Cognitive Radio Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-949-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Cognitive Radio Market Size & Trends

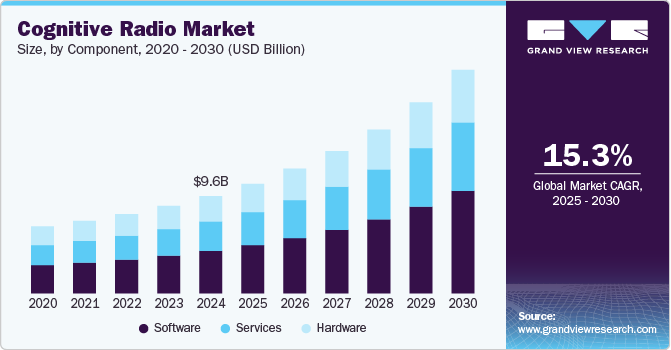

The global cognitive radio market size was estimated at USD 9,562.4 million in 2024 and is projected to grow at a CAGR of 15.3% from 2025 to 2030. The market is primarily driven by the advancement of cutting-edge technologies such as 5G, as well as the rising adoption of cognitive radios within defense and government organizations. The appeal of optimized spectrum utilization and reduced power consumption has driven the adoption of cognitive radios to fulfill technological needs, which is expected to fuel the market growth in the coming years.

Integrating cognitive radios with cloud computing and the Internet of Things (IoT) is poised to have a significant impact on the adoption of cognitive radios. IoT devices have gained prominence in the communication landscape due to their combination with the internet for operational purposes. These devices are anticipated to gather and exchange data efficiently, with spectrum utilization being a critical consideration. Cognitive radio plays a pivotal role in wireless communication by utilizing unused spectrum portions for wireless systems. The integration with cloud computing not only enhances the performance of cognitive radio networks without compromising security but also improves platform accessibility.

The rise of 5G technology is poised to be a pivotal driver for global cognitive radio market growth. The increasing prevalence of mobile phones, advancements in wireless communication devices, and the continuous surge in data traffic, coupled with improved network performance in areas such as data capacity, energy usage, bandwidth efficiency, latency, throughput, and cost, have collectively contributed to the emergence of 5G networks. This, in turn, is expected to fuel the growth of the cognitive radio market over the forecast period.

In addition, the increasing implementation of cognitive radio technology in government and defense applications involves spectrum sensing, evaluation, and allocation for defense purposes including military communication is expected to boost the market growth over the forecast period. The market is likely to be driven by the increasing implementation of cognitive radio technology in government and defense applications such as aerospace, military, and security. Military applications for cognitive radio technology include tactical situational awareness systems, equipment and weapons platforms, and command and control systems, etc.

Furthermore, the growing need to optimize spectrum utilization is a driving factor propelling the cognitive radio market growth. The electromagnetic spectrum, used in wireless communication, is a limited yet priceless resource. However, its availability is increasingly strained due to the explosion of wireless devices and applications. This surge in demand has led to spectrum scarcity and congestion, making efficient spectrum utilization a supreme concern, which is expected to drive market growth in the coming years.

Moreover, companies focus on integrating cognitive radio technology with 5G networks to enhance wireless communication capabilities and optimize spectrum use. This integration is crucial for meeting the rising demands for bandwidth and connectivity in various sectors, especially telecommunications. Companies are aiming to innovate their offerings to stay competitive and meet evolving customer demands.

Component Insights

The software segment accounted for the largest market share of over 26.2% in 2024, owing to the increased adoption of software-based cognitive radio in the telecommunication, defense, and government sectors. The growth is attributed to the flexibility offered by cognitive radios that provide a novel network resource management framework to overcome several challenges related to network resource management.

The services segment is expected to witness a considerable of 15.6% CAGR from 2025 to 2030. The services such as managed and professional services are expected to witness increased demand, owing to rapid urbanization and technological advancements in the market. The services segment includes a range of offerings provided by companies and organizations to support the deployment, operation, and maintenance of cognitive radio systems. These services are essential for ensuring that cognitive radio technology is effectively implemented and optimized for various applications, which is driving market growth over the forecast period.

Application Insights

The spectrum-sensing segment accounted for the largest market share in 2024. This growth can be attributed to preventing harmful interference with licensed users and improving spectrum utilization by identifying the available spectrum. The increased implementation in defense and government organizations and further technological developments such as IoT integration are expected to enable more features, resulting in wide adaptation of spectrum sensing for various applications. Furthermore, the application of spectrum sensing in power grid communication systems to fulfill large-capacity data transmission needs and improve the quality of communication is expected to boost the growth of the market for cognitive radio.

The spectrum allocation segment is expected to register the fastest CAGR from 2025 to 2030. The presence of several spectrum allocation techniques in cognitive radio networks is fueling the segment demand. The techniques include centralized, distributed, and hybrid spectrum allocation, which changes as per the requirement of the end-user. Some factors that influence the choice of the technique include the size of the network, the number of users, and the type of applications being used, among others. Furthermore, cognitive radio systems continuously monitor the spectrum environment and identify unused or underutilized frequency bands. Spectrum allocation algorithms allocate these idle resources to users or applications as needed, maximizing spectrum utilization, which is driving the segment demand over the forecast period.

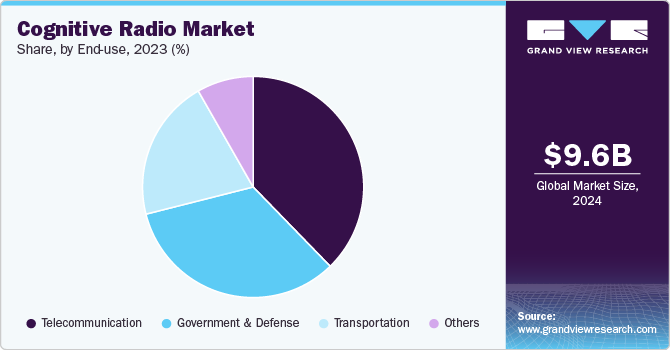

End Use Insights

The telecommunication segment dominated the market in 2024, owing to its acute spectrum scarcity issues, especially in the lower frequency bands, where the demand for wireless services has been steadily increasing. Cognitive radios address this challenge by dynamically adapting to available frequencies, reducing interference, and optimizing spectrum utilization, making them essential for ensuring efficient and high-quality wireless data services in the era of 4G and 5G networks, thereby driving the market growth over the forecast period.

The government & defense segment is projected to grow at the significant CAGR from 2024 to 2030,owing to its ability to address critical communication challenges and emphasis on spectrum security. As cyber threats and electronic warfare become more sophisticated, government and defense agencies are investing in cognitive radio solutions to enhance spectrum security and reduce vulnerabilities. Another significant trend is interoperability. With the need for seamless communication among various military and government entities, there is a growing focus on developing cognitive radio systems that can seamlessly interoperate with existing communication systems. This ensures that vital information can be shared securely and efficiently in complex operational environments.

Regional Insights

The cognitive radio market in North America accounted for the highest revenue share of over 33.0% in 2024. The growth is attributed to the increasing adoption of cognitive radio across defense and government organizations. The strong presence of various major technology companies, such as Datasoft Corporation, Shared Spectrum Company, and RTX Corporation, providing high-end Cognitive Radio is the primary factor contributing to the market growth. Moreover, the acquisition of government contracts by the regional companies is driving market growth further over the forecast period.

U.S. Cognitive Radio Market Trends

The U.S. cognitive radio market held a dominant position in 2024.The ongoing technological advancement in the cognitive radio market and new platform development by market players is expected to drive market growth in the coming years.

Europe Cognitive Radio Market Trends

The Europe cognitive radio market was identified as a lucrative region in 2024.The market is primarily driven by technological developments and increased use of IoT devices that can be integrated with cognitive radios for improved wireless communications. In addition, the region is also observing significant steps to establish a strong 5G network infrastructure to support the burgeoning demand for high-speed internet and low latency.

The UK cognitive radio market is expected to grow rapidly in the coming years. The market growth is attributed to the ability to overcome radio spectrum scarcity to improve satellite communications and enhance service quality is resulting in the faster adoption of cognitive radios in the country, consequently driving the market growth. In addition, key market players are significantly investing in the development of the infrastructure, which will augment the market demand.

Cognitive radio market in Germany held a substantial market share in 2024 owing to the wide range of applications of cognitive radio in the country, which includes industrial automation, smart transportation, and healthcare, among others. Cognitive radios are used to improve the efficiency of transportation systems.

Asia-Pacific Cognitive Radio Market Trends

The cognitive radio market in the Asia Pacific region is expected to grow at the fastest CAGR of over 17.1% from 2025 to 2030. The emergence of advanced transportation sources such as smart railways in countries such as Japan, China, and India is expected to fuel market growth in the region. Furthermore, the emergence of 5G in the Asia Pacific region is expected to increase the adoption of cognitive radios in the telecommunication sector resulting in promising growth of the cognitive radio market over the forecasted period.

The Japan cognitive radio market is expected to grow rapidly in the coming years, driven by the growing focus on enhancing user experiences through immersive technologies across various industries, including gaming, retail, and education. Furthermore, Japan's emphasis on advanced manufacturing and robotics complements the development of AR technologies, driving innovation and adoption

Cognitive radio market in China held a substantial market share in 2024, driven by the focus on 5G deployment and spectrum management. The country is aggressively expanding its 5G networks, and cognitive radio technology is being integrated to optimize spectrum sharing and reduce interference. Additionally, there is a growing emphasis on research and development in cognitive radio technology, with Chinese companies actively working on innovative solutions to address spectrum challenges.

Key Cognitive Radio Company Insights

Some of the key players operating in the market include Thales Group, RTX Corporation and BAE Systems, Inc.

-

RTX Corporation is an American multinational aerospace and defense conglomerate and the company focuses on advanced technologies in areas such as missile systems, cybersecurity solutions, and aircraft engines. The company has developed advanced solutions such as the MicroLight, a compact, software-defined military radio that enhances communication capabilities for soldiers by integrating voice, data, and tracking functionalities in a single device. With a strong emphasis on innovation and security, Raytheon is leveraging technologies such as 5G and artificial intelligence to optimize spectrum utilization and improve operational efficiency in complex environments

-

Thales Group is a multinational company that operates in the aerospace, defense, transportation, and security markets. The company specializes in providing cutting-edge communication solutions tailored for defense and government sectors. The company is known for its commitment to enhancing secure communication through advanced cognitive radio systems that adapt to dynamic environments. The company has been actively involved in projects that integrate cognitive radio technology with emerging trends like IoT and cloud computing, thereby improving spectrum management and expanding the capabilities of wireless networks.

EpiSys Science, Inc. and Shared Spectrum, Inc. are some of the emerging participants in the cognitive radio market.

-

EpiSys Science, Inc. is a multidisciplinary innovation company, specializing in next-generation autonomous technologies for both defense and commercial applications. The company focuses on developing disruptive solutions that leverage artificial intelligence (AI), digital signal processing (DSP), and software-defined networking (SDN). The company is actively engaged in government R&D programs and aims to transition its research into practical military and commercial products, including autonomous UAV swarms and advanced communication systems.

-

Shared Spectrum, Inc. is known for its innovative approaches to spectrum management and sharing technologies. The company focuses on developing solutions that enable efficient use of wireless spectrum resources, addressing the growing demand for bandwidth in various sectors. Shared Spectrum's technologies facilitate dynamic spectrum access, allowing for improved communicationcapabilities across diverse applications, including military and commercial uses.

Key Cognitive Radio Companies:

The following are the leading companies in the cognitive radio market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems, Inc.

- RTX Corporation

- Thales Group

- Rohde & Schwarz GmbH & Co. KG

- Spectrum Signal Processing

- Nutaq Incorporated.

- Shared Spectrum, Inc.

- EpiSys Science, Inc.

- DataSoft Corporation

- Vecima Networks Inc.

Recent Developments

-

In June 2024, Rohde & Schwarz joined the AI-RAN Alliance, collaborating with industry leaders such as NVIDIA, Ericsson, and Nokia to advance AI-driven methodologies for optimizing next-generation wireless networks. The alliance focuses on enhancing radio access network (RAN) capabilities through AI, improving spectral efficiency, and deploying AI services at the network edge.

-

In June 2024, KATIM, an EDGE Group entity and Thales have announced a strategic partnership to co-develop Software Defined Radio technologies in the UAE, aiming to enhance communication solutions for both domestic and international markets. The agreement, signed at the Eurosatory defense show, focuses on the full cycle development, production, and maintenance of high-frequency radio communication systems.

-

In October 2023, RTX Corporation entered into a licensing agreement with Hanwha Systems to manufacture airborne tactical radios in South Korea, specifically for the Second-generation Anti-jam Tactical UHF Radio for NATO waveform (SATURN) upgrade program. This partnership will enable the production of the TruNet AR-1500, a software-defined radio that enhances connectivity between ground and airborne forces, incorporating advanced anti-jam technologies essential for mission readiness and interoperability with allies.

Cognitive Radio Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 10,761.7 million |

|

Revenue forecast in 2030 |

USD 21,940.0 million |

|

Growth rate |

CAGR of 15.3% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2025 to 2030 |

|

Report Technology |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, end use, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E. |

|

Key companies profiled |

BAE Systems, Inc.; RTX Corporation; Thales Group; Rohde & Schwarz GmbH & Co. KG; Spectrum Signal Processing; Nutaq Incorporated; Shared Spectrum Inc.; EpiSys Science, Inc.; DataSoft Corporation; and Vecima Networks Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cognitive Radio Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cognitive radio market report based on component, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cognitive Routing

-

Location Tracking

-

Spectrum Allocation

-

Spectrum Analysis

-

Spectrum Sensing

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government & Defense

-

Telecommunication

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cognitive radio market size was estimated at USD 9,562.4 million in 2024 and is expected to reach USD 10,761.7 million in 2025.

b. The global cognitive radio market is expected to grow at a compound annual growth rate of 15.3% from 2025 to 2030 to reach USD 21,940.0 million by 2030.

b. The spectrum-sensing segment accounted for the largest market share in 2024. This growth can be attributed to preventing harmful interference with licensed users and improving spectrum utilization by identifying the available spectrum. The increased implementation in defense and government organizations and further technological developments such as IoT integration are expected to enable more features, resulting in wide adaptation of spectrum sensing for various applications. Furthermore, the application of spectrum sensing in power grid communication systems to fulfill large-capacity data transmission needs and improve the quality of communication is expected to boost the growth of the market for cognitive radio.

b. Some of the key players operating in the cognitive radio market include BAE Systems, Inc., RTX Corporation, Thales Group, Rohde & Schwarz GmbH & Co. KG, Spectrum Signal Processing, Nutaq Incorporated, Shared Spectrum, Inc., EpiSys Science, Inc., DataSoft Corporation, and Vecima Networks Inc.

b. The market is driven by the advancement of cutting-edge technologies such as 5G, as well as the rising adoption of cognitive radios within defense and government organizations. The appeal of optimized spectrum utilization and reduced power consumption has driven the adoption of cognitive radios to fulfill technological needs, which is expected to further fuel the market growth in the coming years.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."