- Home

- »

- Automotive & Transportation

- »

-

Cold Chain Telematics Market Size And Share Report, 2030GVR Report cover

![Cold Chain Telematics Market Size, Share & Trends Report]()

Cold Chain Telematics Market (2024 - 2030) Size, Share & Trends Analysis By Component (Hardware, Software), By Temperature Range, By Application (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-402-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Chain Telematics Market Size & Trends

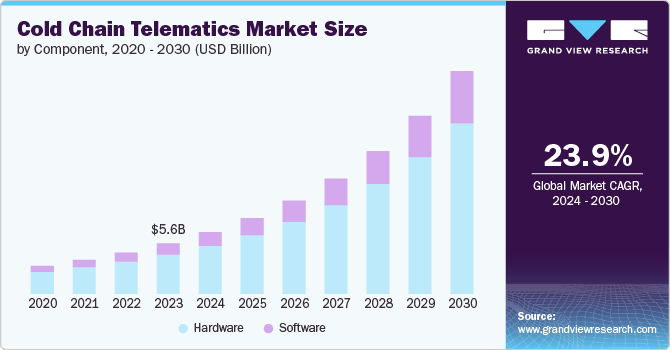

The global cold chain telematics market size was estimated at USD 5.63 billion in 2023 and is projected to grow at a CAGR of 23.9% from 2024 to 2030. The growth of the global market is being driven by a combination of technological advancements, increasing demand for perishable goods, regulatory requirements, and the need for enhanced supply chain visibility and efficiency. Cold chain telematics is a technology-driven approach used in the logistics and supply chain industry to monitor and manage the transportation of temperature-sensitive goods. This system integrates telecommunications, informatics, and data analytics to provide real-time visibility, tracking, and control over the conditions of products throughout the cold chain.

Cold chain telematics systems can send real-time alerts and notifications via SMS, email, or mobile apps if temperature, humidity, or other conditions deviate from preset thresholds. This allows for immediate corrective action to prevent product spoilage or damage. Telematics devices record data over time, providing a historical log of temperature, humidity, and location information. This data is essential for auditing, regulatory compliance, and quality control purposes. Devices often include wireless connectivity options such as Global System for Mobile Communication (GSM), Long-Term Evolution (LTE), Bluetooth, or Wi-Fi, enabling data transmission to central monitoring systems or cloud-based platforms. This connectivity supports real-time data access and remote monitoring.

As supply chains become more global, the need for consistent monitoring across different regions and transportation modes becomes critical. Cold chain telematics offers a solution for managing complex logistics networks, ensuring that products are kept within safe temperature ranges across long distances. Cold chain telematics helps identify potential risks in the supply chain, such as delays, equipment failures, or adverse environmental conditions. By addressing these risks promptly, companies can avoid significant losses and ensure that products reach their destination in good condition.

The development of advanced sensors and the integration of the Internet of Things (IoT) in cold chain telematics systems have improved the accuracy and reliability of monitoring solutions. IoT-enabled devices can collect and transmit large amounts of data in real time, enhancing visibility and control. The ability to analyze data collected by telematics systems enables predictive maintenance and decision-making. Companies can anticipate potential issues before they arise, optimizing maintenance schedules and minimizing downtime.

Companies are continually innovating and launching new cold chain monitoring solutions, positively impacting the growth of the cold chain telematics market. For instance, in September 2022, Astrata, a Singapore-based company, announced the launch of ColdLinc ColdLinc solution includes a compact digital thermograph that accurately records and monitors the temperature of cargo, trailers, and containers, in real time, with a precision of 0.01°C. This system is essential for industries such as pharmaceuticals and food retail, ensuring compliance with European Union (EU) regulations and Good Distribution Practice standards, with digitally accessible temperature data for verification purposes.

Component Insights

The hardware segment dominated the market in 2023 and accounted for more than 77.0% share of global revenue. The segment’s growth is attributed to the rising demand for real-time monitoring. There is a growing need for real-time monitoring of temperature-sensitive products, especially in industries like pharmaceuticals and food. This has led to increased adoption of advanced hardware components such as temperature and humidity sensors, GPS modules, and communication devices that provide continuous data tracking and monitoring. In May 2023, Tridentify AB, a Sweden-based company, announced the launch of a real-time cold chain monitoring system that continuously tracks the stability and remaining shelf-life of products in transit, offering a comprehensive view of shipment conditions. This system enables companies to make informed, data-driven decisions and optimize their operations by monitoring the stability budget and identifying inefficiencies in real time.

The software segment is projected to witness the fastest CAGR from 2024 to 2030. The segment’s growth can be attributed to the growing adoption of advanced data analytics and Machine Learning (ML) in software solutions. Modern software solutions use advanced data analytics and machine learning to predict potential issues before they arise, optimizing cold chain operations and reducing risks. Customers demand greater transparency and higher service levels regarding the condition of their products. Software solutions facilitate better communication and visibility, enhancing the customer experience.

Temperature Range Insights

The frozen (-18°C to -25°C) segment dominated the market in 2023 and accounted for more than 61.0% share of global revenue. The segment's growth is attributed to the increasing demand for frozen food. There is a growing consumer preference for frozen foods due to their convenience, longer shelf life, and ease of storage. This trend boosts the need for effective cold chain management within this temperature range. The expansion of frozen food categories, including ready-to-eat meals, frozen vegetables, and desserts, drives the demand for precise temperature control in cold chain logistics.

The chilled (0°C to 15°C) segment is projected to grow at a considerable CAGR from 2024 to 2030. The segment’s growth is attributed to the rise of e-commerce and direct-to-consumer models. The growth of e-commerce and direct-to-consumer models for chilled products requires robust cold chain solutions to ensure products remain within the proper temperature range during transit and delivery. Consumers expect fresh, high-quality products delivered on time, driving the need for reliable temperature control and monitoring solutions and driving the growth of the market.

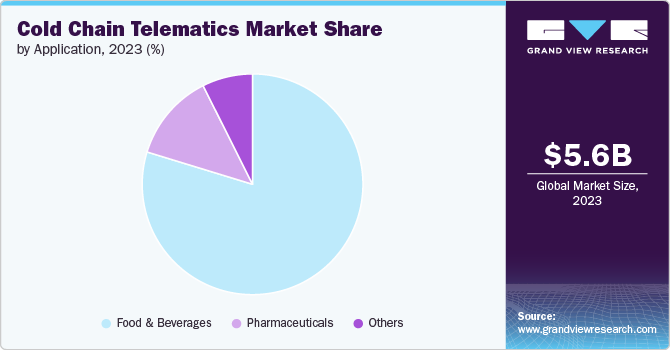

Application Insights

The food & beverages segment dominated the market in 2023 and accounted for more than 79.0% share of global revenue. The need to ensure regulatory compliance drives the segment’s growth. The expansion of the food & beverage industry and the need to reduce food waste are driving the segment’s growth. The global food and beverage industry is expanding, driven by population growth, urbanization, and changing dietary habits. This expansion increases the volume of products requiring effective cold chain management. The introduction of new food and beverage products with specific storage requirements necessitates sophisticated cold chain solutions to manage diverse temperature needs. Moreover, cold chain telematics solutions help reduce food waste by preventing spoilage through accurate temperature control and monitoring, leading to better management of inventory and supply chains.

The pharmaceuticals segment is projected to witness the fastest CAGR from 2024 to 2030. The segment’s growth is attributed to the need to ensure compliance with stringent regulatory requirements. Regulatory bodies such as the European Medicines Agency (EMA), U.S. Food and Drug Administration (FDA), and World Health Organization (WHO) impose strict guidelines for the storage and transportation of pharmaceuticals to ensure product integrity. Cold chain telematics solutions help companies comply with these regulations. Maintaining precise temperature control is crucial to prevent spoilage and degradation of pharmaceuticals, ensuring that products are safe and effective upon administration. Cold chain telematics solutions help maintain the quality and efficacy of pharmaceutical products by providing continuous monitoring and real-time alerts.

Regional Insights

North America dominated the global market and accounted for a revenue share of over 34.0% in 2023. The market’s growth in the region is attributed to the rising investments in cold chain infrastructure in the region and the need to ensure compliance with stringent regulations and standards for food and pharmaceutical goods. North America has stringent regulations and standards for food safety and pharmaceutical storage, including the U.S. FDA and United States Department of Agriculture (USDA) guidelines. Compliance with these regulations drives the adoption of cold chain telematics solutions. Moreover, investments in cold storage facilities, transportation fleets, and other infrastructure support the growth of the market.

The U.S. Cold Chain Telematics Market Trends

The U.S. market is expected to grow at a CAGR of 22.6% from 2024 to 2030. The market’s growth in the country is attributed to the technological advancements in the U.S. The integration of Internet of Things (IoT) devices with cold chain telematics enhances real-time monitoring and management capabilities, providing accurate temperature tracking and data analytics. Moreover, the presence of numerous market players, such as Verizon, Sensitech (Carrier), and ORBCOMM, drives the market’s growth in the country.

Asia Pacific Cold Chain Telematics Market Trends

The market in Asia Pacific is expected to grow at the fastest CAGR of 25.6% from 2024 to 2030. The market’s growth in the region can be attributed to the growth in e-commerce and online grocery in the region. The expansion of e-commerce platforms and online grocery services in the region necessitates efficient cold chain solutions to ensure the delivery of fresh and perishable items. Consumers expect timely and reliable delivery of fresh products, which drives the adoption of advanced cold chain telematics.

Europe Cold Chain Telematics Market Trends

The market in Europe is expected to grow at a significant CAGR of 23.5% from 2024 to 2030. The market's growth can be attributed to the growing pharmaceutical and biotech sectors in the region. The growing pharmaceutical and biotech sectors in Europe require precise temperature control for sensitive drugs and vaccines, driving the need for cold chain telematics solutions. Moreover, the focus on food waste reduction and sustainability is driving the growth of the market in the region. According to Eurostat, in the EU, over 58 million tons of food waste was generated in 2021. Reducing food waste is a major priority in Europe, and cold chain telematics solutions help minimize spoilage and improve resource efficiency.

Key Cold Chain Telematics Company Insights

Some of the key companies operating in the market include Verizon, Sensitech (Carrier), ORBCOMM, Zebra Technologies Corp., and ELPRO-BUCHS AG, among others.

-

ELPRO-BUCHS AG, a Switzerland-based company, is a provider of temperature and environmental monitoring solutions, specializing in the cold chain sector. The company focuses on providing comprehensive cold chain monitoring solutions that help businesses track and manage temperature-sensitive products throughout the supply chain. Its key offerings include temperature monitoring systems, data loggers, and software solutions.

Astrata and Controlant are some of the emerging companies in the target market.

-

Astrata, a Singapore-based company, provides advanced telematics and fleet management solutions, specializing in innovative technologies for tracking and monitoring logistics and transportation. The company operates worldwide, serving various industries, including cold chain management. It offers specialized solutions for the cold chain sector, focusing on the real-time monitoring and management of temperature-sensitive goods. These solutions are designed to ensure that perishable products are transported and stored under optimal conditions.

Key Cold Chain Telematics Companies:

The following are the leading companies in the cold chain telematics market. These companies collectively hold the largest market share and dictate industry trends.

- Verizon

- Sensitech (Carrier)

- ORBCOMM

- Zebra Technologies Corp.

- Controlant

- Roambee Corporation

- Monnit Corporation

- ELPRO-BUCHS AG

- Astrata

- Savi Technology

Recent Developments

-

In June 2024, Carrier, via its Sensitech division, finalized a definitive agreement to acquire the Monitoring Solutions business of Berlinger & Co. AG, a Swiss company renowned for its innovative monitoring solutions for temperature-sensitive goods in the pharmaceutical and life science industries. This acquisition will broaden Sensitech's range of monitoring solutions and strengthen its expertise in cloud-based platforms and real-time monitoring.

-

In June 2024, ORBCOMM announced the launch of the CT 3600 device as part of its latest reefer container monitoring solution, designed to simplify intelligent reefer management for container leasing companies, shipping lines, and others. The new system streamlines installation and management, reduces component requirements, and supports wireless Bluetooth sensors, offering improved efficiency and coverage while complying with Digital Container Shipping Association (DCSA) interoperability standards.

Cold Chain Telematics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.89 billion

Revenue forecast in 2030

USD 24.9 billion

Growth Rate

CAGR of 23.9% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, temperature range, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Verizon; Sensitech (Carrier); ORBCOMM; Zebra Technologies Corp.; Controlant; Roambee Corporation; Monnit Corporation; ELPRO-BUCHS AG; Astrata; Savi Technology

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Chain Telematics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cold chain telematics market report based on component, temperature range, application, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Temperature Range Outlook (Revenue, USD Million, 2017 - 2030)

-

Chilled (0°C to 15°C)

-

Frozen (-18°C to -25°C)

-

Deep-frozen (Below -25°C)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold chain telematics market size was estimated at USD 5.63 billion in 2023 and is expected to reach USD 6.89 billion in 2024.

b. The global cold chain telematics market is expected to grow at a compound annual growth rate of 23.9% from 2024 to 2030 to reach USD 24.90 billion by 2030.

b. North America dominated the cold chain telematics market with a share of over 34.0% in 2023. This is attributable to the developed technological infrastructure and the presence of numerous market players in the region.

b. Some key players operating in the cold chain telematics market include Verizon, Sensitech (Carrier), ORBCOMM, Zebra Technologies Corp., Controlant, Roambee Corporation, Monnit Corporation, ELPRO-BUCHS AG, Astrata, and Savi Technology.

b. Key factors driving market growth include the increasing need for enhanced supply chain visibility and efficiency and the rise in demand for perishable goods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.