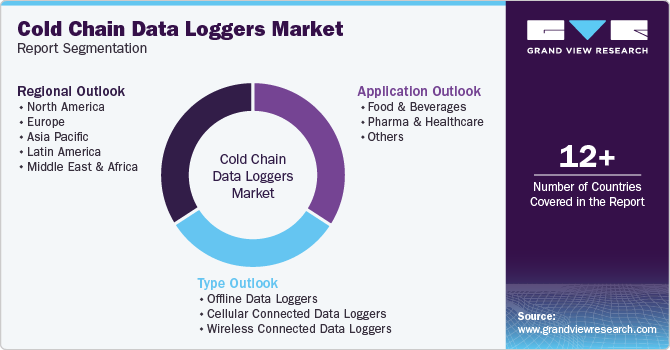

Cold Chain Data Loggers Market Size, Share & Trends Analysis Report By Type (Offline Data Loggers, Cellular Connected Data Loggers, Wireless Connected Data Loggers), By Application (Food & Beverages), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-472-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Cold Chain Data Loggers Market Trends

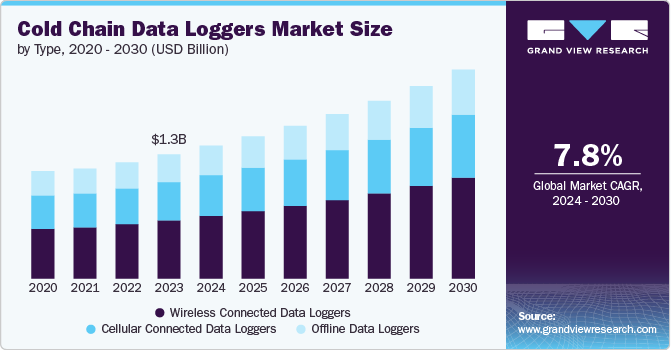

The global cold chain data loggers market size was estimated at USD 1.29 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. The rising need for temperature-sensitive supply chains, the expansion of pharmaceutical production, and the rapid growth of the food industry are key factors driving the demand for cold chain data loggers. The rise of online grocery shopping has increased the need for efficient cold chain logistics. Fresh produce, dairy products, frozen foods, and meat products all require temperature-controlled transportation, and data loggers help ensure these products maintain quality during delivery. E-commerce companies like Amazon.com, Inc.; Walmart Inc.; and Alibaba Group Holding Limited are investing heavily in cold chain infrastructure, and the need for reliable monitoring systems is driving the demand for data loggers.

One of the primary driving factors for the cold chain data loggers market is regulatory compliance. In industries such as pharmaceuticals, strict regulations are in place to ensure that products are stored and transported within specific temperature ranges. Agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the World Health Organization (WHO) have stringent guidelines for the handling of temperature-sensitive products. Compliance with these guidelines is essential for companies, and data loggers provide the necessary monitoring and documentation to meet regulatory requirements.

Sustainability is becoming a significant trend in the cold chain industry. Many companies are seeking ways to reduce their carbon footprint, and energy-efficient cold chain systems are gaining popularity. Data loggers help monitor energy consumption and optimize refrigeration systems to minimize energy wastage. Additionally, reducing spoilage through precise monitoring contributes to waste reduction, further enhancing the sustainability of cold chains.

The integration of Internet of Things (IoT) and cloud computing with cold chain data loggers is creating new opportunities for market growth. IoT-enabled data loggers can provide real-time monitoring, remote access, and automated alerts, allowing for better decision-making and proactive issue resolution. Cloud-based platforms allow companies to store and analyze large amounts of data, providing valuable insights into supply chain performance and helping optimize processes. The rise of personalized medicine and gene therapies, which require specific storage conditions, is expected to drive the demand for cold chain logistics and monitoring systems.

Wireless and Bluetooth-enabled data loggers are gaining popularity due to their ease of use and ability to provide real-time data transmission. These devices allow for remote monitoring of temperature conditions, reducing the need for manual intervention. Bluetooth-enabled data loggers can sync with smartphones or tablets, providing instant access to data and eliminating the need for physical retrieval of devices. Moreover, Radio Frequency Identification (RFID) technology is being integrated into cold chain data loggers to enhance tracking and monitoring capabilities. Such technological advances are anticipated to drive the demand for the market over the forecast period.

Type Insights

In terms of type, the market is classified into offline data loggers, cellular connected data loggers, and wireless connected data loggers. The wireless connected data loggers segment dominated the market in 2023 and accounted for more than 46.0% share of global revenue. One of the key trends in this segment is the increasing use of IoT-enabled data loggers that integrate seamlessly with warehouse management system (WMS) and enterprise resource planning platform. This allows companies to automate data collection, streamline operations, and improve decision making processes. Additionally, wireless data loggers are increasingly being used in conjunction with predictive analytics. By leveraging historical data, companies can predict potential risks in the cold chain and take proactive measures to prevent temperature excursions.

The cellular connected data loggers segment is projected to witness a CAGR from 2024 to 2030. This growth can be attributed to increased regulatory scrutiny, particularly in industries like pharmaceuticals, where maintaining a consistent temperature is critical to product efficiency. Furthermore, a major trend in cellular connected data loggers is the integration of GPS tracking. Many cellular data loggers now come equipped with location-tracking features, allowing companies to monitor both the temperature and the physical location of their shipments in real time.

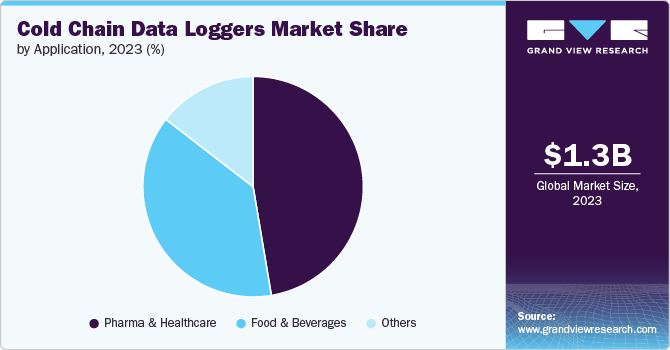

Application Insights

In terms of application, the market is classified as food & beverages, pharma & healthcare, and others. The pharma & healthcare segment dominated the market in 2023 and accounted for more than 47.0% share of global revenue. The pharmaceutical industry is expanding rapidly, driven by increasing demand for biopharmaceuticals, vaccines, and personalized medicines. Many of these products require temperature-controlled storage and transportation are anticipated to drive the demand for cold chain data loggers market in pharma & healthcare segment.

The food & beverages segment is projected to register a significant CAGR from 2024 to 2030. The food & beverage industry is experiencing significant growth due to rising populations, increasing disposable incomes, and shifting consumer preferences. Many food products such as dairy, meat, and frozen goods, are temperature-sensitive and require cold chain logistics. The need to monitor and control temperature conditions throughout the food supply chain is driving the demand for cold chain data loggers. Moreover, the rising demand for frozen and processes foods is a key driver for food & beverage segment. As these products require consistent low temperatures during transit, the need for advanced monitoring tools like cold chain data loggers is gaining popularity in the market.

Regional Insights

North Americadominated the global cold chain data loggers market and accounted for a revenue share of over 31.0% in 2023. The region is characterized by a well-established cold chain infrastructure, particularly in industries like pharmaceuticals and food & beverages. The ongoing rise in e-commerce, especially in the delivery of temperature-sensitive products like fresh foods and medical supplies, is fueling the demand for cold chain logistics and data loggers.

U.S. Cold Chain Data Loggers Market Trends

The cold chain data loggers market in the U.S. is expected to grow at a CAGR of 6.1% from 2024 to 2030. The rapid expansion of pharmaceutical sector in the U.S. is a major factor in the increasing adoption of data loggers, particularly for biologics, gene therapies, and other temperature-sensitive medications. Companies are leveraging data loggers that are FDA-compliant and meet the specific needs of this industry.

Europe Cold Chain Data Loggers Market Trends

The cold chain data loggers market in Europe is expected to register a considerable growth rate from 2024 to 2030. The country’s stringent regulations for food and safety under frameworks like Hazard Analysis Critical Control Point (HACCP), which mandate precise temperature monitoring for perishable food products, thus led to a higher adoption of data loggers in the region.

Asia Pacific Cold Chain Data Loggers Market Trends

The cold chain data loggers market in Asia Pacific is expected to grow at a highest CAGR of 10.0% from 2024 to 2030. A notable trend in the region is the expansion of cold chain infrastructure in emerging markets like China, India, and Southeast Asia. These countries are investing heavily in cold storage facilities, refrigerated transportation, and data loggers to meet the rising demand for temperature-sensitive goods. Additionally, the government initiatives to improve food safety and healthcare systems are supporting the growth of cold chain data loggers.

Key Cold Chain Data Loggers Company Insights

Some of the key companies operating in the market include Lascar Electronics Limited; Monnit Corporation; NXP Semiconductors; Omega Engineering, Inc.; and ROTRONIC AG.

-

Monnit Corporation, a U.S. based wireless sensors and IoT enabled remote monitoring solutions provider. The company has a strong global presence, providing its cold chain data loggers to a wide range of industries across North America, Europe, and Asia Pacific. The company is constantly evolving its product portfolio, leveraging cutting-edge technologies such as IoT and AI for predictive maintenance and advanced data analytics.

CAEN RFID S.r.l., TempSen Electronics, and Thermosense Limited are some of the emerging companies in the target market.

-

TempSen Electronics is engaged in providing data acquisition systems and data loggers for cold chain monitoring. The company’s clientele ranges from food, life science, pharmaceutical, and chemical industries. The company offers single-use and multi-use data loggers provide flexibility to customers based on their operational needs.

Key Cold Chain Data Loggers Companies:

The following are the leading companies in the cold chain data loggers market. These companies collectively hold the largest market share and dictate industry trends.

- CAEN RFID S.r.l.

- Lascar Electronics Limited

- Monnit Corporation

- NXP Semiconductors

- Omega Engineering, Inc.

- ROTRONIC AG

- Sensaphone

- Sensitech

- TempSen Electronics

- Thermosense Limited

Recent Developments

-

In August 2024, Sensitech, a business unit of Carrier Global Corporation, completed the acquisition of the monitoring solution business of Berlinger & Co. AG, a provider of temperature monitoring solutions in clinical trials, life science, pharmaceuticals, and global health. The acquisition helps the former company to expand its capabilities in cold chain monitoring and visibility solutions in the life science and pharmaceutical industry.

-

In April 2024, TOWER Cold Chain Solutions launched a live tracking and monitoring feature in collaboration with ELPRO-BUCHS AG, a monitoring solution provider for the life science and pharma industry. The collaboration helps the former company strengthen its ability to offer advanced temperature-controlled containers and real-time insights to customers regarding their shipments throughout the transit process.

Cold Chain Data Loggers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.38 billion |

|

Revenue forecast in 2030 |

USD 2.16 billion |

|

Growth rate |

CAGR of 7.8% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

CAEN RFID S.r.l.; Lascar Electronics Limited; Monnit Corporation; NXP Semiconductors; Omega Engineering, Inc.; ROTRONIC AG; Sensaphone; Sensitech; TempSen Electronics; Thermosense Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cold Chain Data Loggers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cold chain data loggers market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline Data Loggers

-

Cellular Connected Data Loggers

-

Wireless Connected Data Loggers

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food and Beverages

-

Pharma & Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold chain data loggers market size was estimated at USD 1.29 billion in 2023 and is expected to reach USD 1.38 billion in 2024.

b. The global cold chain data loggers market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 2.16 billion by 2030.

b. The wireless connected data loggers segment dominated the market in 2023 and accounted for more than 46.0% share of global revenue. One of the key trends in this segment is the increasing use of IoT-enabled data loggers that integrate seamlessly with warehouse management system (WMS) and enterprise resource planning platform. This allows companies to automate data collection, streamline operations, and improve decision making processes.

b. Some of the key companies operating in the cold chain data loggers market include Lascar Electronics Limited, Monnit Corporation, NXP Semiconductors, Omega Engineering, Inc., ROTRONIC AG, among others.

b. The rising need for temperature-sensitive supply chains, the expansion of pharmaceutical production, and the rapid growth of the food industry are key factors driving the demand for cold chain data loggers market. The rise of online grocery shopping has increased the need for efficient cold chain logistics. Fresh produce, dairy products, frozen foods, and meat products all require temperature-controlled transportation, and data loggers help ensure these products maintain quality during delivery.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."