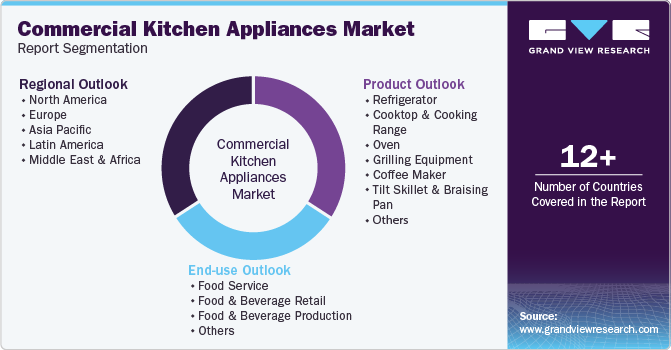

Commercial Kitchen Appliances Market Size, Share & Trends Analysis Report By Product, By End-use (Food Service, Food & Beverage Retail, Food & Beverage Production), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-664-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

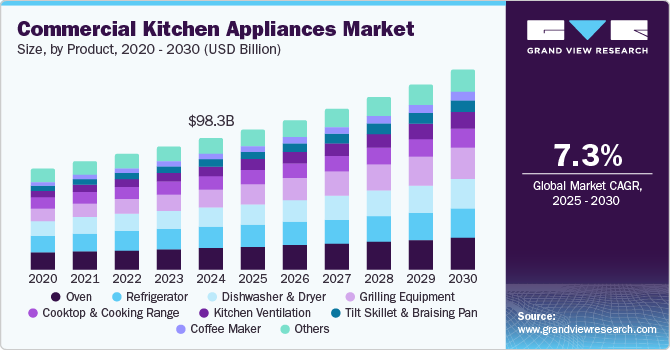

The global commercial kitchen appliances market size was valued at USD 98.34 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2030. The increasing pace of modernization of commercial kitchens globally and the steadily rising presence of restaurants and other food service establishments are expected to maintain a significant demand for advanced kitchen appliances. Furthermore, promising growth of the travel & tourism industry, continued expansion of the hospitality sector, and the popularity of Quick Service Restaurants (QSRs) among the younger demographic are expected to ensure sustained market expansion in the coming years.

Major hotels chains globally are investing significantly in upgrading their infrastructure through the addition of high-capacity energy-efficient appliances. This has compelled manufacturers to expand their portfolio of dishwashers, ovens, refrigeration equipment, and beverage dispensers through the introduction of innovative solutions.

The emergence of cloud kitchens, also known as ghost kitchens, and delivery-only restaurants has created a substantial demand for efficient, high-capacity kitchen equipment. These kitchens focus on delivery and takeout, driving the need for specialized appliances such as ovens, fryers, and refrigeration units. Increasing proliferation of technologies such as the Internet of Things (IoT), machine learning, and artificial intelligence (AI) in electronic items presents another promising avenue for continued market expansion. Smart ovens, refrigerators, fryers, and other equipment can be remotely monitored, controlled, and maintained, leading to better efficiency and reduced downtime. Rising popularity of customizable and quick-service dining experiences is further encouraging restaurants to incorporate versatile and efficient appliances, such as rapid cooking ovens, automated fryers, and high-speed blenders, into their operations. Consumers are increasingly seeking healthier food options, driving the demand for equipment suited to plant-based and health-focused menus. Commercial kitchens are investing in specialized appliances for vegan, gluten-free, or low-fat cooking, such as air fryers, induction cooktops, and high-powered blenders.

The market is being governed by regulations that aim to ensure safety of kitchen staff and reliability of equipment, compelling industry players to manufacture easy-to-use appliances that also offer longer service life. The U.S. Environment Protection Agency (EPA) has proposed that foodservice industries utilize refrigerators that are R-290 certified, as it is considered non-toxic, natural, and free from ozone-damaging properties and further reduces overall energy costs by almost 28.0%. Product manufacturers are establishing R&D centers across the globe to introduce innovative solutions that address customer concerns of sustainability and reliability. For instance, Electrolux Professional Group, which develops appliances for the food service, beverage, and laundry segments, has Competence centers based in France, Sweden, Thailand, Italy, and the U.S.

With rising energy costs and increased focus on sustainability, commercial kitchens are seeking energy-efficient equipment from leading companies. Appliances such as induction cooktops, energy-saving ovens, and low-energy refrigerators are in high demand as restaurants and foodservice operators aim to reduce their carbon footprint and operating costs. Consequently, market competitors are leveraging strategies such as product launches, mergers & acquisitions, and collaborations aimed at moving towards a more environment-focused approach. For instance, in April 2024, Electrolux Professional Group announced the acquisition of Adventys, a France-based manufacturer of induction cooking solutions. Induction cooking is considered to be an environment-friendly technology as it results in substantially lower C02 emission in comparison to conventional gas technology.

Product Insights

The oven segment accounted for a leading revenue share of 16.5% in the global market in 2024. The demand for commercial ovens has expanded globally, owing to the strong growth of the foodservice industry, which includes restaurants, cafes, hotels, catering services, and quick-service restaurants (QSRs). Consumer trends of dining out and casual dining, growth of fast food chains, and rising establishment of cloud kitchens has directly driven the need for high-performance cooking equipment, including ovens. Recent developments in technology have led to the emergence of smart ovens, which are equipped with IoT capabilities that allow operators to control and monitor oven performance remotely. This feature helps improve energy efficiency, reduce downtime, and allow predictive maintenance while also enabling central kitchen management in multi-location operations. Combi ovens, which combine convection, steam, and microwave technology, are also in high demand among commercial kitchens. They offer versatility and energy efficiency, making them popular for a wide range of cooking techniques such as baking, roasting, and steaming.

The grilling equipment segment is expected to advance at the fastest CAGR from 2025 to 2030. These appliances are considered essential across various foodservice operations, from quick-service restaurants (QSRs) to fine dining establishments, as well as for catering businesses and food trucks. Grilling is a popular cooking technique because it imparts a unique flavor, texture, and appeal to food, particularly meats, vegetables, and seafood. As grilling remains an important aspect in many culinary traditions, the demand for commercial grilling equipment has risen significantly, with innovations continually improving performance, energy efficiency, and cooking versatility. As energy efficiency of equipment becomes a key factor for kitchens, eco-friendly grill designs are expected to become a popular and preferred option for customers in the coming years.

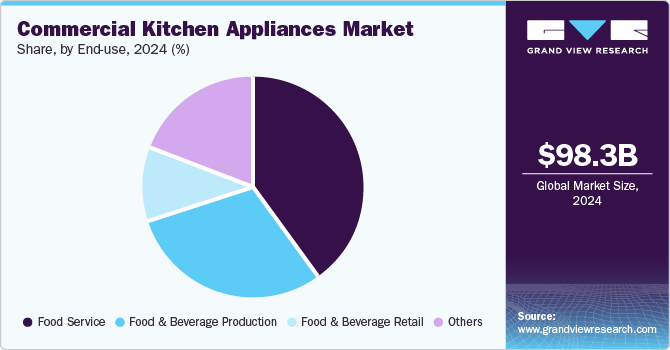

End-use Insights

The food service segment accounted for the highest revenue share in the global market in 2024, aided by the global expansion of the food service industry and the development of innovative service models such as cloud kitchens. This segment is increasingly leveraging smart kitchen technology, creating a substantial demand for intelligent, connected appliances that can improve kitchen efficiency, consistency, and energy management. This includes the adoption of IoT-enabled appliances, programmable ovens, and energy-efficient refrigerators. The foodservice segment is further classified into QSR, FSR, resorts & hotels, institutional canteens, hospitals, and rail, cruise & airway catering. Of these, Quick Service Restaurants (QSR) account for a leading revenue share. QSRs are high-volume and fast-paced foodservice establishments that focus on delivering food quickly, often with a limited menu. As consumer demand for convenience, speed, and quality continues to grow, these facilities are increasingly investing in high-performance, efficient, and cost-effective commercial kitchen equipment to boost their productivity.

The food & beverage production segment is expected to witness the fastest CAGR during the forecast period. The steady growth in production of food and beverage items to address the increasing global population is a major segment driver. Continued evolutions in regulatory standards and technological advancements have necessitated manufacturers to launch products that can ensure quality control and efficiency in operations, while also bringing in scalability and automation in production processes. Appliances that are easy to clean and sanitize, such as automated washing systems or self-cleaning fryers, are critical for maintaining a hygienic environment and meeting regulatory standards. For perishable products, accurate temperature control is an essential feature, which highlights the need for refrigeration units, pasteurizers, and cook-chill systems that ensure proper temperature management.

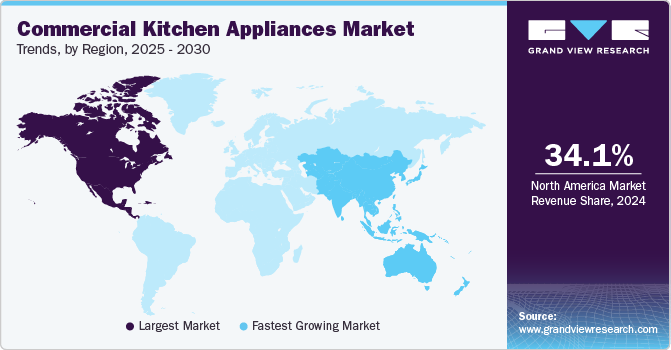

Regional Insights

North America commercial kitchen appliances market accounted for a leading revenue share of 34.1% in the global market in 2024, aided by the rapid growth of the food service industry, integration of advanced technologies in the food & beverage sector, and extensive presence of major market players. In recent years, the region has witnessed a sharp increase in the number of restaurants, hotels, and food businesses, particularly in Canada and Mexico. These establishments are investing heavily in advanced kitchen equipment to boost their operational efficiency and meet consumer demands effectively. With the rapid emergence of ghost kitchens, demand for specialized, space-efficient kitchen appliances has surged. These facilities prioritize efficient operations and high-volume food production with less emphasis on customer-facing operations. Rising adoption of online food services in this region thus presents a major opportunity for companies to drive sales.

U.S. Commercial Kitchen Appliances Market Trends

The U.S. commercial kitchen appliances market accounts for a dominant revenue share in the regional market, owing mainly to the increasing pace of technological advancements in restaurants, hotels, and the catering sector. The presence of several major fast-food chains, including McDonald’s, Starbucks, and Subway, has driven substantial demand for high-capacity and energy-efficient equipment in commercial kitchens across the country. They are increasingly investing in automation to streamline operations, reduce labor costs, and improve consistency. Smart kitchen appliances, such as programmable ovens, fryers, and refrigerators, can be controlled remotely and offer features such as predictive maintenance and energy consumption tracking, which help reduce operational costs and ensure uptime. Furthermore, stringent guidelines implemented by regulatory bodies such as the Occupational Safety and Health Administration (OSHA) and state-wide laws to ensure proper sanitation in cooking spaces and maintenance of hygiene and safety is expected to remain a major factor shaping market growth in the U.S.

Europe Commercial Kitchen Appliances Market Trends

Europe commercial kitchen appliances market accounted for a substantial revenue share in the global market in 2024, aided by factors such as economic trends, consumer preferences, sustainability initiatives, technological advancements, and regulatory requirements. The region has a strong and diverse foodservice industry, ranging from high-end fine dining to casual dining establishments, quick-service restaurants (QSR), and food trucks. The restaurant sector has witnessed strong growth, particularly in major cities such as London, Paris, Berlin, and Milan, highlighting a steadily increasing demand for commercial kitchen appliances. Europe has rigorous health and safety regulations concerning food preparation, storage, and handling. Regulations such as the EU Food Hygiene Regulations (852/2004) and national standards in economies including the UK, Germany, France, and Italy require that commercial kitchens meet high standards of cleanliness and food safety. This creates a constant demand for appliances that ensure compliance, such as high-quality refrigerators, dishwashers, and food processors with easy-to-clean surfaces. The need to follow Good Manufacturing Practice (GMP) guidelines also has compelled companies to launch reliable and high-quality products for regional customers.

Asia Pacific Commercial Kitchen Appliances Market Trends

The Asia Pacific region is expected to advance at the fastest CAGR during the forecast period. Increasing pace of urbanization in emerging economies and the expansion of several major chains such as KFC, McDonald’s, and Starbucks has led to the extensive deployment of modern kitchen appliances. The rising middle class, especially in China, India, and other Southeast Asian economies, has driven consumer spending on dining out. This demographic demands a greater variety of dining experiences, from quick-service restaurants (QSR) to more upscale dining, presenting growth avenues for commercial kitchen appliance makers across foodservice establishments. These appliances are required to follow local and regional guidelines for build, safety, and quality, which helps in positively shaping the industry.

China commercial kitchen appliances market has witnessed significant urbanization, with people migrating to cities rapidly, leading to a higher demand for restaurants, hotels, and foodservice establishments. There is a growing demand for food customization, faster service, and more diverse culinary offerings. As a result, foodservice providers are adopting high-performance kitchen appliances to meet these requirements. Furthermore, the Chinese government has introduced several policies to support the hospitality sector's growth, including financial incentives, food safety standards, and regulations on energy efficiency. Increasing focus on food safety and hygiene further pushes foodservice providers to upgrade their kitchen equipment to meet the highest standards, aiding market growth.

Key Commercial Kitchen Appliances Company Insights

Some of the major companies involved in the commercial kitchen appliance market include Electrolux Professional AB, Ali Group, and BAKERS PRIDE, among others.

-

Electrolux Professional AB is a leading global supplier of professional-grade kitchen, laundry, and beverage equipment. Under the kitchen equipment segment, the company offers ovens, grills, and ranges; boiling and braising pans; dishwashers; and cooking stations. It further manufactures dishwashers under brand names including NeoBlue and green&clean. Meanwhile, refrigeration offerings include refrigerated and freezer cabinets, wine cellars, pastry & bakery line, blast chillers, and cold rooms. Electrolux Professional mainly caters to restaurants, hotels, bars & cafes, marine, supermarkets, and small businesses. The company sells its products across 110 countries globally and is focusing on developing energy-efficient solutions for customers.

-

Ali Group, headquartered in Italy, is a leading global manufacturer of high-quality commercial foodservice equipment and kitchen appliances, catering to commercial kitchens, restaurants, hotels, catering services, and institutional kitchens worldwide. The company’s major product segments include cooking equipment, refrigeration, washing and waste management, ice & beverage dispensing, bakery equipment, and coffee machines. Ali Group has several established brands, such as ACP (commercial ovens), Ali Comenda (dishwashing), Alphatech (convection and combi ovens), BGI, Champion (dishwashing), and Delfield (refrigeration), among others. The company further provides preventative maintenance, breakdown cover, and service products for institutional and commercial food service caterers.

Key Commercial Kitchen Appliances Companies:

The following are the leading companies in the commercial kitchen appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Electrolux Professional AB

- Ali Group Worldwide

- Alto-Shaam, Inc.

- BAKERS PRIDE

- Blodgett Corporation

- Carrier

- Caterware Connection

- Foster Refrigerator

- FUKUSHIMA GALILEI CO. LTD.

- GARLAND GROUP

- Hamilton Beach Brands, Inc.

- Hobart

- HOSHIZAKI CORPORATION

- The Vollrath Company, LLC

- True Manufacturing Co., Inc.

- Universal Steel Industries Pte Ltd.

- Vulcan

View a comprehensive list of companies in the Commercial Kitchen Appliances Market

Recent Developments

-

In September 2024, Electrolux Professional introduced the NeoBlue Touch under-counter dishwasher, which is expected to provide significant efficiency and performance benefits to fast-food establishments, restaurants, and beverage chains. The dishwasher offers a one-touch button for convenient usage and a companion application for easy selection of wash cycles and detergent ordering. The appliance further leverages an advanced spray arm and hydraulic system to improve productivity to 65 baskets per hour, much higher than the industry average of 40 baskets per hour.

-

In July 2024, Scotsman, a sub-brand of Ali Group that develops ice maker and dispenser solutions, launched the Meridian HID207 Compact Countertop Water and Ice Dispenser. The device has a compact design and is ideal for office break rooms, hotel lobbies, and healthcare facilities. It produces chewable nugget ice at a rate of around 200 pounds per day and has a storage capacity of over 7 pounds. The machine is additionally equipped with a UV sanitation module to ensure the high purity of dispensed water.

Commercial Kitchen Appliances Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 104.97 billion |

|

Revenue forecast in 2030 |

USD 149.34 billion |

|

Growth Rate |

CAGR of 7.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia |

|

Key companies profiled |

Electrolux Professional AB; Ali Group Worldwide; Alto-Shaam, Inc.; BAKERS PRIDE; Blodgett Corporation; Carrier; Caterware Connection; Foster Refrigerator; FUKUSHIMA GALILEI CO.LTD.; GARLAND GROUP; Hamilton Beach Brands, Inc.; Hobart; HOSHIZAKI CORPORATION; The Vollrath Company, LLC; True Manufacturing Co., Inc.; Universal Steel Industries Pte Ltd.; Vulcan |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Commercial Kitchen Appliances Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial kitchen appliances market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Refrigerator

-

Cooktop & Cooking Range

-

Oven

-

Pizza Oven

-

Conveyor and Impinger Oven

-

Smoker & Roaster Oven

-

Multi-cook Oven

-

Others

-

-

Grilling Equipment

-

Coffee Maker

-

Tilt Skillet & Braising Pan

-

Dishwasher & Dryer

-

Kitchen Ventilation

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food Service

-

QSR

-

FSR

-

Resort & Hotel

-

Institutional Canteen

-

Hospital

-

Rail, Cruise & Airway Catering

-

Others

-

-

Food & Beverage Retail

-

Food & Beverage Production

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."