- Home

- »

- Automotive & Transportation

- »

-

Cold-end Exhaust System Aftermarket Size Report, 2030GVR Report cover

![Cold-end Exhaust System Aftermarket Size, Share & Trends Report]()

Cold-end Exhaust System Aftermarket Size, Share & Trends Analysis Report By System (Basic & Performance), By Vehicle Type (Passenger Cars & Commercial Vehicle), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-320-1

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global cold-end exhaust system aftermarket size was valued at USD 5.48 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.0% from 2023 to 2030. Stringent government regulations and emission norms drive the cold-end exhaust aftermarket. Regional regulatory authorities, such as the U.S. Environmental Protection Agency and the Japanese Automobile Sport Muffler Association (JASMA), monitor the noise levels associated with the automotive exhaust system's modern-day automotive mufflers and resonators.

The digitization of automotive repair and maintenance services with the development of online global auto-part supplier groups, such as CarParts.com and U.S. Auto Parts Network, Inc., is expected to draw huge investments from the key participants, thus driving regional market demand in the future. Owing to the abovementioned advantages, aftermarket arcade parades have a high potential in Asia Pacific countries.

Various competitors prevailing in the market are challenged to provide innovative offerings that help consumers address changing technologies, business practices, and security needs. The leading players are in an advantageous yet vulnerable position and can either lead over the forecast period or lose market share. The key players are adopting mergers and acquisitions to extend their global market share.

The automobile industry is observing an increase in demand for hybrid electric cars, which will eventually throttle the demand for exhaust parts and specific tools for these specialized cars. This curb can be attributed to increased petrol and petrol engine-based automobile prices.

Transparency delivered via digitalization of the auto maintenance service will resolve some of these issues, driving the independent cold-end exhaust aftermarket industry. The resultant digitalization is expected to greatly impact the industry as more people are inclined toward digitization and IoT trends.

System Insights

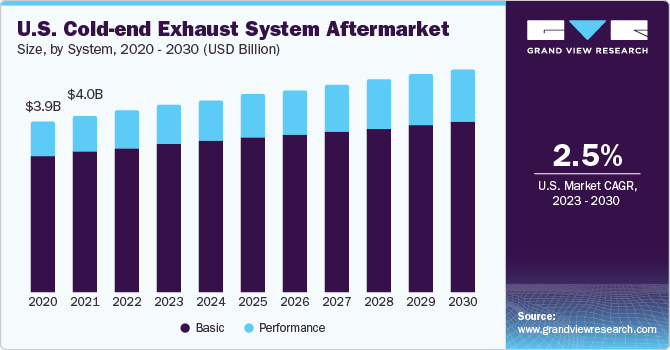

Based on the system, the industry is segmented into basic and performance-based cold-end exhaust systems. The basic segment held the highest market share of 79.8% in 2022. Basic exhaust systems are more prone to wear and tear, requiring regular maintenance or replacement. As a result, the demand for basic system components, such as mufflers, exhaust pipes, and catalytic converters, remains consistently high in the aftermarket. This ongoing demand for replacement parts boosts the dominance of the basic system segment.

The performance segment is estimated to register the fastest CAGR of 4.8% over the forecast period. Advancements in exhaust system technology have led to the development of performance-oriented components and systems. Manufacturers continuously invest in research and development to create aftermarket products that deliver improved performance, durability, and efficiency. These technological advancements, such as lightweight materials or advanced exhaust designs, attract customers looking for aftermarket solutions to enhance their vehicle's performance.

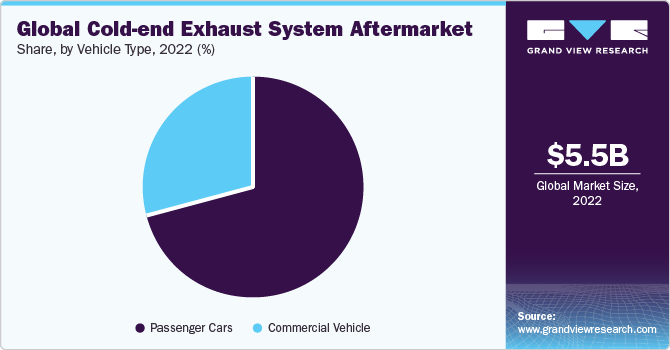

Vehicle Type Insights

The passenger cars segment dominated the market with a revenue share of 71.0% in 2022. The growth in the disposable income of consumers in emerging markets is expected to impact the growth rate of passenger cars positively. The increasing awareness of health disorders among consumers related to improper ventilation in cabins is anticipated to act favorably on the cold-end exhaust systems market for the passenger car segment.

The commercial vehicle segment is estimated to register the fastest CAGR of 3.8% over the forecast period. As the demand for the movement of goods and materials continues to rise, there is a corresponding increase in the number of commercial vehicles on the road. This surge in commercial vehicle usage is driving the demand for aftermarket cold-end exhaust systems, as these vehicles require regular maintenance, repairs, and performance enhancements to ensure optimal functioning.

Regional Insights

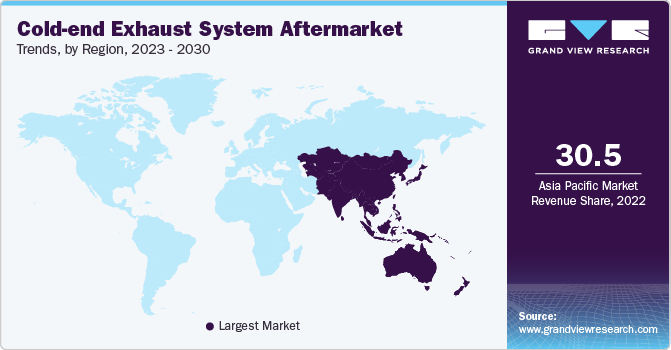

Asia Pacific accounted for the largest market share of 30.5% in 2022. The Asia-Pacific region is home to some of the world's largest automotive markets, with a rapidly expanding automotive industry. As the number of vehicles on the roads increases, so does the need for effective exhaust systems to control emissions. Cold-end exhaust systems offer superior emission control and contribute to meeting the sustainability goals of the automotive sector.

On the other hand, MEA is projected to demonstrate significant market growth of 4.9% over the forecast period. The MEA region has witnessed a significant rise in vehicle ownership over the past decade. As more individuals and businesses in the region acquire vehicles, the demand for maintenance and aftermarket services, including cold-end exhaust systems, naturally increases. This vehicle ownership growth contributes to the cold-end exhaust system aftermarket expansion.

The North American regional market will grow at a considerable market share in 2022. Due to administrative regulations and stringent regional automotive authority norms related to automotive emissions, growing adoption is anticipated to spur cold-end exhaust system sales in the region. Rising pollution and consumer safety concerns have led the governments of countries across the globe to lay down strict rules relating to vehicular emissions. Such rules have forced component suppliers to produce high-efficiency, environment-friendly cold-end components for the domestic and international markets.

Key Companies & Market Share Insights

The market players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in June 2022, the Mercedes-AMG C 43 4MATIC incorporated cutting-edge Formula 1 technology to elevate its performance and agility. The vehicle's driving dynamics, including an electric exhaust gas turbocharger and a 48-volt electrical system, are significantly enhanced. Additionally, these innovative features boost the car's overall performance and improve fuel efficiency, emphasizing a balance between power and environmental responsibility.

Key Cold-end Exhaust System Aftermarket Companies:

- MagnaFlow

- Flowmaster, Inc.

- DRiV Inc.

- BOSAL

- Marelli Corporation

- Eberspächer

- FORVIA Faurecia

- Tenneco Inc.

- Rogue Engineering

Recent Developments

-

In June 2023, Wabtec introduced its Generation 3 Collision Avoidance System to elevate safety, productivity, and performance. The advanced system not only enhances safety measures but also offers a higher level of performance through its rules and intelligence capability. With this latest release, Wabtec aims to provide an innovative solution that maximizes safety and operational efficiency in various industries.

-

In February 2023, Tenneco's aftermarket division, DRiV, has recently unveiled its strategy to expand the coverage of its product portfolio. The company aims to lead the industry by significantly broadening its brand offerings. This expansion will provide shop owners and technicians with a wider selection of parts to meet the needs of their customers and facilitate comprehensive service repairs. DRiV's commitment to quality and consistency ensures that all the parts are backed by their renowned standards, giving customers peace of mind.

-

In September 2022, Vance & Hines unveiled a brand-new lineup of exhaust systems specifically tailored for UTVs (Utility Task Vehicles). These exhaust systems have been crafted to cater to the most popular side-by-side UTV models. With this latest release, Vance & Hines aims to provide UTV enthusiasts with high-quality exhaust options that enhance their vehicles' performance and overall experience.

-

In March 2021, Eaton, a power management company, and Tenneco announced a collaborative development agreement. The partnership involves Eaton's Vehicle Group and Tenneco's Clean Air business group working together to create an integrated exhaust thermal management system. This innovative system aims to assist commercial truck and light vehicle manufacturers in meeting upcoming emissions regulations. By combining their expertise, both companies provide sustainable solutions that support compliance with environmental standards in the automotive industry.

Cold-end Exhaust System Aftermarket Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.49 billion

Revenue forecast in 2030

USD 7.01 billion

Growth rate

CAGR of 3.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

MagnaFlow; Flowmaster, Inc.; DRiV Inc.; BOSAL; Marelli Corporation; Eberspächer; FORVIA Faurecia; Tenneco Inc.; Rogue Engineering

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold-end Exhaust System Aftermarket Market Report Segmentation

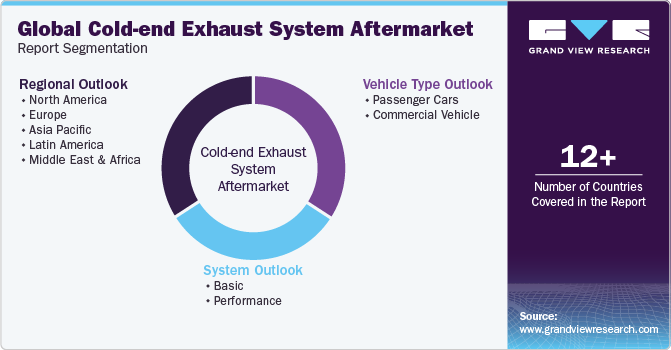

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cold-end exhaust system aftermarket based on system, vehicle type, and region:

-

System Outlook (Revenue in USD Million, 2017 - 2030)

-

Basic

-

Performance

-

-

Vehicle Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Passenger Cars

-

Commercial Vehicle

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cold-end exhaust system aftermarket size was estimated at USD 5.48 billion in 2022 and is expected to reach USD 5.49 billion in 2023.

b. The global cold-end exhaust system aftermarket is expected to grow at a compound annual growth rate of 3.0% from 2023 to 2030 to reach USD 7.01 billion by 2030.

b. Asia Pacific dominated the cold-end exhaust system aftermarket with a share of 30.5% in 2022. This is attributable to the growing adoption on account of administrative regulations and stringent regional automotive authority norms related to automotive emission in the region.

b. Some key players operating in the cold-end exhaust system aftermarket include MagnaFlow; Flowmaster, Inc.; Bosal Group; Calsonic Kansei Corporation; Eberspächer Exhaust Aftermarket GmbH & Co. KG; Magneti Marelli S.p.A.; and Tenneco Inc.

b. Key factors that are driving the market growth include the digitalization of automotive repair & maintenance services and stringent government norms related to exhaust emission.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.