- Home

- »

- Homecare & Decor

- »

-

Commercial Kitchen Knives Market Size, Share Report, 2030GVR Report cover

![Commercial Kitchen Knives Market Size, Share & Trends Report]()

Commercial Kitchen Knives Market (2024 - 2030) Size, Share & Trends Analysis Report By Cutting Edge (Plain, Serrated), By Type (Chef’s Knife, Utility & Paring Knife), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-310-2

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Kitchen Knives Market Trends

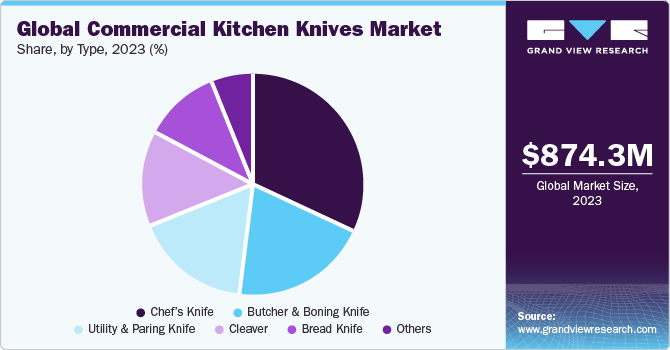

The global commercial kitchen knives market size was estimated at USD 874.3 million in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. The expansion of the food service industry, which includes restaurants, hotels, catering services, and institutional food service providers, is a significant driver of the commercial kitchen knives market. As the demand for prepared food and dining experiences continues to rise globally, there is a growing need for high-quality kitchen knives to support food preparation, cooking, and presentation.

Consumers are becoming more adventurous and discerning in their dining preferences. Therefore, food service establishments are under pressure to innovate and offer unique culinary experiences. This trend toward culinary innovation often requires specialized kitchen tools, including knives tailored to specific tasks such as filleting fish, carving meats, or creating intricate garnishes. As establishments seek to differentiate themselves through their culinary offerings, the demand for specialized commercial kitchen knives increases.

The U.S. has a thriving food service sector, encompassing a wide array of establishments involved in providing meals prepared for consumption outside the home. This diverse industry includes full-service restaurants (FSRs), quick-service restaurants (QSRs), catering companies, coffee shops, cafes, private chefs, and various other dining establishments catering to different culinary preferences and occasions.

Japanese knives such as Santoku, have gained immense popularity and recognition in the global culinary community, with their precision, craftsmanship, and superior performance setting them apart from other types of kitchen knives. Various factors are driving the surge in demand for Japanese knives in the commercial kitchen knives market. Exploring the unique characteristics, cultural significance, and functional advantages has propelled their popularity among professional chefs, culinary enthusiasts, and food service establishments worldwide.

According to a study conducted by the Japan External Trade Organization (JETRO), a notable transformation has occurred within the American cutlery market. While German manufacturers have traditionally held sway, Japanese brands are progressively establishing themselves, carving out a distinctive space. The remarkable artistry inherent in Japanese knives, particularly the traditional varieties, is garnering extensive recognition.

The proliferation of counterfeit kitchen knives has significant economic repercussions for legitimate manufacturers, who lose revenue and market share to counterfeiters engaging in unfair competition. Counterfeit products undercut the prices of genuine knives, making it difficult for legitimate manufacturers to compete on a level playing field. Moreover, the resources spent on combating counterfeiting, such as legal fees, brand protection measures, and anti-counterfeiting technologies, divert valuable resources away from innovation, research, and development, hindering the growth and sustainability of the industry.

Market Concentration & Characteristics

Technology trends in the commercial kitchen knives market are revolutionizing the way knives are designed, manufactured, and used. The integration of advanced materials, such as high-performance steel and composite handle materials, enhances durability, sharpness, and ergonomic comfort. Moreover, precision manufacturing techniques, such as CNC machining and laser cutting, are enabling the production of knives with unparalleled precision and consistency.

Regulatory trends in the market are focusing on product safety, quality standards, and labeling requirements. Authorities are implementing stringent regulations to ensure that knives meet specific safety standards, particularly regarding blade sharpness and handle materials. Moreover, there is a growing emphasis on environmental sustainability, with regulations encouraging the use of eco-friendly materials and manufacturing processes.

The market is shaped by various competitive dynamics that influence industry behavior. Product differentiation, innovation, and technology play significant roles as manufacturers emphasize quality, design, and material advancements to set their knives apart. Additionally, branding, marketing, and the effectiveness of distribution channels are crucial factors that impact market reach and consumer accessibility.

Cutting Edge Insights

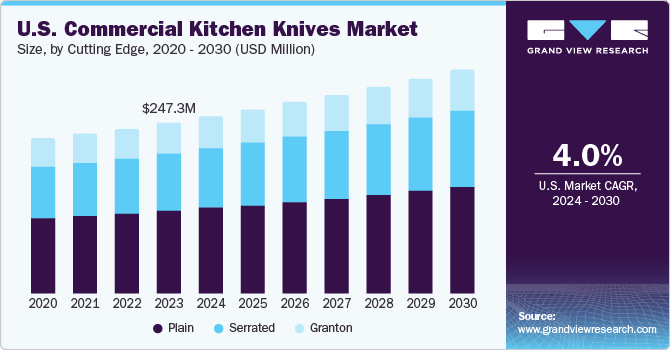

The plain cutting edge knives accounted for a revenue share of around 49% in 2023. These knives are renowned for their durability and reliability. They are crafted from high-quality stainless steel and are built to withstand the rigors of daily use in professional kitchens. Moreover, one of the main reasons for the increasing demand for plain commercial kitchen knives is their application versatility. Unlike specialized knives tailored to specific tasks, such as filleting fish or deboning poultry, plain knives excel in a wide range of culinary endeavors. From chopping herbs to dicing onions, their straightforward design and sharp blades make them suitable for virtually any cutting task encountered in a commercial kitchen setting. This versatility streamlines kitchen operations, reducing the need for multiple specialized knives and simplifying the chef's workflow, likely favoring the growth of the segment.

The serrated commercial kitchen knives segment is projected to grow at a CAGR of 6.8% from 2024 to 2030. Serrated commercial kitchen knives have minimal maintenance requirements compared to smooth-edged knives. The serrations help preserve the knife's cutting ability, reducing the frequency of sharpening and prolonging the knife's lifespan. In addition, the toothed edges of serrated knives are less prone to becoming dull from contact with cutting boards or hard surfaces, further minimizing maintenance needs.

Type Insights

The chef’s knife commercial kitchen knives accounted for a revenue share of around 32% in the year 2023. Chef’s knives are renowned for their durability and longevity, making them reliable investments for commercial kitchens. Constructed from high-quality materials such as stainless steel or carbon steel, Chef’s knives are built to withstand the rigors of daily use in professional culinary settings. Their robust construction and resilient blades retain sharpness over time, even with frequent use of tough or fibrous ingredients. Chef’s knives also perform consistently in demanding kitchen environments, likely favoring the growth of the segment.

The demand for utility & paring knives in commercial kitchens is projected to grow at a CAGR of 7.9% from 2024 to 2030. Utility and paring knives provide chefs with the precision and control necessary to achieve consistent results with every use. The efficiency and precision offered by these knives contribute to increased productivity and streamlined kitchen operations in commercial food service establishments. In addition, utility and paring knives offer chefs the flexibility to handle intricate cutting tasks with ease and precision. Their compact size and nimble blades make them indispensable tools for chefs seeking efficiency and precision in their culinary endeavors.

End-use Insights

The food service segment accounted for a revenue share of around 25% in 2023. The increase in the number of food service restaurants across has directly fueled the demand for kitchen knives. As more restaurants open their doors, whether it's major chains expanding their footprint, chef-driven establishments prioritizing culinary excellence, or the emergence of food halls and food truck parks, the need for high-quality knives rises proportionally. Each kitchen requires a range of knives tailored to specific tasks, from slicing and dicing ingredients to filleting and breaking down proteins. The growing emphasis on fresh, locally sourced ingredients and ethnic cuisine diversity has further driven the demand for specialized knives suited for processing various produce, meats, and seafood.

The hospitality segment is estimated is projected to grow at a CAGR of 8.4% from 2024 to 2030. The demand for commercial kitchen knives is experiencing a significant increase in the hospitality industry. From hotels and resorts to restaurants and catering companies, establishments within the hospitality sector rely heavily on high-quality knives to deliver exceptional culinary experiences to guests. As new hotels are built and existing ones expand, the need for well-equipped kitchens with appropriate knives increases. According to the America Hotel & Lodging Association, the average hotel occupancy rate increased from 57.5% in 2021 to 63.8% in 2023.

Regional Insights

The commercial kitchen knives market in North America held 36% of the global revenue in 2023. The construction plans for new slaughterhouses in the U.S. are projected to create thousands of jobs, which will likely lead to an increase in demand for kitchen knives in the food processing industry, as workers will require high-quality tools for tasks such as meat preparation and slicing.

U.S. Commercial Kitchen Knives Market Trends

The commercial kitchen knives market in the U.S. is expected to grow at a CAGR of 4.0% from 2024 to 2030. The U.S. market is experiencing growth driven by the increasing demand for high-quality kitchen tools among professional chefs and cooks. As the culinary industry continues to evolve, there is a growing emphasis on precision, durability, and cutting-edge technology in commercial kitchen knives.

Asia Pacific Commercial Kitchen Knives Market Trends

Asia Pacific commercial kitchen knives market is projected to grow at a CAGR of 8.6% from 2024 to 2030. Asia Pacific is projected to witness significant growth in commercial kitchen knives sales during the forecast period. China, India, and Japan are some of the key countries accounting for a major revenue share in the region. Moreover, the Asia Pacific region is experiencing rapid urbanization and population growth, leading to the expansion of the food service and hospitality industry and a surge in demand for commercial kitchen knives.

Key Commercial Kitchen Knives Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Commercial Kitchen Knives Companies:

The following are the leading companies in the commercial kitchen knives market. These companies collectively hold the largest market share and dictate industry trends.

- Werhahn KG

- Victorinox AG

- Wüsthof

- Yoshida Metal Industry Co. Ltd.

- MAC Knife

- Friedr. Dick GmbH & Co. KG

- KYOCERA Corporation

- Kai USA Ltd.

- Mercer Tool Corporation

- Dexter-Russell, Inc.

- Morakniv AB

- Groupe SEB

- Johannes Giesser Messerfabrik GmbH

Recent Developments

-

In April 2024,Victorinox AG expanded its Fibrox knife collection to include HACCP color coding, offering a range of colors, including blue, red, white, yellow, green, and purple, in addition to the classic black handles. The collection features 10 blade types suitable for various applications, all with handles made from thermoplastic elastomers (TPE) known for their non-slip properties and ability to withstand temperatures up to 80-100 degrees Celsius.

-

In April 2024,Wüsthof announced the building of its primary continental distribution center at the former Subway headquarters property. For its Americas headquarters, the company plans to construct a 160,000-square-foot warehouse and occupy two nearby office buildings.

Commercial Kitchen Knives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 926.7 million

Revenue forecast in 2030

USD 1.33 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cutting edge, type, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Switzerland; China; India; Japan; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Werhahn KG; Victorinox AG; Wüsthof; Yoshida Metal Industry Co. Ltd.; MAC Knife; Friedr. Dick GmbH & Co. KG; Messermeister; KYOCERA Corporation; Kai USA Ltd.; Mercer Tool Corporation; Dexter-Russell, Inc.; Morakniv AB; Groupe SEB; Johannes Giesser Messerfabrik GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Kitchen Knives Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial kitchen knives market based on the cutting edge, type, end-use, and region.

-

Cutting Edge Outlook (Revenue, USD Million; Volume, Million Units, 2018 - 2030)

-

Plain

-

Granton

-

Serrated

-

-

Type Outlook (Revenue, USD Million; Volume, Million Units, 2018 - 2030)

-

Chef’s Knife

-

Utility & Paring Knife

-

Butcher & Boning Knife

-

Bread Knife

-

Cleaver

-

Others

-

-

End Use Channel Outlook (Revenue, USD Million; Volume, Million Units, 2018 - 2030)

-

Foodservice

-

Hospitality

-

Hospitals & Medical Establishments

-

Meat Processing Industry

-

Butcher Shops

-

Slaughterhouses

-

Institutional

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Million Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial kitchen knives market was estimated at USD 874.3 million in 2023 and is expected to reach USD 926.7 million in 2024.

b. The global commercial kitchen knives market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 1.33 billion by 2030.

b. North America dominated the commercial kitchen knives market with a share of around 36% in 2023. The market in the region is witnessing a notable surge in construction plans for new slaughterhouses in the U.S. and technological advancements in knife manufacturing in the region thereby driving the market growth.

b. Some of the key players operating in the commercial kitchen knives market include Werhahn KG; Victorinox AG; Wüsthof; Yoshida Metal Industry Co. Ltd.; MAC Knife; Friedr. Dick GmbH & Co. KG; Messermeister; KYOCERA Corporation; Kai USA Ltd.; Mercer Tool Corporation; Dexter-Russell, Inc.; Morakniv AB; Groupe SEB; Johannes Giesser Messerfabrik GmbH

b. Key factors that are driving the commercial kitchen knives market growth include rising foodservice establishments across the globe, and rising demand for specialized knives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.