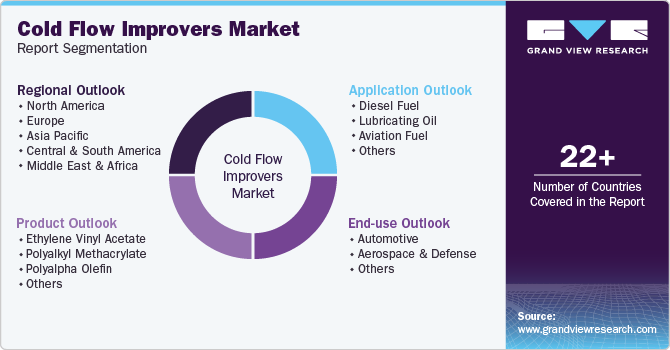

Cold Flow Improvers Market Size, Share & Trends Analysis Report By Product (Ethylene Vinyl Acetate, Polyalkyl Methacrylate), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-426-4

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2023

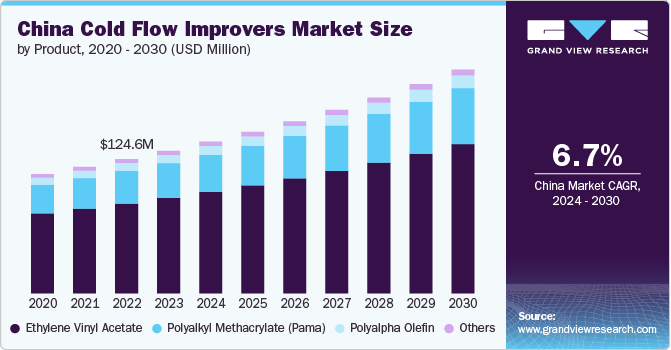

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Cold Flow Improvers Market Size & Trends

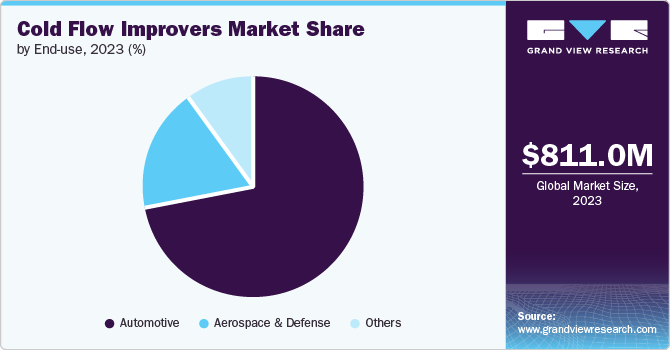

The global cold flow improvers market size was estimated at USD 811.05 million in 2023 and is expected to grow at a CAGR of 5.6% from 2024 to 2030. In light of the stricter regulations on fuel quality and the common occurrence of colder weather conditions, there is a pressing demand for additives that can improve the performance of fuel in low-temperature environments.

Cold flow improvers are additives commonly used in petroleum to enhance the performance of fuels, particularly diesel, in cool temperatures. Their function is to modify the crystallization of paraffin wax in diesel, thereby preventing blockages in fuel systems caused by wax crystals. This helps ensure uninterrupted fuel flow and mitigates potential engine issues in winter. The industry for cold flow improvers holds significant potential for expansion, driven by the global demand for cleaner and more efficient fuels.

Drivers, Opportunities & Restraints

There is a growing utilization of cold flow improvers in the aerospace and defense sector, aimed at maintaining the essential flow properties of engine oil. This has led to an acceleration in demand from the aerospace and defense sector, resulting in increased production capacity, which is expected to propel the market growth during the forecast period. Furthermore, with continuous progress in technology and research, it is anticipated that new, more efficient, and eco-conscious cold flow improvers will be developed.

Also, the necessity for additives that avert fuel system complications in cooler environments is spurring on both innovation and research, ensuring alignment with the changing needs of the market and regulatory mandates, thus aiding in the market's growth. However, the industry faces considerable challenges. Moreover, adapting to the diverse fuel compositions, which vary significantly across the globe, poses its own set of challenges. In addition, striking an equilibrium between affordability and maintaining the highest quality proves to be a significant hurdle. Therefore, market participants must explore and deploy diverse marketing strategies to effectively circumvent these challenges.

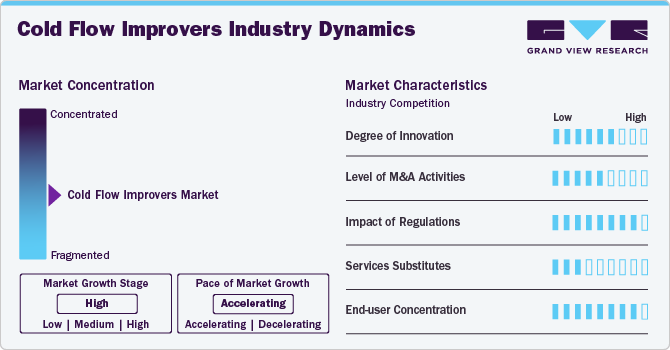

Market Concentration & Characteristics

The cold flow improver market is moderately fragmented with robust competition among the tier-1 and domestic players.

The leading players in the market, notably AkzoNobel N.V., Afton Chemical, BASF SE, and Evonik Industries AG, are engaging in a variety of strategies to maintain their market presence over time and secure a competitive edge. Afton Chemical is dedicated to pioneering innovative methods and fostering partnerships within the industry to enhance the development of fuel and lubricant additives.

The global market is moderately fragmented, featuring a significant number of both local and international companies that concentrate on regional markets. In pursuit of future growth, industry players are pursuing strategies such as introducing new products agreements and expanding into emerging markets.

Product Insights

“Polyalkyl methacrylate segment is expected to witness growth at 6% CAGR”

The Ethylene vinyl acetate segment of the market was valued at USD 531.4 million in 2023 and is projected to reach USD 771.8 million by 2030. Ethylene vinyl acetate (EVA) is highly preferred in the marketplace for its outstanding capability to enhance performance in cold conditions by lowering the pour points of fuel. This material excels in compatibility with a broad spectrum of fuels and additives, making the process of formulation more straightforward and versatile across various fuel types and operational settings. Moreover, cold flow improvers that utilize EVA stand out as economically favorable solutions when compared to other materials like polyalkyl methacrylate and polyalpha olefin.

Polyalkyl methacrylate is valued in the fuel finishing and lubricant industry for its crucial role in preventing wax deposition in cold environments, which stops wax crystals from forming and collecting in engines of both heavy and light vehicles. Moreover, it has the versatility to be mixed with different types of fuels, such as diesel and aviation fuel.

Application Insights

Lubricating oil segment is expected to witness highest growth at 6.1% CAGR”

The diesel fuel segment accounted for the largest revenue share of 52.8% of the market in 2023. Diesel fuel is the preferred choice for powering a broad spectrum of vehicles, including trucks, trains, buses, and agricultural equipment, thus playing a vital role in supporting global logistics and commerce. Diesel's cost-effectiveness for intensive tasks is notable due to its superior energy density and efficiency, especially in terms of mileage, compared to gasoline. In addition, the preference for diesel engines is reinforced by their reliability and power, further securing their place in the market.

Cold flow improvers are widely used in optimizing the flow characteristics of lubricants under low temperatures, facilitating uninterrupted machinery performance in colder regions. These additives are effective in markedly lowering both the CFPP (Cold Filter Plugging Point) and the Pour Point in thick lubricating oils.

End Use Insights

“Automotive segment is expected to witness highest growth at 5.8% CAGR”

The automotive segment accounted for the largest revenue share of 72.4% of the market in 2023. Cold flow improvers are crucial for the automotive industry, enhancing diesel fuel efficiency in cold climates by preventing wax crystallization, ensuring smooth fuel movement, and engine functionality. They are especially valuable in sub-zero temperatures, preventing fuel solidification and filter blockages, thereby improving vehicle reliability and reducing fuel costs and maintenance. With automotive companies prioritizing enhanced engine performance and reliability, the market for cold flow improvers is set for growth.

In the aviation industry, the extensive deployment of cold flow improvers is essential, especially given that aircraft frequently operate in sub-zero temperatures where maintaining the flow properties of fuel is challenging. These additives alter the crystallization of wax particles, making them smaller and less likely to clog filters or impede fuel flow.

Regional Insights

“Asia Pacific is expected to witness a market growth of CAGR 6%”

The regional market is experiencing significant growth due to diverse climatic conditions and increasing demand for cleaner and more efficient fuels. Stringent fuel quality standards further contribute to the demand for effective cold flow improvers in the region. Ongoing technological advancements position the North American market for steady growth in the future.

U.S. Cold Flow Improvers Market Trends

The US cold flow improver market is driven by the increasing demand for diesel fuel in the US, particularly in the transportation sector. Also, increasing focus on fuel efficiency and cold weather conditions, particularly in the northern states, significantly drives the demand for cold flow improvers to prevent fuel gelling and waxing.

Asia Pacific Cold Flow Improvers Market Trends

Asia Pacific accounted for the largest revenue share of 36.9% in 2023. This growth is attributed to significant economic expansion and a growing demand for finished fuel. The regional product demand is largely fueled by the expanding automotive and aerospace & defense sectors, along with a higher adoption of EVA and polyalkyl methacrylate for cold flow improvements.

The cold flow improvers market in China, the product demand is mainly propelled by growing automobile sector, rising urbanization, and increasing air travel. In addition, China’s harsh climatic conditions with extreme cold temperatures during winter creates a need for cold flow improver in automobile and aviation fuels.

Europe Cold Flow Improvers Market Trends

The growth of the European market is notably driven by the strong performance of the automotive and aviation sectors in Germany, France, and the UK. The region's cold climate, combined with the increased demand for luxury vehicles, is anticipated to enhance the expansion of the cold flow improvers market within this area over the projected period.

Cold Flow Improvers Company Insights

Some of the key players operating in the market include Afton Chemical, Baker Hughes, BASF SE, Bell Performance, Inc. among others.

-

Afton Chemical Corporation, part of the NewMarket Corporation (NYSE: NEU), has been a leader in fuel and lubricant additives for over 95 years. Their global operations are headquartered in Richmond, Virginia, USA, and they offer a wide range of unique additives for gasoline and distillate fuels, driveline fluids, engine oils, and industrial lubricants.

-

Baker Hughes is a premier company in the energy technology field specialized in the design, manufacture, and service of cutting-edge technologies. With operations in over 120 countries, the company builds strong partnerships with its customers. It boasts a workforce of 58,000 employees and offers a wide array of equipment and services that cover the entire spectrum of the energy and industrial sectors. The company operates through two main segments: Oilfield Services & Equipment, and Industrial & Energy Technology

Key Cold Flow Improvers Companies:

The following are the leading companies in the cold flow improvers market. These companies collectively hold the largest market share and dictate industry trends.

- Afton Chemical

- Baker Hughes

- BASF SE

- Bell Performance, Inc.

- Chevron Corporation

- Clariant

- Dorf Ketal

- Evonik Industries

- Infineum International Limited

- Innospec

- The Lubrizol Corporation

Recent Developments

-

In January 2024, BASF launched an innovative Keropur gasoline additive bottle in Taiwan. This new formulation is designed to improve the engine cleaning effect by effectively targeting and removing deposits in modern direct injection engines and conventional port fuel injection engines. The resulting cleaner combustion process significantly contributes to a more sustainable mobility system.

-

In October 2020, LSI Chemical launched a cold flow additive for diesel fuel that improves engine performance in extreme temperatures by enhancing Cold Filter Plugging Point and Pour Point. They offer market-ready additives such as ArcticArmor523 and custom lab and formulation capabilities to diesel fuel professionals worldwide.

Cold Flow Improvers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 853.7 million |

|

Revenue forecast in 2030 |

USD 1,184.6 million |

|

Growth rate |

CAGR of 5.6% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Thailand; Brazil; Argentina; South Africa |

|

Key companies profiled |

Afton Chemical; Baker Hughes; BASF SE; Bell Performance, Inc.; Chevron Corporation; Clariant; Dorf Ketal; Evonik Industries; Infineum International Limited; Innospec |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cold Flow Improvers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cold flow improvers market report based on product, application, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ethylene Vinyl Acetate

-

Polyalkyl Methacrylate

-

Polyalpha Olefin

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Diesel Fuel

-

Lubricating Oil

-

Aviation Fuel

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global cold flow improvers market size was estimated at USD 811.05 million in 2023 and is expected to reach USD 853.66 million in 2024.

b. The global cold flow improvers market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 1,184.6 million by 2030.

b. Asia Pacific dominated the cold flow improvers market with a share of 36.9% in 2023. This growth is attributed to significant economic expansion and a growing demand for finished fuel.

b. Some key players operating in the cold flow improvers market include Afton Chemical, Baker Hughes, BASF SE, Bell Performance, Inc., Chevron Corporation, Clariant, Dorf Ketal, Evonik Industries, Infineum International Limited, Innospec, and The Lubrizol Corporation.

b. In light of the stricter regulations on fuel quality and the common occurrence of colder weather conditions, there is a pressing demand for additives that can improve the performance of fuel in low-temperature environments.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."