estimated to record a CAGR of 23.3% from 2023 to 2030 owing to the increasing product demand driven by numerous advantages. They can carry a variety of payloads, which has increased their demand for heavy-lift and long-endurance applications such as crop management, cargo delivery, surveying, mapping, etc. The extra payload capacity of these UAVs can be further used to carry additional fuel tanks, thereby providing more range and endurance.

Application Insights

The media & entertainment segment captured a revenue share of around 25.5% in 2022 in the commercial UAV market. The adoption of UAVs is transforming the way films are made through high-quality aerial photography. Moreover, UAVs can be programmed for filming mountainous highways, high-speed chases, following subjects through busy streets, or any other difficult setting.

Several technology companies are introducing innovative UAVs designed especially for filmmaking. In January 2021, at the Consumer Electronics Show, Sony Corporation unveiled Airpeak, its moviemaking drone based on artificial intelligence and robotics. It is equipped with image-steadying AI and flight-stabilizing technology designed to make films dynamically.

The retail segment is expected to witness a substantial growth rate of 24.9% over the forecast period. Commercial UAVs are finding important applications in the retail sector, especially in inventory management in terms of the optimization of yard and warehouse operations. They can scan the products through aisles and help retailers access inventory information rapidly with greater accuracy as compared to humans. Several retail companies are employing UAVs for faster and last-mile deliveries.

Regional Insights

North America captured a significant revenue share of 32.7% in 2022, owing to the increasing production of UAVs and their applications in the commercial sectors. According to the Federal Aviation Administration (FAA), 855,860 drones were registered in the U.S., as of May 2022. Out of these, 316,075 were for commercial purposes such as surveying and mapping, photography and filming, inspection, spraying and seeding, etc.

For instance, the National Oceanic and Atmospheric Administration (NOAA) uses UAVs for collecting survey data. According to the NOAA, drone-based surveys of large marine areas are more precise and can be completed in significantly lesser time as compared to traditional vessel-based surveys.

On the other hand, Asia Pacific is estimated to record a CAGR of 21.7% from 2023 to 2030, owing to favorable government initiatives in the region. For instance, in December 2021, the Australian government announced a USD 23.6 million initiative to explore the application of new aviation technology. The Emerging Aviation Technology Partnerships Program aims to support the sector comprising drones, alternative propulsion systems, and electric vertical take-off and landing aircraft. The funding will be allocated for operational trials of innovative technologies and enabling R&D activities.

Key Companies & Market Share Insights

The key market players operating in the commercial UAV space are focusing on employing technologically advanced solutions. They are also implementing various strategic initiatives, such as collaborations, mergers, acquisitions, and partnerships to gain a competitive edge in the market. In January 2023, Korea Aerospace Industries (KAI) signed an agreement with Northrop Grumman for technical cooperation for the development of vertical take-off and landing UAVs. These UAVs for maritime missions will be used for the surveillance of jurisdictional waters and territorial defense. Some of the prominent players in the global commercial UAV market are:

-

AeroVironment Inc.

-

Aurora Flight

-

BAE Systems plc

-

Challis Heliplane UAV Inc.

-

DJI Innovations

-

Draganfly, Inc.

-

EHang

-

Elbit Systems Ltd.

-

General Dynamics Corporation

-

Israel Aerospace Industries

-

Parrot SA

-

Prox Dynamics AS

-

SAIC

-

Textron Inc.

-

The Boeing Company

-

Turkish Aerospace Industries Inc.

-

Yuneec Holding Ltd.

Commercial UAV Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12,027.7 million

Revenue forecast in 2030

USD 41,781.7 million

Growth rate

CAGR of 19.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; China; Japan; South Korea; Australia; Brazil; Mexico; UAE; Israel; South Africa

Key companies profiled

AeroVironment Inc.; Aurora Flight; BAE Systems plc; Challis Heliplane UAV Inc.; DJI Innovations; Draganfly, Inc.; EHang; Elbit Systems Ltd.; General Dynamics Corporation; Israel Aerospace Industries; Parrot SA; Prox Dynamics AS; SAIC; Textron Inc.; The Boeing Company; Turkish Aerospace Industries Inc.; Yuneec Holding Ltd.

Pricing and purchase options

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global commercial UAV Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial UAV market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed wing UAV

-

Rotary blade UAV

-

Hybrid UAV

-

Nano UAV

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Retail

-

Energy

-

Media and Entertainment

-

Construction

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Israel

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial UAV market size was estimated at USD 9,393.0 million in 2022 and is expected to reach USD 12,027.7 million in 2023.

b. The global commercial UAV market is expected to grow at a compound annual growth rate of 19.5% from 2023 to 2030 to reach USD 41,781.7 million by 2030.

b. Based on product, the rotary blade UAV segment dominated the market in 2022 with a share of more than 68.0%. The segment growth is attributed to the ability of rotary blade UAV to traverse several directions as well as hover in a particular position which makes them ideal for a vast array of applications.

b. The key players in this industry are BAE Systems, Northrop Grumman, Lockheed Martin Corporation, and The Boeing Company among others.

b. Key factors that are driving the commercial UAV market growth include surging applications in the government and retail industry sector and relaxations in regulations among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."