- Home

- »

- Homecare & Decor

- »

-

Cold Plunge Tub Market Size & Share, Industry Report, 2033GVR Report cover

![Cold Plunge Tub Market Size, Share & Trends Report]()

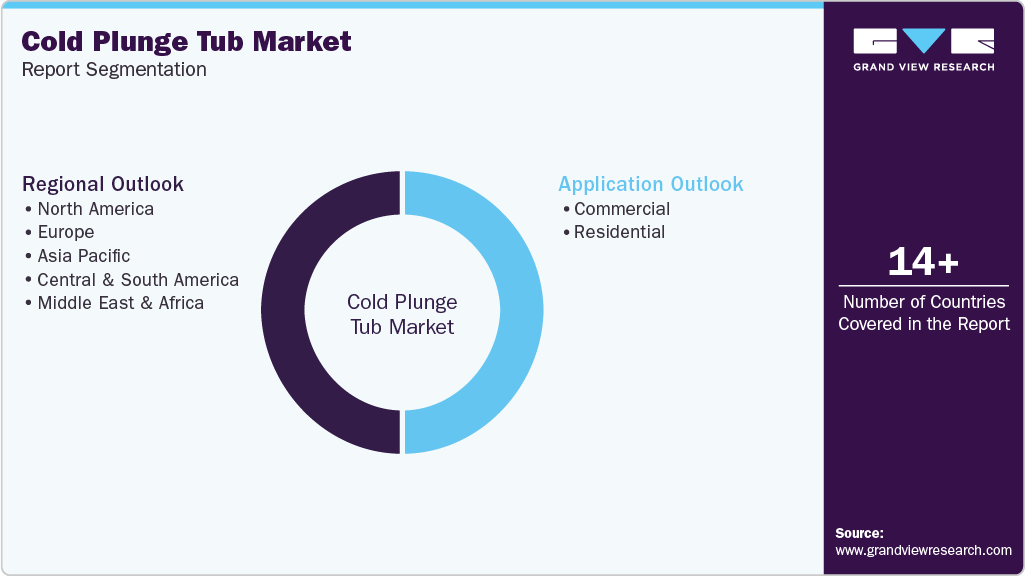

Cold Plunge Tub Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-955-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Plunge Tub Market Summary

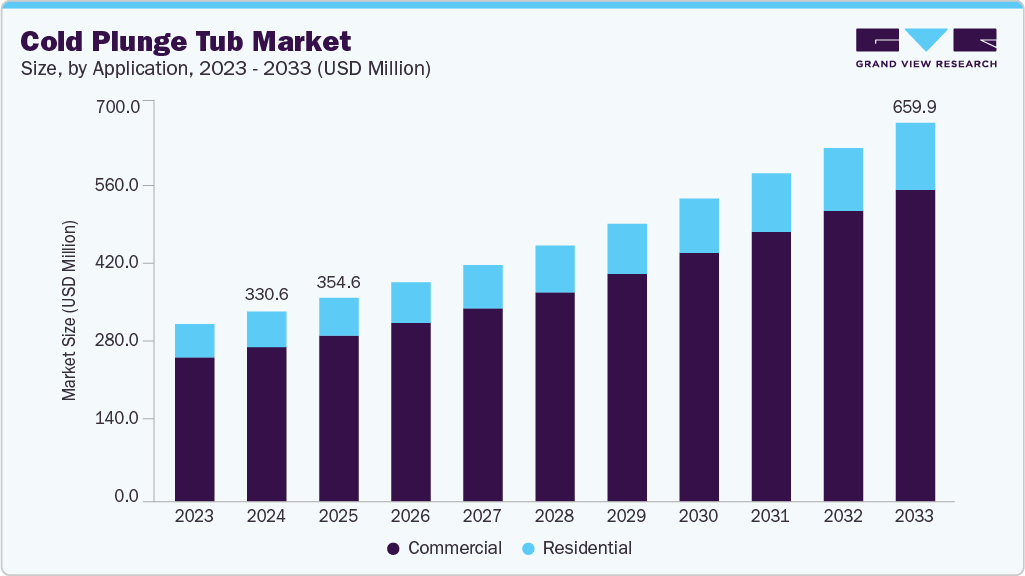

The global cold plunge tub market size was estimated at USD 330.58 million in 2024 and is projected to reach USD 659.86 million by 2033, growing at a CAGR of 8.1% from 2025 to 2033. The need to treat the increasing number of cases of inflammation, discomfort, and muscle soreness among athletes and in sports training facilities is a primary factor driving market growth.

Key Market Trends & Insights

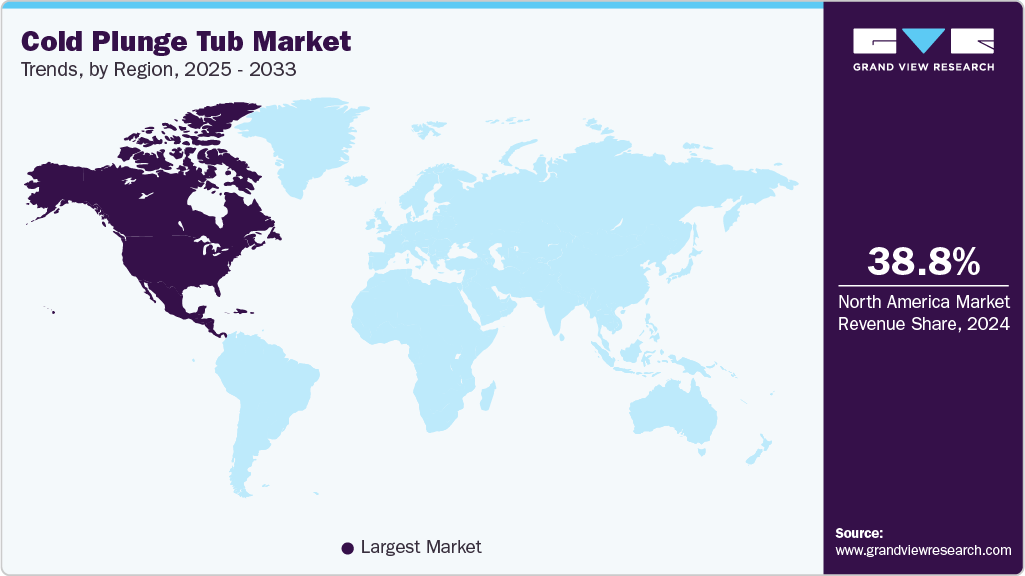

- By region, North America region led the global cold plunge tube market with a share of 38.8% in 2024

- The cold plunge tub industry in the U.S. as well as in Canada and Mexico, is witnessing that consumers have become increasingly aware of the proven benefits of cold exposure for reducing inflammation, promoting muscle recovery, managing stress, and enhancing mental resilience.

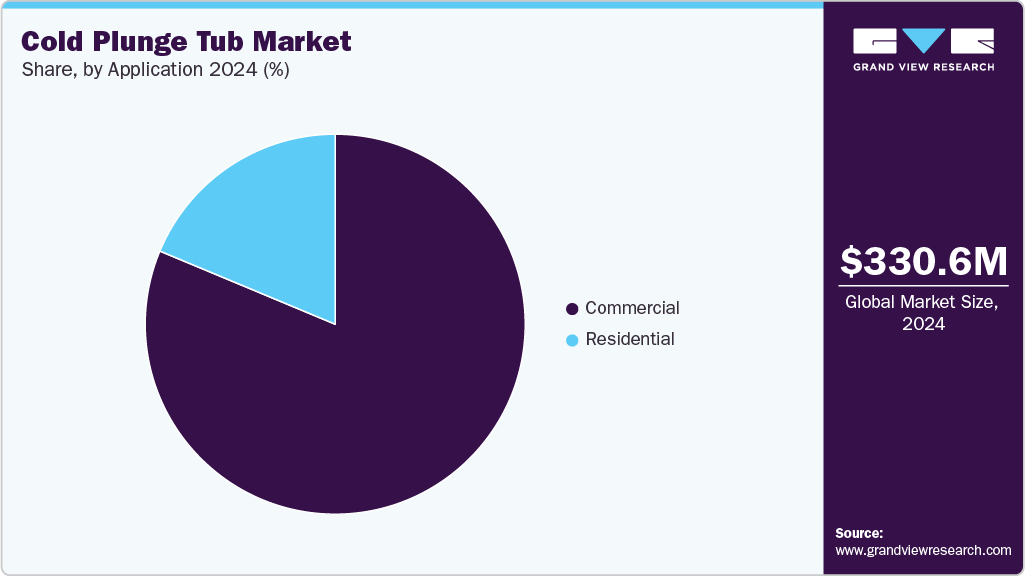

- By application, commercial led the market and accounted for a share of 81.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 330.58 Million

- 2033 Projected Market Size: USD 659.86 Million

- CAGR (2025-2033): 8.1%

A rise in the population's use of cold plunge pools is also related to the rising demand for hydrotherapy as a result of numerous neurologic and musculoskeletal diseases. As a result, the market for cold plunge tubs is estimated to witness strong growth over the forecast period. Rising investments in private hospitals, healthcare facilities, spas, and the fitness industry will further accelerate the growth of the industry.

Hydrotherapy is nowadays being prioritized for treatment by both private and significant government healthcare institutions, which will significantly fuel the size of the industry during the projection period. In addition, the expansion of the market for cold plunge tubs is aided by rising healthcare expenditure and disposable income. The need for hydrotherapy equipment has risen due to the high patient preference for non-invasive pain treatment techniques. Other factors, such as high investments by athletes and sports associations to purchase technologically advanced therapy devices and a rise in the adoption of hydrotherapy equipment by surgeons and physicians, are expected to have a profound impact on the industry. In addition, major initiatives by key market players to build next-generation medical devices equipped with Internet of Things (IoT) and smart sensor solutions are expected to open a plethora of business expansion opportunities.

The market is witnessing a significant surge in demand, driven largely by the increasing popularity of corporate and social networking events. Companies like Grand Dynamics, which specialize in executive retreats and team-building activities, report that in 2024, more than half of their clients request cold immersion experiences. This trend highlights the growing appreciation for cold plunge activities as an effective method for team bonding and stress relief, leading to their adoption in various professional settings.

In addition, firms such as Fyre Sauna have capitalized on this interest by providing mobile cold-plunge tanks for corporate retreats, enhancing team interactions, and fostering a unique environment for networking.

Buyer Insights

The rise in wellness tourism and the resurgence of the global hospitality industry have contributed to the growing demand for cold plunge tubs over the past few years. Cold plunge tubs are widely used in spas and health-centric resorts. Cold-water therapy is an ancient practice and a growing trend in health and wellness today. It offers numerous benefits, including promoting deeper sleep, boosting energy levels, enhancing blood circulation, and reducing inflammation. Therefore, the increasing number of spas and health resorts worldwide has driven the growth of the cold plunge tub industry.

Source: Spa Business Magazine

Customers prefer therapeutic spas to reduce their stress and anxiety. According to the International Spa Association (ISPA), the U.S. spa industry revenue reached USD 22.5 billion in 2024, increasing by 5.8% from USD 21.3 billion in 2023. Similarly, according to the Global Wellness Institute (GWI), in 2023, the spa industry reached USD 136.8 billion in spa revenue and 191,348 spa establishments. This marked a 4.1% yearly revenue rise, which was primarily driven by rising consumer earnings, continuing tourism expansion, and a rising tendency to spend on all things wellness-related.

As per the ISPA, the U.S. spa industry reported 187 million visits in 2024, which was a 3.1% increase from 182 million visits in 2023. The number of spa locations increased by 0.6% to 21,980, while revenue per visit rose by 2.6%.

Table 1 Number of spa establishments by region, 2019-2023

Region

2019

2020

2021

2022

2023

Europe

59,695

58,967

60,866

63,073

65,385

Asia Pacific

53,532

51,929

53,132

55,266

56,705

North America

31,917

30,813

30,917

31,842

32,588

Latin America-Caribbean

16,924

15,917

16,750

18,362

19,307

Middle East-North Africa

8,190

7,970

8,403

9,260

9,687

Sub-Saharan Africa

5,157

5,067

5,819

6,696

7,676

World

175,415

170,663

175,887

184,499

191,348

Source: Global Wellness Institute (GWI)

Globally, the increasing number of spa establishments has widened the scope of the cold plunge tub industry. According to the Global Wellness Institute, there was a surge in the number of spas in 2023. This was not only because of new spas being built, but also because of a dramatic increase in the number of hotel/resorts listing themselves and their spa facilities/services on global online booking sites, especially in emerging market countries. This trend has presented the cold plunge tub industry with stronger growth opportunities.

The appeal of sleek, high-tech wellness equipment is growing across countries such as the U.S., UK, Canada, Germany, France, China, India, and Japan. Builders, interior designers, and plumbers are placing greater emphasis on integrating stylish, advanced bathroom and wellness products, such as showers, toilets, bathtubs, faucets, mirrors, and cold-plunge tubs, into unified design setups. Users increasingly expect equipment that not only achieves low temperatures consistently (even in hot climates) but also offers remote scheduling, session tracking, quiet operation, low-maintenance design, and durable all-season construction. Such features make smart plunge-tub systems a valuable investment for health- and wellness-focused consumers seeking reliable, user-friendly solutions.

Application Insights

The commercial application held the largest share in the cold plunge tub industry, accounting for a share of 81.3% in 2024. Cold plunge tubs have gained immense popularity among a diverse range of users, including elite athletes, celebrities, wellness enthusiasts, and corporate leaders. For instance, LeBron James, Naomi Osaka, Klay Thompson, and J.J. Watt are among the elite athletes using cold plunge tubs as part of their rigorous recovery routine to enhance performance.

The percentage of Olympians and elite competitors using ice baths in their recovery protocols has surged, with the Paris 2024 Olympics planning to use 650 tons of ice, a tenfold increase from the Tokyo 2020 Games.

Residential demand is anticipated to witness a CAGR of 7.4% from 2025 to 2033. The demand for cold plunge tubs in homes is increasing because wellness has shifted from an occasional activity to a daily lifestyle priority. Consumers are investing more in creating personal wellness spaces at home as part of a broader movement toward physical and mental self-care. Cold water immersion is no longer viewed only as an athletic recovery technique; it is now associated with improved mood, stress reduction, immune support, and overall resilience. As awareness of these benefits spreads through mainstream media and medical conversations, people are increasingly motivated to incorporate cold therapy into their daily routines, without relying on gyms or wellness centers.

Regional Insights

The North American cold plunge tub industry accounted for a global share of around 38.8% in 2024. The cold-plunge tub industry in North America is expanding steadily due to the convergence of wellness, recovery, and hospitality trends, which have elevated cold-water immersion from a niche practice to a mainstream recovery method.

U.S. Cold Plunge Tub Market Trends

The cold plunge tub industry in the U.S. as well as in Canada and Mexico, is witnessing that consumers have become increasingly aware of the proven benefits of cold exposure for reducing inflammation, promoting muscle recovery, managing stress, and enhancing mental resilience. This rising awareness, supported by growing visibility from professional athletes, fitness influencers, and wellness practitioners, has increased consumer confidence and normalized the use of at-home and commercial products. As a result, cold-plunge tubs are increasingly viewed as an accessible part of daily recovery routines rather than a specialized therapy reserved for elite athletes.

Europe Cold Plunge Tub Market Trends

The cold plunge tub industry in Europe is expected to grow at a CAGR of 7.7% from 2025 to 2033. Consumers are increasingly viewing cold plunging as a structured method to improve circulation, reduce inflammation, and enhance post-exercise recovery, aligning with broader trends in preventive health and self-care. This shift has enabled cold plunge tubs to transition from niche athletic equipment to a widely accepted wellness fixture in both households and commercial facilities. Demand is also rising due to the influence of sports recovery, physiotherapy, and fitness ecosystems across Europe. Professional football, rugby, cycling, and winter sports teams have long incorporated ice baths into their performance recovery strategies. As athletes and physiotherapists openly endorse the benefits of cold immersion, mainstream consumers in Germany, the UK, France, Spain, and the Nordic countries are replicating these routines at home.

Asia Pacific Cold Plunge Tub Market Trends

The Asia Pacific cold plunge tub industry accounted for a global share of around 23.6% in 2024. The demand for plunge bath tubs in the Asia Pacific is rising due to the rapid expansion of the wellness, fitness, and recovery ecosystem across major markets. Consumers are increasingly prioritizing physical restoration, stress reduction, and mental well-being, which aligns with global interest in cold-water immersion as a recovery modality. The region’s spa, fitness, and boutique wellness industries are proactively adopting cold-therapy offerings to differentiate services, integrate contrast-therapy routines, and meet growing expectations for modern wellness treatments. As a result, both commercial operators and home-use customers are driving sustained demand for cold plunge tubs.

Central & South America Cold Plunge Tub Market Trends

The Central & South America cold plunge tub industry is expected to grow at a CAGR of 6.4% from 2025 to 2033. The market for plunge bath tubs in Central and South America is expanding due to the rapid growth of the region’s wellness and recovery ecosystem. Hotels, spas, boutique fitness centers, and physiotherapy clinics are increasingly integrating contrast-therapy facilities into their service offerings to enhance customer experience and differentiate themselves in competitive urban markets. Rising investment in wellness tourism across Brazil, Mexico, Colombia, Costa Rica, and Chile has further accelerated the installation of cold-immersion systems, as operators seek to offer premium hydrotherapy amenities that justify higher room rates and strengthen occupancy.

Middle East & Africa Cold Plunge Tub Market Trends

The cold plunge tub industry in the Middle East and Africa is expected to grow at a CAGR of 7.0% from 2025 to 2033. The Middle East & Africa region has been witnessing a rising demand for cold plunge tubs, fueled by the expanding wellness tourism sector. According to Wellness Strategy and Development at Red Sea Global (RSG) in May 2024, the Middle East stands out for its responsiveness to evolving consumer preferences. For instance, Saudi Arabia, exemplified by the luxury destination AMAALA, showcases a strategy of utilizing natural landscapes to attract wellness industry leaders. Moreover, wellness tourism not only offers travelers an opportunity to engage deeply with destinations but also serves as a key factor influencing tourists' location choices.

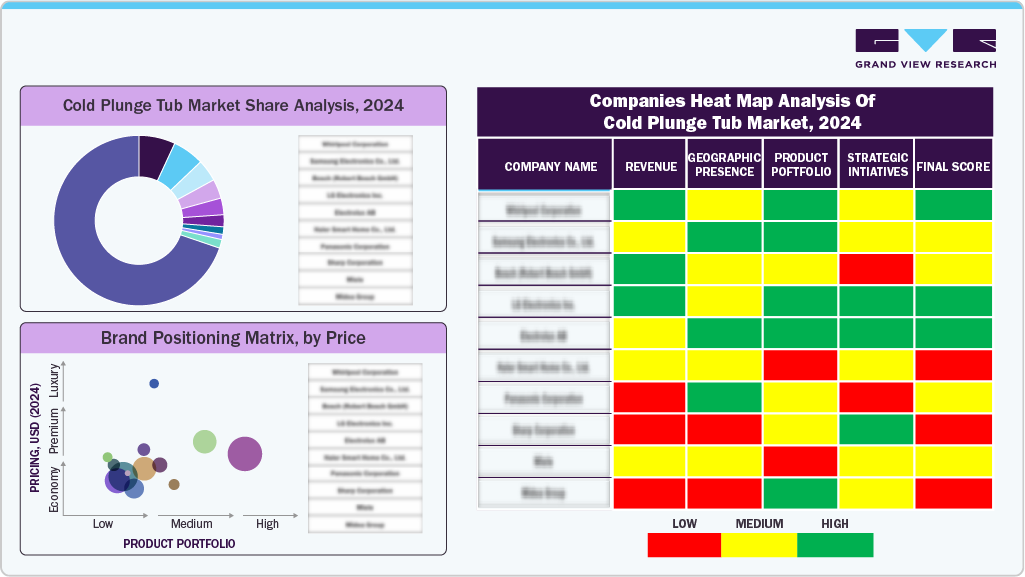

Key Cold Plunge Tub Company Insights

Leading players in the cold plunge tub industry include BlueCube Cold Plunge Tubs & BlueCube Wellness LLC, Morozko Forge, The Ice Bath Co., Ice Barrel Inc., and others. Companies in the cold plunge tub industry are increasingly investing in advanced materials, ergonomic design innovations, and modular construction techniques to improve the durability, sustainability, and adaptability of their products across both commercial and residential applications. The growing integration of smart technology, including IoT-enabled features and energy-efficient systems, is further driving market development by enhancing functionality and user experience in commercial installations.

Rising consumer demand for sustainable sourcing, eco-friendly materials, and circular design principles is creating significant opportunities for products made from recycled or renewable resources. In addition, the ongoing trend toward flexible workspaces, luxury home interiors, and hospitality refurbishments is reinforcing the long-term growth potential of the cold plunge tub industry. These developments are positioning cold plunge tubs as not only a wellness solution but also a key component of modern aesthetic and functional transformations in both personal and commercial environments.

Key Cold Plunge Tub Companies:

The following are the leading companies in the cold plunge tub market. These companies collectively hold the largest market share and dictate industry trends.

- COLDTUB

- BlueCube Cold Plunge Tubs & BlueCube Wellness LLC

- Morozko Forge

- The Ice Bath Co.

- Ice Barrel Inc.

- iCool (Australia) Pty Ltd

- Renu Therapy

- Brass Monkey Health Ltd

- Coldture Wellness Inc.

- Plunge

Recent Developments

-

In October 2025, Alphasauna introduced a new cold plunge tub tailored for global markets, featuring a sleek, modern design and advanced technology, including WiFi-enabled temperature control and dual hot/cold functionality. The product features a stainless steel liner, customizable color finishes, a compact footprint, an integrated refrigeration system with rapid cooling (approximately 4-5 °C/hr), and full certifications, including CE, ETL, PSE, and SAA.

-

In September 2025, Plunge launched the All-In Gen 2 model, which offered significantly faster cooling (31% quicker) and 50% improved energy efficiency, along with upgraded filtration, smarter sensor-driven automation, and enhanced app connectivity.

-

In May 2025, Clearwater Wellness Co. launched its new product, the SnowCap, which it described as the world’s first thermoelectric ice bath that requires no ice, plumbing, or external chillers. The company stated that the product had already generated approximately USD 700,000 in pre-sales and secured around USD 1.84 million in funding to support its global rollout.

-

In November 2024, Kohler and Remedy Place debuted a luxury ice‑bath installation at Design Miami, where they showcased their collaborative “Ice Bath” product featuring precision temperature control, ergonomic body seating, UV filtration, and integrated lights for breath‑work guidance, designed for both indoor and outdoor use and slated for shipment in spring 2025.

Cold Plunge Tub Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 354.56 million

Revenue Forecast in 2033

USD 659.86 million

Growth rate

CAGR of 8.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

COLDTUB; BlueCube Cold Plunge Tubs & BlueCube Wellness LLC; Morozko Forge; The Ice Bath Co.; Ice Barrel Inc.; iCool (Australia) Pty Ltd; Renu Therapy; Brass Monkey Health Ltd; Coldture Wellness Inc.; Plunge

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Plunge Tub Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the cold plunge tub market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Wellness Centers/Gyms/Spas

-

Hotels/Hospitality

-

Hospitals/Medical Centers

-

Institutional

-

Others (Senior Living Homes, etc.)

-

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold plunge tub market was estimated at USD 330.58 million in 2024 and is expected to reach USD 354.56 million in 2025.

b. The global cold plunge tub market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 659.86 million by 2033.

b. Commercial held the largest share in the cold plunge tub market, accounting for a share of 81.3% in 2024. Cold plunge tubs have gained immense popularity among a diverse range of users, including elite athletes, celebrities, wellness enthusiasts, and corporate leaders. For instance, LeBron James, Naomi Osaka, Klay Thompson, and J.J. Watt are among the elite athletes using cold plunge tubs as part of their rigorous recovery routine to enhance performance.

b. Key players in the cold plunge tub market are Plunge; COLDTUB; Renu Therapy; Edge Theory Labs, Inc; BlueCube Cold Plunge Tubs & BlueCube Wellness LLC; iCool (Australia) Pty Ltd; Brass Monkey Health Ltd; Morozko Forge; Ice Barrel Inc.; The Ice Bath Co.; Odin Ice Baths Pty Ltd.

b. Key factors that are driving the cold plunge tub market growth include increasing usage of cold plunge tubs in spas and rising demand for hydrotherapy across the world

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.