Combat Drone Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Product (Fixed-Wing, Multi-Rotor), By Technology, By Payload Capacity, By Power Source, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-440-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Combat Drone Market Size & Trends

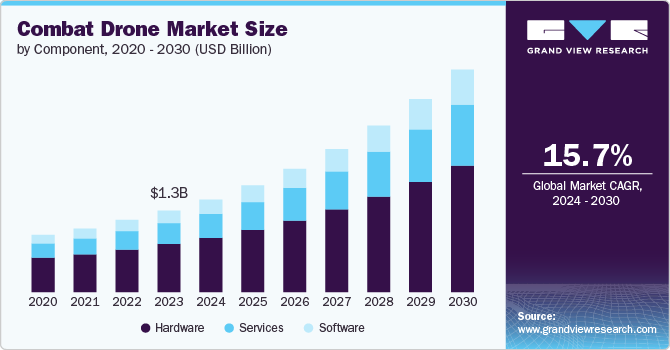

The global combat drone market size was estimated at USD 1.32 billion in 2023 and is projected to grow at a CAGR of 15.7% from 2024 to 2030. The increasing demand for unmanned aerial vehicles (UAVs) for military operations, intelligence gathering, and surveillance is the major factor driving the market growth. Moreover, increasing military budgets amid ongoing geopolitical tensions and rising need to strengthen defense infrastructure are further driving the demand for combat drones, creating significant market growth. According to a report released by Stockholm International Peace Research Institute in 2024, the military expenditure across the globe reached USD 2443 billion in 2023, a 6.8% rise as compared to that in 2022.

The market growth is being further accelerated by the technological developments in terms of improvements in propulsion systems, such as electric and hybrid propulsion, that enhance endurance, speed, and maneuverability of drones. In addition, the introduction of advanced artificial intelligence and autonomous flight capabilities enables drones to operate with minimal human intervention. Besides, integration of cutting-edge sensors, high-resolutions cameras, thermal imaging, and robust communication systems in are expected to stimulate the demand for combat drones, proliferating the market expansion.

Advancements in autonomous flight and weaponization are significantly driving the market growth. The development of sophisticated artificial intelligence systems enables drones to operate with minimal human intervention, making them capable of executing complex missions independently. Moreover, the integration of advanced weaponry, such as precision-guided missiles and laser-guided bombs, has transformed combat drones into formidable military assets.

The market is witnessing high demand amid the growing prominence of Intelligence, surveillance, and reconnaissance (ISR) missions in the defense sector. The ability of drones to gather critical information and intelligence in real-time has become invaluable for military operations. Drone can be deployed to monitor enemy activity, identify potential threats, and gather intelligence on strategic targets. Their persistence, endurance, and ability to operate in challenging environments make them ideal platforms for ISR missions.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 59.03% in 2023, owing to technological advancements, such as miniaturization of electronics, improved battery performance, and efficient propulsion systems, that are enabling the production of smaller, more capable drones. The increasing demand for unmanned aerial vehicles (UAVs) for military and commercial applications is driving the need for specialized hardware components, including sensors, cameras, communication systems, and payloads. Furthermore, the focus on enhancing autonomy and intelligence in combat drones requires sophisticated hardware solutions, creating positive growth prospects for the segment.

The services segment is expected to grow at the fastest CAGR of 16.8% from 2024 to 2030. The growth is credited to the increasing complexity and specialization of drone operations, which is creating considerable demand for comprehensive services, such as training, maintenance, repair, and operational support. In addition, the need for data analysis, intelligence processing, and mission planning is also creating opportunities for specialized service providers. These factors, combined with the growing number of drone operators, are driving the expansion of services segment within the global market.

Product Insights

The multi-rotor segment led the market with the largest revenue share of 60.65% in 2023, owing to increasing demand for these combat drones for a wide range of military applications due to their ability to hover, maneuver in tight spaces, and take off and land vertically. Their compact size and flexibility make them particularly useful for operations that require precision and close-proximity engagement. In addition, the endurance and payload capacity of multi-rotor drones, enable them to carry advanced sensors, cameras, and even light munitions which helps military forces during tactical missions, from intelligence gathering to precision strikes, making them a valuable asset in modern warfare, further driving the segmental growth.

The hybrid segment is expected to record at the fastest CAGR from 2024 to 2030, on account of the benefits associated with them. These drones combine the advantages of both multi-rotor and fixed-wing designs to deliver extended flight endurance and greater payload capacity while retaining the ability to perform vertical take-offs and landings. These features allow hybrid drones to carry out longer missions with more sophisticated equipment, making them suitable for both strategic reconnaissance and combat roles. The growing need for drones that can operate effectively in diverse environments is further contributing to segmental growth.

Technology Insights

Based on technology, the remotely operated segment led the market with the largest revenue share of 76.01% in 2023, owing to heightened demand for these drones as they offer a high level of control and precision, enabling operators to conduct complex missions in hostile environments without risking human lives. The increasing focus on asymmetrical warfare, counterterrorism operations, and border security is further stimulating their demand. Advancements in communication technologies, such as satellite links and secure data transmission, have further enhanced the capabilities of remotely operated drones, making them more effective for ISR and precision strike operations. These factors, coupled with ongoing investments in drone technology by military forces, are driving the segmental growth.

The fully-autonomous segment is poised to register at the fastest CAGR from 2024 to 2030. These drones are gaining traction as advancements in artificial intelligence (AI) and machine learning enhance their capabilities. These drones can operate independently, making real-time decisions without human intervention, which is particularly valuable in highly complex environments. Besides, these drones are seen as the future of warfare, offering potential for more efficient operations, continuous mission capability without operator fatigue, and reduced communication vulnerability, providing ample growth opportunities for the segment.

Payload Capacity Insights

Based on payload capacity, the up to 2 kg segment led the market with the largest revenue share of 50.27% in 2023. These drones are typically small, lightweight, and highly portable, making them suitable for rapid deployment in various environments. These drones are particularly valuable for reconnaissance, surveillance, and intelligence-gathering missions where quick and agile operations are essential. Their low cost and ease of use also make them accessible for a wide range of military units, including those in special operations and front-line reconnaissance roles. The increasing usability of these drones is expected to drive the segmental growth in the coming years.

The 2kg to 19kg segment is expected to record at the fastest CAGR from 2024 to 2030, owing to increasing demand for these drones owing to their ability to carry more sophisticated payloads, including advanced sensors, cameras, and even small munitions. This capacity allows for more versatile missions, such as precision strikes, electronic warfare, and extended surveillance. The growing emphasis on asymmetric warfare and counterterrorism operations has increased the demand for these drones, as they provide the ability to conduct targeted strikes with minimal collateral damage, enhancing the overall outlook of the market for drones in this category.

Power Source Insights

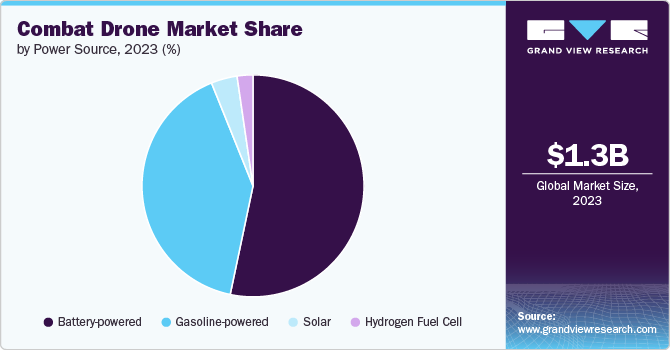

Based on power source, the battery-powered segment led the market with the largest revenue share of 53.3% in 2023. Battery-powered combat drones are increasingly favored due to advancements in battery technology, which have significantly enhanced energy density and reduced weight. This allows for longer flight times and higher payload capacities, making these drones more effective in various combat scenarios. In addition, the development of fast-charging and swappable battery systems enhances operational readiness, which is critical for military applications. These factors are expected to accelerate market growth over the foreseeable future.

The hydrogen fuel cell segment is expected to record at a notable CAGR from 2024 to 2030. These drones are witnessing high demand as they serve as a promising alternative to conventional battery systems by providing longer endurance and higher energy efficiency. Besides, this technology is environmentally friendly, which supports sustainability goals of the defense sector. Moreover, hydrogen fuel cells facilitate quieter operations compared to internal combustion engines, which is advantageous in stealth missions. The ability to support extended flight durations without the need for frequent refueling is also driving their adoption in combat drones, favoring the segment growth.

Regional Insights

North America dominated the combat drone market with the largest revenue share of 40.01% in 2023. The region is home to some of the world’s leading defense contractors and technology companies, such as General Atomics, Northrop Grumman, and Boeing, which are driving innovation in unmanned aerial vehicle (UAV) technology. The strong emphasis on military modernization, particularly by the U.S. Department of Defense, is boosting demand for advanced combat drones that offer superior capabilities in intelligence, surveillance, reconnaissance (ISR), and precision strikes. These factors underline the dominance of the region within the market.

Asia Pacific Combat Drone Market Trends

The combat drone market in Asia Pacific is expected to record at the fastest CAGR of 17.0% from 2024 to 2030. Countries such as China, India, and South Korea are increasingly investing in combat drones to strengthen their defense forces and maintain regional security. Besides, technological advancements in drone manufacturing and growing production capabilities in regional countries have made combat drones more accessible and cost-effective, contributing to the market growth. Moreover, supportive government initiatives and increasing defense budgets for the development and acquisition of UAVs are further fueling the market growth in the region.

Europe Combat Drone Market Trends

The combat drone market in Europe is expected to grow at a notable CAGR during the forecast period, owing to increased investment in advanced military technologies amid increasing geopolitical tensions and rising need for enhanced defense capabilities. Moreover, several countries in the region are prioritizing the modernization of their armed forces, and drones as they serve as a cost-effective, versatile solution for surveillance, intelligence gathering, and precision strikes. In addition, the European defense industry is benefiting from substantial government funding aimed at developing indigenous drone technologies, which is expected to drive the regional market growth over the coming years.

Key Combat Drone Company Insights

Some of the key players operating in the market are SZ DJI Technologies Co. Ltd., Lockheed Martin Corporation, Northrop Grumman, Boeing, AeroVironment, Inc., and General Atomics among others.

-

Northrop Grumman delivers a broad range of products, services, and solutions to the U.S. and global customers, mainly to the U.S. Department of Defense (DoD) and intelligence community. The company’s major segments include aeronautics systems, defense systems, mission systems, and space systems

-

SZ DJI Technologies Co. Ltd. manufactures and supplies a range of commercial drones along with accessories and payloads. The company’s product portfolio includes drone series, such as the Phantom, Inspire, Ronin, and Spreading Winds. The company also provides attachments, such as aerial gimbals, flight controllers, flame wheels, and propulsion systems

-

Teal Drones, Inc., is an innovative tech company specializing in the design and manufacture of advanced UAVs for both commercial and military markets. The company aims to revolutionize aerial technology's utilization across various industries by delivering high-performance, rugged, and intelligent drone solutions

-

General Atomics is a defense and technologies company engaged in the manufacturing of unmanned aircraft and electro-optical, radar, automated airborne surveillance systems, and signals intelligence solutions. It also delivers electro-magnetic aircraft launch and recovery systems for the U.S. Navy, electro-magnetic rail gun, satellite surveillance, high power laser, power conversion systems, and hypervelocity projectile

Key Combat Drone Companies:

The following are the leading companies in the combat drone market. These companies collectively hold the largest market share and dictate industry trends.

- Northrop Grumman

- RTX Corporation

- Israel Aerospace Industries Ltd.

- AeroVironment, Inc.

- General Atomics

- Boeing

- Thales Group

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- SZ DJI Technologies Co. Ltd.

- Teal Drones, Inc.

- Teledyne FLIR LLC

Recent Developments

-

In July 2024, Lockheed Martin Corporation collaborated with the Defense Advanced Research Projects Agency (DARPA) for the development of artificial intelligence-based drones. The company received a USD 4.6 million contract to employ AI and machine learning techniques to create surrogate models of aircraft, electronic warfare, sensors, and weapons. This initiative is aimed at providing advanced modeling and simulation solutions for live, multi-ship beyond- visual-range missions

-

In July 2024, Thales Group signed a Memorandum of Understanding (MoU) with Garuda Aerospace for the development of the drone ecosystem in India. This initiative is aimed at advancing the development of technological solutions that enable secure drone operations and support the growth of drone applications in the country

-

In June 2024, Red Cat Holdings, Inc., (Teledrones, Inc.), revealed its plans acquire FlightWave Aerospace Systems Corporation, a Vertical Take-off and Landing (VTOL) drone, sensor, and software solutions provider. As a part of this initiative, the latter’s military-grade tricopter- Edge 130 will be included in the company’s line of unmanned Intelligence, Surveillance, and Reconnaissance (ISR) systems

Combat Drone Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.51 billion |

|

Revenue forecast in 2030 |

USD 3.61 billion |

|

Growth rate |

CAGR of 15.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, product, technology, payload capacity, power source, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; and South Africa |

|

Key companies profiled |

Northrop Grumman; RTX Corporation; Israel Aerospace Industries Ltd.; AeroVironment, Inc.; General Atomics; Boeing; Thales Group; Elbit Systems Ltd.; Lockheed Martin Corporation; SZ DJI Technologies Co. Ltd.; Teal Drones, Inc.; Teledyne FLIR LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Combat Drone Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segment from 2018 to 2030. For this study, Grand View Research has further segmented the global combat drone market report based on component, product, technology, payload capacity, power source, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Frames

-

Control System

-

Power & Propulsion System

-

Camera System

-

Navigation System

-

Transmitter

-

Wings

-

Others

-

-

Software

-

Services

-

Integration & Engineering

-

Maintenance & Support

-

Training & Education

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed-Wing

-

Multi-Rotor

-

Single-Rotor

-

Hybrid

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely Operated

-

Semi-Autonomous

-

Fully Autonomous

-

-

Payload Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 2 Kg

-

2 Kg to 19 Kg

-

20 Kg to 200 Kg

-

Over 200 Kg

-

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery-Powered

-

Gasoline-Powered

-

Hydrogen Fuel Cell

-

Solar

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global combat drone market size was estimated at USD 1.32 billion in 2023 and is expected to reach USD 1.51 billion in 2024.

b. The global combat drone market is expected to grow at a compound annual growth rate of 15.7% from 2024 to 2030 to reach USD 3.61 billion by 2030.

b. The North America region dominated the industry with a revenue share of 40.0% in 2023. This can be attributed to increasing military modernization initiatives in the region which is creating significant demand for advanced combat drones that offer superior capabilities in intelligence, surveillance, reconnaissance (ISR), and precision strikes.

b. Some key players operating in combat drone market include Northrop Grumman, RTX Corporation, Israel Aerospace Industries Ltd., AeroVironment, Inc., General Atomics, Boeing, Thales Group, Elbit Systems Ltd., Lockheed Martin Corporation, SZ DJI Technologies Co. Ltd. Teal Drones, Inc., and Teledyne FLIR LLC

b. Key factors that are driving combat drone market growth include increasing demand for unmanned aerial vehicles (UAVs) for military operations, growing military budgets amid ongoing geopolitical tensions, and rising need to strengthen defense infrastructure.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."