Color Cosmetics Market Size, Share & Trends Analysis Report By Product (Lip Products, Facial Products, Eye Products), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-335-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Color Cosmetics Market Size & Trends

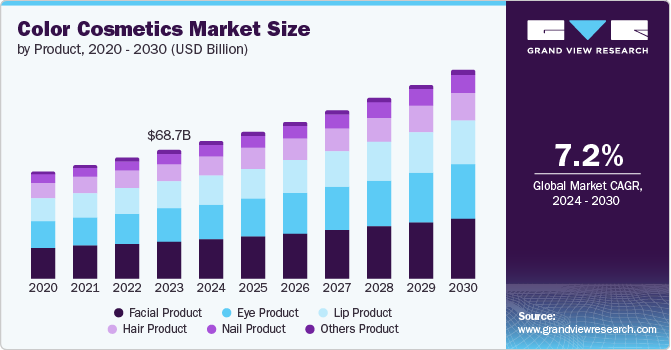

The global color cosmetics market size was valued at USD 68.74 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. Continuous innovation and the introduction of new products by major brands are driving the growth of the global color cosmetics market. Brands are constantly striving to differentiate themselves through cutting-edge formulations and unique product offerings. A growing demand for organic and natural ingredients is driven by a heightened awareness of health and environmental concerns. These products are perceived as safer and more beneficial for the skin, attracting a broad base of health-conscious consumers.

The influence of social media platforms such as Instagram, YouTube, and TikTok, combined with endorsements by beauty influencers, has elevated the visibility and popularity of color cosmetics. These platforms serve as powerful marketing tools, enabling brands to reach a vast and diverse audience instantly. Beauty influencers, with their large and engaged followings, play an important role in shaping consumer perceptions and preferences through authentic and relatable content. Their tutorials, reviews, and demonstrations provide valuable insights into product efficacy, application techniques, and trends, fostering trust and credibility among viewers. The interactive nature of social media allows for real-time engagement and feedback, enhancing the consumer experience and driving interest in new products.

The rise of online purchasing platforms has boosted the availability of color cosmetics to a wider audience. E-commerce systems provide exceptional ease, allowing customers to browse and buy things from the comfort of their own homes at any time. The wide number of options available online appeals to a variety of interests and demands, making it easier for customers to locate specific products and discover new companies. Competitive pricing and frequent promotions on these platforms encourage online shopping, attracting budget-conscious customers.

Product Insights

Facial products held the largest market share of 29.2% in terms of revenue in the year 2023. There is a growing trend towards the use of organic and natural ingredients in cosmetics due to heightened consumer awareness about health and environmental impacts. Brands that offer facial products with clean, sustainable ingredients are increasingly favored. In October 2023, Organic Harvest announced the launch of its new line of makeup products. This strategic expansion into color cosmetics reflects the brand’s commitment to providing consumers with high-quality, eco-friendly beauty solutions. The new collection features a range of facial products, including foundations, blushes, and highlighters, all formulated with natural and sustainably sourced ingredients. Emphasizing skin health and environmental responsibility, Organic Harvest’s makeup line is free from harmful chemicals, synthetic fragrances, and parabens, catering to the growing consumer demand for clean and green beauty options.

Nail products are expected to register the fastest growth of 8.5% over the forecast period. The growing trend of nail art and DIY nail designs has significantly boosted the demand for a diverse range of nail products, including polishes, decals, and nail care tools. This trend is driven by the desire for self-expression and creativity, as individuals seek to personalize their nail appearance with unique designs and intricate patterns. The availability of a wide array of colors, finishes, and effects in nail polishes caters to this creative demand, while decals and stickers provide an easy and affordable way to achieve complex designs without professional skills.

Distribution Channel Insights

The offline distribution channel held the highest revenue market share in 2023. Brand visibility and presence in physical stores are important for the global color cosmetics market as they offer unparalleled opportunities to engage with consumers. Displays strategically showcase products, leveraging visual appeal and accessibility to draw shoppers' attention. Promotions and dedicated counters create a sensory experience that online platforms often cannot replicate. This immersive environment allows brands to reinforce their identity through tailored aesthetics and interactive elements, fostering brand loyalty and encouraging impulse purchases. Additionally, the presence of knowledgeable beauty advisors enhances customer interactions, providing personalized recommendations and beauty tips that cater directly to individual preferences and needs.

The online distribution channel is projected to grow at the fastest CAGR over the forecast period. Online channels have revolutionized the global color cosmetics market by enabling brands to transcend geographical boundaries effortlessly. With e-commerce platforms, brands can reach international markets without requiring extensive physical infrastructure in every region. This global reach expands market penetration and enhances brand visibility and accessibility to a diverse consumer base worldwide. Moreover, advanced algorithms and sophisticated customer data analytics empower brands to deliver personalized shopping experiences. By analyzing consumer preferences and behavior, brands can offer tailored product recommendations, targeted promotions, and customized marketing campaigns. This personalized approach fosters more robust customer engagement and increases satisfaction and loyalty, driving growth in the competitive landscape of color cosmetics.

Regional Insights

Continuous advancements in cosmetic technologies are revolutionizing consumer preferences in North America, particularly in the color cosmetics market. Innovations focus on improving formulations to offer longer-lasting wear and integrating skincare benefits into makeup products. Consumers are increasingly seeking multifunctional cosmetics that not only enhance appearance but also provide skincare benefits such as hydration, sun protection, and anti-aging properties. Advanced technologies enable brands to develop products with improved textures, pigmentation, and application methods, catering to diverse skin types and preferences. This trend is driven by consumer demand for products that not only deliver on performance but also align with their skincare goals, promoting healthier-looking skin alongside cosmetic enhancement.

U.S. Color Cosmetics Market Trends

The U.S. color cosmetics market has seen remarkable surge in the demand of these products because of consumer tendency towards personal hygiene and emphasis on appearance. Consumers are particular about skin care and take help from dermatologists to have a suitable product as well. According to YouGov PLC in May 2024, 60% of women in U.S. have a consistent skincare routine and are willing to spend more money on quality products. The increased spending capacity of consumers and aggressive marketing strategies from various brands have positively influenced the market. Additionally, the availability of these products through offline and online distribution has boosted the market growth. Many e-commerce websites provide a timely delivery to the doorstep of consumers at discounted pricing.

Asia Pacific Color Cosmetics Market Trends

Asia Pacific region held the highest revenue market share of 33.5% in 2023. Increasing disposable income in countries such as China, India, and Southeast Asia have significantly boosted consumer spending on beauty and personal care products, mainly color cosmetics. As individuals in these regions experience higher economic prosperity, there is a growing inclination towards enhancing personal grooming and adopting beauty routines. This trend is particularly pronounced among the increasing middle class and urban populations, who view cosmetics as essential for self-expression, confidence, and aligning with global beauty standards. Furthermore, the expansion of retail infrastructure and the proliferation of e-commerce platforms have made a wide range of color cosmetics easily accessible to a broader consumer base. This combination of rising incomes, cultural shifts towards beauty consciousness, and improved market accessibility continues to drive robust growth in the color cosmetics market across China, India, and Southeast Asia.

The trend towards hybrid products, combining skincare benefits with color cosmetics, is increasingly appealing to health-conscious consumers seeking multifunctional beauty solutions that enhance appearance and skin health in China. These products offer the convenience of addressing multiple beauty needs, such as foundation with SPF or lipstick with moisturizing properties. Additionally, there is a growing demand for natural and organic color cosmetics as consumers become more aware of ingredient safety and potential health impacts. This shift towards clean beauty is driven by a desire for products free from harmful chemicals, aligning with the broader movement towards sustainability and wellness in personal care, driving the growth of color cosmetics in China.

Europe Color Cosmetics Market Trends

Europe is expected to grow at the fastest CAGR during the forecast period 2024 - 2030. The ageing population in Europe is a significant driver for the color cosmetics market, as it increases the demand for anti-aging and skin-enhancing products specifically designed to cater to mature skin. With a growing number of consumers seeking to maintain a youthful appearance and address age-related skin concerns, there is an increasing need for color cosmetics that offer benefits beyond basic coverage. These products often include ingredients that provide hydration, improve skin elasticity, reduce the appearance of fine lines and wrinkles, and offer sun protection. Brands are capitalizing on this trend by developing targeted product lines that combine makeup with skincare benefits, such as foundation with built-in serums, concealers with anti-aging properties, and lipsticks infused with moisturizing agents. According to the WHO, the population aged 60 and older in the WHO European Region is increasing rapidly. In 2021, this demographic numbered 215 million; by 2030, it is expected to reach 247 million, and by 2050, it is projected to exceed 300 million.

Key Color Cosmetics Company Insights

Some of the key companies in the global color cosmetics market include L'Oréal S.A, Unilever and Avon Products, Inc. Large companies in the market are aiming to develop organic and chemical free products through various innovations. Various new companies and startups are entering the market providing new research insights to the market. To acquire larger customer base, companies are looking to expand the online presence as well.

-

L'Oréal S.A, beauty products manufacturing global company offers a wide range of products catering to diverse consumer needs, including foundations, concealers, lipsticks, eyeshadows, mascaras, and nail polishes. Their color cosmetics brands, such as L'Oréal Paris, Maybelline New York, Lancôme, and NYX Professional Makeup, are well-regarded for their innovative formulations, vibrant color palettes, and trendsetting products.

-

Unilever, a global consumer goods company, offers a diverse portfolio of beauty and personal care products through its well-known brands such as Dove, Pond's, Vaseline, and Lux. In the color cosmetics segment, Unilever's product offerings include foundations, lipsticks, mascaras, eyeshadows, and nail polishes.

Key Color Cosmetics Companies:

The following are the leading companies in the color cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- L'Oréal S.A

- Unilever

- Estée Lauder Inc.

- Avon Products, Inc.

- Shiseido Company, Limited

- Coty Inc.

- Revlon, Inc.

- CIATÉ

- KRYOLAN

- CHANTECAILLE BEAUTÉ

Recent Developments

-

In November 2023, Avon Products, Inc. announced their first physical store in the UK, featuring more than 150 products. Along with door to door marketing, the company decided to open stores in the neighborhood communities to be accessible for middle income range customers. The new outlets are named ‘mini beauty boutiques’ and are run by franchise model.

-

In December 2023, Unilever declared acquisition of a haircare brand K18, further expanding the portfolio of brands in premium hair care segment. The acquisition mainly aims to provide a research based product to consumers to cure hair damage. K18 has an expertise in biotech based hair research for the products.

Color Cosmetics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 73.22 billion |

|

Revenue forecast in 2030 |

USD 111.07 billion |

|

Growth rate |

CAGR of 7.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa |

|

Key companies profiled |

L'Oréal S.A, Unilever, Estée Lauder Inc., Avon Products, Inc., Shiseido Company, Limited, Coty Inc., Revlon, Inc., CIATÉ, KRYOLAN, CHANTECAILLE BEAUTÉ |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Color Cosmetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global color cosmetics market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nail product

-

Lip product

-

Eye product

-

Facial product

-

Hair product

-

Others product

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

- South Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."