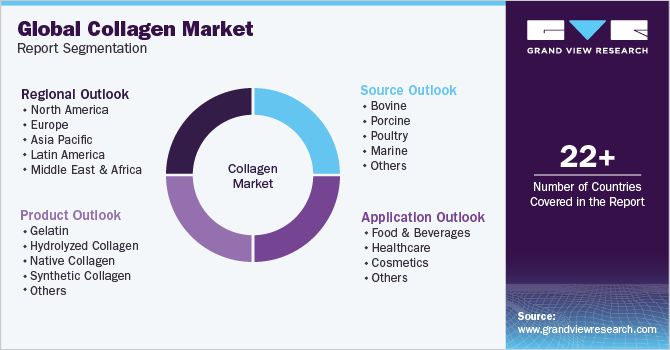

Collagen Market Size, Share & Trends Analysis Report By Product (Gelatin, Hydrolyzed Collagen), By Source (Bovine, Porcine), By Application (Food & Beverages, Healthcare), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-835-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

Collagen Market Size & Trends

The global collagen market size was valued at USD 9.9 billion in 2024 and is projected to grow at a CAGR of 11.3% from 2025 to 2030 due to the growing health and wellness trends, along with expanding application areas. Consumers increasingly prioritize natural, sustainable products for skin care, joint health, and overall well-being, contributing to a rising demand for collagen supplements. Collagen's versatility in industries, particularly in cosmetics, food and beverages, and pharmaceuticals, further fuels its market growth. As the awareness of collagen's benefits for anti-aging, gut health, and muscle recovery spreads, its adoption in diverse products continues to increase, propelling the market to new heights.

The escalating demand for animal-free collagen, driven by growing consumer interest in plant-based and vegan products, significantly impacts the collagen market. As more individuals seek ethical and sustainable alternatives, plant-derived and lab-grown collagen options are becoming increasingly popular. Coupled with technological advancements in collagen extraction, which improve efficiency and reduce production costs, the market is set to witness substantial growth. These innovations enable the development of high-quality, cost-effective, and cruelty-free collagen, further fueling the expansion of the global collagen market in the years ahead.

Market Concentration & Characteristics

Rousselot, Gelita AG, and Nitta Gelatin, NA Inc., Weishardt International Juncà Gelatines SL, and Collagen Matrix, Inc. are the major market players with a market share of more than 60% collectively. Compared to other industry participants, these major companies have a higher penetration of their products in various end-use markets such as food & beverage, health & nutrition, and pharmaceuticals among others due to their exceptional distribution network and goodwill worldwide. An extensive range of product portfolio for end-use markets have also fueled the sales of the above-mentioned companies.

Key developments by major industry participants have resulted in increased market share over the past few years. For instance, In April 2023, GELITA AG, a leading player in the industry, launched a fast-setting gelatin which allows a breakthrough in the fortified gummy manufacturing. CONFIXX, the new gelatin brand, enables for the starch-free manufacture of gummies with a sensorial profile that was previously possible only with a starch-based production process. This innovation creates ample opportunities for producers of on-trend supplements to incorporate various active ingredients, make significant cost savings and streamline the production process.

Major industry participants prefer sources such as pork, bovine, and marine among others. Thus, companies involved in the production from a single source or specific grade lack to cater to various end-use markets. One of the major factors influencing the company's market share is a high level of integration in the value chain.

Product Insights

The gelatin segment captured the largest share of 66.4% in 2024, fueled by its versatile applications across various industries, including food and beverages, pharmaceuticals, cosmetics, and healthcare. Gelatin's ability to form gels, biocompatibility, and cost-effectiveness easily make it a popular choice. It is widely used in gummies, capsules, and food additives. Additionally, its natural origin and functional benefits, such as joint support and skin health, have contributed to its widespread demand, reinforcing its dominance in the global market.

Hydrolyzed collagen segment is expected to emerge as the fastest growing segment and grow at a CAGR of 11.9% over the forecast period, attributed to its increased demand across various industries, such as healthcare, beauty, and food. Hydrolyzed collagen is known for its superior absorption and bioavailability, making it an ideal ingredient for skin elasticity, joint health, and overall wellness. The rising consumer focus on anti-aging solutions, functional foods, and natural supplements further boosts the growth of hydrolyzed collagen. With ongoing research supporting its health benefits, the segment is anticipated to witness rapid growth and innovation in the coming years.

Source Insights

The bovine segment accumulated the largest share of 34.9% in 2024, owing to its wide availability and cost-effectiveness. Bovine collagen is rich in Type I and Type III collagen, making it highly sought after for various applications, including cosmetics, health supplements, and food products. Its versatility and strong presence in the meat industry ensure a consistent supply, further fueling its dominance. In addition, bovine collagen's well-documented benefits for skin, joints, and overall health have contributed significantly to its market lead, making it a preferred choice for consumers and manufacturers alike.

The porcine segment is anticipated to stand out as the fastest growing segment and register a CAGR of 12.1% during the forecast period due to the widespread availability and cost-effectiveness of pig-derived collagen. Porcine collagen is known for its high similarity to human collagen, making it highly sought after in the medical, cosmetic, and food industries. With increased demand for collagen-based products, particularly in the healthcare and beauty sectors, the porcine collagen segment is experiencing significant growth. Furthermore, advancements in extraction technologies and the growing acceptance of animal-derived collagen are projected to boost its market share further.

Application Insights

The food and beverages application segment registered the largest revenue share of 56.9% in 2024, attributed to the surging consumer demand for functional, health-boosting products. Collagen, particularly in hydrolyzed peptides, is widely incorporated into protein bars, smoothies, and dietary supplements, offering benefits such as improved skin health, joint support, and enhanced muscle recovery. As health-conscious consumers seek natural and effective ingredients, collagen's versatility in improving the nutritional profile of beverages and snacks has led to its growing popularity, driving significant market share in this segment.

The healthcare segment is expected to emerge as the fastest growing segment and record a CAGR of 11.2% over the forecast period, owing to its growing use in medical applications such as wound healing, tissue regeneration, and joint therapies. Collagen’s unique ability to promote cell growth and support tissue repair makes it highly valuable in surgical procedures, burn care, and orthopedic treatments. Additionally, its use in developing collagen-based biomaterials for drug delivery systems and implants further boosts its demand. As healthcare innovations expand, the need for collagen in medical treatments is projected to drive significant market growth.

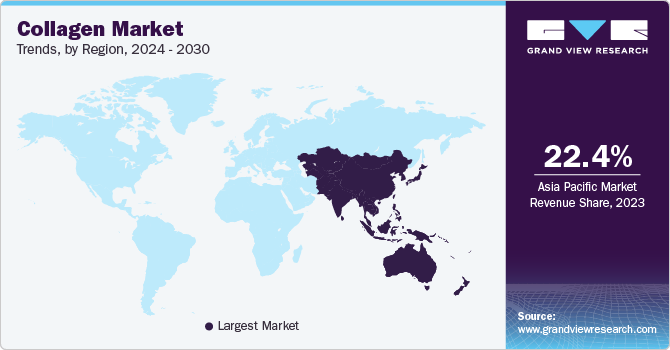

Regional Insights

North America is set to emerge as a fastest growing region and expand at a CAGR of a 11.9% from 2025 to 2030, propelled byincreasing consumer awareness of the health benefits associated with collagen, such as joint support, skin elasticity, and overall wellness. The escalating demand for collagen-based supplements, functional foods, and skincare products is further fueling growth. Besides, advancements in healthcare and medical applications, including collagen’s use in wound healing and regenerative therapies, contribute to market expansion. With strong distribution networks, high disposable income, and a growing health-conscious population, North America is anticipated to experience significant growth in the collagen market.

U.S. Collagen Market Trends

The U.S. held a considerable position in the collagen industry in 2024, spurred bythe increased demand for grass-fed and sustainable collagen and the growing presence of collagen in sports nutrition.Consumers are becoming more conscious of the ethical sourcing of their products, leading to a preference for grass-fed collagen, which is perceived as cleaner and more natural. Besides, athletes and fitness enthusiasts increasingly turn to collagen for muscle recovery, joint health, and improved performance, further boosting its use in sports nutrition products. These trends are fueling the rapid expansion of the U.S. collagen market.

Advancements in collagen extraction technologies and the integration of collagen into functional foods and beverages are projected to fuel the growth of the collagen market in Canada over the forecast period. Improved extraction methods, such as enzymatic hydrolysis, enhance collagen’s bioavailability and effectiveness, making it more accessible for various applications. Additionally, the growing consumer interest in health-conscious functional foods, such as collagen-infused drinks, protein bars, and supplements, is further boosting demand. These trends align with the increasing focus on wellness and the aging population, fueling Canada collagen market expansion.

Europe Collagen Market Trends

Europe secured the largest market share of 32.8% in 2024, fueled by the high demand for collagen-based products in various industries, particularly in healthcare, cosmetics, and food sectors. The region’s strong emphasis on health and wellness, coupled with a growing aging population, has boosted the consumption of collagen supplements and treatments. Europe also benefits from advanced research and development, leading to innovations in collagen-based products. Strict regulations and high-quality standards in European markets further ensure the safety and efficacy of collagen, fostering consumer trust and sustaining market growth.

The surging demand for plant-based and vegan collagen, driven by shifting consumer preferences for ethical and sustainable products, is significantly expanding the Europe collagen market. Consumers increasingly seek alternatives to animal-derived collagen, fueling the growth of plant-based options like algae and mushroom-based collagen. Additionally, the growing focus on skincare and anti-aging products further propels market growth, as collagen is a key ingredient for enhancing skin elasticity and reducing wrinkles. These trends and increasing consumer awareness of natural beauty solutions are driving the demand for collagen in Europe.

Germany is expected to accumulate sizable gains by 2030, propelled by the growing demand for marine collagen coupled with the expansion of the food and beverage sector. Marine collagen, renowned for its high bioavailability and skin benefits, is increasingly favored in supplements, functional foods, and beverages. As German consumers become more health-conscious, the demand for collagen-infused products in beverages, protein bars, and skincare is rising. This shift toward natural and effective ingredients, combined with Germany's strong food industry, positions the country for robust collagen market growth in the coming years.

Innovations in collagen products are anticipated to drive the growth of the UK collagen market over the forecast period, particularly with advancements in collagen formulations and delivery methods. New, more effective collagen supplements, including powders, drinks, and topical creams, are gaining popularity due to their enhanced bioavailability and targeted benefits. The expansion of collagen in cosmetics and personal care products, such as anti-aging skincare, haircare, and beauty supplements, further boosts market demand. As consumer interest in natural, high-performance beauty solutions rises, these innovations are set to propel the UK collagen market's growth in the coming years.

Asia Pacific Collagen Market Trends

Asia Pacific collagen market is projected to grow from 2025 to 2030, owing to the rising preference for traditional and herbal collagen sources, which align with the region's cultural emphasis on natural health and wellness. Herbal-based collagen, derived from plants like soy and bamboo, is gaining popularity for its sustainable and vegan-friendly appeal. In addition, increasing health consciousness among consumers, driven by a desire for enhanced skin, joint, and overall well-being, is fueling demand. As consumers prioritize natural beauty and health products, the collagen market in the region is set for substantial expansion.

China is expected to emerge as the fastest growing region over the forecast period, spurred by the rising preference for bovine and poultry-based collagen. These sources are in high demand due to their cost-effectiveness and nutritional benefits. The healthcare sector's need for collagen in supplements, joint health products, and wound healing is fueling market expansion. Additionally, the food and beverage industries are increasingly incorporating collagen in products like jellies, confectioneries, and nutritional bars. As consumer awareness of collagen's health benefits grows, the demand from these industries will continue to boost the market in China.

The demand for nutritional supplements and plant-based collagen alternatives is expected to catalyze the growth of India collagen market. As more consumers turn to supplements for improving skin health, joint mobility, and overall wellness, collagen products are becoming increasingly popular. Additionally, with the rise of veganism and plant-based diets, there is a growing shift towards plant-based collagen alternatives, offering cruelty-free and sustainable options. This demand for traditional and plant-derived collagen solutions is poised to expand the market, catering to the diverse preferences of health-conscious Indian consumers.

Key Collagen Company Insights

Some of the key companies in the collagen market include Gelita AG; Nitta Gelatin; NA Inc.; Darling Ingredients Inc.; Weishardt International; Nippi Collagen NA Inc.; Rousselot B.V.; Collagen Matrix, Inc.; Koninklijke DSM N.V.; CONNOILS LLC; Advanced BioMatrix; Inc.; Tessenderlo Group; Juncà Gelatines SL; Symatese; Xiamen Yiyu Biological Technology Co., Ltd.; STERLING GELATIN; Collagen Solutions Plc.

-

Gelita AG offers high-quality collagen peptides, gelatins, and functional proteins for various industries, including food, beverages, pharmaceuticals, cosmetics, and health supplements, focusing on health, wellness, and sustainability.

-

Nitta Gelatin NA Inc. specializes in high-quality collagen and gelatin products sourced from bovine, porcine, and marine sources. Their offerings cater to industries such as food, beverages, pharmaceuticals, and cosmetics.

Key Collagen Companies:

The following are the leading companies in the collagen market. These companies collectively hold the largest market share and dictate industry trends.

- Rousselot B.V.

- GELITA AG

- Tessenderlo Group

- STERLING GELATIN

- Weishardt Holding SA

- Juncà Gelatines SL

- Darling Ingredients Inc.

- Nippi Collagen NA Inc.

- Koninklijke DSM N.V.

- Xiamen Yiyu Biological Technology Co., Ltd.

- Symatese

- Collagen Matrix, Inc.

- Collagen Solutions Plc

- ConnOils LLC

- Advanced BioMatrix, Inc.

- Nitta Gelatin, NA Inc.

Recent Developments

-

In January 2025, GNC launched its Premier Collagen line for skin health, offering two supplement formulas-Premier Collagen and Advanced Shot-featuring marine and bovine collagen peptides and vitamin C, designed for fast absorption and promoting youthful-looking skin in various formats.

-

In March 2024, ISOPURE launched Collagen Peptides to its product range, promoting healthy joints, hair, skin, nails, and immunity. Each scoop offers 20 grams of grass-fed, pasture-raised collagen peptides in refreshing lemonade or unflavored options.

Collagen Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 10.9 billion |

|

Revenue forecast in 2030 |

USD 18.7 billion |

|

Growth Rate |

CAGR of 11.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, source, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Netherlands; Poland; China; India; Japan; Indonesia; Vietnam; Thailand; Philippines; Mexico; Brazil; Argentina; Ecuador; Colombia; Peru; Bolivia; Chile; Guatemala; El Salvador; Honduras; Costa Rica; Panama; Dominican Republic; Venezuela, Saudi Arabia; South Africa; Turkey; UAE; Qatar; Israel |

|

Key companies profiled |

Gelita AG; Nitta Gelatin; NA Inc.; Darling Ingredients Inc.; Weishardt International; Nippi Collagen NA Inc.; Rousselot B.V.; Collagen Matrix, Inc.; Koninklijke DSM N.V.; CONNOILS LLC; Advanced BioMatrix; Inc.; Tessenderlo Group; Juncà Gelatines SL; Symatese; Xiamen Yiyu Biological Technology Co., Ltd.; STERLING GELATIN; Collagen Solutions Plc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Collagen Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global collagen market report based on product, source, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Hydrolyzed Collagen

-

Native Collagen

-

Synthetic Collagen

-

Others

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Porcine

-

Poultry

-

Marine

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Functional Foods

-

Meat Processing

-

Functional Beverages

-

Dietary Supplements

-

Confectionery

-

Desserts

-

-

Healthcare

-

Bone & Joint Health Supplements

-

Wound Dressing

-

Tissue Regeneration

-

Medical Implants

-

Cardiology

-

Research

-

Drug Delivery

-

-

Cosmetics

-

Beauty Supplements (Nutricosmetics)

-

Topical Cosmetic Products

-

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Vietnam

-

Thailand

-

Philippines

-

-

Central & South America

-

Mexico

-

Brazil

-

Argentina

-

Ecuador

-

Colombia

-

Peru

-

Bolivia

-

Chile

-

Guatemala

-

El Salvador

-

Honduras

-

Costa Rica

-

Panama

-

Dominican Republic

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Turkey

-

UAE

-

Qatar

-

Israel

-

-

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Collagen Market Variables, Trends & Scope

3.1. Global Collagen Market Outlook

3.2. Industry Value Chain Analysis

3.3. Technology Overview

3.4. Regulatory Framework

3.4.1. Policies and Incentive Plans

3.4.2. Standards and Compliances

3.4.3. Regulatory Impact Analysis

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. Collagen Market: Product Outlook Estimates & Forecasts

4.1. Collagen Market: Product Movement Analysis, 2025 & 2030

4.1.1. Gelatin

4.1.1.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

4.1.2. Hydrolyzed Collagen

4.1.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

4.1.3. Native Collagen

4.1.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

4.1.4. Synthetic Collagen

4.1.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

4.1.5. Others

4.1.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 5. Collagen Market: Source Outlook Estimates & Forecasts

5.1. Collagen Market: Source Movement Analysis, 2025 & 2030

5.1.1. Bovine

5.1.1.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

5.1.2. Porcine

5.1.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

5.1.3. Poultry

5.1.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

5.1.4. Marine

5.1.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

5.1.5. Others

5.1.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 6. Collagen Market: Application Outlook Estimates & Forecasts

6.1. Collagen Market: Application Movement Analysis, 2025 & 2030

6.1.1. Food & Beverages

6.1.1.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.1.2. Functional Foods Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.1.3. Meat Processing Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.1.4. Functional Beverages Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.1.5. Dietary Supplements Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.1.6. Confectionery Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.1.7. Desserts Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.2. Healthcare

6.1.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.2.2. Bone & Joint Health Supplements Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.2.3. Wound Dressing Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.2.4. Tissue Regeneration Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.2.5. Medical Implants Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.2.6. Cardiology Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.2.7. Research Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.2.8. Drug Delivery Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.3. Cosmetics

6.1.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.3.2. Beauty Supplements (Nutricosmetics) Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.3.3. Topical Cosmetic Products Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

6.1.4. Others

6.1.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Collagen Market Regional Outlook Estimates & Forecasts

7.1. Regional Snapshot

7.2. Collagen Market: Regional Movement Analysis, 2025 & 2030

7.3. North America

7.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.3.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.3.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.3.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.3.5. U.S.

7.3.5.1. Market Estimates and Forecast, 2018 – 2030 (USD Million) (Kilotons)

7.3.5.2. Market Estimates and Forecast, By Product, 2018 – 2030 (USD Million) (Kilotons)

7.3.5.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.3.5.4. Market Estimates and Forecast, By Application, 2018 – 2030 (USD Million) (Kilotons)

7.3.6. Canada

7.3.6.1. Market Estimates and Forecast, 2018 – 2030 (USD Million) (Kilotons)

7.3.6.2. Market Estimates and Forecast, By Product, 2018 – 2030 (USD Million) (Kilotons)

7.3.6.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.3.6.4. Market Estimates and Forecast, By Application, 2018 – 2030 (USD Million) (Kilotons)

7.4. Europe

7.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.2. Market Estimates and Forecast, By Product, 2018 – 2030 (USD Million) (Kilotons)

7.4.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.4.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.4.5. Germany

7.4.5.1. Market Estimates and Forecast, 2018 – 2030 (USD Million)

7.4.5.2. Market Estimates and Forecast, By Product, 2018 – 2030 (USD Million)

7.4.5.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.4.5.4. Market Estimates and Forecast, By Application, 2018 – 2030 (USD Million)

7.4.6. UK

7.4.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.6.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.4.6.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.4.6.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.4.7. France

7.4.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.7.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.4.7.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.4.7.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.4.8. Italy

7.4.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.8.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.4.8.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.4.8.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.4.9. Spain

7.4.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.9.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.4.9.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.4.9.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.4.10. Netherlands

7.4.10.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.10.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.4.10.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.4.10.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.4.11. Poland

7.4.11.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.11.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.4.11.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.4.11.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.5. Asia Pacific

7.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.5.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.5.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.5.5. China

7.5.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.5.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.5.5.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.5.5.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.5.6. India

7.5.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.6.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.5.6.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.5.6.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.5.7. Japan

7.5.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.7.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.5.7.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.5.7.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.5.8. Indonesia

7.5.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.8.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.5.8.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.5.8.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.5.9. Vietnam

7.5.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.9.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.5.9.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.5.9.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.5.10. Thailand

7.5.10.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.10.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.5.10.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.5.10.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.5.11. Philippines

7.5.11.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.11.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.5.11.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.5.11.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6. Latin America

7.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.5. Mexico

7.6.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.5.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.5.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.5.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.6. Brazil

7.6.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.6.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.6.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.6.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.7. Argentina

7.6.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.7.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.7.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.7.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.8. Ecuador

7.6.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.8.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.8.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.8.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.9. Colombia

7.6.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.9.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.9.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.9.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.10. Peru

7.6.10.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.10.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.10.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.10.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.11. Bolivia

7.6.11.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.11.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.11.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.11.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.12. Chile

7.6.12.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.12.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.12.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.12.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.13. Guatemala

7.6.13.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.13.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.13.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.13.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.14. EI Salvador

7.6.14.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.14.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.14.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.14.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.15. Honduras

7.6.15.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.15.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.15.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.15.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.16. Costa Rica

7.6.16.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.16.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.16.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.16.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.17. Panama

7.6.17.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.17.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.17.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.17.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.18. Dominican Republic

7.6.18.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.18.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.18.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.18.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.6.19. Venezuela

7.6.19.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.19.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.6.19.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.6.19.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.7. Middle East and Africa

7.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.7.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.7.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.7.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.7.5. Saudi Arabia

7.7.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.7.5.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.7.5.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.7.5.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.7.6. South Africa

7.7.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.7.6.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.7.6.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.7.6.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.7.7. Turkey

7.7.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.7.7.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.7.7.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.7.7.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.7.8. UAE

7.7.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.7.8.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.7.8.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.7.8.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.7.9. Qatar

7.7.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.7.9.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.7.9.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.7.9.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

7.7.10. Israel

7.7.10.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Kilotons)

7.7.10.2. Market Estimates and Forecast, By Product, 2018 - 2030 (USD Million) (Kilotons)

7.7.10.3. Market Estimates and Forecast, By Source, 2018 - 2030 (USD Million) (Kilotons)

7.7.10.4. Market Estimates and Forecast, By Application, 2018 - 2030 (USD Million) (Kilotons)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Vendor Landscape

8.2.1. Company Categorization

8.2.2. List of Key Distributors and Channel Partners

8.2.3. List of Potential Customers/End Users

8.3. Competitive Dynamics

8.3.1. Competitive Benchmarking

8.3.2. Strategy Mapping

8.3.3. Heat Map Analysis

8.4. Company Profiles/Listing

8.4.1. Rousselot B.V.

8.4.1.1. Participant’s Overview

8.4.1.2. Financial Performance

8.4.1.3. Product Benchmarking

8.4.1.4. Strategic Initiatives

8.4.2. GELITA AG

8.4.2.1. Participant’s Overview

8.4.2.2. Financial Performance

8.4.2.3. Product Benchmarking

8.4.2.4. Strategic Initiatives

8.4.3. Tessenderlo Group

8.4.3.1. Participant’s Overview

8.4.3.2. Financial Performance

8.4.3.3. Product Benchmarking

8.4.3.4. Strategic Initiatives

8.4.4. STERLING GELATIN

8.4.4.1. Participant’s Overview

8.4.4.2. Financial Performance

8.4.4.3. Product Benchmarking

8.4.4.4. Strategic Initiatives

8.4.5. Weishardt Holding SA

8.4.5.1. Participant’s Overview

8.4.5.2. Financial Performance

8.4.5.3. Product Benchmarking

8.4.5.4. Strategic Initiatives

8.4.6. Juncà Gelatines SL

8.4.6.1. Participant’s Overview

8.4.6.2. Financial Performance

8.4.6.3. Product Benchmarking

8.4.6.4. Strategic Initiatives

8.4.7. Darling Ingredients Inc.

8.4.7.1. Participant’s Overview

8.4.7.2. Financial Performance

8.4.7.3. Product Benchmarking

8.4.7.4. Strategic Initiatives

8.4.8. Nippi Collagen NA Inc.

8.4.8.1. Participant’s Overview

8.4.8.2. Financial Performance

8.4.8.3. Product Benchmarking

8.4.8.4. Strategic Initiatives

8.4.9. Koninklijke DSM N.V.

8.4.9.1. Participant’s Overview

8.4.9.2. Financial Performance

8.4.9.3. Product Benchmarking

8.4.9.4. Strategic Initiatives

8.4.10. Xiamen Yiyu Biological Technology Co., Ltd.

8.4.10.1. Participant’s Overview

8.4.10.2. Financial Performance

8.4.10.3. Product Benchmarking

8.4.10.4. Strategic Initiatives

8.4.11. Symatese

8.4.11.1. Participant’s Overview

8.4.11.2. Financial Performance

8.4.11.3. Product Benchmarking

8.4.11.4. Strategic Initiatives

8.4.12. Collagen Matrix, Inc.

8.4.12.1. Participant’s Overview

8.4.12.2. Financial Performance

8.4.12.3. Product Benchmarking

8.4.12.4. Strategic Initiatives

8.4.13. Collagen Solutions Plc

8.4.13.1. Participant’s Overview

8.4.13.2. Financial Performance

8.4.13.3. Product Benchmarking

8.4.13.4. Strategic Initiatives

8.4.14. ConnOils LLC

8.4.14.1. Participant’s Overview

8.4.14.2. Financial Performance

8.4.14.3. Product Benchmarking

8.4.14.4. Strategic Initiatives

8.4.15. Advanced BioMatrix, Inc.

8.4.15.1. Participant’s Overview

8.4.15.2. Financial Performance

8.4.15.3. Product Benchmarking

8.4.15.4. Strategic Initiatives

8.4.16. Nitta Gelatin, NA Inc.

8.4.16.1. Participant’s Overview

8.4.16.2. Financial Performance

8.4.16.3. Product Benchmarking

8.4.16.4. Strategic Initiatives

List of Tables

Table 1. List of Abbreviations

Table 2. Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 3. Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 4. Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 5. Collagen Market Estimates and Forecasts, By Region, 2018 - 2030 (USD Million) (Kilotons)

Table 6. North America Collagen Market Estimates and Forecasts, By Country, 2018 - 2030 (USD Million) (Kilotons)

Table 7. North America Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 8. North America Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 9. North America Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 10. U.S. Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 11. U.S. Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 12. U.S. Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 13. Canada Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 14. Canada Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 15. Canada Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 16. Europe Collagen Market Estimates and Forecasts, By Country, 2018 - 2030 (USD Million) (Kilotons)

Table 17. Europe Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 18. Europe Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 19. Europe Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 20. Germany Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 21. Germany Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 22. Germany Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 23. UK Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 24. UK Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 25. UK Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 26. France Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 27. France Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 28. France Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 29. Italy Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 30. Italy Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 31. Italy Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 32. Spain Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 33. Spain Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 34. Spain Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 35. Netherlands Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 36. Netherlands Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 37. Netherlands Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 38. Poland Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 39. Poland Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 40. Poland Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 41. Asia Pacific Collagen Market Estimates and Forecasts, By Country, 2018 - 2030 (USD Million) (Kilotons)

Table 42. Asia Pacific Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 43. Asia Pacific Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 44. Asia Pacific Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 45. China Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 46. China Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 47. China Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 48. India Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 49. India Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 50. India Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 51. Japan Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 52. Japan Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 53. Japan Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 54. Indonesia Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 55. Indonesia Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 56. Indonesia Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 57. Vietnam Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 58. Vietnam Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 59. Vietnam Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 60. Thailand Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 61. Thailand Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 62. Thailand Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 63. Philippines Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 64. Philippines Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 65. Philippines Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 66. Latin America Collagen Market Estimates and Forecasts, By Country, 2018 - 2030 (USD Million) (Kilotons)

Table 67. Latin America Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 68. Latin America Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 69. Latin America Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 70. Mexico Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 71. Latin America Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 72. Latin America Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 73. Brazil Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 74. Brazil Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 75. Brazil Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 76. Argentina Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 77. Argentina Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 78. Argentina Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 79. Ecuador Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 80. Ecuador Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 81. Ecuador Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 82. Colombia Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 83. Colombia Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 84. Colombia Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 85. Peru Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 86. Peru Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 87. Peru Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 88. Bolivia Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 89. Bolivia Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 90. Bolivia Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 91. Chile Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 92. Chile Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 93. Chile Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 94. Guatemala Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 95. Guatemala Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 96. Guatemala Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 97. El Salvador Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 98. El Salvador Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 99. El Salvador Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 100. Honduras Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 101. Honduras Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 102. Honduras Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 103. Costa Rica Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 104. Costa Rica Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 105. Costa Rica Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 106. Panama Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 107. Panama Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 108. Panama Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 109. Dominican Republic Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 110. Dominican Republic Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 111. Dominican Republic Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 112. Venezuela Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 113. Venezuela Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 114. Venezuela Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 115. Middle East & Africa Collagen Market Estimates and Forecasts, By Country, 2018 - 2030 (USD Million) (Kilotons)

Table 116. Middle East & Africa Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 117. Middle East & Africa Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 118. Middle East & Africa Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 119. Saudi Arabia Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 120. Saudi Arabia Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 121. Saudi Arabia Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 122. South Africa Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 123. South Africa Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 124. South Africa Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 125. Turkey Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 126. Turkey Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 127. Turkey Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 128. UAE Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 129. UAE Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 130. UAE Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 131. Qatar Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 132. Qatar Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 133. Qatar Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

Table 134. Israel Collagen Market Estimates and Forecasts, By Product, 2018 - 2030 (USD Million) (Kilotons)

Table 135. Israel Collagen Market Estimates and Forecasts, By Source, 2018 - 2030 (USD Million) (Kilotons)

Table 136. Israel Collagen Market Estimates and Forecasts, By Application, 2018 - 2030 (USD Million) (Kilotons)

List of Figures

Fig. 1 Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Market Snapshot

Fig. 6 Segmental Outlook - Product, Source, and Application

Fig. 7 Competitive Outlook

Fig. 8 Value Chain Analysis

Fig. 9 Market Dynamics

Fig. 10 Porter’s Analysis

Fig. 11 PESTEL Analysis

Fig. 12 Collagen Market, By Product: Key Takeaways

Fig. 13 Collagen Market, By Product: Market Share, 2025 & 2030

Fig. 14 Gelatin Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 15 Hydrolyzed Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 16 Native Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 17 Synthetic Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 18 Others Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 19 Collagen Market, By Source: Key Takeaways

Fig. 20 Collagen Market, By Source: Market Share, 2025 & 2030

Fig. 21 Bovine Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 22 Porcine Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 23 Poultry Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 24 Marine Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 25 Others Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 26 Collagen Market, By Application: Key Takeaways

Fig. 27 Collagen Market, By Application: Market Share, 2025 & 2030

Fig. 28 Food & Beverages Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 29 Healthcare Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 30 Cosmetics Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 31 Others Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 32 Collagen Market, By Region: Key Takeaways

Fig. 33 Collagen Market, By Region: Market Share, 2025 & 2030

Fig. 34 North America Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 35 US Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 36 Canada Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 37 Europe Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 38 Germany Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 39 UK Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 40 France Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 41 Italy Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 42 Spain Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 43 Netherlands Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 44 Poland Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 45 Asia Pacific Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 46 China Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 47 India Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 48 Japan Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 49 Indonesia Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 50 Vietnam Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 51 Thailand Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 52 Philippines Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 53 Latin America Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 54 Middle East & Africa Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 55 Saudi Arabia Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 56 South Africa Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 57 Turkey Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 58 UAE Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 59 Qatar Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 60 Israel Collagen Market, 2018 - 2030 (USD Million) (Kilotons)

Market Segmentation

- Collagen Product Outlook (Revenue, Kilotons, USD Million; 2018 - 2030)

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Collagen Source Outlook (Revenue, Kilotons, USD Million; 2018 - 2030)

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Collagen Application Outlook (Revenue, Kilotons, USD Million; 2018 - 2030)

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- Collagen Regional Outlook (Revenue, Kilotons, USD Million; 2018 - 2030)

- North America

- North America Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- North America Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- North America Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- U.S.

- U.S. Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- U.S. Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- U.S. Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- U.S. Collagen Market, By Product

- Canada

- Canada Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Canada Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Canada Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- Canada Collagen Market, By Product

- North America Collagen Market, By Product

- Europe

- Europe Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Europe North America Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Europe Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- Germany

- Germany Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Germany Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Germany Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- Germany Collagen Market, By Product

- UK

- UK Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- UK Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- UK Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- UK Collagen Market, By Product

- France

- France Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- France Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- France Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- France Collagen Market, By Product

- Italy

- Italy Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Italy Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Italy Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- Italy Collagen Market, By Product

- Spain

- Spain Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Spain Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Spain Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- Spain Collagen Market, By Product

- Netherlands

- Netherlands Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Netherlands Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Netherlands Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- Netherlands Collagen Market, By Product

- Poland

- Poland Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Poland Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Poland Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- Poland Collagen Market, By Product

- Europe Collagen Market, By Product

- Asia Pacific

- Asia Pacific Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Asia Pacific Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Asia Pacific Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- China

- China Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- China Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- China Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- China Collagen Market, By Product

- India

- India Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- India Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- India Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Research

- Drug Delivery

- Cosmetics

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

- Others

- Food & Beverages

- India Collagen Market, By Product

- Japan

- Japan Collagen Market, By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

- Japan Collagen Market, By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

- Japan Collagen Market, By Application

- Food & Beverages

- Functional Foods

- Meat Processing

- Functional Beverages

- Dietary Supplements

- Confectionery

- Desserts

- Healthcare

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration