Commercial Food And Biomedical Refrigerators And Freezers Market Size, Share & Trends Analysis Report By Offering (Food, Biomedical), By End Use, By Capacity, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-409-3

- Number of Report Pages: 225

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

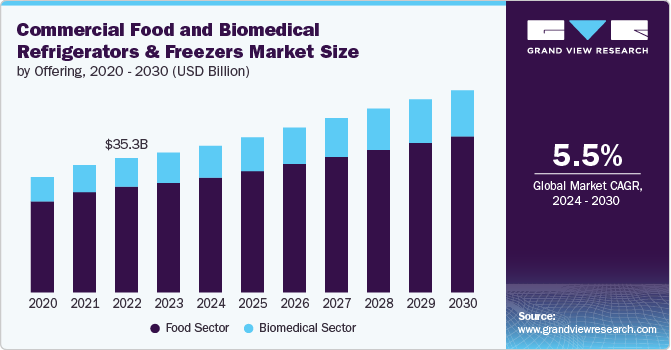

The global commercial food and biomedical refrigerators and freezers market size was valued at USD 36.69 billion in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. The growth of the market can be attributed to the increasing demand for food & beverages coupled with the rising preference for online grocery shopping in line with the growing e-commerce. The increasing need for robust and efficient refrigeration systems for biomedical applications requiring effective storage of biological products, vaccines, DNA samples, blood samples, organs, and tissues, among others, is also contributing to the growth of the market.

The growth of the industry is being largely influenced by technological advancements in terms of innovative features and eco-friendly refrigerants. For instance, in April 2024, Liebherr-International Deutschland GmbH broadened its reliable selection of ultra-low temperature freezers by adding a new, compact 350-litre model to its lineup. This smaller version is ideal for limited laboratory spaces due to its reduced size. ULT freezers are engineered for exceptionally low temperatures, ranging from -40°C to -86°C, making them perfect for the preservation of sensitive materials such as DNA, viruses, proteins, and vaccines, whether for short or long durations.

Market expansion in the biomedical segment is majorly stimulated by the rapid development of new biopharmaceuticals, including gene therapies, vaccines, and protein-based drugs. These products often require precise temperature control to retain efficacy and prevent degradation, fueling the demand for specialized storage solutions. Moreover, the global increase in the number of clinical trials testing new biopharmaceuticals necessitates robust refrigeration and freezing equipment to store research samples, vaccines, and investigational drugs at controlled temperatures. In addition, favorable government initiatives to support clinical trials are also positively influencing the market.

Increasing government and private investments into the development of healthcare infrastructure, including hospitals, clinics, and research facilities, are creating significant demand for biomedical refrigerators and freezers to store critical medical supplies. Furthermore, rising demand for personalized medicine, which provides treatments to individual patients, requires specialized biomedical freezers with ultra-low temperatures to store biological samples, such as tissue and genetic material, which is expected to create numerous growth avenues for the market in the coming years.

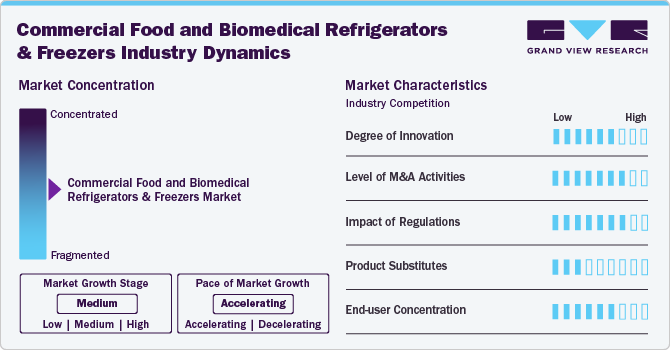

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The commercial food and biomedical refrigerators and freezers market is characterized by a high degree of innovation, with increased demand for improved energy efficiency, reduced operating costs, and regulatory-compliant commercial refrigerators.

The number of merger and acquisition (M&A) activities in the market is increasing. These strategies by commercial refrigeration market players aim to expand their share and increase their existing product portfolio.

Regulations aimed at reducing the usage of refrigerants with high global warming potential have a significant impact on the commercial food and biomedical refrigerators and freezers market. The implementation of stringent regulations by various government authorities globally is compelling manufacturers to develop new technologies and products that use natural refrigerants.

The market has a significant end-user concentration owing to rapid demand for refrigeration equipment from supermarkets, restaurants, convenience stores, and hospitality businesses. In the biomedical sector, the market has end users, including pharmaceuticals, chemical companies, hospitals, clinics, diagnostics labs, blood banks, research institutions, etc.

Offering Insights

The food sector accounted for the largest revenue share of more than 78.0% in 2023. The thriving food service industry, including restaurants, hotels, and catering services, is bolstering the demand for various refrigeration solutions. Stringent food safety regulations are pushing businesses to invest in advanced cooling systems. The trend toward fresh, organic, and locally sourced ingredients requires efficient cold storage. Energy-efficient models with smart monitoring capabilities are gaining traction as businesses seek to reduce operational expenses. The expansion of online food delivery services and ghost kitchens is paving the way for new market opportunities.

The biomedical sector segment is expected to record the highest CAGR of over 6.0% from 2024 to 2030. Stringent regulations on the storage of pharmaceuticals, vaccines, and biological samples are pushing healthcare facilities to invest in high-precision refrigeration units. Advanced features such as remote monitoring, automated inventory management, and backup power systems are becoming standard. Personalized medicine and cell-based therapies are leading to further demand for specialized storage units across various temperature ranges, providing lucrative growth opportunities for the market.

End Use Insights

The food & beverage retail segment accounted for the largest revenue share in 2023. The expansion of supermarket chains and hypermarkets in emerging marketplaces is increasing demand for large-scale refrigeration systems. The prevalence of convenience stores and small-format urban markets is boosting demand for compact, multi-functional refrigeration units. The growing popularity of grab-and-go meals and ready-to-eat products is prompting the need for open-display refrigerators and freezers. These factors are driving product demand in food & beverage retail sector, enhancing the market outlook.

The pharmaceuticals segment is expected to record the highest CAGR from 2024 to 2030. The growing production of temperature-sensitive drugs, including biologics and vaccines, is bolstering the demand for reliable cold storage solutions. Stringent regulations on pharmaceutical storage and distribution are driving investments in high-precision refrigeration units with advanced monitoring capabilities. Personalized medicine and gene therapies are leading to a high demand for ultra-low temperature storage, driving segmental growth.

Capacity Insights

The medium (51 to 300 liters) segment accounted for the largest revenue share in 2023. This capacity range is particularly popular among small- to medium-sized restaurants, cafes, and healthcare facilities, making it versatile. The growing number of quick-service restaurants and convenience stores is boosting demand for these units. In the healthcare sector, medium-capacity refrigerators are ideal for storing vaccines, blood samples, and other medical supplies in clinics and small hospitals. Moreover, technological advancements, such as improved energy efficiency and smart features, are providing positive growth prospects for the segment.

The large (above 300 liters) segment is expected to record a significant CAGR from 2024 to 2030. These units are essential in large-scale food service operations, such as hotel kitchens, institutional cafeterias, and central production facilities. The increasing number of supermarket chains and hypermarkets is significantly boosting demand for large-capacity refrigeration units. In the healthcare and life sciences sectors, large biomedical freezers are crucial for research facilities, blood banks, and large hospitals that require storage for substantial quantities of samples or materials, creating significant growth opportunities for the market in the coming years.

Distribution Channel Insights

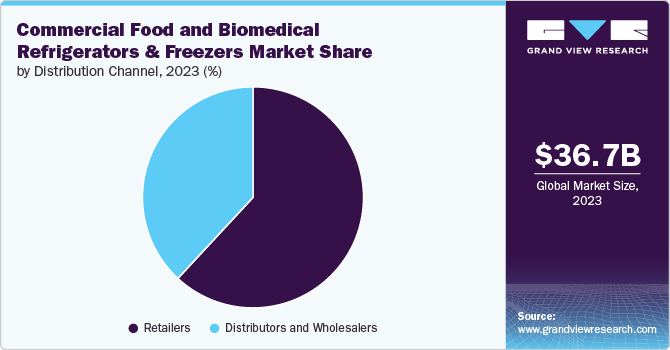

The retailers segment accounted for the largest revenue share in 2023. This segment covers the distribution of commercial refrigeration equipment through retailers, which typically purchase refrigeration units from manufacturers or wholesalers and sell those to end users, including supermarkets, convenience stores, restaurants, and other commercial establishments. The expansion of supermarket chains, convenience stores, and specialty food shops is increasing demand for a wide range of refrigeration solutions, accelerating segmental growth.

The distributors and wholesalers segment is expected to record a notable CAGR from 2024 to 2030. The growth is credited to the complex nature of supply chains and the need for efficient cold storage solutions throughout the distribution process which are driving demand for large-capacity, high-performance refrigeration units. The booming e-commerce and online grocery shopping are drawing investments in cold storage warehouses and distribution centers. The segmental growth is further driven by the rising significance of specialized logistics services for pharmaceutical and biotechnology products which is driving the need for advanced, temperature-controlled storage and transportation solutions.

Regional Insights

North America commercial food and biomedical refrigerators & freezers market accounted for the largest revenue share of around 32.0% in 2023. The expanding food service industry, including restaurants, hotels, and catering services, is increasing the demand for commercial refrigeration equipment in the region. Stringent food safety regulations are pushing businesses to invest in advanced refrigeration systems. The growing healthcare and pharmaceutical sectors are boosting the demand for biomedical refrigerators and freezers for storing vaccines, blood samples, and other biological materials, favoring the market growth.

U.S. Commercial Food And Biomedical Refrigerators And Freezers Market Trends

The commercial food and biomedical refrigerators & freezers market in the U.S. is estimated to witness a considerable growth rate of nearly 4.0% from 2024 to 2030. The robust foodservice industry, including quick-service restaurants, fine dining establishments, and institutional cafeterias, is a major driver for the U.S. market growth.

Asia Pacific Commercial Food And Biomedical Refrigerators And Freezers Market Trends

The commercial food and biomedical refrigerators & freezers market in Asia Pacific is expected to record its highest growth rate of over 7.0% from 2024 to 2030. The expanding healthcare sector across the region is driving the demand for biomedical refrigeration equipment. Economic growth in countries such as China and India is fueling expansion in the food service industry, including restaurants and hotels. Moreover, increasing inclination toward the development of cold chain logistics is driving investments in advanced refrigeration technologies, favoring the regional market growth.

Indiacommercial food and biomedical refrigerators & freezers market is estimated to record a notable CAGR from 2024 to 2030. The expanding organized retail sector, including supermarkets and convenience stores, is a major driver of market growth.

The commercial food and biomedical refrigerators & freezers market in China held a significant revenue share in 2023. Rapid urbanization and a growing middle class are increasing the demand for processed and frozen foods, boosting the need for commercial refrigeration.

Japancommercial food and biomedical refrigerators & freezers market is expected to witness a significant growth rate from 2024 to 2030 on account of investments in advanced refrigeration technologies driven by increasing emphasis on food quality and safety in the country.

Europe Commercial Food And Biomedical Refrigerators And Freezers Market Trends

The commercial food and biomedical refrigerators & freezers market in Europe accounted for a significant revenue share in 2023 and is expected to witness a notable growth over the coming years. Stringent EU regulations on food safety and storage are pushing businesses to invest in advanced refrigeration systems. Moreover, increasing focus on energy efficiency and reducing carbon emissions is driving the demand for eco-friendly refrigeration solutions. The growing healthcare and pharmaceutical sectors are boosting the need for biomedical refrigeration equipment, thereby driving the market growth.

UK commercial food and biomedical refrigerators & freezers market accounted for a sizeable revenue share in 2023. The country's thriving foodservice industry, including pubs, restaurants, and quick-service chains is a major contributor to the market growth.

The commercial food and biomedical refrigerators & freezers market in Germany is estimated to record a considerable growth rate from 2024 to 2030 owing to the country's focus on energy efficiency and environmental sustainability is driving demand for eco-friendly refrigeration solutions.

Middle East and Africa (MEA) Commercial Food And Biomedical Refrigerators And Freezers Market Trends

The commercial food and biomedical refrigerators & freezers market in the Middle East and Africa (MEA) is estimated to register a notable CAGR from 2024 to 2030.Rapid urbanization and improving living standards in many countries are increasing the demand for processed and frozen foods, boosting the need for commercial refrigeration. The expanding tourism industry, particularly in Gulf countries, is boosting demand in the hospitality sector. Improving healthcare infrastructure across the region is driving the need for biomedical refrigeration equipment. The growth of organized retail, including supermarket chains and convenience stores, is contributing significantly to market expansion.

Saudi Arabia commercial food and biomedical refrigerators & freezers market accounted for a notable revenue share in 2023 due to the growing healthcare system and pharmaceutical industry, driving the demand for biomedical refrigeration equipment.

Key Companies & Market Share Insights

Some of the key players operating in the market include Thermofisher Scientific Inc., Samsung Electronics Co., Ltd., Blue Star Limited, and DAIKIN Industries Ltd. among others.

-

Thermo Fisher Scientific Inc. is a global company in the science industry that provides a comprehensive range of high-tech instruments, laboratory equipment, software, services, consumables, and reagents to enable innovative research, complex analytical challenges, diagnostics, and increased laboratory productivity. Established in 2006 through the merger of Thermo Electron and Fisher Scientific, Thermo Fisher has grown into an entity that boasts a presence in more than 150 countries and is valued for its commitment to science and technology.

-

DAIKIN Industries Ltd. specializes in air conditioning, heating, ventilation, and refrigeration solutions. The company offers a wide range of products including air conditioners for residential, commercial, and industrial use. The company offers energy-efficient solutions catering to varying needs and preferences.

-

Samsung Electronics Co., Ltd. is the flagship subsidiary of the Samsung Group. The company operates in various areas, including consumer electronics, IT & mobile communications, device solutions, visual displays, and digital appliances. The company offers a range of refrigeration products that cater to both residential and commercial needs. These refrigeration solutions are designed to be energy-efficient, reliable, and technologically advanced, meeting the demands of modern consumers and businesses.

Hussmann Corporation, Aegis Scientific Inc., and Froilabo SAS are some of the emerging market participants in the commercial food and biomedical refrigerators & freezers market.

-

Hussmann Corporation is a leading provider of display cases, refrigeration systems, and other solutions for the retail food industry. The company offers a wide range of products and services designed to help retailers enhance their merchandising strategies, improve energy efficiency, and ensure food safety.

-

Aegis Scientific Inc. is prominent for its comprehensive range of medical and laboratory refrigeration solutions, offering both freezers and refrigerators tailored to meet the needs of the medical and scientific communities. The company’s products are meticulously designed to cater to various applications, including hospitals, laboratories, community health centers, medical offices, pharmacies, and vaccination centers, ensuring they fulfill their unique requirements.

Key Commercial Food And Biomedical Refrigerators And Freezers Companies:

The following are the leading companies in the commercial food and biomedical refrigerators and freezers market. These companies collectively hold the largest market share and dictate industry trends.

• Biomedical Sector - Refrigeration Companies- Aegis Scientific Inc.

- Angelantoni Life Science

- Arctiko

- B Medical Systems India Private Limited

- Biomedical Solutions Inc (BSI)

- Blue Star Limited

- Eppendorf AG

- Fiocchetti Scientific S.R.L.

- Froilabo SAS

- Gram Scientific ApS (Gram BioLine)

- Haier Biomedical

- Helmer Scientific Inc.

- IC Biomedical, LLC.

- Jeio Tech Co., Ltd.

- KW Apparecchi Scientifici srl

- LabRepCo

- LIEBHERR Group

- NuAire, Inc.

- PHC Corporations

- Philips Kirsch GmbH

- Terumo Corporation

- Thermofisher Scientific Inc.

- Vestfrost Solutions (A/S Vestfrost)

- Zhongke Meiling Cryogenics Co., Ltd.

• Food Sector - Commercial Refrigeration Companies

- AHT Cooling System GmbH

- Al Ameen Dev. and Trade Co.

- Arctic Ai

- Carrier Global Corporation

- CGS (cgs.com.sa)

- DAIKIN Industries Ltd.

- Delfield

- Dover Corporation

- Electrolux AB

- FRYKA-Refrigeration Technology GmbH

- GEA Group Aktiengesellschaft

- Hoshizaki America, Inc.

- Hussmann Corporation

- Illinois Tools Works Inc.

- LIEBHERR Group

- Norlake, Inc.

- Panasonic Corporation

- SAMSUNG ELECTRONICS CO., LTD.

- True Manufacturing Co., Inc.

Recent Developments

-

In June 2024, DAIKIN Industries Ltd. announced its intentions to focus on providing refrigeration solutions for Indian companies. The company was looking forward to tapping into the growing demand for refrigeration solutions from the incumbents of food processing, pharmaceuticals, and logistics, among other industries and industry verticals.

-

In April 2024, Thermo Fisher Scientific Inc. introduced its latest innovation in ULT freezers. The Thermo Scientific TSX Universal Series ULT Freezers bring advancements in efficiency, usability, and environmental friendliness. These freezers are designed to integrate effortlessly with various laboratory workflows, setting new standards in performance, dependability, and eco-consciousness.

-

In April 2024, Samsung Electronics Co. Ltd launched its first EU energy A-rating energy-efficient extra-wide bottom-mount freezer. The new appliance was designed to provide consumers with a more energy-efficient option for storing their food while also offering a spacious interior for better organization.

Commercial Food And Biomedical Refrigerators And Freezers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 38.52 billion |

|

Revenue forecast in 2030 |

USD 53.10 billion |

|

Growth Rate |

CAGR of 5.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, end use, capacity, and distribution channel |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; and South Africa |

|

Key companies profiled (Biomedical Sector) |

Aegis Scientific Inc.; Angelantoni Life Science; Arctiko; B Medical Systems India Private Limited; Biomedical Solutions Inc (BSI) ; Blue Star Limited; Eppendorf AG; Fiocchetti Scientific S.R.L. ; Froilabo SAS; Gram Scientific ApS (Gram BioLine) ; Haier Biomedical; Helmer Scientific Inc. ; IC Biomedical, LLC.; Jeio Tech Co., Ltd.; KW Apparecchi Scientifici srl; LabRepCo; LIEBHERR Group; NuAire, Inc.; PHC Corporations; Philips Kirsch GmbH; Terumo Corporation; Thermofisher Scientific Inc.; Vestfrost Solutions (A/S Vestfrost); and Zhongke Meiling Cryogenics Co., Ltd. |

|

Key companies profiled (Food Sector) |

AHT Cooling System GmbH; Al Ameen Dev. and Trade Co.; Arctic Ai; Carrier Global Corporation; CGS (cgs.com.sa); DAIKIN Industries Ltd.; Delfield; Dover Corporation; Electrolux AB; FRYKA-Refrigeration Technology GmbH; GEA Group Aktiengesellschaft; Hoshizaki America, Inc.; Hussmann Corporation. Illinois Tools Works Inc.; LIEBHERR Group; Norlake, Inc.; Panasonic Corporation.; SAMSUNG ELECTRONICS CO., LTD.; and True Manufacturing Co., Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Commercial Food And Biomedical Refrigerators And Freezers Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels, and analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global commercial food and biomedical refrigerators and freezers market report based on offering, end use, capacity, distribution channel, and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Sector

-

Refrigerators

-

Walk-in Refrigerators

-

Reach-in Refrigerators

-

Display Refrigerators

-

Undercounter Refrigerators

-

Blast Chillers

-

-

Freezers

-

Walk-in Freezers

-

Reach-in Freezers

-

Display Freezers

-

Chest Freezers

-

Undercounter freezers

-

-

-

Biomedical Sector

-

Refrigerators

-

Blood bank Refrigerators

-

Laboratory /Pharmacy/Medical Refrigerators

-

-

Freezers

-

Shock Freezers

-

Plasma Freezers

-

Ultra-low-temperature (ULT) Freezers

-

Laboratory /Pharmacy/Medical Freezers

-

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitality

-

Hotels & Resorts

-

Restaurants

-

Others

-

-

Food & Beverage Retail

-

Hypermarkets & Supermarkets

-

Convenience Store

-

Specialty Food Store

-

Grocery Store

-

-

Healthcare & Lifesciences

-

Hospitals

-

Research Laboratories

-

Diagnostic Centers

-

Blood Banks

-

Others

-

-

Pharmaceuticals

-

Chemicals

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Small (up to 50 Liters)

-

Medium (51 to 300 Liters)

-

Large (Above 300 Liters)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Distributors and Wholesalers

-

Retailers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial food and biomedical refrigerators & freezers market size was estimated at USD 36.69 billion in 2023 and is expected to reach USD 38.52 billion in 2024.

b. The global commercial food and biomedical refrigerators & freezers market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 53.09 billion by 2030.

b. North America accounted for the highest market revenue share in 2023. The expanding food service industry, including restaurants, hotels, and catering services, is increasing the demand for commercial refrigeration equipment. Stringent food safety regulations are pushing businesses to invest in advanced refrigeration systems.

b. Some key players operating in the commercial food and biomedical refrigerators & freezers market include Blue Star Limited, PHC Holdings Corporation, Terumo Corporation, Thermo Fisher Scientific Inc., Eppendorf SE and among others

b. The growth of the market can be attributed to the increasing demand for food & beverages coupled with the rising preference for online grocery shopping in line with the growing e-commerce. The increasing need for robust and efficient refrigeration systems for biomedical applications requiring effective storage of biological products, vaccines, DNA samples, blood samples, organs, and tissues, among others, is also contributing to the growth of the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."