Cold Form Blister Packaging Market Size, Share & Trends Analysis Report By Material (Oriented-polyamide, Polyvinyl Chloride, Polypropylene), By Application (Healthcare, Electronics & Semiconductors), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-141-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Cold Form Blister Packaging Market Trends

The global cold form blister packaging market size was valued at USD 4.38 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. This is attributed to the exceptional properties of this packaging solution, such as easy sealing and a complete barrier against oxygen, water, light, and moisture. Cold-form blister packaging is performed on cold-forming foil, and the cold-forming technique prevents heat from being applied to the packaging. They find major applications in the primary packaging of pharmaceuticals, including tablets and capsules.

Consumer awareness regarding product safety and quality has significantly increased over recent years. This trend is particularly evident in sectors such as pharmaceuticals and food products, where consumers are more informed about the implications of packaging on product integrity. Cold form blister packaging offers tamper-evident features and enhances product traceability, which aligns with consumer preferences for safe and reliable products. As regulatory bodies impose stricter guidelines on packaging standards to ensure consumer safety, manufacturers are likely to adopt cold form blister solutions to comply with these regulations.

The rise of e-commerce platforms and online pharmacies has created new opportunities for cold form blister packaging solutions. With more consumers opting to purchase medications online, there is a growing need for secure and protective packaging that can withstand shipping conditions while ensuring product integrity upon delivery. Cold form blister packs are ideal for this purpose as they provide robust protection during transit, reducing the risk of damage or contamination.

Emerging markets present significant growth opportunities for the cold form blister packaging industry due to increasing healthcare expenditures and rising disposable incomes among consumers. Countries in Asia-Pacific, Latin America, and Africa are witnessing rapid urbanization and a growing middle class demanding higher-quality healthcare products that are securely packaged. As local pharmaceutical companies expand their operations to meet domestic needs while adhering to international standards, they increasingly adopt advanced packaging technologies like cold form blisters to enhance their product offerings.

Material Insights

Based on material, the cold form blister packaging industry is further segmented into oriented polyamide, aluminum, polyvinyl chloride (PVC), polypropylene (PP), polyethylene (PE), and polyethylene terephthalate (PET). Among these, aluminum held the largest market share of over 42.3% in 2024 due to its unique characteristics, such as acting as an effective barrier, preventing contamination, and extending the shelf life of the products by preventing oxygen and moisture ingress. In addition, it helps maintain the stability and effectiveness of healthcare products such as OTC drugs, capsules, and others, ensuring that they remain viable for a longer period, which further drives the market growth for this segment.

Polyvinyl chloride (PVC) is expected to grow at the fastest CAGR of 6.5% during the forecast period due to its cost-effectiveness and high visibility properties. PVC, as compared to other materials, is an attractive alternative for cold-form blister packaging solutions, especially for products with lower prices or where cost optimization is a significant consideration. In addition, these films offer excellent visibility properties, which is essential for products where the visual appeal or identification of the contents is significant, such as oral drugs, which further drives the market growth for this segment.

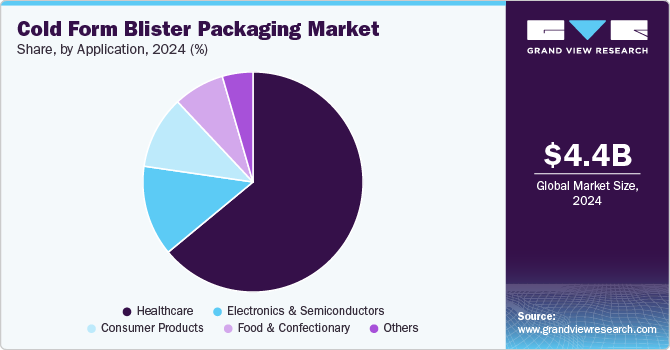

Application Insights

Based on application, the market is further segmented into healthcare, consumer products, electronics & semiconductors, food & confectionary, and others. Among these, the healthcare application segment recorded the largest market share of 64.0% in 2024. This is attributed to the combination of aluminum and plastic film materials, which are used in cold-forming blister packaging, offering a higher level of product protection compared to thermoformed plastics by creating a tighter seal around the product that offers better resistance against physical damage, contamination, and tampering, ensuring the safety and efficacy of the product.

The electronics & semiconductors application segment is anticipated to register the fastest CAGR of 8.0% over the forecast period due to its customization and flexibility properties to accommodate different types of electronic devices or components according to their dimensions and specific requirements. Electrostatic discharge (ESD) is a significant aspect in the electronics and semiconductor industries, as it can cause damage to sensitive electronics. Cold-form blister packaging solutions are designed to provide ESD protection by utilizing an anti-static coating and treatment to the product packaging. This ensures that the products are safely protected from static electricity, reducing the risk of physical damage during shipping and warehousing.

Regional Insights

North America cold form blister packaging market accounted for 28.4% of the market revenue share in 2024. North America is a hub for computer hardware and accessories, including components, peripherals, and networking devices, owing to the presence of several well-established electronic companies in the region such as Apple Inc., Microsoft, and others. Cold-form blister packaging is widely adopted in this sector to protect fragile and sensitive electronic components during shipping and warehousing. The cold-form blister packaging provides cushioning, prevents moisture ingress, and reduces the risk of damage during handling and transportation.

U.S. Cold Form Blister Packaging Market Trends

The U.S. cold form blister packaging market held the largest market share in North America in 2024 owing to the presence of several healthcare companies and medical device manufacturers such as Pfizer Inc., Johnson & Johnson, and others that have adapted to cold form blister packaging solutions. For instance, Johnson & Johnson’s Tylenol caplets are packed with cold-form blister packaging solutions made from a combination of plastic films and aluminum layers to protect against moisture, light, and any physical damage to the product.

Europe Cold Form Blister Packaging Market Trends

Europe cold form blister packaging market is anticipated to grow significantly over the forecast period due to the growing healthcare industry in the region. The growing emphasis on child-resistant packaging and increased demand for unit-dose packaging offered by cold-form blister packaging solutions is driving market growth across the region. Moreover, the shift in consumer preference for sustainable packaging solutions in the healthcare industry is driving the demand for sustainable cold-form blister packaging solutions made with recyclable PET materials, aligning with the region’s sustainability goals.

Germany cold form blister packaging market held the largest market revenue share in Europe. As Germany continues to be a hub for pharmaceutical manufacturing and innovation, with numerous global companies operating within its borders, the demand for reliable and effective packaging solutions is rising. The stringent regulations governing pharmaceutical packaging also necessitate high-quality materials that can ensure product integrity throughout their shelf life.

Asia Pacific Cold Form Blister Packaging Market Trends

The cold form blister packaging market in Asia Pacific dominated the global market in 2024 with a revenue share of over 33.0%. It is also the fastest-growing region in 2024, owing to the growing pharmaceutical and healthcare industries in the region. The growth of retail pharmacies and e-commerce platforms has also contributed to the demand for cold form blister packaging in the region. Retail pharmacies prefer these cold form blister packs due to their space efficiency, easy handling, and ability to display the product and its information on the transparent packaging. E-commerce platforms such as Amazon prioritize blister packaging as it offers secure and compact packaging solutions for shipping healthcare products, which further drives the market growth in the region.

China cold form blister packaging market held the largest revenue share in the Asia Pacific in 2024 owing to the abundant availability of raw materials such as PVC and aluminum for cold-form blister packaging solutions. In addition, the market is driven by the growing trend of contract manufacturing owing to the cost-effectiveness and supply chain efficiency in the country. Contract manufacturing in China allows companies to lower their manufacturing costs while maintaining the quality standards of the products. Cold form blister packaging solution, being a cost-efficient packaging solution, aligns well with contract manufacturing strategies, as it offers good value for money to the products. Moreover, a well-established supply chain network, enabling efficient sourcing of raw materials and components required to produce cold-form blister packaging solutions is further driving the market growth in the country.

Key Cold Form Blister Packaging Company Insights

The competitive environment of the cold form blister packaging industry is marked by the presence of several major players, including Amcor plc, Constantia Flexibles, and others who dominate the global market with their extensive product portfolios and advanced technologies. These companies compete on factors such as innovation, sustainability, and cost efficiency, focusing on developing eco-friendly packaging solutions to meet the increasing demand for sustainable packaging in the food and beverage industry. Moreover, increasing production capacity and expansion initiatives are undertaken by major players to gain a competitive edge in the market.

- In April 2023, Amcor plc announced a collaboration with Tyson Foods, Inc., a global food company, to develop and design cost-effective cold-form blister packaging solutions for food products.

Key Cold Form Blister Packaging Companies:

The following are the leading companies in the cold form blister packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Constantia Flexibles

- Sonoco Products Company

- WINPAK LTD.

- SteriPackGroup

- Klöckner Pentaplast

- ACG

- Bilcare Limited

- Svam Toyal Packaging Industries Pvt. Ltd.

- Tekni-Plex, Inc

- Essentra plc

- Ningbo Dragon Packaging Technology Co., Ltd.

- Rollprint Packaging Products, Inc.

- R-Pharm Germany GmbH

- Wasdell Group

- Shanghai Haishun New Pharmaceutical Packaging Ltd.

View a comprehensive list of companies in the Cold Form Blister Packaging Market

Cold Form Blister Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.67 billion |

|

Revenue forecast in 2030 |

USD 6.46 billion |

|

Growth rate |

CAGR of 6.7% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE |

|

Key companies profiled |

Amcor plc, Constantia Flexibles, Sonoco Products Company, WINPAK LTD., SteriPackGroup, Klöckner Pentaplast, ACG, Bilcare Limited, Svam Toyal Packaging Industries Pvt. Ltd., Tekni-Plex, Inc., Essentra plc, Ningbo Dragon Packaging Technology Co., Ltd., Rollprint Packaging Products, Inc., R-Pharm Germany GmbH, Wasdell Group, and Shanghai Haishun New Pharmaceutical Packaging Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cold Form Blister Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cold form blister packaging market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Oriented polyamide

-

Aluminum

-

Polyvinyl Chloride (PVC)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Polyethylene Terephthalate (PET)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Consumer Products

-

Electronics & Semiconductors

-

Food & Confectionery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cold-form blister packaging market size was estimated at USD 4.38 billion in 2024 and is expected to reach USD 4.67 billion in 2025.

b. The global cold-form blister packaging market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 6.46 billion by 2030.

b. Aluminum dominated the cold form blister packaging market with a share of 42.3% in 2024 owing to its unique characteristics, such as acting as an effective barrier, preventing contamination, and extending the shelf life of the products by preventing oxygen and moisture ingress.

b. Some of the key players operating in the cold form blister packaging market include Amcor plc, Constantia Flexibles, Sonoco Products Company, WINPAK LTD., SteriPackGroup, Klöckner Pentaplast, ACG, Bilcare Limited, Svam Toyal Packaging Industries Pvt. Ltd., Tekni-Plex, Inc., Essentra plc, Ningbo Dragon Packaging Technology Co., Ltd., Rollprint Packaging Products, Inc., R-Pharm Germany GmbH, Wasdell Group, and Shanghai Haishun New Pharmaceutical Packaging Ltd.

b. Rising awareness about the benefits of cold-form blister packaging, increasing demand for drugs for chronic disease patients, and growing medical spending from developing economies are expected to drive the market's growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."