Cognitive Supply Chain Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-Premise), By Enterprise Size, By Automation Used, By Industry Verticals, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-114-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Cognitive Supply Chain Market Size & Trends

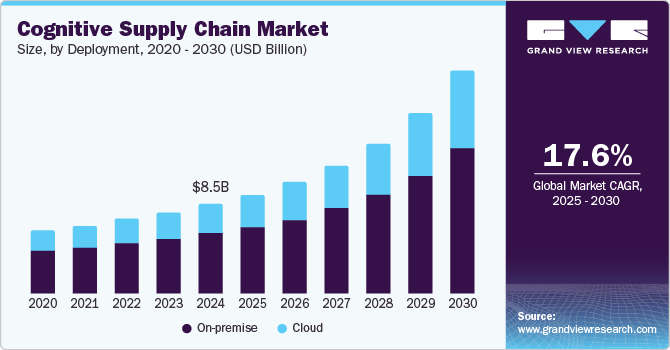

The global cognitive supply chain market size was estimated at USD 8,579.7 million in 2024 and is projected to grow at a CAGR of 17.6% from 2025 to 2030. The market is on track for significant growth due to technological advancements and evolving business needs. Supply chain systems have grown more complex and data-driven because of the rapid progress of AI technologies such as machine learning and natural language processing. This enables businesses to employ predictive analytics and demand forecasting to optimize inventory management and keep the supply chain running smoothly. In addition, the integration of Big Data and Internet of Things (IoT) devices in supply chain operations has resulted in vast amounts of data.

Cognitive technology can process and analyze this data in real time, providing valuable insights that lead to better decision-making and operational efficiency.

The rise of customer-centricity as a core business strategy has also been a driving force behind the adoption of cognitive supply chain solutions. Businesses now strive to deliver a superior customer experience by streamlining processes and reducing lead times. Cognitive technologies help achieve this by optimizing operations, ensuring products reach customers promptly, and improving overall supply chain responsiveness. Cost optimization remains a significant factor in driving the growth of this market. Businesses can achieve significant cost savings by minimizing inventory holding costs, reducing transportation expenses, and enhancing overall supply chain efficiency. This cost-effectiveness makes cognitive supply chain solutions attractive for companies seeking to stay competitive in today's dynamic market landscape. The increasing adoption of cognitive technologies is not limited to a specific industry but is observed across various sectors. As more companies witness the tangible benefits of cognitive supply chain solutions, the market is expected to experience higher adoption rates. This growing interest and acceptance of cognitive technologies will likely further fuel the market's expansion.

COVID-19 Impact on the Cognitive Supply Chain Industry

The COVID-19 pandemic has significantly impacted the industry, reshaping how businesses approach supply chain management. One of the most notable effects was an increased demand for supply chain resilience. The pandemic exposed vulnerabilities in global supply chains, resulting in widespread disruptions and shortages. As a response, businesses recognized the urgent need to build more robust and agile supply chains that could withstand future disruptions. Cognitive technologies like AI and machine learning became vital tools in predicting disruptions, optimizing inventory management, and enhancing overall supply chain visibility and resilience. Moreover, the pandemic accelerated the digital transformation of supply chain operations. As companies shifted to remote work and faced operational challenges, there was a heightened emphasis on automation and cognitive technologies. Organizations that had already adopted AI-driven supply chain solutions were better equipped to manage sudden changes and mitigate the impact of disruptions. The pandemic acted as a catalyst, driving businesses to explore and embrace technologies that could improve supply chain efficiency and decision-making.

In the face of uncertainty caused by the pandemic, demand forecasting became particularly challenging. With shifting consumer behaviors and demand patterns, accurate forecasting was critical for inventory planning and optimization. Here, AI-powered predictive analytics played a crucial role in providing businesses with valuable insights into customer demand patterns, enabling them to make informed decisions and adapt to rapidly changing market conditions. Health and safety concerns also came to the forefront during the pandemic, impacting supply chain operations. Cognitive technologies played a role in optimizing warehouse layouts, automating tasks to reduce human interaction, and ensuring adherence to safety protocols. By incorporating AI into safety measures, businesses aimed to protect their workforce while maintaining operational continuity.

Deployment Insights

In terms of deployment, the market is classified into cloud and on-premise segments. The on-premise deployment segment dominated the overall market, gaining a market share of 68.3% in 2022 and witnessing a CAGR of 14.8% during the forecast period. The preference for on-premise deployment in the market can be attributed to several factors. One primary consideration is data security. Companies dealing with sensitive supply chain data, such as those in the healthcare or defense sectors, often have stringent data security and compliance requirements. Opting for on-premise deployment allows them to maintain direct control over their data, reducing the risk of data breaches and ensuring compliance with industry-specific regulations. Moreover, data privacy concerns play a significant role in driving the demand for on-premise deployment. Organizations can exercise greater control over data privacy by hosting cognitive supply chain solutions on their own servers or data centers, minimizing the exposure of sensitive information to external entities.

The cloud deployment segment is anticipated to witness the fastest CAGR of 18.7% over the forecast period. One of the primary reasons for cloud deployment's rising popularity in the market is its scalability. Cloud-based solutions allow businesses to adjust their resources based on demand fluctuations and evolving business needs. As supply chain operations often vary seasonally or due to changes in market conditions, the cloud provides a dynamic infrastructure that can efficiently handle varying workloads without significant reconfiguration. Cost-effectiveness is another compelling advantage of the cloud deployment segment. Companies can significantly reduce their initial capital expenditure by eliminating the need for substantial upfront investments in hardware and infrastructure. Rather, they can go for a pay-as-you-go model, where they only pay for the computing resources they use. This cost-effective approach can appeal to businesses seeking to adopt cognitive technologies while managing their budget efficiently.

Enterprise Size Insights

In terms of enterprise size, the market is classified into SMEs and large enterprises. Among these, the large enterprises segment is dominated in 2024 with a market share of 68.8% and is anticipated to witness a CAGR of 17.2% over the forecast period. Large enterprises were leveraging cognitive technologies to enhance their supply chain capabilities in several key areas, such as demand forecasting, inventory management, logistics optimization, and supplier relationship management. By integrating AI and ML into their supply chain processes, these enterprises could gain deeper insights from vast amounts of data, identify patterns, and make more accurate predictions. Adopting cognitive technologies also improved efficiency, reduced operational costs, and minimized disruptions in supply chain activities. For instance, real-time monitoring of supply chain data enabled companies to proactively address potential bottlenecks, mitigate risks, and respond swiftly to changes in demand or supply. Furthermore, large enterprises were increasingly partnering with tech companies and specialized AI providers to implement cognitive supply chain solutions tailored to their specific needs. Such collaborations allowed them to access cutting-edge technologies and expertise, speeding up the implementation process and yielding more substantial benefits.

The SME segment is anticipated to observe significant growth at a CAGR of 18.2% throughout the forecast period. One key factor contributing to the growth of the SME enterprise segment in the market is cost-effectiveness. SMEs can now access cloud-based cognitive supply chain platforms that require lower upfront investment than traditional on-premises solutions, making them more feasible for smaller budgets. This reduced financial barrier has opened up opportunities for SMEs to adopt innovative technologies and gain a competitive edge in their respective industries. Moreover, the scalability of cognitive supply chain solutions has been another driving force behind SME adoption. Many providers of these solutions offer flexible packages that allow SMEs to start with a small-scale implementation and expand as their business grows. This approach aligns well with the dynamic nature of SMEs, as they often experience fluctuating demands and changing business requirements. With the ability to scale their cognitive supply chain operations, SMEs can adapt more effectively to market demands and seize new growth opportunities.

Automation Used Insights

In terms of automation used, the market is classified into the Internet of Things (IoT), Machine Learning (ML), and others. The Internet of Things (IoT) segment dominated in 2024, gaining a market share of 44.6%, and is anticipated to witness a CAGR of 17.8% over the forecast period. One of the primary drivers behind adopting IoT automation in the market is the promise of significant cost savings and operational efficiency gains. Companies can streamline their operations and reduce unnecessary expenditures by automating various aspects of the supply chain, such as inventory management, asset tracking, and order processing. This improved overall efficiency and a more cost-effective supply chain management approach. Integrating IoT devices and cognitive technologies also offers enhanced visibility and transparency across the supply chain. With real-time data collection and analysis, businesses gained valuable insights into the movement and condition of goods at each stage of the supply chain. This unprecedented visibility allowed companies to proactively identify bottlenecks and potential issues, leading to better decision-making and optimized processes.

The machine learning (ML) segment is anticipated to witness the fastest CAGR of 18.6% over the forecast period. ML automation in the market segment allows businesses to streamline and optimize their supply chain processes, reduce operational costs, improve efficiency, and make data-driven decisions. By automating repetitive tasks, analyzing vast amounts of data, and identifying patterns and insights, ML-driven solutions can help companies gain a competitive edge in the market. The growth of ML automation in the industry can be attributed to several factors. First, AI and ML adoption is increasing as businesses recognize the potential benefits of these technologies in supply chain management. Companies have embraced these solutions to gain better control over their supply chain, enhancing performance and improving customer satisfaction. Secondly, advancements in ML algorithms have been instrumental in driving the growth of automation in the segment. Ongoing research and development have led to more sophisticated ML algorithms capable of handling complex supply chain challenges, making automation more effective and reliable. These advanced algorithms can process vast amounts of data quickly and accurately, enabling businesses to make more informed decisions.

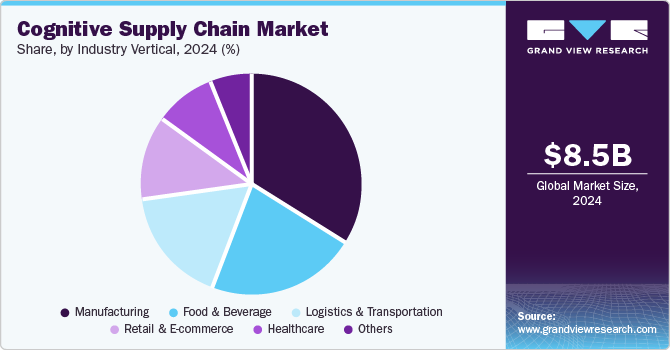

Industry Verticals Insights

In terms of industry verticals, the market is classified into manufacturing, retail & e-commerce, logistics & transportation, healthcare, food & beverage, and others. Among them, the manufacturing segment is expected to dominate in 2024, gaining a market share of 33.3% and witnessing a CAGR of 16.8% during the forecast period. One of the key factors of growth is predictive maintenance. Manufacturers are increasingly integrating cognitive technologies to implement predictive maintenance strategies. By analyzing real-time data from sensors and equipment, they can predict potential failures and perform maintenance before breakdowns occur. This proactive approach reduced unplanned downtime and extended the lifespan of critical machinery, contributing to improved operational efficiency. Quality control and defect detection are also areas witnessing notable advancements in the manufacturing industry by integrating cognitive supply chain solutions. AI algorithms were utilized to identify defects and deviations during the production process, leading to higher product quality and reduced waste. This enhanced quality control played a crucial role in ensuring customer satisfaction and maintaining the brand reputation of manufacturers.

The logistics & transportation segment is anticipated to witness the fastest CAGR of 19.7% over the forecast period. One significant advancement in this market is the emergence of autonomous vehicles, including trucks, drones, and delivery robots. These vehicles leverage cognitive capabilities such as computer vision and machine learning algorithms to navigate traffic, identify obstacles, and optimize routes for efficient and safe deliveries. Another key development is the widespread adoption of predictive analytics. Logistics companies can anticipate demand fluctuations, identify potential disruptions, and optimize inventory levels by harnessing data from various sources like IoT devices, sensors, and weather forecasts. This results in reduced costs and improved service levels. Furthermore, implementing blockchain technology has enhanced transparency, traceability, and security throughout the supply chain. Cognitive capabilities complement blockchain by automating data verification, ensuring records' accuracy, and strengthening supply chain management. Cognitive robotics has also played a crucial role in the logistics and transportation industry. These robots can handle complex tasks, adapt to dynamic environments, and collaborate with human workers, improving warehouse efficiency and order fulfillment. Natural Language Processing (NLP) has facilitated better communication within the supply chain. Voice-enabled interfaces and chatbots allow users to interact with supply chain systems intuitively, enhancing data entry, tracking, and issue resolution processes.

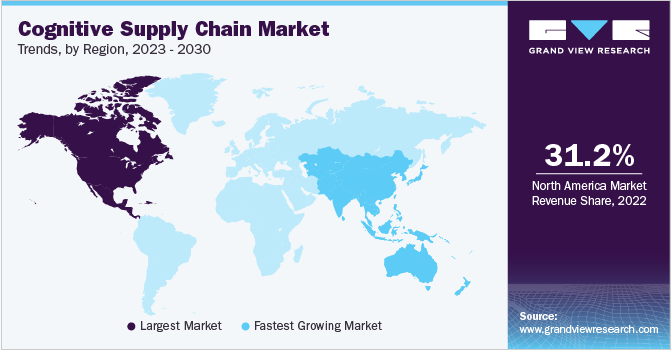

Regional Insights

North America cognitive supply chain market led the global market in 2024, with a revenue share of 35.2%. One of the primary factors contributing to the expansion of the market in North America is the increasing demand for efficiency and cost savings. Companies actively seek ways to streamline their supply chain operations, reduce expenses, and enhance productivity. Cognitive supply chain solutions allowed them to identify patterns, predict demand, and optimize inventory and logistics processes to improve resource allocation and reduce waste. Moreover, the proliferation of big data and analytics played a pivotal role in driving the adoption of cognitive supply chain technologies. With the exponential growth of data from various sources, such as IoT devices, sensors, and transactional systems, businesses can leverage advanced analytics and AI techniques. These solutions could process vast amounts of data and derive valuable insights, enabling better decision-making and more informed strategic planning.

U.S. Cognitive Supply Chain Market Trends

The cognitive supply chain market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The U.S. is a global leader in technological advancements and early adoption of emerging technologies. Key industries, such as manufacturing, retail, and healthcare, are increasingly adopting AI and IoT to optimize their supply chains. The presence of numerous tech giants and established supply chain companies in the U.S. has accelerated the development and deployment of cognitive supply chain solutions. These companies are investing heavily in research and development, leading to cutting-edge technologies that can improve forecasting accuracy, inventory management, and logistics. Furthermore, the U.S. government's emphasis on digital transformation and innovation has created a supportive regulatory environment. Initiatives like the American Innovation and Choice Online Act aim to promote competition and innovation, which can benefit the cognitive supply chain industry. However, challenges such as supply chain disruptions and cybersecurity threats may hinder growth to some extent.

Asia Pacific Cognitive Supply Chain Market Trends

Asia Pacific cognitive supply chain market is anticipated to observe significant growth at a CAGR of 19.2% over the forecast period. The Asia Pacific market has witnessed substantial growth over the past few years, driven by a convergence of technological advancements and a burgeoning demand for efficient supply chain management solutions. With the region experiencing robust economic growth and rapid digital transformation across industries, businesses have been eager to optimize operations and reduce costs. As a result, adopting artificial intelligence (AI) and cognitive computing in supply chain management has become increasingly prevalent. One of the key factors contributing to this growth is the increasing need for efficiency in supply chain operations. As markets become more competitive and customer expectations rise, companies are under significant pressure to streamline their supply chain processes and improve responsiveness. Cognitive technologies offer advanced analytics and decision-making capabilities, empowering businesses to make data-driven, real-time decisions, thereby enhancing overall efficiency.

The cognitive supply chain market in Japan is expected to grow at a significant CAGR from 2025 to 2030. Japan, with its strong manufacturing base and focus on operational efficiency, is well-positioned to capitalize on the growth of the cognitive supply chain industry. The country's commitment to technological advancement, coupled with a strong emphasis on quality and precision, makes it an ideal market for AI-powered supply chain solutions. The aging population and labor shortages in Japan are driving the need for automation and intelligent solutions. Cognitive supply chain technologies can help address these challenges by improving productivity, reducing costs, and enhancing supply chain visibility. However, cultural and language barriers may hinder the adoption of these solutions. In addition, the country's complex regulatory environment and data privacy concerns may pose challenges for foreign companies.

The cognitive supply chain market in India is expected to grow at a significant CAGR from 2025 to 2030. India, with its burgeoning economy and rapid technological advancements, presents a significant opportunity for the cognitive supply chain industry. The country's large and diverse population, coupled with a growing middle class, is driving the demand for efficient and sustainable supply chains. The Indian government's initiatives to promote digital transformation, such as the Digital India program, are accelerating the adoption of AI and IoT technologies. E-commerce growth further fuels the demand for advanced supply chain solutions. However, challenges like infrastructure bottlenecks, skilled workforce shortages, and complex regulations may hinder growth. Despite these, India's strong economic growth and focus on technology make it a promising market for cognitive supply chain solutions.

Europe Cognitive Supply Chain Market Trends

The cognitive supply chain market in Europeis expected to grow at a significant CAGR from 2025 to 2030. The region's emphasis on Industry 4.0 and the circular economy is driving the demand for advanced supply chain solutions. Several European countries, such as Germany and the Netherlands, are at the forefront of technological innovation and have established themselves as global leaders in logistics and supply chain management. These countries are actively investing in AI and IoT technologies to improve the efficiency and sustainability of their supply chains. However, the fragmented nature of the European market and the varying levels of technological adoption across different countries may pose challenges. In addition, stringent data privacy regulations, such as GDPR, can impact the implementation of AI-powered solutions.

The cognitive supply chain market in Germany is expected to grow at a significant CAGR from 2025 to 2030. Germany is well-positioned to benefit from the growth of the cognitive supply chain industry. The country's strong focus on Industry 4.0 and digital transformation has created a conducive environment for the adoption of advanced technologies. German companies are actively investing in AI and IoT solutions to improve their supply chain visibility, optimize inventory management, and enhance logistics operations. The country's strong engineering expertise and focus on quality and precision make it an ideal market for cognitive supply chain solutions.However, the complex regulatory landscape and data privacy concerns may hinder market growth. In addition, the country's reliance on global supply chains makes it vulnerable to disruptions, which can impact the adoption of cognitive supply chain solutions.

The cognitive supply chain market in France is expected to grow at a significant CAGR from 2025 to 2030. The country's government initiatives to promote AI and IoT technologies have created a supportive environment for the development and deployment of these solutions. French companies, particularly in the automotive, aerospace, and luxury goods sectors, are increasingly adopting AI-powered solutions to optimize their supply chains. The country's strong research and development capabilities, coupled with a focus on sustainability, are driving the demand for advanced supply chain technologies. However, language barriers and cultural differences may hinder the adoption of these solutions. In addition, the country's complex regulatory environment and data privacy concerns may pose challenges for foreign companies.

Competitive Insights

The market is fragmented and is anticipated to witness competition due to the presence of several players in the industry. To capture a greater market share, the key market players are adopting strategies such as entering into collaboration and engaging in mergers & acquisitions of other small players. In October 2022, Oracle introduced new product innovations for its data and analytics solutions. With Oracle Fusion Analytics, decision-makers can access over 2,000 prebuilt KPIs, dashboards, and reports across CX, HCM, ERP, and SCM analytics to monitor performance against strategic goals. The latest Oracle Analytics Cloud enhancements aim to boost business users' productivity by reducing their reliance on IT while benefiting from curated data assets and a centralized semantic model. In addition, adding advanced composite visualizations and AI/ML enhancements extend ML capabilities, including Oracle Cloud Infrastructure cognitive services like AI Vision for processing visual information.

Some of the key companies operating in the cognitive supply chain industry include IBM Corporation, Amazon.com, and C.H. Robinson Worldwide, Inc., among others.

-

IBM, a global technology leader, leverages its deep expertise and advanced AI capabilities to offer robust Cognitive Supply Chain solutions. By harnessing the power of Watson AI, IBM provides intelligent insights and automation to optimize supply chain operations. Their comprehensive suite of solutions, ranging from procurement to logistics, empowers businesses to improve forecasting accuracy, streamline inventory management, and enhance overall supply chain visibility. IBM's global reach and industry-specific knowledge enable them to tailor solutions to meet the unique needs of diverse clients.

-

Amazon.com, a pioneer in e-commerce, has revolutionized the supply chain industry with its data-driven approach and innovative technologies. Their vast network of fulfillment centers, coupled with advanced robotics and automation, enables them to deliver products efficiently and cost-effectively. Amazon's machine learning algorithms provide accurate demand forecasting and inventory optimization, reducing waste and minimizing stockouts. By leveraging its scale and technological prowess, Amazon offers cutting-edge Cognitive Supply Chain solutions that drive efficiency and customer satisfaction.

-

C.H. Robinson, a leading global logistics provider, offers comprehensive Cognitive Supply Chain solutions to optimize transportation and logistics operations. Their extensive network of carriers and transportation modes enables them to provide flexible and efficient solutions. By leveraging advanced technologies, such as AI and data analytics, C.H. Robinson enhances visibility, improves decision-making, and reduces costs. Their focus on industry specialization and customer collaboration allows them to tailor solutions to meet the specific needs of their clients.

Oracle, Honeywell International Inc., and Panasonic are some of the emerging companies in the target market.

-

Oracle, a global technology leader, is leveraging its strong foundation in database and analytics to offer robust cognitive supply chain solutions. By integrating AI and machine learning into its existing supply chain management solutions, Oracle enables businesses to gain deeper insights, optimize operations, and improve decision-making. Their focus on cloud-based solutions and seamless integration with other enterprise applications positions them as a strong contender in the market. Oracle's extensive customer base and strong brand reputation provide a solid foundation for growth in the cognitive supply chain industry.

-

Honeywell, a diversified technology and manufacturing company, brings a unique perspective to the cognitive supply chain industry. With a strong presence in industrial automation and control systems, Honeywell offers solutions that optimize supply chain operations across various industries. Their expertise in IoT and analytics enables real-time monitoring, predictive maintenance, and intelligent decision-making. By combining hardware, software, and services, Honeywell provides end-to-end solutions that address the complex challenges of modern supply chains.

-

Panasonic, a global leader in electronics and technology, is expanding its footprint in the cognitive supply chain industry. By leveraging its IoT capabilities and deep understanding of supply chain operations, Panasonic offers innovative solutions that improve efficiency and visibility. Their focus on sustainability and energy efficiency aligns with the growing demand for environmentally friendly supply chain practices. Panasonic's strong brand reputation and global reach position it as a significant player in the market, especially in industries like automotive, manufacturing, and retail.

Key Cognitive Supply Chain Companies:

The following are the leading companies in the cognitive supply chain market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Oracle

- Amazon.com

- Accenture plc

- Intel Corporation

- NVIDIA Corporation

- Honeywell International Inc.

- C.H. Robinson Worldwide, Inc.

- Panasonic

- SAP SE

Recent Developments

-

In January 2024, Blue Yonder launched a significant product update, offering interoperable solutions across the entire supply chain. This update leverages the company's cognitive platform and data cloud to enhance productivity, reduce waste, and bolster supply chain resilience. By focusing on interoperability, Blue Yonder aims to address the limitations of fragmented legacy systems and create a more unified and efficient supply chain ecosystem.

-

In January 2023, Accenture acquired Inspirage, an Oracle Cloud specialist firm. This acquisition will enhance Accenture's Oracle Cloud capabilities, especially in supply chain management. By integrating Inspirage's expertise, Accenture aims to accelerate innovation for clients through emerging technologies like touchless supply chain and digital twins.

-

In March 2021, FourKites and Cardinal Health partnered to enhance the tracking of medical supplies in transit. By leveraging FourKites' advanced tracking and analytics capabilities, Cardinal Health aims to optimize its supply chain operations, ensuring timely and reliable delivery of critical medical products to healthcare facilities. This collaboration will improve supply chain visibility, predict demand, and ultimately enhance patient care.

Cognitive Supply Chain Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 9,513.2 million |

|

Revenue forecast in 2030 |

USD 21,352.2 million |

|

Growth Rate |

CAGR of 17.6% from 2025 to 2030 |

|

Historic year |

2019 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, enterprise size, automation used, industry verticals, region |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, South Korea, Australia, Brazil, KSA, UAE, and South Africa. |

|

Key companies profiled |

IBM Corporation; Oracle; Amazon.com; Accenture plc; Intel Corporation; NVIDIA Corporation; Honeywell International Inc.; C.H. Robinson Worldwide, Inc.; Panasonic; SAP SE |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cognitive Supply Chain Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global cognitive supply chain market report based on deployment, enterprise size, automation used, industry verticals, and region.

-

Deployment Outlook (Revenue, USD Million; 2019 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million; 2019 - 2030)

-

SMEs

-

Large Enterprise

-

-

Automation Used Outlook (Revenue, USD Million; 2019 - 2030)

-

Internet of Things (IoT)

-

Machine Learning (ML)

-

Others

-

-

Industry Verticals Outlook (Revenue, USD Million; 2019 - 2030)

-

Manufacturing

-

Retail & E-commerce

-

Logistics and Transportation

-

Healthcare

-

Food and Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The global cognitive supply chain market size was estimated at USD 8,579.7 million in 2024 and is expected to reach USD 9,513.2 million in 2025.

b. The global cognitive supply chain market is expected to grow at a compound annual growth rate of 17.6% from 2025 to 2030 to reach USD 21,352.2 million by 2030.

b. The on-premise deployment segment dominated the cognitive supply chain market and accounted for the largest revenue share of 67.4% in 2024. The segment is expected to have a considerable share during the forecast period owing to the increasing demand for data security.

b. Some key players operating in the cognitive supply chain market include IBM Corporation; Oracle; Amazon.com; Accenture plc; Intel Corporation; NVIDIA Corporation; Honeywell International Inc.; C.H. Robinson Worldwide, Inc.; Panasonic; and SAP SE.

b. North America accounted for the largest revenue share of more than 35.2% in 2024 in the cognitive supply chain market and is estimated to witness a significant growth rate from 2025 to 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."