Cold Chain Monitoring Market Size, Share, & Trends Analysis Report By Component (Hardware, Software), By Application (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-675-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Cold Chain Monitoring Market Size & Trends

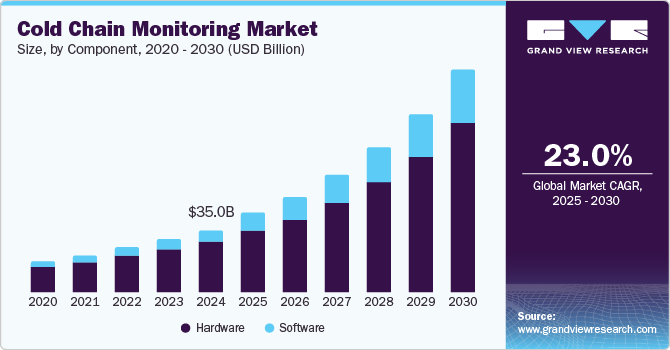

The global cold chain monitoring market size was estimated at USD 35.03 billion in 2024 and is projected to grow at a CAGR of 23.0% from 2025 to 2030. The growing trade of pharmaceutical and temperature-sensitive products across the globe is anticipated to spur industry growth over the forecast period. An increasing number of strict government regulations regarding the storage and shipment of pharmaceutical products is leading to increased demand for cold chain monitoring solutions. Moreover, rising private and government investments in building refrigerated warehouses and government efforts to reduce spoilage of food and other temperature-sensitive goods are expected to propel the industry growth over the forecast period.

Pharmaceutical products are extremely temperature-sensitive and need effective temperature monitoring technologies. In addition, temperature monitoring technologies are used to keep the temperature level throughout the shipment to protect the quality of products. Countries such as the U.S. and Canada are expected to portray a significant growth rate in the near future due to well-developed transportation & distribution networks.

The market is expected to expand in developing economies with growing technological developments in Radio Frequency Identification (RFID) technology and the Internet of Things (IoT). Cold chain monitoring solutions are designed to track and monitor products such as perishable, eatable, food items, and other temperature-sensitive products during storage and transportation activities. These products are tracked through various methods, including real-time and predictive analytics, among others. Increasing demand for perishable & fragile products, along with maintaining their optimum temperature, has significantly boosted the market.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and others have set strict standards for the storage and transport of temperature-sensitive goods, particularly pharmaceuticals, biologics, and food products. Compliance with these regulations ensures that perishable goods maintain their quality and efficacy, necessitating the use of advanced monitoring systems. For instance, the FDA’s Food Safety Modernization Act (FSMA) mandates that food companies monitor temperature-sensitive shipments to prevent spoilage. Failure to comply can lead to product recalls, legal actions, and loss of consumer trust.

Companies are increasingly focusing on reducing waste in the supply chain by implementing efficient cold chain monitoring systems. Food loss reduction has become a global priority, with cold chain monitoring playing a critical role in minimizing spoilage and ensuring sustainability. In addition, there is growing interest in energy-efficient and eco-friendly cold chain technologies as companies strive to reduce their environmental impact.

Companies are actively innovating with new cold chain tracking solutions. In July 2024, U.S.-based Trucker Tools introduced its Cold Chain Load Tracking, a real-time, customizable solution for monitoring temperature-sensitive shipments such as food, chemicals, and medical products. This advanced tool enhances visibility and compliance, helping freight brokers and shippers maintain product integrity and elevate standards in cold chain logistics.

Component Insights

Based on component, the market is segmented into software and hardware. The hardware segment dominated the overall cold chain monitoring industry, gaining a market share of 78.1% in 2024. It is expected to grow at a significant CAGR throughout the forecast period. Hardware monitoring equipment includes various sensors, Radio Frequency Identification (RFID) devices, telematics devices, and networking devices, among others, which are used to collect real-time data, such as temperature and location data. Businesses can use these devices to monitor the cold chain and make decisions accordingly. Samsara Inc. and Laird Connectivity offer cold chain monitoring hardware. The growth of this segment can be attributed to the need to monitor temperature-sensitive products by collecting data through hardware solutions for cold chains.

The software segment is anticipated to grow at the fastest CAGR from 2025 to 2030. The software segment includes on-premise and cloud-based software for monitoring temperature-sensitive products. Software analyses the information received from various hardware components, including data loggers, sensors, and telematics devices. The need to analyze data collected from hardware devices to improve the overall cold chain operations is driving the growth of the software segment.

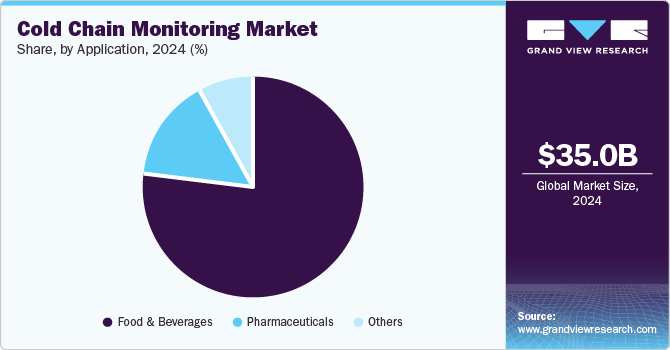

Application Insights

Based on application, the market is segmented into pharmaceuticals, food & beverages, and others. The food & beverages segment dominated the overall cold chain monitoring industry, gaining a market share of 77.0% in 2024. It is expected to grow at a significant CAGR from 2025 to 2030. The growing demand for processed food and changes in consumer preferences is driving the demand for cold chain monitoring solutions across the food & beverages sector. Hence, cold chain monitoring solutions are required to effectively track and collect data on perishable food products and, take corrective actions, and mitigate any potential damages.

The pharmaceuticals segment is expected to grow at the fastest CAGR from 2025 to 2030. High demand in the pharmaceutical segment can be attributed to the importance of maintaining the efficacy of pharmaceutical products. The COVID-19 pandemic accelerated the demand for cold chain monitoring solutions to store and distribute COVID-19 vaccines safely. The need to maintain the quality of pharmaceutical products and comply with strict regulations drives the segment’s growth.

Regional Insights

North America cold chain monitoring market held the largest revenue share of more than 33.0% in 2024. The growth of the cold chain monitoring market in the region can be attributed to developed technology infrastructure and the presence of prominent cold chain monitoring companies such as U.S.-based ORBCOMM and Canada-based Geotab Inc. aid market growth in the region. Moreover, the region has very high Research & Development (R&D) activities of advanced technologies such as Artificial Intelligence (AI), robotics, and the Internet of Things (IoT). This makes the region favorable for innovating cold chain monitoring solutions.

U.S. Cold Chain Monitoring Market Trends

The U.S. cold chain monitoring market is growing due to rising demand for perishable foods and pharmaceuticals, along with stringent FDA regulations that require the safe transport of temperature-sensitive products. Advanced IoT and real-time monitoring technologies are enhancing visibility, while the growth of e-commerce has increased the need for effective last-mile cold chain solutions. Additionally, investments in sustainable, automated cold storage facilities are helping companies reduce waste and improve supply chain efficiency.

Asia Pacific Cold Chain Monitoring Market Trends

Asia Pacific cold chain monitoring market is expected to grow at the fastest CAGR from 2025 to 2030. The market's growth can be attributed to the developing technological infrastructure in the region. China is one of the major participants in the R&D of advanced technologies. According to the United Nations Conference on Trade and Development (UNCTAD), China and India led the IoT research with 28,641 and 21,188 IoT-related publications, respectively, between 2000 and 2021. The large population is expected to drive the demand for cold chain monitoring solutions as there will be a growing need for perishable goods such as food and pharmaceutical products.

Key Cold Chain Monitoring Company Insights

Some of the key players operating in the market include Carrier, ORBCOMM, and Geotab Inc., among others.

-

ORBCOMM is a company specializing in connectivity and remote monitoring for supply chain and logistics industries, including cold chain monitoring. Founded in 1993 and headquartered in the U.S., ORBCOMM offers satellite and cellular-based IoT services that provide real-time tracking, monitoring, and management of assets across various sectors, such as transportation, heavy equipment, maritime, and energy.

Monnit Corporation and Controlant are some of the emerging market participants in the target market.

-

Monnit Corporation is a U.S.-based provider of wireless IoT (Internet of Things) solutions known for its easy-to-deploy sensor technology used in asset monitoring and environmental conditions across a range of industries, including cold chain, healthcare, agriculture, and facilities management. Founded in 2010, Monnit Corporation has established itself as an emerging player in cold chain monitoring by offering reliable, low-cost wireless sensors for temperature, humidity, and other environmental factors designed for real-time monitoring and alerts.

Key Cold Chain Monitoring Companies:

The following are the leading companies in the cold chain monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier

- ORBCOMM

- Geotab Inc.

- Controlant

- ELPRO-BUCHS AG

- Savi Technology

- Berlinger & Co. AG

- Monnit Corporation

- Zest Labs, Inc.

- Infratab, Inc

Recent Development

-

In November 2024, Monnit Corporation launched three new products in its ALTA Wireless Sensing line to meet customer demands across various industries: the 15-Amp Latching Relay Control Unit, the ALTA MultiStage Thermostat, and a detachable lead for the ALTA Industrial Ultrasonic Ranging Sensor. These products enhance Monnit's IoT sensing solutions, offering greater control, energy efficiency, and flexibility for applications like HVAC systems, automation, and environmental monitoring, helping customers access real-time data for more informed decision-making.

-

In September 2024, ELPRO-BUCHS AG announced the launch of elproPREDICT, a real-time predictive analytics solution developed in collaboration with SmartCAE GmbH & Co. KG, a Germany-based company, designed to enhance cold chain logistics by providing actionable insights for proactive risk management. By integrating data from ELPRO-BUCHS AG’s monitoring devices, elproPREDICT helps pharmaceutical professionals optimize costs, ensure product integrity, and receive real-time alerts, improving supply chain efficiency and compliance with regulatory requirements.

-

In May 2023, Tridentify announced the launch of its real-time temperature monitoring system. The system features real-time monitoring of the remaining shelf-life and stability of pharmaceutical products. With this launch, the company aimed to help businesses optimize their operations.

Cold Chain Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 42.59 billion |

|

Revenue forecast in 2030 |

USD 119.74 billion |

|

Growth Rate |

CAGR of 23.0% from 2025 to 2030 |

|

Historical data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, Norway, Netherlands, Switzerland, Russia, China, Japan, India, Singapore, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, and South Africa |

|

Key companies profiled |

Carrier, ORBCOMM, Geotab Inc., Controlant, ELPRO-BUCHS AG, Savi Technology, Berlinger & Co. AG, Monnit Corporation, Zest Labs, Inc., and Infratab, Inc |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cold Chain Monitoring Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cold chain monitoring market report on the basis of component, application, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Sensors

-

RFID Devices

-

Telematics

-

Networking Devices

-

Others

-

-

Software

-

On-premise

-

Cloud-based

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Norway

-

Netherlands

-

Switzerland

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold chain monitoring market size was estimated at USD 35.03 billion in 2024 and is expected to reach USD 42.59 billion in 2025.

b. The global cold chain monitoring market is expected to grow at a compound annual growth rate of 23.0% from 2025 to 2030 to reach USD 119.74 billion by 2030.

b. North America dominated the cold chain monitoring market with a share of 33.7% in 2024. This is attributable to the rapid industrialization, the continued rollout of transportation & warehousing networks, and the rise in demand for processed & canned food items.

b. Some key players operating in the cold chain monitoring market include ELPRO-BUCHS AG, Carrier, Berlinger & Co. AG, Savi Technology, ORBCOMM, Geotab Inc., Monnit Corporation, Controlant, Zest Labs, Inc., and Infratab, Inc, among others

b. Key factors that are driving the cold chain monitoring market growth include the increasing emphasis on enhancing the efficiency of the supply chains of the processed food, frozen food, dairy products, and pharmaceutical products & other products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."