Cold Climate Air Source Heat Pump Market Size, Share & Trends Analysis Report By Product (Split Systems), By Application (Residential), By Operation Type (Electric), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-083-0

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global cold climate air source heat pump market size was valued at USD 529.9 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.55% from 2023 to 2030. Favorable government policies for energy-efficient solutions & to lowering carbon footprint are expected to boost the market over the forecast period. Many governments are providing subsidies or incentives for the installation of cold climate air source heat pumps, tax credits, and rebates these factors are expected to further fuel the demand for energy-efficient heat pumps, thereby, benefitting the overall market growth.Raw materials used in the production of cold source air source heat pumps include large iron castings with aluminum tubing and stainless-steel components. Fluctuations in the prices of raw materials, such as steel, copper, aluminum, and nickel, can affect a company’s competitive position and increase its operational cost, in turn, negatively impacting cash flow and financial conditions.

Heat pumps are witnessing a renewed interest in cold areas, in part because of technological advancements that have made it possible for heat pumps to function in frigid temperatures like cold climates. The main technological development can be seen in variable speed, inverter-driven compressor technology that enables sub-freezing performance. For instance, Johnson Controls introduced air source heat pumps for areas with temperatures below -29 C in December 2022. York HMH7 and York YZV cold climate air source heat pumps from the company can already operate in -15 °C temperatures. Throughout the projected period, such attributes are anticipated to drive market expansion.

The U.S. Department of Energy (DoE) recently announced a federal funding opportunity of USD 250 million as part of the Biden administration's Investing in America program to encourage domestic heat pump manufacturers in the U.S. The DoE has started the Cold Climate Heat Pump Challenge to advance the technology. For instance, Rheem declared in 2023 that its air-source heat pump had successfully completed the Heat Pump Challenge by continuously heating a space at -22.9 degrees Fahrenheit. As a result, market growth is expected to speed up in the upcoming years due to increased government efforts and the introduction of new products.

Cold climate air source heat pump technology is likely to dominate the market in the U.S. over the forecast period, owing to growing awareness of the negative consequences of greenhouse gas emissions. For instance, the U.S. Department of Energy (DOE) and Lennox International developed an electric heat pump in June 2022 that is more effective than existing models for heating homes in northern regions. These air-source heat pumps for cold climates provide high-efficiency heating in subfreezing conditions without emitting greenhouse gases, and they can save families up to USD 500 per year on utility costs.

Since the outbreak of COVID-19, there has been an increase in the demand for green/sustainable buildings and improved indoor air quality. Improving energy efficiency across industries has become a top priority for governments all around the world. Installing an energy-efficient heating system may entitle the buyer to various tax breaks. Tax breaks are also available for using renewable energy equipment such as air-source heat pumps. These aforementioned factors are expected to propel the product demand over the forecast period.

Moreover, government restrictions, initiatives, and emission requirements are expected to increase consumer demand for energy-saving goods in the residential and light commercial sectors. For instance, the Canadian government introduced the Oil to Heat Pump Affordability rebate program in February 2023. The purchase and installation of a modern, electric, air-source CCHP can now be funded with an upfront payment of up to USD 7,357.25 for middle- low and income households currently heating their houses with oil. A maximum of USD 3,678.63 from the Canada Greener Homes Grant (CGHG) is included in this funding. These aforementioned factors are anticipated to propel the growth of cold climate air source heat pump product demand over the projected period.

Product Insights

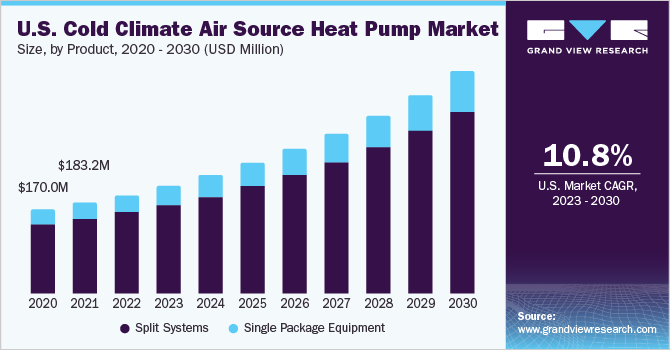

The split systems product segment dominated the cold climate air source heat pump market in 2022 by accounting for a share of over 86.0% of the market in terms of revenue. This is largely due to its higher efficiency, lower noise levels, and lower operating costs. Moreover, split systems provide consistent temperatures across a household from one central unit. These factors are expected to positively impact product demand during the forecast period.

Split systems are significantly available for cold climates. There are single-zone and multi-zone indoor units available for both system types. A hybrid system combines the higher performance of a gas furnace with the silent operation, small footprint, and better efficiency of an air source heat pump system for cold climates.

The demand for the single-package equipment segment was estimated at USD 73.9 million in 2022. A slab or roof will frequently be fitted with a single package unit that has both electric and gas heating. The ease of installation and maintenance, simplicity of product control, accessibility, and effective performance are projected to drive the segment's demand.

Application Insights

The residential application dominated the cold climate air source heat pump market in 2022 by accounting for a share of over 86.7% of the market in terms of revenue. The residential sector utilizes heating systems for space heating, water heating, and other utility purposes. For example, companies such as Daikin Industries, Ltd., Ingersoll Rand plc, and Mitsubishi Electric Corporation supply cold climate air source heat pumps for the residential segment.

It is anticipated that global population expansion would significantly boost the growth of the residential construction sector in the coming years. Moreover, increasing investments by the government of Canada to provide affordable housing for low-income families through the Canada Mortgage and Housing Corporation (CMHC) program and the Affordable Housing Initiative (AHI) are anticipated to further augment residential construction activities in the country. Thus, increasing investments in the construction industry are expected to boost the demand for cold climate air source heat pumps in the construction industry as they are more efficient in very cold temperatures and work efficiently in a varied temperature range.

The demand for the commercial segment was estimated at USD 70.7 million in 2022. Increasing government investments in light commercial construction. An increasing number of service-providing firms is expected to fuel the demand for office spaces, thus, driving light commercial construction. Thus, rising light commercial construction in the world is expected to augment the growth of the cold climate air source heat pump industry.

Moreover, cold climate air source heat pumps provide significant energy savings and can be installed in a wide range of commercial facilities, including office buildings, medical facilities, schools, courthouses, and training facilities. The extensive use of large heat pumps in commercial buildings for space cooling or heating applications is expected to be one of the major factors influencing market growth.

Operation Type Insights

The electric operation type segment accounted for a share of 91.7% of the market in terms of revenue in 2022. The electric cold climate air source heat pump transfers heat from a chilly space to a warm space using electricity. In addition to being used for heating, these heat pumps are also employed for cooling during the summer. Due to the advantages of electric heat pumps such as higher air quality, energy efficiency, quiet operation, and greater safety than petrol pumps, the market is anticipated to have profitable expansion.

Hybrid heat pumps lower the monthly energy costs for the end user, ensuring long-term savings. End-users that adopt hybrid heat pumps may potentially qualify for a tax credit or rebate, which will help this market flourish. Additionally, because hybrid heat pumps can switch between a heat pump and a gas furnace, using them minimizes the carbon footprint.

Application Insights

The residential application segment dominated the heat pump market in 2022 by accounting for a share of over 86.7% of the market in terms of revenue in the same year. Growing residential construction in North America, Europe, and Asia Pacific is expected to drive the installation of cold-climate air source heat pumps, which will further drive the demand. With hydronic distribution systems in residential spaces, such as low-temperature radiators, radiant flooring, or fan coil units, air-to-water heat pumps, are used to heat or cool the water. In addition, cold climate air source heat pumps are used as an energy-efficient solution as they help save energy, especially in cold climates, like that of the Canadian region.

Furthermore, government restrictions and emission requirements are expected to increase consumer demand for energy-saving goods in the residential sectors. Residential heating is an essential sector as it accounts for a considerable share of national energy consumption in cold-weather nations. These aforementioned factors are expected to drive the demand for energy-efficient cold climate air source heat pumps over the projected period.

The market for cold climate air source heat pumps is expected to increase over the forecast period due to the growing efforts to improve energy efficiency and growing initiatives by business stakeholders to counteract global warming. Increasing demand for cold climate air source heat pumps on account of various factors, including lower electrical power requirements, low lifecycle costs, eco-friendly aspects, and tax credit incentives, is expected to drive market growth. Thus, the increasing adoption of cold climate air source heat pumps in light commercial applications is further expected to augment market growth over the forecast period.

Europe, North America, and Asia Pacific’s construction sectors are anticipated to rise as a result of these regions’ growing population, urbanization, immigration rates, and increasing government investments in light commercial construction. An increasing number of service-providing firms in these regions is expected to fuel the demand for office spaces, thus, driving light commercial construction. Thus, rising light commercial construction is expected to augment the growth of the cold climate air source heat pump industry in the country.

Regional Insights

North America, led by the U.S. and Canada, accounted for a significant share of the global heat pump market in 2022. Government initiatives and rebates offered to promote the incorporation of environment-friendly and energy-saving technologies are projected to augment the demand for advanced cold climate air source heat pumps. Furthermore, increasing carbon emissions and fluctuating energy prices have encouraged consumers to use renewable heating sources, which are expected to boost the growth of the cold climate air source heat pump industry in the region over the forecast period.

Asia Pacific accounted for 14.5% of the global revenue share in 2022. The Asia Pacific is characterized by the availability of large skilled labor at low cost. Moreover, cold climate air source heat pumps provide significant energy savings and can be installed in a wide range of commercial facilities, including office buildings, medical facilities, schools, courthouses, and training facilities. The extensive use of large cold climate air source heat pumps in commercial buildings for space cooling or heating applications is expected to be one of the major factors influencing the market growth in this region.

According to a report published by Geospatial World, total investment in the European construction sector increased by 5.2% in 2021. In addition, owing to the strong support of the local governments for infrastructure development the European construction industry is expected to witness significant growth. Moreover, the region is witnessing new developments in the form of sports facilities, hotels, and restaurants. As the construction industry in Europe is growing, the demand for sustainable cooling solutions such as air source heat pumps is expected to increase in the region. This is anticipated to contribute to the growth of the cold climate air source heat pump industry in Europe in the coming years.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including acquisitions geographical expansions, new joint ventures, product developments, and mergers to enhance market penetration and cater to the changing technological requirements of various applications such as residential, and commercial. For instance, in February 2023, LG unveiled an air source heat pump in February 2023 that can warm up to 270 liters of household water. The pump uses R134a as a refrigerant and has a coefficient of performance (COP) of up to 3.85. Some prominent players in the global cold climate air source heat pump market include:

-

Carrier

-

Daikin Industries, Ltd

-

Robert Bosch GmbH

-

Lennox International

-

Johnson Controls, Inc.

-

Midea Group

-

Hitachi, Ltd.

-

Ingersoll Rand Plc.

-

Rheem Manufacturing Company

-

Panasonic Holdings Corporation

-

Fujitsu

-

LG Electronics, Inc.

-

Mitsubishi

Cold Climate Air Source Heat Pump Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 583.2 million |

|

Revenue forecast in 2030 |

USD 1,264.3 million |

|

Growth Rate |

CAGR of 11.55% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million, CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends |

|

Segments covered |

Product, application, operation type, region |

|

Regional scope |

North America; Europe; Asia Pacific |

|

Country Scope |

U.S.; Canada; Germany; France; Poland; Finland; Norway; Sweden; Spain; Italy; Denmark; UK; Netherlands |

|

Key companies profiled |

Carrier; Daikin Industries, Ltd; Robert Bosch GmbH; Lennox International; Johnson Controls, Inc.; Midea Group; Hitachi, Ltd.; Ingersoll Rand Plc.; Rheem Manufacturing Company; Panasonic Holdings Corporation; Fujitsu; LG Electronics, Inc.; Mitsubishi |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cold Climate Air Source Heat Pump Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cold climate air source heat pump industry report based on product, application, operation type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Split Systems

-

Single Package Equipment

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Operation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

Hybrid

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

Poland

-

Finland

-

Norway

-

Sweden

-

Spain

-

Italy

-

Denmark

-

UK

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The global cold climate air source heat pump market size was estimated at USD 529.9 million in 2022 and is expected to be USD 583.2 million in 2023.

b. The cold climate air source heat pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 11.55% from 2023 to 2030 to reach USD 1,264.3 million by 2030.

b. Asia Pacific dominated the cold climate air source heat pump market in 2022. The Asia Pacific is characterized by the availability of large skilled labor at low cost. Moreover, cold climate air source heat pump provide significant energy savings and can be installed in a wide range of commercial facilities, including office buildings, medical facilities, schools, courthouses, and training facilities.

b. Some of the key players operating in the cold climate air source heat pump market include Carrier, Daikin Industries, Ltd, Robert Bosch GmbH, Lennox International, Johnson Controls, Inc., Midea Group, Hitachi, Ltd., Ingersoll Rand Plc., among others.

b. The cold climate air source heat pump market is anticipated to witness a surge in demand owing to the increasing awareness of the advantages of energy efficient cooling & heating solutions. In addition, secondary factors which are expected to fuel the market demand includes government regulations, rising energy costs, and favorable incentives for energy efficient appliances.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."