- Home

- »

- Food Safety & Processing

- »

-

Commercial Seeds Market Size, Share, Industry Report, 2030GVR Report cover

![Commercial Seeds Market Size, Share & Trends Report]()

Commercial Seeds Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Maize (Corn), Vegetable, Soybean, Cereals, Cotton, Others), By Genetically Modified Seeds Product, By Region, And Segment Forecasts

- Report ID: 978-1-68038-138-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Seeds Market Summary

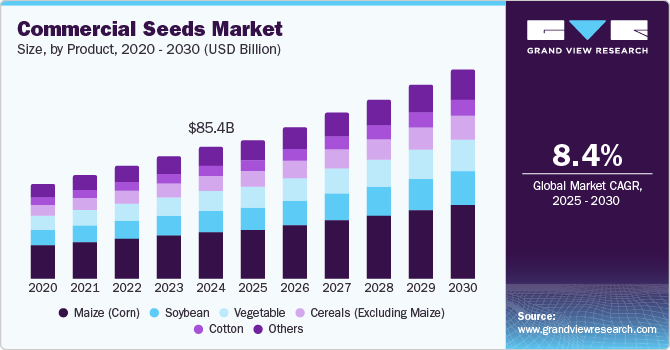

The global commercial seeds market size was valued at USD 85.42 billion in 2024 and is projected to reach USD 138.32 billion by 2030, growing at a CAGR of 8.4% from 2025 to 2030. The ability of commercial seeds to optimize crop yield while reducing arable land is a major driver of this market.

Key Market Trends & Insights

- The North America commercial seeds market accounted for the largest global revenue share of 33.5% in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024.

- Based on product, the maize (corn) segment accounted for the largest revenue share of 35.9% in the global commercial seeds industry in 2024.

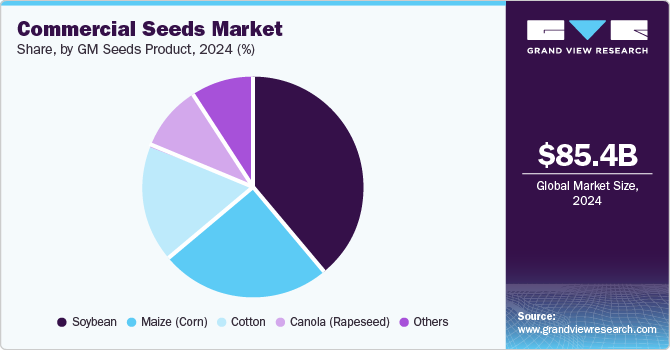

- Based on genetically modified seeds, the soybean segment accounted for a leading revenue share in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 85.42 Billion

- 2030 Projected Market Size: USD 138.32 Billion

- CAGR (2025-2030): 8.4%

- North America: Largest market in 2024

As the global population is poised to reach 9.7 billion by 2050, there is an urgent demand for increasing crop production through technologies and innovative cultivation processes. The steadily rising per capita disposable income, particularly in developing economies, has led to the extensive and inefficient consumption of food resources. This is expected to present a significant opportunity to market players, as commercial seeds are known to improve crop yield compared to farm seeds.In recent years, constant research in molecular biology has resulted in the faster and cheaper mapping of the genetic codes of plants. Continued technological advancements are expected to enable gene-edited crops to play an important role in improving food security, increasing crop resilience to climate change, and meeting the demands of a growing global population. The emergence of genetically modified (GM) seeds has empowered farmers to efficiently address major agricultural challenges, such as high demand, through increased production. The development of GM seeds that provide traits such as insect resistance (Bt cotton, Bt maize), herbicide tolerance (glyphosate-resistant crops), and drought tolerance (drought-resistant maize) has significantly boosted the demand for commercial GM seeds. Seeds designed for lower input requirements, such as less fertilizer, water, or pesticides, are becoming increasingly popular. These include drought-resistant and pest-resistant varieties that help farmers save on costs while producing high-quality crops.

The need for higher crop yields to meet global food requirements is a major driver of the commercial seeds industry. Hybrid and GM seeds, which typically offer higher productivity, have become appealing because they help farmers achieve greater efficiency in their operations. The growing impact of climate change in terms of unpredictability in weather patterns and increased frequency of droughts has surged the demand for drought-resistant seeds. Drought-resistant varieties, particularly in water-scarce regions, are critical for maintaining crop yields. In addition to drought resistance, seeds that can tolerate extreme temperatures, flood conditions, or other climate-related stresses are increasingly becoming popular among stakeholders in the market. This includes crops such as heat-tolerant maize, flood-resistant rice, and crops that can survive in saline soils. Governments often play a key role in driving demand for commercial seeds through subsidies, grants, or incentives. These strategies encourage the adoption of high-yielding or environmentally sustainable crops, aiding market growth.

Product Insights

The maize (corn) segment accounted for the largest revenue share of 35.9% in the global commercial seeds industry in 2024. According to data from the United Nations Food and Agriculture Organization, as of December 2024, the global maize output has been forecast to stand at 1,217 million tons, accounting for around 80% of the overall total of coarse grains. Commercial maize seeds are developed by seed companies and sold to farmers for large-scale production, typically for food, animal feed, and industrial uses. Moreover, the extensive utilization of corn-based products in manufacturing starch and sweeteners is expected to remain a major demand driver in the near future. Food security risks prevalent in underdeveloped and developing economies have compelled them to import such crops, shaping market growth. For instance, in May 2024, the Brazilian government stated that the country’s non-GMO corn had received approval to be exported to Zambia.

Meanwhile, the demand for commercial cereal seeds, excluding maize, is expected to grow at the fastest CAGR from 2025 to 2030. A significant proportion of consumers globally prefer non-GMO foods due to concerns over their potential health risks. This demand is particularly strong in developed markets such as the European Union, where GMO regulations are more stringent. In some economies, governments offer subsidies, grants, or incentives to support the cultivation of non-GMO or organic cereal crops. They are often considered part of more sustainable agricultural systems prioritizing soil health, biodiversity, and natural pest management.

Genetically Modified (GM) Seeds Product Insights

The soybean segment accounted for a leading revenue share in the global market in 2024. The urgent global need for higher crop yield and demand for soybean crops that are resistant to pests and diseases and are adaptable to various environmental conditions have led to this segment’s substantial contribution to the commercial seeds industry. GM soybeans are modified to resist herbicides or insects, making them popular among farmers in many countries, particularly in regions where agriculture is widely industrialized. According to data from a U.S. Department of Agriculture (USDA) survey, domestic soybean acres planted with herbicide-tolerant (HT) seeds grew from 17% in 1997 to 96% in 2024. South American economies such as Brazil and Argentina also have witnessed significant planting of GM varieties due to their benefits in terms of yield and ease of cultivation.

The maize (corn) segment is expected to grow at a substantial CAGR from 2025 to 2030. Notable advantages of GM maize, such as herbicide resistance, pest resistance, and enhanced drought tolerance, make it a popular choice for farmers, particularly in regions with high agricultural demand and economic pressures. Maize is a staple food crop in many developing countries, and GM varieties that are more resistant to pests and diseases can help stabilize food supplies. Additionally, GM maize may be used to create more nutritious food products, aiding its demand in food markets. Regions such as Africa have shown rising acceptance of such crops, as long-standing issues such as climate change and food security can be effectively addressed using GM seeds. For instance, in January 2024, Nigeria’s Federal Government announced its approval for the commercial release of GM drought-tolerant and insect-resistant maize variety, the TELA maize. This made it the second food crop in the economy to receive commercialization after Bt cowpea.

Regional Insights

The North America commercial seeds market accounted for the largest global revenue share of 33.5% in 2024. The demand for commercial seeds in regional economies is robust, driven by factors such as advanced agricultural practices, high adoption of genetically modified (GM) crops, and the growing focus on sustainable farming. The U.S. and Canada are major global producers of notable crops such as maize, soybeans, wheat, and cotton. To maintain high productivity, farmers rely heavily on seeds with traits such as high yield, pest resistance, and drought tolerance. Additionally, several notable companies in the region that are involved in developing commercial seeds and related technologies have boosted regional market growth.

U.S. Commercial Seeds Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, aided by establishing cutting-edge technologies, a strong export market, and implementing advanced agricultural practices. The country is a leading global agricultural producer, with key crops such as corn, soybeans, wheat, cotton, and vegetables requiring high-quality commercial seeds to ensure sustained productivity. American farmers rely on commercial seeds to enhance crop yields, pest resistance, and adaptability to varying climatic conditions. Key export markets such as China, Mexico, and Japan drive demand for premium seed varieties. Additionally, government initiatives such as the Farm Bill provide extensive support to agricultural innovations and subsidies to adopt advanced farming technologies, including high-quality seeds.

Europe Commercial Seeds Market Trends

Europe accounted for a substantial revenue share in the global market in 2024. Factors such as sustainability trends, technological advancements, climate change adaptation needs, and evolving consumer preferences have helped drive regional expansion. The market is growing, especially in the organic sector, with increasing demand for high-quality, climate-resilient, and sustainable crop varieties. Regulatory factors, positive consumer perception towards GMO varieties, and a growing focus on environment-friendly farming practices are expected to shape the commercial seeds industry in Europe. Countries such as the Netherlands, France, and Denmark have developed strong markets, and this sector has increased trade within Europe and internationally.

Asia Pacific Commercial Seeds Market Trends

Asia Pacific is expected to grow at the highest CAGR in this market during the forecast period. The demand for grains and vegetables remains consistently high across regional economies due to the vast population, leading to an increasing demand for commercial seed varieties. According to the United Nations Population Fund, the region is home to around 60% of the global population, driving the need for higher agricultural yields. Furthermore, increasing food consumption and changing dietary patterns, such as a shift toward higher protein diets, have highlighted the need for improved crop varieties. Many regional governments support agricultural modernization to improve food security, for instance, subsidies for high-yield and hybrid seeds in India and policies promoting GM crops in China. These factors are expected to increase the pace of industry expansion in the coming years.

China accounted for the largest revenue share in the Asia Pacific market for commercial seeds in 2024. The country is the second most populous economy globally, with more than 1.4 billion people, creating significant pressure on its agricultural sector to meet the steadily growing demand for food. As a result, the government is prioritizing food security, which drives the adoption of high-yield and high-quality commercial seeds to increase agricultural productivity. China has invested significantly in research & development initiatives to develop high-performing hybrid and genetically modified seeds. Government authorities have stated that scientists have been cataloging samples collected in three years from a countrywide survey on agricultural germplasm. These samples are being stored in several seed banks that are expected to cater to China’s food requirements for a minimum of three decades.

Key Commercial Seeds Company Insights

Some major companies involved in the global commercial seeds industry include Syngenta, Vilmorin-Mikado, and Bayer Group, among others.

-

Syngenta is a Switzerland-based global agribusiness company focused on agricultural technology and innovation. The company offers products in crop protection, seeds, and biologicals while also providing digital and professional solutions. Syngenta develops technologically advanced seeds to mitigate challenges such as insects, diseases, and unfavorable climatic conditions. The company has over 150 production and R&D sites and has partnered with 90,000 production growers in 35 countries to generate high seed demand.

-

Vilmorin-Mikado is a seed producer specializing in creating, producing, and marketing vegetable seeds for professional growers and farmers. The company operates in over 100 countries and has 14 operational sites. Products include Leafy seeds (Babyleaf, Spinach, Iceberg, Oakleaf, Witloof Chicory, Romaine, Chioggia, and Batavia), Solanaceae (tomato, pepper, eggplant, cherry), and Roots & bulbs (carrot, radish, onion, and beetroot). Other notable offerings include Gourds and brassicas such as kabocha squash, melons, cauliflower, and broccoli.

Key Commercial Seeds Companies:

The following are the leading companies in the commercial seeds market. These companies collectively hold the largest market share and dictate industry trends.

- Syngenta Global AG

- Vilmorin-Mikado

- KWS SAAT SE & Co. KGaA

- Bayer Group

- Dow

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- SAKATA SEED AMERICA

- TAKII & CO.,LTD.

- Corteva

- Advanta Seeds

Recent Developments

-

In November 2024, Corteva introduced a proprietary and novel non-GMO hybrid technology for wheat, which is expected to ensure substantial yield improvements to the crop. The new method boosts yield potential by 10% while utilizing the same quantity of land resources. The company further states that research studies have shown the technology to be more drought-resistant, enabling farmers to have better results in water-stressed environments. The resulting wheat, called Hard Red Winter, is expected to launch in 2027 for the North American market.

-

In June 2023, seed breeding company Takii unveiled a new advanced seed production facility in Karacabey, Turkey. The plant, situated in the Bursa province, has been established to improve the company’s production process for both flower and vegetable seeds. The facility builds upon the company’s existing presence in the country, where two major R&D sites have already been established in Antalya. This move is expected to strengthen Takii’s worldwide presence and elevate its distribution activities to customers globally.

Commercial Seeds Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 92.45 billion

Revenue forecast in 2030

USD 138.32 billion

Growth Rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, genetically modified (GM) seeds product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Syngenta Global AG; Vilmorin-Mikado; KWS SAAT SE & Co. KGaA; Bayer Group; Dow; Rijk Zwaan Zaadteelt en Zaadhandel B.V.; SAKATA SEED AMERICA; TAKII & CO.,LTD.; Corteva; Advanta Seeds

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Seeds Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial seeds market report based on product, GM seeds product, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Maize (Corn)

-

Vegetable

-

Cereals (excluding Maize)

-

Cotton

-

Soybean

-

Others

-

-

Genetically Modified Seeds Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Soybean

-

Maize (Corn)

-

Cotton

-

Canola (Rapeseed)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.