Commercial Tableware Market Size, Share & Trends Analysis Report By Product (Dinnerware, Cutlery), By Distribution Channel (Offline, Online), By Region (North America, Europe, Asia Pacific, Latin America, MEA) , And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-578-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Commercial Tableware Market Size & Trends

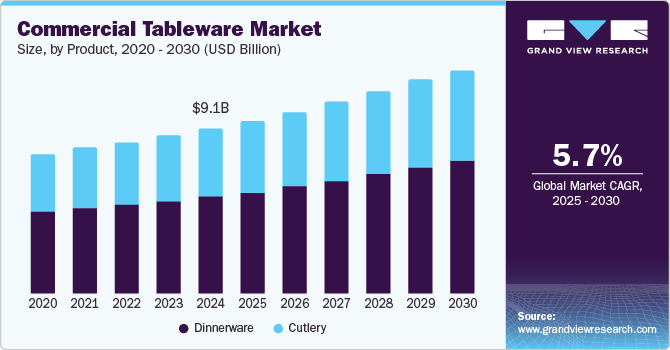

The global commercial tableware market size was valued at USD 9.06 billion in 2024 and is projected to grow at a CAGR of 5.66% from 2025 to 2030. The growth of this market is mainly driven by aspects such as growing utilization by the hospitality and food services industry, changing lifestyles, and rising demand for serving ware characterized with distinctive aesthetic value, colors, and designs. Significant growth in consumption of ready-to-eat food and items served by restaurants, hotels, street food vendors, and others is likely to add growth opportunities.

In recent years, luxury food service experiences have gained increasing customer attention worldwide. The growth experienced by the global tourism industry has contributed to this, with a large number of tourists visiting multiple restaurants across regions for authentic tastes of cuisines, traditional food menus, and links of culinary affection with different cultures. According to UN Tourism, in 2024, nearly 1.1 billion travelers traveled internationally during the first nine months. This has increased demand for commercial tableware products such as plates, bowls, spoons, forks, knives, etc.

An increasing number of social gatherings followed by dinner served by local caterers or popular vendors has also increased demand for commercial tableware services. Social gatherings such as weddings, corporate team outings, private parties, sports tournament closing ceremonies, and others include dinners designed according to the hosts' instructions. This requires a large set of dinnerware, numerous spoons and forks, bowls, knives, and others. Caterers and vendors prefer keeping the stock of such tableware products with them to ensure a seamless flow of operations.

Growth in urbanization and a large number of individuals choosing to eat outside frequently have resulted in a rise in the number of food service vendors. In 2023, 4.61 billion individuals lived in urban areas worldwide. This is expected to fuel demand for commercial tableware products that are easy to wash, store, and carry across places according to requirements.

Product Insights

Based on products, the dinnerware segment dominated the global commercial tableware industry with a revenue share of 58.4% in 2024. This is attributed to the increasing demand for luxury culinary experiences, the growth in several individuals who prefer eating outside, the entry of new businesses in the hospitality industry, rising demand from commercial catering service providers, and the availability of extensive collections launched by key market participants. In October 2024, LOUIS VUITTON, a prominent brand in the high-end fashion and style industry, announced the launch of a permanent tableware collection.

The cutlery segment is expected to experience significant growth from 2025 to 2030. This market's development is primarily influenced by aspects such as increasing demand from restaurants, quick-service restaurant outlets, food vendors, and luxury hotels. Changing lifestyles in urban areas, increased consumption of ready-to-eat meal servings, and increased spending on culinary experiences are expected to add novel opportunities for this segment.

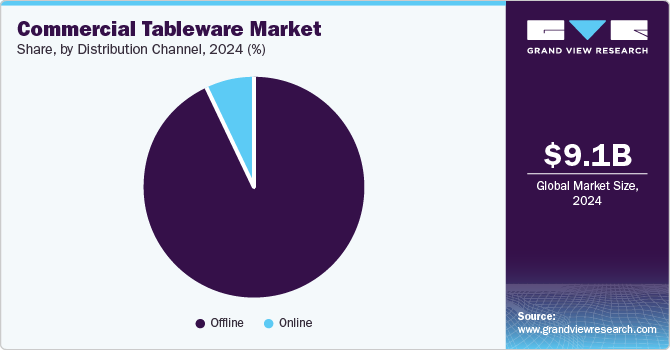

Distribution Channel Insights

The offline segment held the largest revenue share of the global commercial tableware market in 2024. The growth of this segment is mainly attributed to the availability of commercial tableware products such as stoneware, ceramic ware, starter and dessert sets, plates, serving bowls, dip plates, cups, mugs, platters, trays, and others through specialty stores. Commercial buyers prefer purchasing such products in greater quantity at once to ensure aesthetic similarities in service experience at restaurants or cafes. Companies prefer launching high-end collections through offline stores to accomplish enhanced brand visibility.

The online distribution segment is expected to experience moderate growth during the forecast period. Growth in this segment is primarily driven by aspects such as the convenience offered by the online shopping experience, the availability of diverse collections through key companies' online portals, and ease of accessibility. Additional services such as diligent deliveries, detailed product descriptions on websites, and enhanced customer assistance are expected to add growth opportunities.

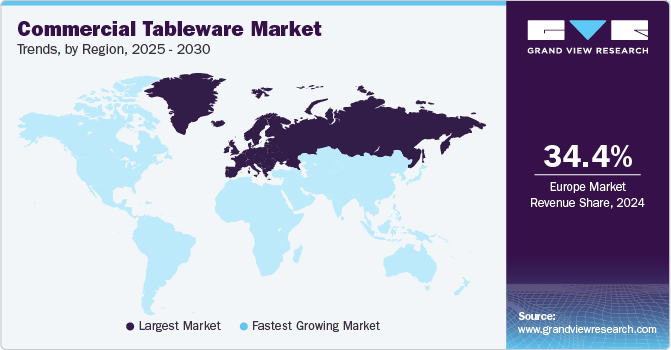

Regional Insights

Europe dominated the global commercial tableware industry, with a revenue share of 34.4% in 2024. This is attributed to factors such as the robust luxury culinary experience industry operating in the region and the large number of cafes, eateries, and restaurants present in countries such as Italy, France, the UK, and others. The increase in the number of international traveler visits in Europe is adding lucrative growth opportunities to this market.

Germany commercial tableware market held the largest revenue share of the European commercial tableware market in 2024. The growth of this market is mainly influenced by the expansion of the tourism and hospitality industry, growth in demand for high-quality tableware products, and the robust manufacturing sector operating in Germany. The availability of large varieties and increasing utilization of luxury range products for dining experiences is expected to fuel the growth of this market over the forecast period.

North America Commercial Tableware Market Trends

North America commercial tableware market was identified as a key global commercial tableware market region in 2024. This is attributed to factors such as increasing growth experienced by the hospitality and tourism industry and growing demand for exclusive culinary experiences in the area. Accessibility to a wide range of commercial tableware products is expected to add growth opportunities.

The U.S. commercial tableware market held the largest revenue share of the regional industry in 2024. This market's growth is fueled by the country's diverse population with a variety of taste preferences. Demand for numerous culinary offerings, the large number of premium restaurants operating in the U.S., and the increasing growth experienced by theme-based culinary experiences have resulted in growing demand for various tableware products.

Asia Pacific Commercial Tableware Market Trends

Asia Pacific commercial tableware market is expected to experience the fastest CAGR during the forecast period. This is attributed to the growth experienced by the regional food tourism industry, the large number of restaurants, and the entry of multiple international market participants in the regional industry for commercial tableware. Growth in urbanization and various regional manufacturers are likely to add growth.

China commercial tableware market held the largest revenue share of the Asia Pacific commercial tableware market in 2024. The growth of this market is fueled by the presence of multiple manufacturing facilities operating in the country and the popularity of chinaware products often used in high-end dining services and more. An increase in the entry of global market participants in the hospitality industry in the country and growing tourism is expected to influence this market positively.

Key Commercial Tableware Company Insight

Some of the key companies in the global commercial tableware market are Victorino, Cardinal International, Churchill China (UK) Ltd., Steelite International Ltd., FISKARS GROUP, and others. To address growing competition and increasing demand for premium-range products, the major market participants are embracing portfolio expansions, geographical expansions, collaborations, and more strategies.

-

Victorinox offers five categories of high-end products: knives, cutlery, watches, travel gear, and fragrances. Its cutlery portfolio includes a Swiss classic kitchen set, a Swiss classic cutlery block, a Swiss modern chef’s knife, and Grand Maître knives.

-

Churchill China (UK) Ltd. specializes in designing and manufacturing tableware for professionals. Its diverse portfolio includes multiple ranges, such as Inspiration, Blues, and Botanicals. Its products include plates, bowls, cups and saucers, mugs, etc.

Key Commercial Tableware Companies:

The following are the leading companies in the commercial tableware market. These companies collectively hold the largest market share and dictate industry trends.

- Victorinox

- Cardinal International

- Churchill China (UK) Ltd.

- Steelite International Ltd.

- FISKARS GROUP

- Friedr. Dick GmbH & Co. KG

- Libbey

- Villeroy & Boch Group

- Royal Doulton

- Denby Pottery

View a comprehensive list of companies in the commercial tableware market

Recent Developments

-

In January 2025, Victorinox announced the launch of Alox Limited Edition 2025. It includes three distinctive models CLASSIC SD ALOX, PIONEER X ALOX, and EVOKE ALOX.

-

In November 2024, Villeroy & Boch Group announced the opening of its new outlet in company premises in Mettlach. The new outlet is part of the modernization plan of the site initiated by the group.

Commercial Tableware Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 9.50 billion |

|

Revenue forecast in 2030 |

USD 12.51 billion |

|

Growth rate |

CAGR of 5.66% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, South Korea, Japan, Australia Argentina, UAE, South Africa |

|

Key companies profiled |

Victorinox; Cardinal International; Churchill China (UK) Ltd.; Steelite International Ltd.; FISKARS GROUP; Friedr. Dick GmbH & Co. KG; Libbey; Villeroy & Boch Group; Royal Doulton; Denby Pottery; |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Commercial Tableware Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial tableware industry report based on product, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dinnerware

-

Plates

-

Bowls

-

-

Cutlery

-

Spoons

-

Forks

-

Knives

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

Australia

-

-

Latin America

-

Argentina

-

-

Middle East

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."