Cold Press Juice Market Size, Share & Trends Analysis Report By Type (Fruit, Vegetable), By Category (Conventional, Organic), By Packaging, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-424-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Cold Press Juice Market Size & Trends

The global cold press juice market size was estimated at USD 790.1 million in 2023 and is expected to grow at a CAGR of 6.9% from 2024 to 2030.As the health and wellness trend continues to grow, the popularity of cold press juice is increasing. Unlike juices made from freshly juiced fruits and vegetables, cold press juice are produced by extracting the juice and then evaporating most of the water, resulting in a nutrient-dense and flavorful syrup. The rising demand for healthy and convenient food options is propelling the global juice concentrate market forward. In addition, the growing demand for fruit concentrates as flavoring agents in baby food and indulgent bakery products is significantly contributing to market growth.

The demand for cold-pressed juices is increasing as consumers become more health-conscious and seek out beverages that offer significant nutritional benefits. Cold-pressed juices retain a higher concentration of vitamins, minerals, and enzymes compared to traditionally processed juices, appealing to those who prioritize nutrient-dense options in their diet. This growing awareness of health and wellness drives consumers to choose cold-pressed juices for their perceived superior health benefits.

Another factor contributing to the rise in demand is the preference for natural and minimally processed foods. Cold-pressed juices are made without heat, which helps preserve the natural flavors and nutrients of the ingredients. This process avoids the use of added sugars, preservatives, and artificial ingredients, aligning with consumers' desire for pure and wholesome products.

In addition, cold-pressed juices are often associated with detox and wellness trends. They are marketed as part of detox programs and wellness regimens, providing a convenient way to consume a concentrated source of fruits and vegetables. This appeal to those looking to cleanse their bodies and enhance overall health further drives the popularity of these juices.

The fresh and vibrant flavors of cold-pressed juices also play a significant role in their increasing demand. The use of high-quality, ripe produce ensures a more enjoyable and satisfying juice experience, which attracts consumers who value both taste and nutrition. Coupled with the convenience of ready-to-drink options, cold-pressed juices fit well into busy lifestyles.

Manufacturers are continually innovating to meet consumer demand and differentiate their products. One major trend is the emphasis on clean-label products with fewer additives and preservatives. Companies are producing cold press juices that are organic, non-GMO, and free from artificial ingredients. For instance, in February 2022, Pure Green launched a new cold-pressed juice called "Foodgod," in collaboration with influencer Jonathan Cheban, known as Foodgod. This juice is designed to cater to health-conscious consumers and features a blend of ingredients including apples, lemon, ginger, and turmeric. The partnership aims to leverage Foodgod's influence to reach a broader audience, with the juice being available at Pure Green locations and through online orders. The launch reflects a growing trend in the wellness industry, focusing on fresh, nutrient-rich beverages.

Type Insights

Cold press fruit juice accounted for a share of 79.3% in 2023. Cold-pressed fruit juices retain a higher concentration of vitamins, minerals, and antioxidants compared to traditional juicing methods. The absence of heat during the pressing process helps preserve these essential nutrients, making cold-pressed juices a preferred choice for health-conscious consumers.

Cold press vegetable juice is expected to grow at a CAGR of 7.4% from 2024 to 2030. As interest in health and wellness grows, consumers are increasingly incorporating vegetable juices into their diets for their potential health benefits. Cold-pressed vegetable juices align with this trend by offering a convenient way to consume a variety of vegetables and support overall health.

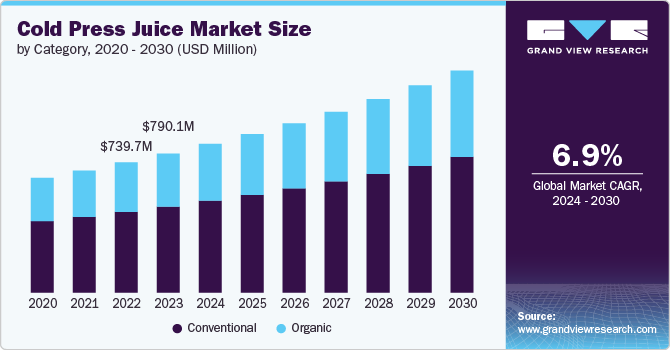

Category Insights

Conventional cold press juice accounted for a revenue share of 61.9% in 2023. There is a growing preference for natural and minimally processed foods. Cold-pressed juices are made without heat, which helps preserve the natural flavors and nutrients of the fruits and vegetables used. This aligns with consumers' desire for pure, wholesome products free from added sugars, preservatives, and artificial ingredients.

Organic cold press juice is expected to grow at a CAGR of 7.2% from 2024 to 2030. Consumers are increasingly aware of the health benefits associated with organic products. Organic cold-pressed juices, which are made from fruits and vegetables grown without synthetic pesticides or fertilizers, appeal to those seeking healthier, cleaner options that avoid potential chemical residues.

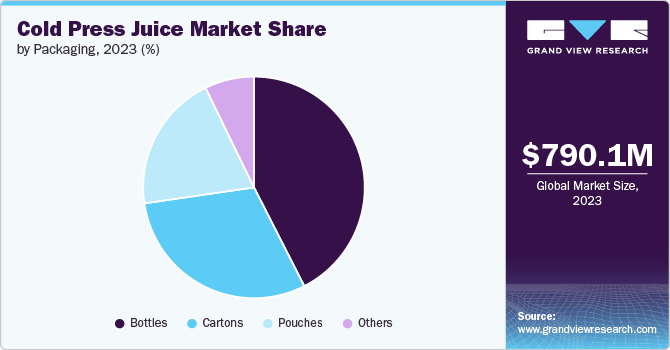

Packaging Insights

Bottles accounted for a revenue share of 42.5% in 2023. Bottled cold-pressed juices offer a ready-to-drink, convenient option for consumers with busy lifestyles. The portability of bottled juices makes it easy to incorporate them into daily routines, whether at home, work, or on the go. Modern bottling techniques, such as high-pressure processing (HPP), preserve the juice’s freshness and nutritional value while ensuring it remains safe and stable for longer periods.

Cartons is expected to grow at a CAGR of 7.4% from 2024 to 2030. Cartons are often perceived as a more environmentally friendly packaging option compared to plastic bottles. Many cartons are made from recyclable or biodegradable materials, aligning with the growing consumer preference for eco-friendly products and sustainable practices.

Distribution Channel Insights

Supermarkets & hypermarkets accounted for a revenue share of 38.5% in 2023. Supermarkets and hypermarkets offer easy access to a wide variety of cold-pressed juices, allowing consumers to conveniently purchase them during regular grocery shopping trips. The availability of these juices in larger retail settings saves time and effort. Larger retail chains frequently offer promotions, discounts, and loyalty rewards on cold-pressed juices. These deals can make purchasing from supermarkets and hypermarkets more economical, attracting cost-conscious consumers looking for value.

Online is expected to grow at a CAGR of 7.5% from 2024 to 2030. Online shopping offers the convenience of purchasing cold-pressed juices from the comfort of home. Consumers can easily browse through a wide selection, place orders at any time, and have the juices delivered directly to their doorstep, saving time and effort. Online platforms often provide access to niche or specialty cold-pressed juice brands that may not be available in local stores. This allows consumers to explore unique flavors, organic options, or specific health-focused juices that cater to their preferences.

Regional Insights

The cold press juice market in North America accounted for a revenue share of 25.7% in 2023 of the global market. Cold-pressed juices are popular for their high nutritional content, as the cold-pressing process preserves vitamins, minerals, and enzymes better than traditional juicing methods. Health-conscious consumers in North America are drawn to these juices for their perceived benefits, such as boosting immunity, detoxifying the body, and supporting overall wellness.

U.S. Cold Press Juice Market Trends

The cold press juice market in the U.S. is facing intense competition due to innovation in cold press juice varieties. The clean eating movement, which emphasizes natural, unprocessed, and minimally refined foods, has gained significant traction in U.S. cold-pressed juices align with this trend, as they are often made from raw, fresh ingredients without added sugars, preservatives, or artificial flavors.

Europe Cold Press Juice Market Trends

The cold press juice market in Europe is expected to grow at a CAGR of 7.2% during the forecast period. European consumers tend to value local and artisan products. Cold-pressed juices from local producers or small-scale brands are often viewed as high-quality and crafted with care, making them a popular choice for those who want to support local businesses and enjoy unique, regionally sourced ingredients.

Asia Pacific Cold Press Juice Market Trends

The cold press juice market in Asia Pacific is expected to grow at a CAGR of 7.7% from 2024 to 2030. With rapid urbanization and the rise of busy, fast-paced lifestyles, many people in the Asia-Pacific region seek convenient and quick nutrition solutions. Cold-pressed juice offers a portable and ready-to-drink option that fits easily into the hectic schedules of urban dwellers. As disposable income increases in many Asia Pacific countries, consumers are more willing to spend on premium, health-oriented products. Cold-pressed juice, often perceived as a premium product due to its natural ingredients and health benefits, appeals to middle- and upper-income groups.

Key Cold Press Juice Company Insights

The cold press juice market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Cold Press Juice Companies:

The following are the leading companies in the cold press juice market. These companies collectively hold the largest market share and dictate industry trends.

- Naked Juice Company (PepsiCo, Inc.)

- Odwalla, Inc. (Coca-Cola Company)

- Tropicana BraNDS Group

- Suja Life, LLC

- The Hain Celestial Group, Inc.

- Rakyan Bottles Private Limited (Raw Pressery)

- Pressed Juicery, Inc.

- Organic Avenue

- Evolution Fresh, Inc. (Starbucks Corporation)

- Mama Juice

Recent Developments

-

In January 2023, Omjoos introduced two new cold-pressed juice flavors: Orange and ABC (Apple, Beetroot, and Carrot). The Orange juice is made from fresh oranges, while the ABC juice combines apple, beetroot, and carrot for a nutritious blend. These new offerings aim to enhance Omjoos' product lineup, catering to health-conscious consumers seeking fresh and natural beverage options. The launch reflects the brand's commitment to providing high-quality, cold-pressed juices. The juices are available for purchase through their website and retail partners.

-

In March 2022, Kayco Beyond launched Wonder Lemon, a 100% organic cold-pressed juice with zero added sugar, making its debut at the Natural Products Expo West 2022 in Anaheim, California. This innovative juice responds to the rising demand for organic beverages and offers a fresh citrus flavor along with health benefits, particularly in boosting immunity. Wonder Lemon is crafted from a blend of cold-pressed fruits and vegetables, featuring three flavors: Lemon Ginger, Lemon Mint, and Lemon Basil Jalapeño. Each variant contains only five to six natural ingredients and has fewer than 110 calories per bottle.

Cold Press Juice Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 845.0 million |

|

Revenue forecast in 2030 |

USD 1.26 billion |

|

Growth rate |

CAGR of 6.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, category, packaging, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; UAE |

|

Key companies profiled |

Naked Juice Company (PepsiCo, Inc.); Odwalla, Inc. (Coca-Cola Company); Tropicana BraNDS Group; Suja Life, LLC; The Hain Celestial Group, Inc.; Rakyan Bottles Private Limited (Raw Pressery); Pressed Juicery, Inc.; Organic Avenue; Evolution Fresh, Inc. (Starbucks Corporation); Mama Juice |

|

Customization scope |

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cold Press Juice Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cold press juice market report based on type, category, packaging, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit Concentrates

-

Citrus Fruits

-

Orange

-

Lemon

-

Grapefruit

-

Berries

-

Strawberry

-

Others

-

-

Tropical Fruits

-

Mango

-

Pineapple

-

Banana

-

Passion Fruit

-

Others

-

-

-

Vegetable Concentrates

-

Carrot

-

Tomato

-

Beetroot

-

Cucumber

-

Others

-

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cartons

-

Pouches

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cold pressed juice market size was estimated at USD 790.1 million in 2023 and is expected to reach USD 845.0 million in 2024.

b. The global cold pressed juice market is expected to grow at a compounded growth rate of 6.9% from 2024 to 2030 to reach USD 1.26 billion by 2030.

b. Cold pressed fruit juice accounted for a share of 79.3% in 2023. Cold-pressed fruit juices are often made from fresh, high-quality fruits without added sugars, preservatives, or artificial ingredients. This commitment to natural and pure ingredients appeals to consumers looking for wholesome and clean beverage options.

b. Some key players operating in cold press juice market include Naked Juice Company (PepsiCo, Inc.), Odwalla, Inc. (Coca-Cola Company), Tropicana BraNDS Group, Suja Life, LLC, The Hain Celestial Group, Inc., and others.

b. Key factors that are driving the market growth include rising popularity of ready-to-drink products among consumers and increasing health consiousness among consumers

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."